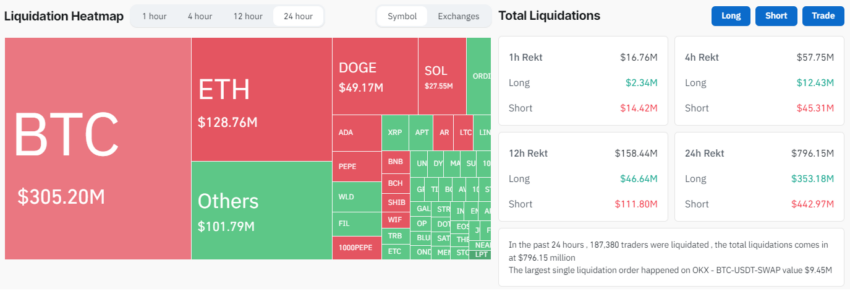

In a tumultuous 24-hour period marked by extreme volatility, the crypto market witnessed a historic liquidation event. Nearly $800 million in both short and long futures positions were wiped out.

This staggering figure represents the largest daily liquidated crypto position value recorded so far in 2024, according to Coinglass data.

Crypto Traders Eat $800M in Liquidated Losses

The trigger for this unparalleled market activity was a significant surge in the value of major cryptocurrencies, with Bitcoin and Ethereum reaching long-term highs not seen in years.

Bitcoin soared to nearly $64,000, a peak since November 2021, while Ethereum neared $3,500, marking a two-year high. This surge contributed to the massive $800M in liquidations as leveraged traders found themselves caught in a maelstrom of price swings.

This was the largest liquidation event since August 18, 2023, when over $1 billion was lost in liquidations. This was immediately following news that Elon Musk had sold $373M in Bitcoin from SpaceX’s holdings.

Read more: How To Trade Bitcoin Futures and Options Like a Pro

Typically, liquidation events in the crypto market tend to disproportionately affect long or short positions. However, this event was unusual in that the liquidations were nearly equal in value between longs and shorts.

Crypto trader Magus watched the destruction unfold, quipping:

“Everyone has a plan until they take a liquidation to the mouth”

Experts attribute this rarity to the whipsaw price action triggered by external factors, including service outages at major cryptocurrency exchange Coinbase.

The Coinbase Blame Game

Coinbase, a leading platform for cryptocurrency trading, experienced significant downtime, leaving many users unable to access their accounts or execute trades during critical moments of price movement. Reports of users seeing a zero balance and encountering transaction errors flooded social media, adding to the panic and exacerbating market movements.

The Coinbase team quickly responded to the issues, reassuring users about the safety of their assets and working diligently to resolve the problem. Coinbase attempted to quell the unrest among its user base,

“Our team is investigating this & will provide an update shortly. Your assets are safe,” the exchange announced.

After starting at $57,074, the cryptocurrency experienced a dramatic 12.66% rise, peaking at an intraday high of $64,300 before undergoing a correction.

Read more: Four Mistakes To Avoid When Trading Bitcoin with Leverage

The volatility was a stark reminder of the risks inherent in the cryptocurrency market and the operational challenges exchanges face in maintaining service stability amidst unpredictable market movements.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.