Russian authorities say dozens dead in attack on Moscow concert venue

Lululemon falls the most in 4 years on warning of US consumer slowdown

Lululemon became the latest retailer to add to concerns about the health of the US consumer, with a concession it was experiencing a “broad-based” slowdown in its biggest market that sent shares tumbling by the most in four years.

“As you may have heard from others in our industry, there has been a shift in the US consumer behaviour of late,” chief executive Calvin McDonald said.

Although traffic growth was still positive, there has been a slowdown this quarter in the US, he told analysts on Thursday afternoon.

Lululemon in January raised its full-year guidance after a solid holiday quarter, but its outlook for the year ahead now sits shy of analysts’ forecasts.

The company’s shares closed 15.8 per cent lower on Friday, its biggest fall since March 2020.

US stocks ride post-Fed relief rally to biggest weekly gain in months

Wall Street’s S&P 500 notched its biggest weekly advance in three months as stocks on both sides of the Atlantic climbed on signals that major central banks remain on course to cut interest rates.

The S&P 500 closed 0.1 per cent lower on Friday, but its 2.3 per cent gain over the past five sessions marked its biggest weekly advance since mid-December and leaves it up about 27 per cent since a low in late October.

The Nasdaq Composite gained 0.2 per cent during the final session of the week. That took its gain since last Friday to 2.9 per cent, the biggest weekly advance since mid-January.

US stocks staged a relief rally on Wednesday after Federal Reserve chair Jay Powell signalled a preference to cut rates by three-quarters of a percentage point this year.

Weekly gains for US stock indices

1.8%

Russell 2000

2.3%

S&P 500

2.9%

Nasdaq Composite

Read more here

Belgian insurer Ageas says it will not make an offer for UK’s Direct Line

Belgian insurer Ageas has cancelled a takeover attempt for UK rival Direct Line saying it “regrets that it has not been able to work collaboratively” with the target’s board.

Ageas said in a statement on Friday it “was not able to identify additional elements based on publicly available information that would justify significant adjustments” to its second preliminary bid.

The Belgian group had most recently proposed a cash-and-shares preliminary offer that valued the UK motor insurer at £3.2bn.

Direct Line acknowledged Ageas’s decision and said it was “well positioned to drive material improvement in performance that is expected to unlock significant value” for its shareholders under new executive Adam Winslow.

Princess of Wales undergoing treatment for cancer

Catherine, Princess of Wales, is undergoing treatment for cancer, which was discovered after undergoing major abdominal surgery in January.

In a video released by Kensington Palace on Friday, the Princess of Wales said although her condition in January was non-cancerous, tests after the operation found that cancer had been present and that she was now in the early stages of undergoing preventive chemotherapy.

The Princess of Wales said: “I am well and getting stronger every day”, but that her family would “need some time, space and privacy” while she completed her treatment.

Her announcement in a video follows weeks of speculation about her recovery from the initial January surgery, which had been fuelled by a prolonged absence from the public eye and the release of a family portrait that showed signs of digital manipulation.

Read more here

Ted Baker appoints administrators threatening almost a thousand jobs

Fashion retailer Ted Baker has formally appointed administrators, putting almost 1,000 jobs at risk.

The brand, which has 46 stores in the UK and sells its colourful clothes online and in department stores, will continue to trade online and in stores during the administration process.

The move comes after it ended a brand licensing partnership with AARC, a Dutch company, earlier this year.

Benji Dymant, joint administrator, said that Authentic Brands, the US owner of the Ted Baker brand, was in advanced discussions with several potential operating partners to take over Ted Baker in the UK and Europe and “bring the business back to full health”.

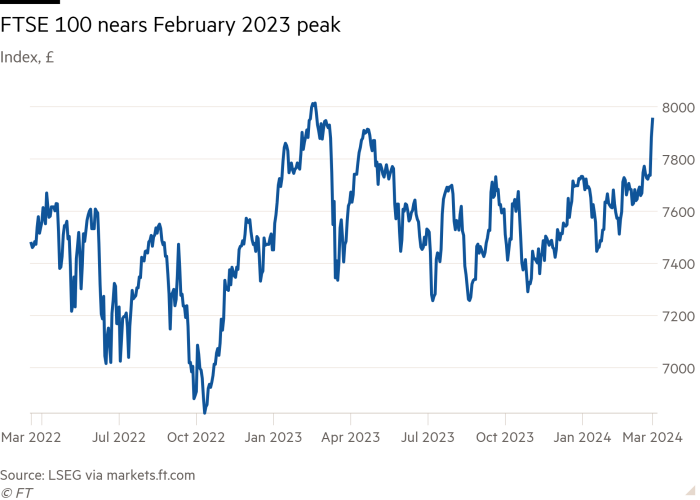

European stocks slip from record high as FTSE 100 reapproaches peak

European stocks slipped from a record closing high, while London’s FTSE 100 closed out its biggest weekly gain since September.

The UK benchmark closed 0.6 per cent higher on Friday and now sits about 1 per cent below its record closing high from 13 months ago. For the week, the FTSE 100 advanced 2.6 per cent, as investors grew more optimistic that the Bank of England will deliver multiple interest rate cuts in 2024.

Markets in Europe were subdued. The region-wide Stoxx Europe 600 fell by less than 0.1 per cent, as gains for utilities were offset by declines for technology and consumer stocks.

France’s Cac 40 closed 0.3 per cent lower, while Germany’s Dax added 0.2 per cent.

Republican firebrand Marjorie Taylor Greene files motion to dismiss US House Speaker

Marjorie Taylor Greene, the hardline Republican congresswoman close to Donald Trump, has launched a bid to oust Mike Johnson as Speaker of the House of Representatives, as chaos gripped the party’s slim majority in the lower chamber of the US Congress.

“I filed the motion to vacate today, but it’s more of a warning and a pink slip,” Greene told reporters after making the move on Friday.

She said it was “time for us to go through the process, take our time, and find a new Speaker of the House, who will stand with Republicans and our Republican majority instead of standing with the Democrats”.

Greene did not put a timeline on when she would seek a vote to remove Johnson.

Read more here

US stocks slide but S&P 500 still on course for best week this year

US stocks were lower in morning trading, but strong gains in recent days after Federal Reserve policymakers affirmed that they still intend to deliver 0.75 percentage points of rate cuts this year have kept the market on course for its biggest weekly rise this year.

Wall Street’s S&P 500 was down 0.2 per cent in mid-morning dealings on Friday, and leaving it up 2.2 per cent week-to-date. That is set to be the benchmark’s biggest weekly gain since December.

The tech-heavy Nasdaq Composite slipped 0.1 per cent.

Trump unlocks potential windfall as media business merger with Spac approved

Donald Trump’s media business will become publicly listed after shareholders of a blank cheque company approved the deal, providing the former president with a potential $3bn windfall.

Trump Media & Technology Group will list on the Nasdaq with the ticker DJT, Trump’s initials, next week.

Shares in Digital World Acquisition Corporation, the special purpose acquisition company with which TMTG will merge, were down about 7 per cent after Friday’s announcement.

The shareholders’ approval of the transaction brings to an end a drawn-out saga, which has included investigations from the Securities and Exchange Commission and Department of Justice that caused significant delays and cast doubts on whether the deal would go through.

It also comes at a crucial time for Trump, who is facing mounting legal bills and has been frantically trying to raise almost $500mn to prevent the enforcement of a fraud judgment in New York.

Read more here

Russia and China veto US resolution calling for immediate Gaza ceasefire

A US resolution calling for an immediate ceasefire in the war in Gaza was vetoed by Russia in the UN Security Council on Friday.

The US proposal was the clearest signal to date that Washington has tired of Israeli Prime Minister Benjamin Netanyahu’s conduct in the war against Hamas in Gaza.

But the decision of Moscow and Beijing to veto the resolution on Friday revealed again the US’s diplomatic isolation in the UN, where it has also been trying to maintain support for Ukraine following Russia’s full-scale invasion. Algeria also voted against the measure.

Additional reporting by James Shotter in Jerusalem and Alice Hancock in Brussels

Read more here

France and Germany reach ‘breakthrough’ on joint tank plans

Germany and France have reached a “breakthrough” on plans for a joint tank, in what they described as a sign of improving Franco-German ties which have been strained by differences over European defence policy and arms for Ukraine.

“This is more than a milestone, it’s a historic moment,” said Boris Pistorius, the German defence minister, on Friday. He was speaking alongside his French counterpart Sébastien Lecornu after the two held talks in Berlin.

“Today we have achieved the breakthrough,” Pistorius said, “an expression of the significance, strength and opportunities of Franco-German co-operation and friendship”.

Tory donor Frank Hester under police investigation

The UK Conservative party’s largest donor is under police investigation after he made a series of inflammatory remarks about former Labour MP Diane Abbott.

Frank Hester, a healthcare entrepreneur who donated £10mn to the Tories last year, is reported to have said in a 2019 meeting that Abbott, Britain’s first female Black MP, made “you just want to hate all Black women” and that she “should be shot”.

London’s Metropolitan Police had referred the matter to West Yorkshire Police for investigation, the force confirmed. Hester previously apologised for the “rude” remarks.

FTSE 100 closes in on record high

London’s FTSE 100 closed in on its record high on Friday as investors grew more confident that the central bank would make multiple interest rate cuts this year.

The blue-chip index added as much as 1 per cent on Friday to hit 7,960, within 60 points of its all-time closing high of 8,014, set in February last year.

Andrew Bailey, governor of the Bank of England, told the Financial Times that rate cuts were “in play” this year as he grew increasingly confident inflation was heading towards the bank’s 2 per cent target.

Swaps markets are pricing in the BoE to make 0.75 percentage points of cuts by the end of the year.

Russia labels invasion of Ukraine a ‘war’ for the first time

Russia is in a “state of war”, the Kremlin has said, overturning its established policy of describing the two-year-long full-scale Russian invasion of Ukraine as a “special military operation”.

“Yes, it started as a special military operation,” Kremlin spokesman Dmitry Peskov said in an interview with a local Russian newspaper. “But as soon as this gang developed and the collective west started participating in the conflict on the side of Ukraine, for us it became a war.”

Peskov added that Russia would continue to fight to “liberate” land in four southern and eastern regions of Ukraine, which Moscow claimed as its own in the autumn of 2022 but has not managed to secure full control.

Risers and fallers in Europe

Big share moves in Europe today include UK life insurance group Phoenix, Polish supermarket chain Dino and UK sportswear retailer JD Sports:

Phoenix Group: Shares in the UK pensions and savings provider rose 9 per cent after it forecast an almost 50 per cent increase in profits by 2026.

Dino Polska: Shares in the supermarket group fell more than 7 per cent after 2023 earnings came in about 10 per cent below expectations.

JD Sports Fashion: Shares fell more than 4 per cent after sportswear giant Nike warned late on Thursday that its revenues would shrink this year, prompting fears of a knock-on effect for the brand’s distributors.

Galderma shares surge in test of European IPOs

Dermatology company Galderma’s shares opened higher on their first day of trading in Zurich, in a welcome sign for European initial public offerings after a prolonged slowdown.

The company, which sells skincare products including injectables for eliminating wrinkles, started trading at SFr61 (€62.6) on Friday morning, up from its IPO price of SFr53.

Private equity group EQT led a consortium to acquire Galderma from Nestlé for $10bn in 2019. The FT reported last month that EQT had revived plans for the IPO after shelving earlier proposals.

Markets update: European stocks slip back from interest rate rally

European stocks slipped slightly in early trading on Friday, after a busy week of central bank policy decisions pushed major indices to all-time highs in the previous trading session.

The region-wide Stoxx Europe 600 was down 0.1 per cent shortly after the opening bell, as was Germany’s Dax. France’s Cac 40 dropped 0.3 per cent.

London’s FTSE 100 added 0.2 per cent after retail sales figures beat analysts’ expectations for a contraction and remained flat in February, signalling that the UK’s economy is continuing to recover.

Contracts tracking Wall Street’s benchmark S&P 500 and the tech-heavy Nasdaq Composite held steady ahead of the New York trading session.

Belgian PM says EU leaders have demanded that violence in Gaza ‘stops right now’

Belgium’s prime minister said EU leaders had made “extremely clear” demands about the war in Gaza in statements agreed late on Thursday.

“We finally have a unified position that is extremely clear. Demanding that the violence stops right now . . . very clear that an invasion of Rafah is something that is not acceptable and a very specific demand that Hamas would release the hostages as soon as possible,” Alexander De Croo said.

EU leaders agreed on Thursday night to call for “an immediate humanitarian pause leading to a sustainable ceasefire, the unconditional release of all hostages and the provision of humanitarian assistance”.

Belgium and Ireland are among countries calling for tougher language on Israel but they have previously been rebuffed by Austria and Germany, among others.

Aston Martin to name Bentley chief Adrian Hallmark as new head in coup for luxury-car maker

Aston Martin is poised to name Bentley head Adrian Hallmark as its latest chief executive, the third change of leadership at the UK luxury-car maker in the space of four years, according to two people.

Hallmark has overseen a turnaround at Bentley in which profits have risen tenfold in the past five years.

Bentley, owned by Volkswagen, announced Hallmark’s immediate departure on Friday. He is leaving “at his own request and by mutual consent”, the company said, adding it would name his successor “in due course”.

He will join Aston Martin later in the year after a notice period of several months, replacing current Aston boss Amedeo Felisa, the people said.

Aston did not immediately respond to a request for comment.

Profits at JD Wetherspoon surge after customers return to pubs

UK pub group JD Wetherspoon posted a surge in profits, as customers returned to its pubs after the pandemic despite the cost of living pressure.

The chain, which operates 814 sites nationwide, reported a profit before tax of £36mn for the six months to January 28, a nearly eightfold increase from £4.6mn a year earlier. Revenues were up 8 per cent to £991mn.

Its operating margin of 6.8 per cent for the half-year was an improvement from last year but was still down on its 7.3 per cent margin in 2019.

Last October, the group recorded its first annual profit since the pandemic.

Regulator presses Vodafone and Three to allay concerns over proposed merger

The UK antitrust regulator is planning to refer the proposed merger of Vodafone’s domestic business with CK Hutchison’s Three UK for an in-depth investigation, citing concerns the tie-up could threaten competition.

The Competition and Markets Authority on Friday said it would open a ‘phase 2’ investigation unless the parties could allay its concerns in the coming days. The merger, which is expected to create Britain’s largest mobile operator, would reduce the number of UK operators from four to three.

Julie Bon, the CMA’s phase 1 decision maker on the case, said that while Vodafone and Three have said their deal is good for competition, “the CMA has not seen sufficient evidence to date to back these claims”.

British retail sales beat expectations

British retail sales beat analysts’ expectations of a contraction and flatlined in February, as growth in clothing offset falling food sales.

The quantity of goods bought in Great Britain was unchanged between January and February following a 3.6 per cent increase in the previous month, the Office for National Statistics said.

This was better than the 0.3 per cent drop forecast by economists polled by Reuters because of wet weather.

Sales volumes fell by 0.4 per cent in the three months to February when compared with the previous three months, and by 1 per cent when compared with the three months to February 2023.

Markets update: Chinese equities decline as renminbi weakens

Hong Kong and China had the worst-performing Asian bourses on Friday as the renminbi weakened against the dollar.

Hong Kong’s Hang Seng index shed 2.8 per cent, with the Hang Seng Tech index dropping 4.1 per cent and the China Enterprises index falling 3.1 per cent. The mainland’s CSI 300 index lost 1.1 per cent.

CK Asset Holdings was among the worst performers in Hong Kong after it cut its dividend amid disappointing property sales.

China’s currency weakened against the dollar to its lowest level since November after a central bank official said there was room for more monetary easing.

Russia targets Ukrainian energy in large-scale missile attack

Russian ballistic and cruise missiles as well as drones targeted critical infrastructure across Ukraine before dawn on Friday in a second consecutive day of massive air attacks, according to authorities.

“Now the enemy is carrying out the largest-scale attack on the Ukrainian energy industry in recent times,” said energy minister German Galushchenko. “The goal is not just to damage, but to try again, like last year, to cause a large-scale failure in the operation of the country’s energy system.”

Galushchenko reported damage to power generation facilities and transmission and distribution systems in many regions of Ukraine.

Cosco subsidiary cites weak global demand as profits plummet

Shares of the Hong Kong-listed shipping and logistics subsidiary of Cosco, one of the world’s largest shipping groups, dipped 15 per cent after the company reported profits fell 86 per cent year on year due to weak demand.

Orient Overseas (International) announced a $1.4bn profit for 2023 on Thursday, down from $10bn in 2022. The company also cut its final dividend by more than 90 per cent.

The company said inflation, a “slowdown in economic growth of advanced economies” and changing consumer spending patterns led to weaker than expected cargo demand last year.

The group also said disruptions to shipping in the Red Sea had complicated this year’s outlook.

What to watch in Europe

Events: The UK Competition and Markets Authority is due to finish the first phase of its investigation into a potential merger of the UK telecoms operations of Vodafone and Three.

Economic data: In the UK, the long-running GfK consumer confidence survey is out for March, after falling two points to minus 21 in February. The Office for National Statistics will release February data on retail sales, which rebounded by 3.4 per cent in January.

Corporate updates: UK pub chain JD Wetherspoon releases half-year results after announcing in October its first annual profits since the pandemic. Pension group Phoenix will release annual results.

China’s renminbi weakens to lowest level against dollar in four months

China’s currency weakened 0.6 per cent against the dollar to Rmb7.26, its lowest level since November, after a central bank official said there was room for more monetary easing.

“There is still room for the reserve requirement ratio to decline,” said Xuan Changneng, deputy governor of the People’s Bank of China, on Thursday, citing a “shift in monetary policy of major economies”, a likely reference to the US Federal Reserve maintaining forecasts for interest rate cuts this year on Wednesday.

Beijing has been wary of easing monetary policy due to concerns over capital flight, but lower US rates reduce some of that risk.

Li Auto shares fall after cutting sales forecasts amid EV price war

Hong Kong-listed shares in Chinese electric-vehicle maker Li Auto dropped 7 per cent on Friday, after the company slashed its January-March sales volume forecast due to lower than expected order intake.

Li Auto expects to deliver 76,000 to 78,000 cars in the current quarter, down 24 per cent from a previous guidance, according to an exchange filing on Thursday. The company had put “excessive” emphasis on sales performance, said chair Xiang Li.

While Li Auto became China’s first major EV start-up to turn a profit last year, it is facing a price war and fierce competition in the world’s largest auto market.

Markets update: CK Asset Holdings falls while Henderson Land climbs

Two of Hong Kong’s largest property developers saw their stock prices diverge on Friday morning after reporting earnings.

Henderson Land was the top performer in the city’s benchmark Hang Seng index in early trading, adding 2.6 per cent. Competing developer CK Asset Holdings was one of the worst-performing large-cap stocks, dropping 12.8 per cent.

Prior to the earnings announcements on Thursday, the two companies’ share prices had been correlated for the year so far. But CK Asset cut its dividend more than expected and missed estimates on property sales, while Henderson Land’s dividend was in line with expectations.

The broader Hang Seng index shed 2 per cent. Japan’s benchmark Topix was the only major stock market in Asia to see gains in early trading.

What to watch in Asia today

Events: India’s external affairs minister starts an official visit to Singapore, the Philippines and Malaysia. Today is World Water Day.

Economic data: Japan releases its consumer price index for February, South Korea publishes its producer purchasers’ index and New Zealand announces trade data. China’s foreign direct investment statistics are scheduled for release.

Corporate results: Chinese tech company Meituan, Zijin Mining Group, property developer Longfor and China Petroleum and Chemical (Sinopec) announce results.

Japanese inflation accelerates at fastest pace in four months

Japan’s core inflation accelerated in February at the fastest pace in four months as the impact from gas and electricity subsidies declined.

The core consumer price index, excluding volatile fresh food prices, rose at an annual rate of 2.8 per cent in February, compared with a 2 per cent rise in January, according to official statistics released on Friday.

But a more closely watched measure of inflation that excludes both food and energy prices slowed for the sixth straight month. The “core core” index rose 3.2 per cent, decelerating from the previous month’s 3.5 per cent, complicating the path for the Bank of Japan after it raised interest rates for the first time in 17 years.

US to bring UN resolution calling for immediate Gaza ceasefire

The US will bring a UN Security Council resolution for a vote on Friday calling for an immediate ceasefire in Gaza of at least six weeks as part of a hostage deal, officials said.

US officials have worked on the resolution, which warns against an offensive in Rafah, for the past several weeks. It urges the release of hostages and an immediate six-week ceasefire, which should “lay the foundation for a sustainable ceasefire”, according to the text of the measure viewed by the Financial Times.

The vote coincides with a trip to Israel by US secretary of state Antony Blinken and comes as tensions between the US and Israel deepen over the Jewish state’s pursuit of its war aims and the high death toll in the Gaza Strip.

EU opens accession talks with Bosnia and Herzegovina

The EU has agreed to open accession negotiations with Bosnia and Herzegovina, giving a green light to the country’s formal process to becoming a member of the bloc.

“Congratulations! Your place is in our European family. Today’s decision is a key step forward on your EU path,” Charles Michel, EU Council president, said after the bloc’s 27 leaders agreed to back the move at a summit in Brussels.

“Now the hard work needs to continue so Bosnia and Herzegovina steadily advances, as your people want,” Michel added.

FedEx shares leap on improved earnings outlook

FedEx has lifted its full-year earnings guidance, sending shares 12 per cent higher in after-hours trading on Thursday even as the company missed sales and profit expectations for its most recent quarter.

The logistics group, a bellwether for global growth, forecast adjusted earnings of $17.25 to $18.25 a share for the fiscal year, up from a prior forecast made in December, when it warned demand was slowing.

In its third quarter, FedEx reported $879mn in net income on $21.7bn in revenue.

“FedEx delivered another quarter of improved profitability in what remains a difficult demand environment,” Raj Subramaniam, chief executive, said on Thursday. He also attributed improved margins to the company’s cost-cutting programme.

US stocks continue post-Fed rally to close at record high

US stocks again closed at record highs, riding momentum from Wednesday’s session as investors gained confidence in the Federal Reserve’s outlook for interest rate cuts this year.

The benchmark S&P 500 advanced 0.3 per cent with gains across the board and the Nasdaq Composite added 0.2 per cent, helped by gains in chipmakers.

Canada’s main stock index, the TSX Composite, closed 0.2 per cent higher, topping a record close set in April 2022. The Bank of Canada on Wednesday said it expected to cut interest rates this year.

US Treasuries activity was relatively muted on Thursday, with the yield on the two-year note rising 0.02 percentage points as prices fell. The short-dated bond rallied on Wednesday.

Comments