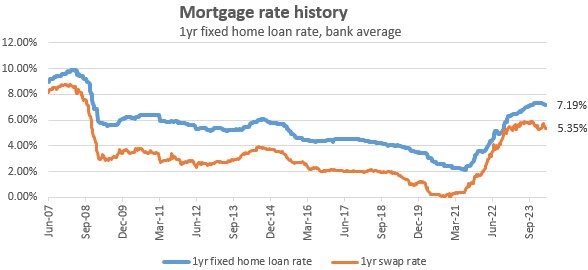

Mortgage rates have been rising.

The most popular term is 1 year fixed - and the rate for that term is now its highest since 2008, rising to over 7% for the first time in 15 years.

In between those rates dipped to almost 2%, but over the subsequent two years it has only been 'up'.

Maybe there is a growing expectation among borrowers that these rates might fall. In fact, there is some support for that. Wholesale markets are pricing in -75 bps of OCR cuts this year alone.

But the question remains: are we getting a fair rate from the banks (given they have to live with the RBNZ monetary settings and the international rate environment like the rest of us) ?

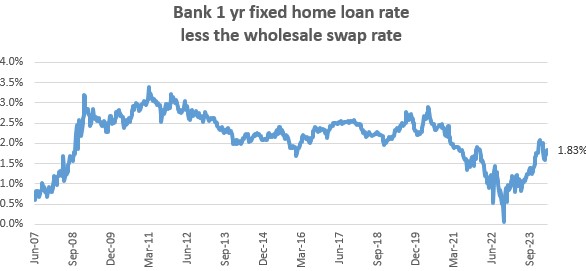

Compared with wholesale swap rates, the margin is currently a little lower than its long term average levels. But what is striking about this difference is that banks did not chase rates up in the late 2021 to early 2023 period when this margin shank. That was undoubtedly due to the fact that they did not need this wholesale funding because customer deposit levels were strong and loan demand was weak.

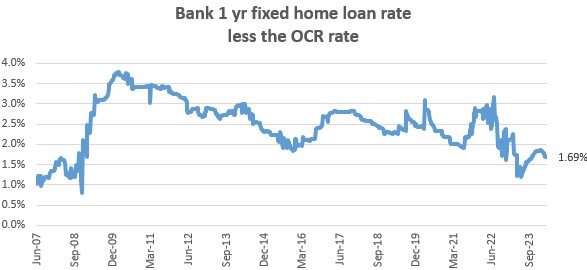

The RBNZ's OCR has some impact on short fixed home loan rates, and by this benchmark banks are charging much less for a one year fixed loan compared to the OCR than they have for most of the past fifteen years.

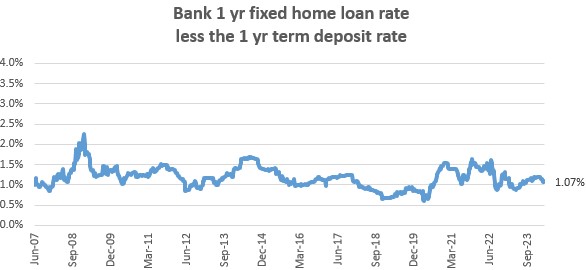

But when loan demand is low, the key funding source remains customer deposits. Customer deposits are held in many forms; current accounts, savings accounts, and term deposits.

Compared with what banks pay for a 1 year term deposit there seems little evidence that they are acting any differently now than they have over the 15+ years of the 'recent' past. An average bank one year home loan will cost about 1% more than what depositors get paid for a one year term deposit.

Opinion:

Banking services are a commodity, with actually little to distinguish them between institutions. And as is the case with all commodities, the service provider can only be efficient with volume. Without volume, inefficiency grows quickly. Big bulk also generates the resources to respond to changing regulation. Regulation is basically designed to keep the financial system 'safe'. But regulators can go off the rails too, causing any industry excess operating costs, and banking is no exception. Only large scale institutions can withstand regulator missteps.

In New Zealand, the long-standing attraction to 'principled regulation' has been whittled away. This is primarily due to us hiring into senior positions regulators from countries that use 'prescriptive regulation' principles. This infection has come mainly from regulators that developed their skill base in Australia, but more recently from an even more prescriptive environment in the UK. Regulators who "know better" are always a risk. They leave a trail of high costs for the outcomes they seek. And only the largest survive that pandemic. Badly focused regulation is a not-talked-about real reason costs of entry into the financial sector for innovative alternatives has become prohibitive.

Ironically, when new rules are proposed, it is the largest that seek 'certainty' and 'clarity', probably knowing full well that will generate more rules and insulate them from pesky upstarts.

'Principled regulation' faces other threats over time. Lawyers and judges pick away at vulnerabilities in the detail as issues that arise have to deal with. 'More regulation' becomes an easy answer to the lawyers crutch after-the-fact question "you knew or you should have known". Even when the tests are at the margin, this pressure gradually undermines principled regulation.

3 Comments

"Banking services are a commodity, with actually little to distinguish them between institutions."

Well said, David. Well said indeed. We need to get this message out. And your opinion helps.

"Ironically, when new rules are proposed, it is the largest that seek 'certainty' and 'clarity', probably knowing full well that will generate more rules and insulate them from pesky upstarts."

100% correct from what I've been involved with. You can drop the "probably" next time. ;-)

I think you will find interest rates are going to go up again. The forecast will be wrong, and rates will go higher or remain the same. Interest rates cannot go down really because they are only barely normal now. So we can expect more of the same, but upward movement if inflation doesn’t get down into the correct band.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.