10 States Where Gen Z Has the Most Debt — and How To Pay It Off Now

According to Scholaroo, Gen Z has the lowest average credit card debt compared to other generations. As a matter of fact, post-millennials, on average, have $2,781 in credit card debt, with an average next card payment of $83. This means that they have approximately 52% less credit card debt than their millennial counterparts and 66.5% less than Gen Xers.

Find Out: You Can Get These 3 Debts Canceled Forever

Read More: Owe Money to the IRS? Most People Don’t Realize They Should Do This One Thing

While Gen Zers haven’t racked up as much debt as other generations, they aren’t exactly debt-free. On average, the youngest adult generation has $15,456 in student loan debt and an average mortgage of $195,849. Debt, however, is not distributed equally among the United States. Some states have Gen Zers with significantly more debt than others. Here are the 10 states where Gen Z has the most debt and how to pay it off now.

Arizona

Average debt: $18,708

Discover More: How Much Does the Average Middle-Class Person Have in Savings?

Check Out: 8 Rare Coins Worth Millions That Are Highly Coveted by Coin Collectors

Oregon

Average debt: $18,713

Read Next: 9 Most Valuable American Quarters in Circulation

South Dakota

Average debt: $18,822

Wyoming

Average debt: $18,924

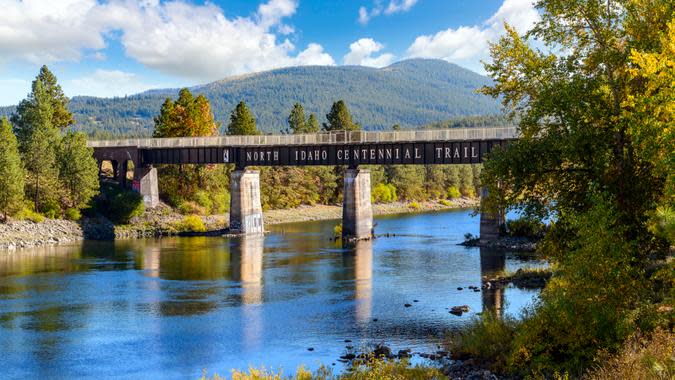

Idaho

Average debt: $19,167

Learn More: 7 Coins Worth a Lot of Money in 2024

North Dakota

Average debt: $19,352

Colorado

Average debt: $19,532

Washington

Average debt: $20,349

For You: Frugal People Love the 6 to 1 Grocery Shopping Method: Here’s Why It Works

Utah

Average debt: $23,047

Hawaii

Average debt: $18,250

How To Pay Off Debt Now

If you are one of the millions of people saddled with large amounts of debt, hope is not lost. As a Gen Zer you are still young with plenty of time to correct course. The first way to fix money mistakes is to make a comprehensive budget. A budget should begin with your income and expenses. Once you can see how much you spend vs. how much you bring in, you can begin to make decisions about what are necessities and what is discretionary.

Most financial experts agree that you should tackle any credit card debt first. Start with your highest-interest cards and pay as much as you can each month until the balance is completely paid off. Continue to make the minimum payments on all other cards. Once you have paid off one card, apply the same principle to the card with the next highest interest rate until all of your credit cards have a zero balance.

Once you have your credit card debt paid off, you will have more money to put towards paying off any other loans and getting yourself set up for a future filled with financial freedom.

This article originally appeared on GOBankingRates.com: 10 States Where Gen Z Has the Most Debt — and How To Pay It Off Now