lucky-photographer

Last week, the Fed meeting turned into a non-event as it went according to expectation. I'm thinking a lot more about bonds around that date and it's a decent time to update my view that the short-end remains quite attractive. Meanwhile, I still don't have a strong view of the long end. The gist of the meeting has been widely reported but in my opinion it is time well spent to just review things for yourself or even better watch or rewatch the thing on video. Whichever media you consume, whether it is Seeking Alpha, WSJ, Bloomberg or Fintwit, there is always something getting lost in translation.

Broadly speaking not much has changed. Fed Chair Jerome Powell reiterated again how the FOMC continues to focus on managing inflation and the long-term objective is still 2% and full employment. I'm inclined to the idea policymakers don't think it is the end of the world if inflation bounces around in the 1.5%-4% range for a few years. That would be relatively high given their goals but as long as long-term inflation expectations remain low it wouldn't be a problem for them. Meanwhile, it could be helpful to work through the (at least partially Covid driven) high government indebtedness. It could also make it a little bit easier to reduce the Fed's balance sheet over time. But that's just a subjective read on my part and not the official FOMC stance.

Diving into the details, I'd say the economy has likely been on the stronger end of the range of where FOMC members expected it to be by now. It is definitely a lot stronger than I expected given the historical rate hikes we've seen.

Here's what Powell said to characterize where we are now (emphasis mine):

We know that reducing policy restraint too soon or too much could result in a reversal of the progress we have seen on inflation and ultimately require even tighter policy to get inflation back to 2 percent. At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment.

...The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably down toward 2 percent. Of course, we are committed to both sides of our dual mandate, and an unexpected weakening in the labor market could also warrant a policy response...

He's basically saying the FOMC could make a mistake in either direction. My read, from listening to the Fed chair over the years, is that Powell likely believes easing rates too early would be the bigger mistake. If there are clear signs of labor weakening in a big way I don't think he will hesitate to ease even if inflation is, at that point, still above target.

The most interesting remarks were related to the balance sheet run-off (emphasis mine):

At this meeting, we discussed issues related to slowing the pace of decline in our securities holdings. While we did not make any decisions today on this, the general sense of the Committee is that it will be appropriate to slow the pace of runoff fairly soon, consistent with the plans we previously issued. The decision to slow the pace of runoff does not mean that our balance sheet will ultimately shrink by less than it would otherwise, but rather allows us to approach that ultimate level more gradually. In particular, slowing the pace of runoff will help ensure a smooth transition, reducing the possibility that money markets experience stress and thereby facilitating the ongoing decline in our securities holdings consistent with reaching the appropriate level of ample reserves.

Later he responded to a question about the balance sheet run-off like this (emphasis mine):

CHAIR POWELL. So, it's sort of ironic that by going slower you can get farther, but that's the idea. The idea is that with a smoother transition, you won't, you'll run much less risk of kind of liquidity problems which can grow into shocks and which can cause you to stop the process prematurely. So, that's-- in terms of how it ends, we're going to be monitoring carefully money market conditions and asking ourselves, what they're telling us about reserves. Are they, right now we would characterize them as abundant, and what we're aiming for is ample. And which is a little bit less than abundant. So there isn't a, there's not a dollar amount or a percent of GDP or anything like that where we think we have a really pretty clear understanding that we're going to be looking at what these, what's happening in money markets in particular, a bunch of different indicators, including the ones I mentioned, to tell us when we're getting close.

If I remember correctly, it wasn't long ago, the Fed put the balance sheet on auto-pilot. Some of the reasons for an auto-pilot run-off where that it avoid signaling the market the Fed believes something's up. Another benefit is reduced volatility because markets can anticipate supply and demand more easily.

Powell specifically says a few times that it's not the banking system they're worried about. The last thing he wants to do is to throw them under the bus. The December 2023 FOMC press-release contained this sentence:

The U.S. banking system is sound and resilient.

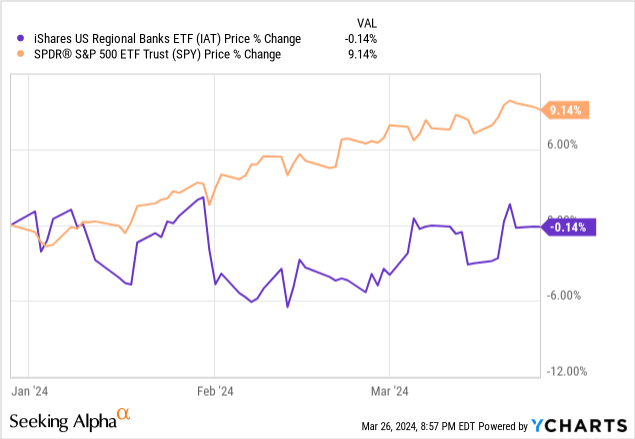

This sentence was actually in every FOMC meeting press-release, except the 1st one, of 2023. Maybe they just figured it was time to move on from the subject in the New Years. With some individual exceptions regional banks haven't been doing great but not like there's a huge crisis going on either:

I'm not sure what the above means for bond or equity markets. The potential liquidity issues Powell is pointing out appear unlikely to affect short-term bonds negatively. I would imagine reducing the run-off would impact the longer end favorably but perhaps not if the run-off is reduced in size because there's something wrong on that end of the curve.

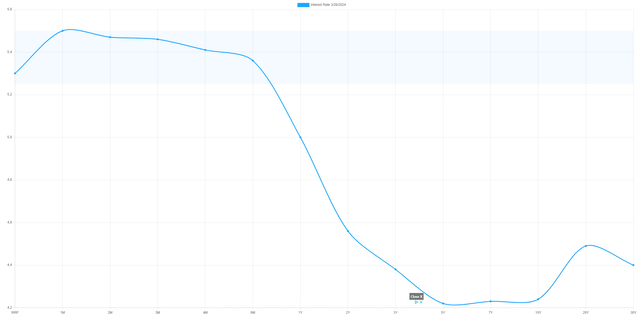

In the last year or so, I've written numerous articles about bond positions (short or long). For quite some time I've been favoring the short-end of the curve. The curve is still inverted with shorter dated securities producing higher yields.

US yield curve 2024 March (UStreasuryyieldcurve.com)

That should indicate the market believes rates will go down, and by not locking in these higher rates, you're missing out on an opportunity. At some point, rates will go down. If they move back down to 1% over the next year, the people who are now buying longer-dated bonds are doing really well. Suddenly, the short-term bond positions will look very silly. So far, the market has continued to surprise in that short rates have remained robust and the longer-end has remained low.

Short-dated bills were among my top-5 positions for 2024. There is some opportunity and reinvestment risk. Yet, there is almost no credit risk on the short-end. I usually just highlight the large short-dated bond ETFs when talking about my bond positions. Many people prefer futures. This time, I wanted to highlight a lesser-known bond ETF called the US Treasury 3 Month Bill ETF (NASDAQ:TBIL). It gets the job done. This passively managed ETF tries to mimic the price and yield performance of the ICE BofA US 3-Month Treasury Bill Index. The fund only charges 0.15%, which means it is among the 20% cheapest funds of this kind according to Morningstar data.

Sign up here for a 14-day free trial of my weekly premium trade & investment ideas. Discover the best things I can find in this market. Unique and hard-to-find ideas, selected based on the presence of edge, outstanding risk/reward and being uncorrelated or being less correlated to the S&P 500.