- India

- International

India’s GDP data for 2023-24’s Q3: Why have GDP and GVA growth rates diverged?

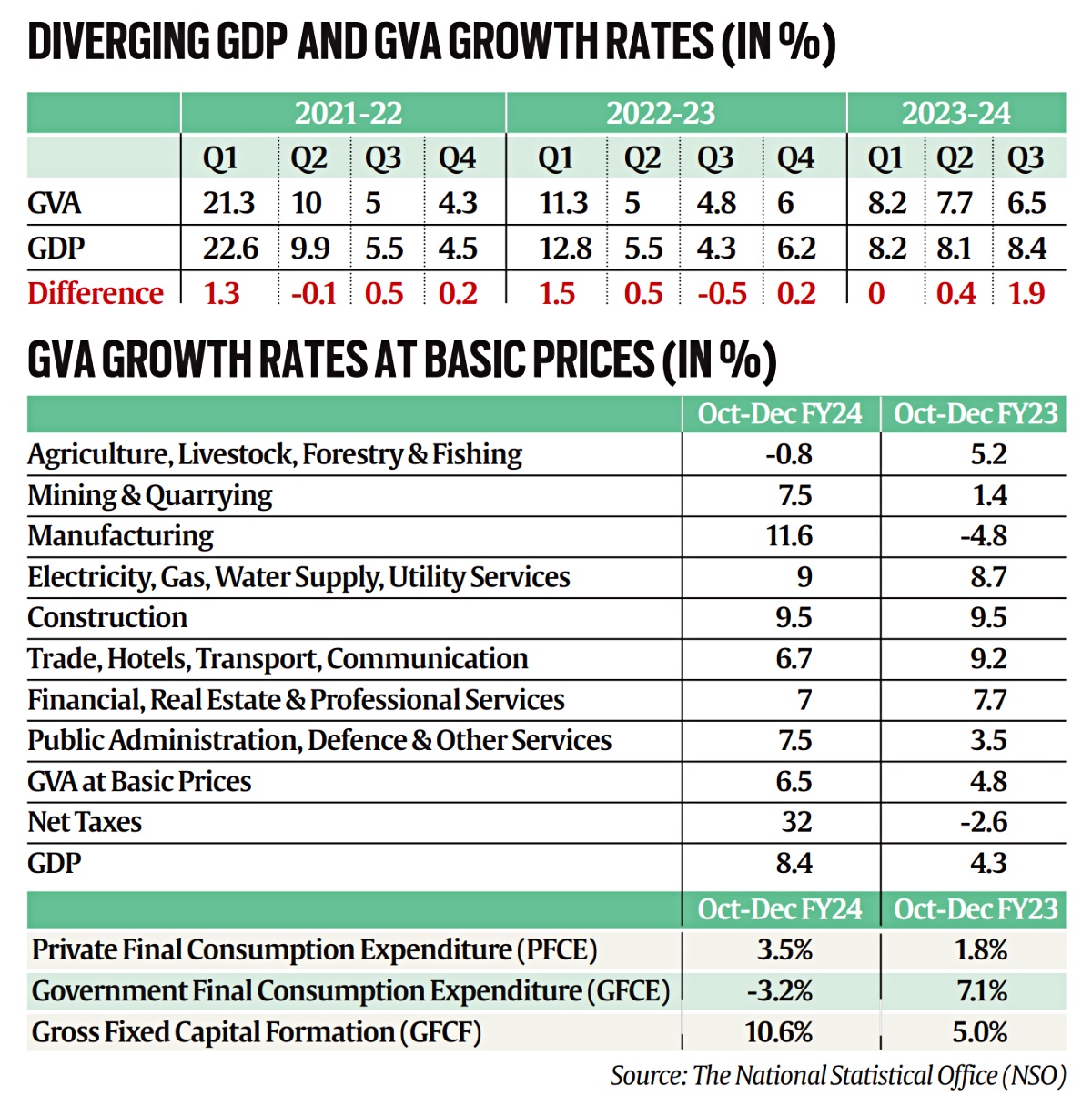

The difference between the two sets of growth rates widened to 190 basis points in Q3, a 10-year high. This large divergence is due to a sharp increase in net taxes and a fall in subsidies

While there was an improvement in manufacturing, mining, construction, trade, hotels, transport and communication, and services related to broadcasting, the agriculture sector recorded a contraction in Q3.

While there was an improvement in manufacturing, mining, construction, trade, hotels, transport and communication, and services related to broadcasting, the agriculture sector recorded a contraction in Q3.India’s Gross Domestic Product (GDP) growth rate surpassed expectations to rise to a six-quarter high of 8.4% in the third quarter (October-December) of 2023-24, data released by the National Statistical Office (NSO) on Thursday showed.

This was much higher than the 6.5% estimate for Q3 by the Reserve Bank of India (RBI), and similar estimates by economists. The Q3 GDP helped push the estimate for the full year to 7.6% in the second advance estimates, from the 7.3% estimated in the first advance estimates released in January.

While there was an improvement in manufacturing, mining, construction, trade, hotels, transport and communication, and services related to broadcasting, the agriculture sector recorded a contraction in Q3.

Table on India’s GDP/GVA growth rate diverging.

Table on India’s GDP/GVA growth rate diverging.

There was, however, a sharp divergence in the growth rates based on GDP and Gross Value Added (GVA), which has led some economists to suspect that GDP may have been overstated. While GDP for Q3 was 8.4%, GVA growth was recorded 190 basis points lower at 6.5%. GDP is arrived at by adding product or indirect taxes, and excluding subsidies to GVA, which measures national income from the output side.

Another factor that seems to have contributed to real growth being overstated is lower-than-usual annual GDP deflator. It is seen growing by 1.4% in FY24 as against 6.8% in FY23, reflecting the deflation in the wholesale price index (WPI) used to calculate it.

The deflator measures changes in prices of all the goods and services produced in an economy, and thereby helps compare the levels of real economic activity from one year to the next. A lower deflator means higher real GDP growth and vice versa. In Q3, deflator increased marginally to 1.7% from 1.5 % in Q2 FY24.

What were the key reasons behind the surge in Q3 GDP?

Barring agriculture, all other sectors posted strong growth during October-December. The GVA of ‘Agriculture, Livestock, Forestry & Fishing’ contracted by 0.8% in Q3 as against a 5.2% growth in the year-ago period, and 1.6% in the previous quarter.

Manufacturing grew at 11.6% in Q3 as against a low base of (-) 4.8% in the year-ago period, while construction posted a strong growth of 9.5% compared with the same rate of growth in Q3 a year ago.

On a sequential basis, manufacturing declined by 4.9% in October-December 2023-24. In the year-ago period too, manufacturing had posted a sequential decline of 2.5% in Q3.

Among services, ‘Trade, Hotels, Transport, Communication & Services related to Broadcasting’ grew 6.7% in October-December as against 9.2% in the year-ago period. ‘Financial, Real Estate & Professional Services’ grew 7.0% and ‘Public Administration, Defence & Other Services’ by 7.5%.

On the expenditure side, a rise in investments supported the GDP growth. “The real estate cycle has turned (households are 40% of investment: their physical savings have risen, a large part of which is housing), and industry utilisation is back at 2019 levels thus leading to a revival in the capex cycle,” Axis Bank said in a note.

There’s a perceptible slowdown in private final consumption expenditure, an indicator of consumption demand, with the FY23 growth levels seen growing at a more than two-decade low (barring the pandemic year).

In Q3, private final consumption expenditure rose by 3.5% year-on-year, while government final consumption expenditure decreased by 3.2%. Gross fixed capital formation, an indicator of investment, grew by 10.6% during the third quarter.

What revisions were made to GDP growth rates?

Several revisions were made to the growth rates of previous financial years, and the third quarter growth rate gained from a favourable base effect from the downward revision in the year-ago period.

For October-December 2022-23, growth rate was revised down to 4.3% from 4.5%. Quarterly growth rates were also revised for the first two quarters of the current fiscal. The GDP growth estimate was revised up to 8.1% from 7.6%, while that for the April-June quarter was revised to 8.2% from 7.8%. This came on the back of a downward revision in FY23 quarterly growth rates to 5.5% in July-September from 6.2% earlier and 12.8% in April-June from 13.1% earlier.

Why is there a divergence between the two measures of growth, GVA and GDP?

The sharp divergence in GDP and GVA rates for Q3 is on account of a sharp rise in net taxes and a fall in subsidies. The difference between the two sets of growth rates widened to 190 basis points in Q3 from 40 basis points in the previous quarter.

Axis Bank in its note said the divergence is at a 10-year high, driven mainly by a rise in net taxes. Net taxes rose by 32% year-on-year in Q3 FY24 in real terms. Net taxes are calculated by adding product taxes and excluding subsidies.

IDFC First Bank said the fluctuation in net tax collections has added a lot of volatility in the GDP print in Q3. “Instead, GVA would be a better metric to look at while assessing growth as it’s not impacted by fluctuation in net tax collections,” it said in a note.

Government officials said the divergence between GVA and GDP rates was mainly due to a sharp fall in subsidies in the quarter because of lower payouts on fertiliser subsidies. As per the latest Controller General of Accounts (CGA) data for April-January, urea subsidy was 25% lower than the year-ago period at Rs 1.05 lakh crore. Payouts by the central government for total major subsidies were lower by 21% during the same period.

The divergence in GVA and GDP growth rates was also seen for the full financial year. GVA is expected to grow at sub-7%, with an estimated rate of 6.9% in FY24 as against 6.7% last fiscal (earlier estimate was 7.0%). This compares with GDP of 7.6% in FY24 as against 7.0% in the previous financial year.

What are the growth expectations and concerns going forward?

The most critical aspect to watch out for will be a broad-based improvement in consumption growth and private investments.

GDP growth was supported by investment growth while private consumption growth remained subdued. Going forward, with slow growth in profits, growth may take a hit.

Also, GDP deflator growth will be even higher in FY25 which is expected to pull down real GDP growth, economists said.

“Growth momentum is expected to moderate as companies’ profit growth slows and as input cost picks up. On the consumption front, rural demand is likely to get support from strong rabi output. However, urban demand could moderate as urban wage growth slows. Government capital expenditure, which has been the key support for the capex cycle, could slow in Q4,” IDFC First Bank said.

More Explained

Must Read

EXPRESS OPINION

Apr 27: Latest News

- 01

- 02

- 03

- 04

- 05