Bitcoin’s (BTC) latest rally has pushed the asset to a new all-time high, surpassing the $72,000 mark. The original crypto is up 4.4% in the daily charts, 7.4% in the weekly charts, over 28% in the 14-day charts, and nearly 50% over the previous month. Moreover, BTC’s price has surged by almost 253% since March 2023.

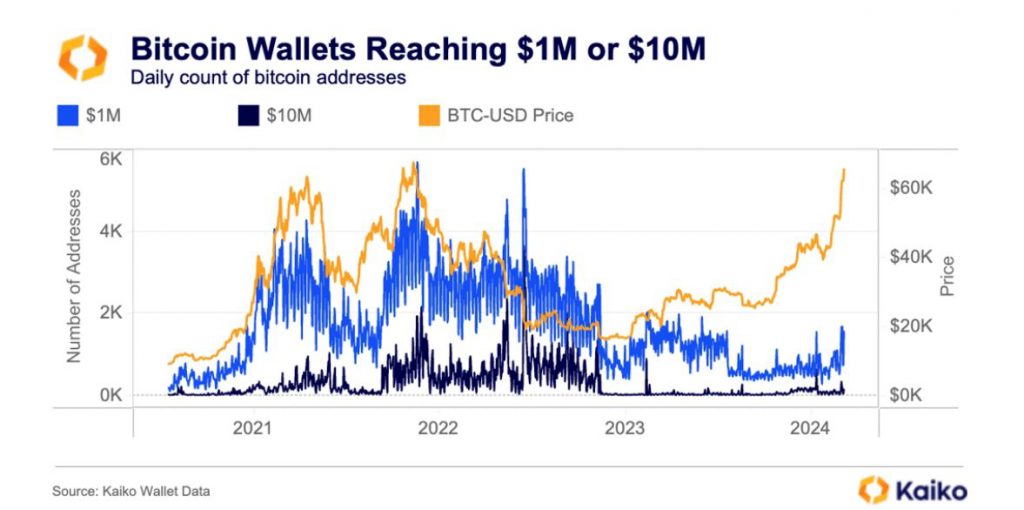

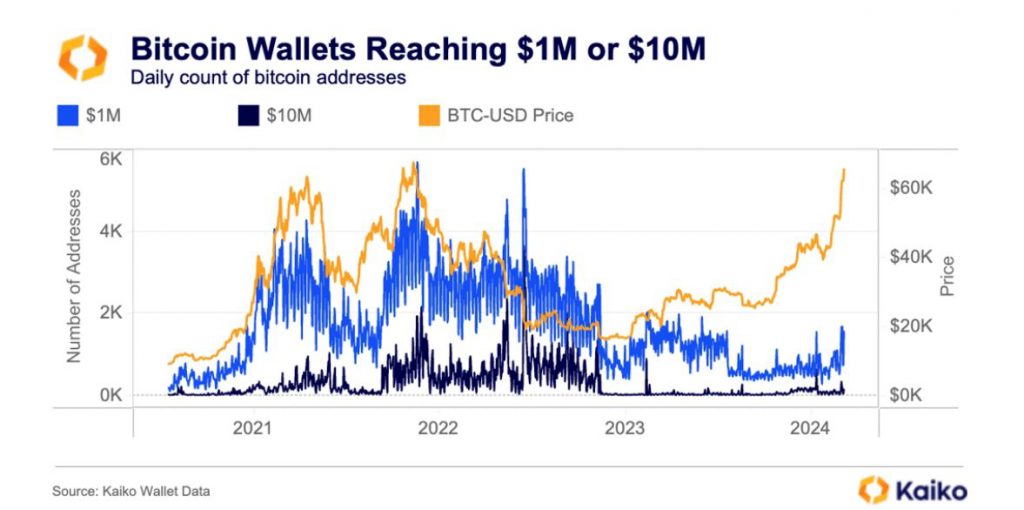

According to a report by Kaiko Research, BTC’s latest rally is creating about 1500 millionaire wallets daily.

Also Read: Microstrategy Boosts Bitcoin Portfolio With Acquisition of 12,000 BTC

However, despite the increase in Bitcoin (BTC) millionaire wallets, Kaiko Research notes that the number of millionaire wallets created daily during the 2021 bull run was closer to 4000, more than double the current number. According to Kaiko Research, low millionaire wallets could be due to the lack of new capital.

The report notes, ‘In 2021, there was a huge influx in capital as all manner of bull sought to benefit from the crypto hype. This time around, whales could be taking a more cautious approach, waiting to see if the gains have legs before investing.‘

How high can Bitcoin (BTC) go in 2024?

According to Changelly, BTC might breach the $80k level in April, hitting $87,101 on Apr. 8, 2024. Reaching $87,101 from current levels would translate to a growth of about 21%. Moreover, the platform anticipates BTC to reach a maximum price of $113,151.68 in 2024, a rise of over 57% from current levels.

Telegaon, on the other hand, anticipates Bitcoin (BTC) to hit a maximum price of $96,919.93 in 2024. Reaching $96,919.93 from current levels would translate to a growth of about 34.8%.

BTC’s latest rally is likely due to increased inflows into spot BTC ETF (Exchange Traded Fund) products. Many analysts anticipate BTC’s rally to continue as the asset will undergo its halving cycle next month. Many consider halving cycles bullish as they reduce rewards for miners, thereby, reducing supply.