ASX 200 dips as copper stocks surge, Macquarie's big downgrade day smashes banks

Today in Review

MARKETS

The S&P/ASX200 (XJO) finished 15.8 points lower at 7,713.6, % from its session high/low and just % from its high/low. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by 127 to 148.

Finally! I get to write in an Evening Wrap that the Resources (XJR) (+1.73%) sector was the best performing sector. At the top line, modest rebounds in BHP Group (BHP) (+2.65%), Rio Tinto (RIO) (+1.92%), and South32 (S32) (+5.23%) helped. But drilling down, it was a combination of gold, copper, and select lithium stocks topping the leaders list.

Also doing well today were the defensive sectors of Consumer Staples (XSJ) (+0.55%) and Health Care (XHJ) (+0.43%). Defence is definitely consistent with investor sentiment at the moment, so this is no surprise.

Probably helping Staples and Health Care was the fact the other typically defensive sector of Financials (XFJ) (-2.58%) was belted today. We know the big banks have had a tremendous run lately, but success on the stock market often comes at a cost.

Major broker Macquarie has downgraded ANZ Group Holdings Ltd (ANZ) (-3.76%), Westpac Banking Corporation (WBC) (-3.75%), and National Australia Bank Ltd (NAB) (-2.76%) to underperform (see Broker Notes for more info).

ChartWatch

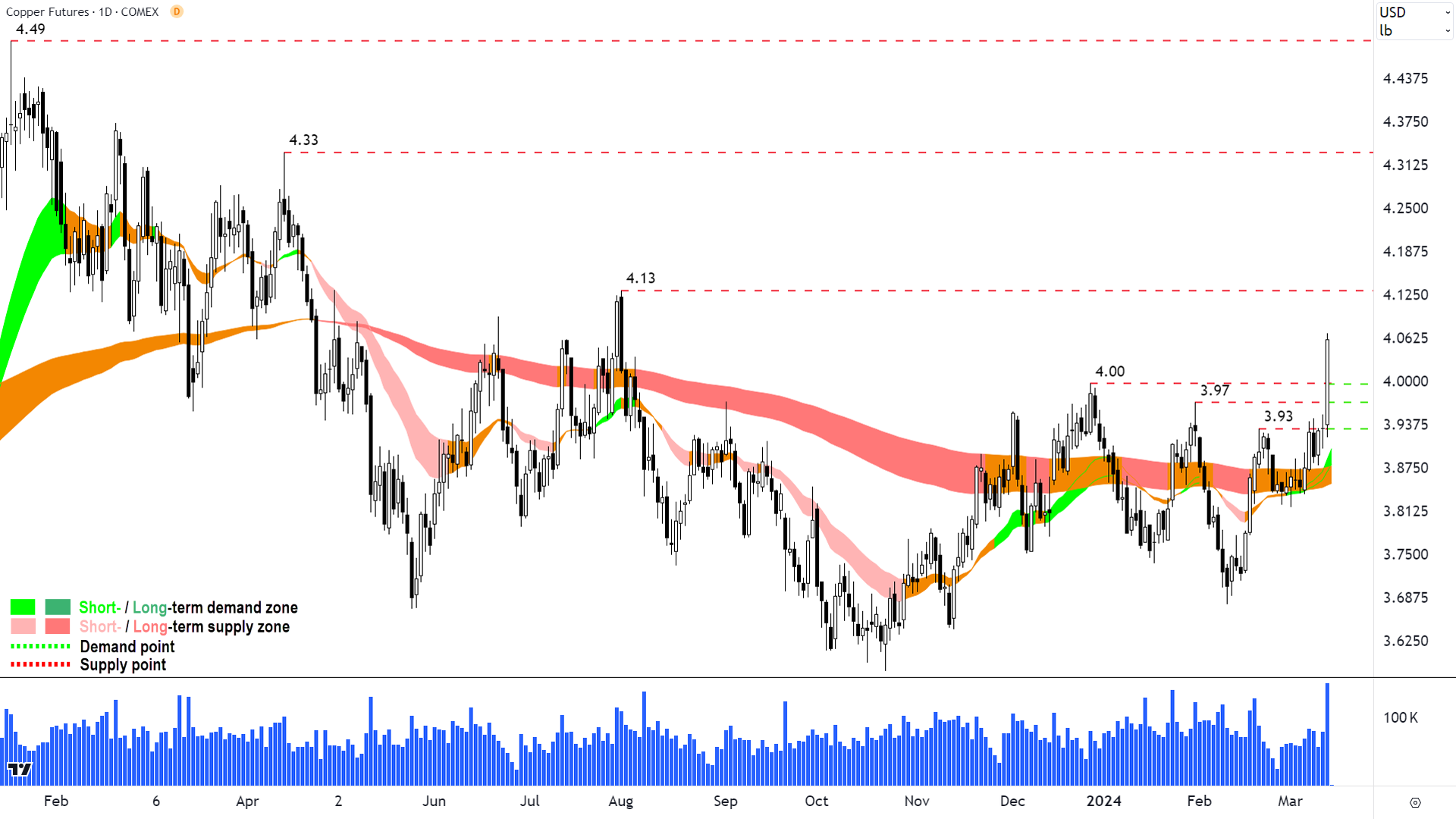

High Grade Copper COMEX

It's a tale of haves and have nots in today's ChartWatch. Let's kick of with a big "have". Copper. It enjoyed a very nice pop on COMEX on Wednesday. This has created a long white candle with a close near the high (i.e., a "Marubozu") which is typical of demand-side control.

Even better, the Marubozu closed above three historical supply points in 3.93, 3.97, and 4.00. Copper is not completely out of the woods though, with 4.13 likely to act as the next key point of excess supply.

We'll need to watch the candles and price action carefully near 4.13. Supply-side candles (i.e., those with black bodies and or upward pointing shadows) would signal the supply-side is indeed exerting their influence on the price.

Alternatively, demand-side candles (i.e., those with white bodies and or downward pointing shadows) would signal the demand-side remains fearless in the face of potential excess supply, and likely, said supply probably isn't there.

The massive spike in volume confirms the return of demand as well as significant supply side removal. This bodes well for continued upside price action.

I'll do a dedicated comprehensive ASX copper ChartWatch for you tomorrow.

Uranium Futures COMEX

On Monday, I did a dedicated ChartWatch on uranium and the ASX uranium sector. I noted that due to the "fluid nature of the fluid nature of the July-Jan rally, there are few points of historical excess supply which could act as future points of excess demand". This meant that the "long term uptrend ribbon is the key area of (dynamic) demand going forward".

Bad news uranium bulls. I was right. We're here, smack bang in the long term uptrend ribbon. I still believe it will do its job and provide some support here, but the reaction from this zone is now critical. We must see a sharp, V-shaped bounce and a return to rising peaks and rising troughs.

If we see a feeble bounce, or no bounce at all, it will likely confirm the end of this phase of the uranium bull market. Note, the next historical support point below the long term uptrend ribbon is not too far way at US$76/oz. It could also act as a reversal point.

Economy

Today

No major economic data releases in our time zone today!

Later this week

Thursday

23:30 US Core Producer Price Index (PPI) February (+0.2% monthly forecast vs +0.5% monthly in January)

23:30 US Retail Sales February (+0.8% forecast vs -0.8% January)

Friday

23:30 US Empire State Manufacturing Index (-7.6% forecast vs -2.4% previous)

Saturday

01:00 US Prelim UoM Consumer Sentiment (77.3 forecast vs 76.9 previous)

Latest News

4 sectors to drive 12% earnings growth over the next 12 months

Copper prices are soaring: The state of play for ASX copper miners

Is there another BHP on the ASX?

Morning Wrap: ASX 200 to rise, S&P 500 lower as tech stocks ease, Copper soars to 11-month high

Evening Wrap: ASX 200 edges higher but iron ore price plunge drags on resources sector

Interesting Movers

Trading higher

+76.3% Arafura Rare Earths (ARU) - Commonwealth Government supports Nolans with US$533m package

+24.8% Superloop (SLC) - Origin contract & upgraded guidance

+18.3% 29METALS (29M) - No news, large rally in copper price Wednesday, likely a degree of short covering also

+14.8% Vulcan Energy Resources (VUL) - No news, likely a degree of runaway short covering

+10.7% Clinuvel Pharmaceuticals (CUV) - CLINUVEL initiates on market share buy-back program

+10.2% Alpha HPA (A4N) - No news, likely some of ARU rally on government funding rubbing off here

+10.0% Macmahon Holdings (MAH) - No news since yesterday's Investor Presentation - Euroz Hartleys Rottnest Conference, rise is consistent with prevailing short and long term uptrends

+7.5% Myer Holdings (MYR) - First Half Results and Board and Management Changes

+7.2% Sandfire Resources (SFR) - No news, large rally in copper price Wednesday, rise is consistent with prevailing short and long term uptrends

+7.0% Latin Resources (LRS) - No news, broad-based strength in ASX lithium sector

+6.6% OFX Group (OFX) - No news, closed above long term downtrend ribbon

+6.1% Resimac Group (RMC) - No news, closed above long term downtrend ribbon

+6.0% Develop Global (DVP) - No news, broad-based strength in ASX lithium sector

+6.0% Evolution Mining (EVN) - No news, broad-based strength in ASX gold sector on modest rise in gold price Wednesday

+5.8% PSC Insurance Group (PSI) - ASX Query Re Media Speculation

+5.8% Adriatic Metals (ADT) - No news, broad-based strength in ASX gold sector on modest rise in gold & silver prices Wednesday

+5.7% Metals X (MLX) - No news, steady rise in tin prices recently, rise is consistent with prevailing short and long term uptrends

+5.7% Silver Lake Resources (SLR) - No news, broad-based strength in ASX gold sector on modest rise in gold price Wednesday

+5.4% Bellevue Gold (BGL) - No news, broad-based strength in ASX gold sector on modest rise in gold price Wednesday

Trading lower

-18.0% Aussie Broadband (ABB) - Termination of White Label Agreement

-10.5% Silex Systems (SLX) - Broad ASX uranium sector weakness on large drop in uranium price Wednesday

-7.9% Bannerman Energy (BMN) - Broad ASX uranium sector weakness on large drop in uranium price Wednesday

-6.8% Polynovo (PNV) - No news, pullback after strong rally since mid-January

-6.8% Eagers Automotive (APE) - Ex-dividend $0.50 fully franked

-5.4% Inghams Group (ING) - Ex-dividend $0.12 fully franked

-5.3% Select Harvests (SHV) - No news 🤔

-5.3% Deep Yellow (DYL) - Broad ASX uranium sector weakness on large drop in uranium price Wednesday

-5.0% Core Lithium (CXO) - Continued negative response to Half Year Financial Results, several broker rating and price target downgrades (see Broker Notes)

-4.5% Neuren Pharmaceuticals (NEU) - No news, fall is consistent with prevailing short tern downtrend

-4.4% Paladin Energy (PDN) - Broad ASX uranium sector weakness on large drop in uranium price Wednesday

-4.2% Zip Co (ZIP) - No news, consistent with recent volatility, pullback after strong rally since October

-4.2% REA Group (REA) - No news 🤔 Close below short term uptrend ribbon and price action back to lower peaks and lower troughs

-3.8% ANZ Group (ANZ) - Macquarie downgrades three of Big 4 banks to underperform

-3.7% Westpac Banking Corporation (WBC) - Macquarie downgrades three of Big 4 banks to underperform (see Broker Notes)

Broker Notes

ANZ Group (ANZ) downgraded to underperform from neutral at Macquarie; Price Target: $27.00 from $25.00

Alliance Aviation Services (AQZ) retained at buy at Ord Minnett; Price Target: $4.35

Australian Vintage (AVG) retained at hold at Bell Potter; Price Target: $0.41

Burgundy Diamond Mines (BDM) retained at buy at Bell Potter; Price Target: $0.40 from $0.45

Commonwealth Bank of Australia (CBA) retained at underperform at Macquarie; Price Target: $95.00 from $88.00

Capricorn Metals (CMM) retained at buy at Bell Potter; Price Target: $5.95 from $6.00

Cosol (COS) retained at buy at Ord Minnett; Price Target: $1.21

Centaurus Metals (CTM) retained at speculative buy at Canaccord Genuity; Price Target: $0.80 from $1.40

Cleanaway Waste Management (CWY) retained at overweight at Jarden; Price Target: $2.85

-

Core Lithium (CXO)

Retained at sell at Citi; Price Target: $0.11

Retained at sell at Goldman Sachs; Price Target: $0.13 from $0.14

Retained at sell at Jarden; Price Target: $0.15

Electro Optic Systems Holdings (EOS) retained at buy at Bell Potter; Price Target: $2.30

Electro Optic Systems Holdings (EOT) retained at buy at Ord Minnett; Price Target: $36.00

Evolution Mining (EVN) retained at equal-weight at Morgan Stanley; Price Target: $3.35

GQG Partners (GQG) retained at buy at Ord Minnett; Price Target: $2.60

Iluka Resources (ILU) retained at equal-weight at Morgan Stanley; Price Target: $7.20 from $7.15

James Hardie Industries (JHX) retained at buy at Citi; Price Target: $63.00

Lindsay Australia (LAU) retained at buy at Ord Minnett; Price Target: $1.52

Light & Wonder (LNW) retained at overweight at Jarden; Price Target: $161.00

-

Liontown Resources (LTR)

Upgraded to neutral from underweight at Barrenjoey; Price Target: $1.35 from $0.90

Retained at buy at Bell Potter; Price Target: $1.90 from $1.60

Downgraded to hold from speculative buy at Canaccord Genuity; Price Target: $1.30 from $1.10

Retained at sell at Citi; Price Target: $1.00

Downgraded to underweight from neutral at Jarden; Price Target: $0.91

Retained at neutral at Morgan Stanley; Price Target: $1.45

Lynas Rare Earths (LYC) initiated underweight at Morgan Stanley; Price Target: $5.00

Megaport (MP1) retained at outperform at Macquarie; Price Target: $18.00 from $15.90

Metcash (MTS) retained at overweight at Jarden; Price Target: $4.20 from $4.30

National Australia Bank (NAB) downgraded to underperform from neutral at Macquarie; Price Target: $32.50 from $30.00

Northern Star Resources (NST) retained at equal-weight at Morgan Stanley; Price Target: $12.40

Nextdc (NXT) retained at buy at Citi; Price Target: $19.75

Orora (ORA) retained at overweight at Morgan Stanley; Price Target: $3.20

Premier Investments (PMV) retained at overweight at Morgan Stanley; Price Target: $32.00

PSC Insurance Group (PSI) retained at overweight at Morgan Stanley; Price Target: $5.85

Regis Healthcare (REG) retained at buy at Ord Minnett; Price Target: $4.25

Reece (REH) retained at neutral at Citi; Price Target: $28.90

Ramsay Health Care (RHC) retained at neutral at Macquarie; Price Target: $53.35

Ramelius Resources (RMS) retained at buy at Ord Minnett; Price Target: $2.10

Regis Resources (RRL) retained at overweight at Morgan Stanley; Price Target: $2.40

Reliance Worldwide Corporation (RWC) retained at buy at Citi; Price Target: $5.45

Siteminder (SDR) retained at overweight at Morgan Stanley; Price Target: $6.45 from $5.70

Sims (SGM) upgraded to buy from neutral at Citi; Price Target: $13.50

Select Harvests (SHV) retained at buy at Ord Minnett; Price Target: $5.41

Supply Network (SNL) retained at buy at Ord Minnett; Price Target: $19.20

SomnoMed (SOM) downgraded to market-weight from overweight at Wilsons; Price Target: $0.45 from $1.25

SRG Global (SRG) retained at buy at Ord Minnett; Price Target: $0.96

Southern Cross Media Group (SXL) retained at neutral at UBS; Price Target: $0.96 from $0.74

Tabcorp Holdings (TAH) retained at outperform at Macquarie; Price Target: $1.00 from $0.85

-

Treasury Wine Estates (TWE)

Retained at buy at Goldman Sachs; Price Target: $12.60

Retained at overweight at Jarden; Price Target: $12.90

Volpara Health Technologies (VHT) retained at hold at Morgans; Price Target: $1.15

Westpac Banking Corporation (WBC) downgraded to underperform from outperform at Macquarie; Price Target: $26.00 from $25.00

Webjet (WEB) retained at buy at Ord Minnett; Price Target: $9.84

Waypoint REIT (WPR) retained at accumulate at Ord Minnett; Price Target: $2.51

Scans

This article first appeared on Market Index on Thursday 14 March.

5 topics

12 stocks mentioned