JEFFERSON COUNTY, Texas — This is the first of a three-part series on emerging energy sources and Texas' role in developing them. Part two, on geothermal energy, publishes Tuesday, and part three, on small nuclear reactors, will publish on Wednesday.

JEFFERSON COUNTY — A concrete platform with fading blue paint marks the birthplace of the modern oil and gas industry in southeast Texas. Weather-beaten signs describe how drillers tapped the Spindletop oil well in 1901, a discovery that launched petroleum giants Texaco, Mobil and Gulf Oil.

Nearby, a red pipeline traces a neat path above flat, gravel-covered earth. French company Air Liquide started building this unassuming facility, with a wellhead and other machinery, on the iconic site in 2014 to store what it believes will be key to an energy revolution: hydrogen.

The ground that once released millions of barrels of oil now holds some 4.5 billion cubic feet of highly pressurized hydrogen. The gas is contained in a skyscraper-shaped cavern that reaches about a mile below ground within a subterranean salt dome.

Hydrogen promoters see the gas as a crucial part of addressing climate change. If it’s produced in a way that creates few or no greenhouse gas emissions, it could provide an eco-friendly fuel for cars, planes, 18-wheelers and ships, and could power energy-intensive industries such as steel manufacturing. Hydrogen emits only water when used as fuel.

If companies can produce clean hydrogen at a price that’s competitive with gasoline or diesel, supporters say it would revolutionize the fuel industry.

That’s a big if.

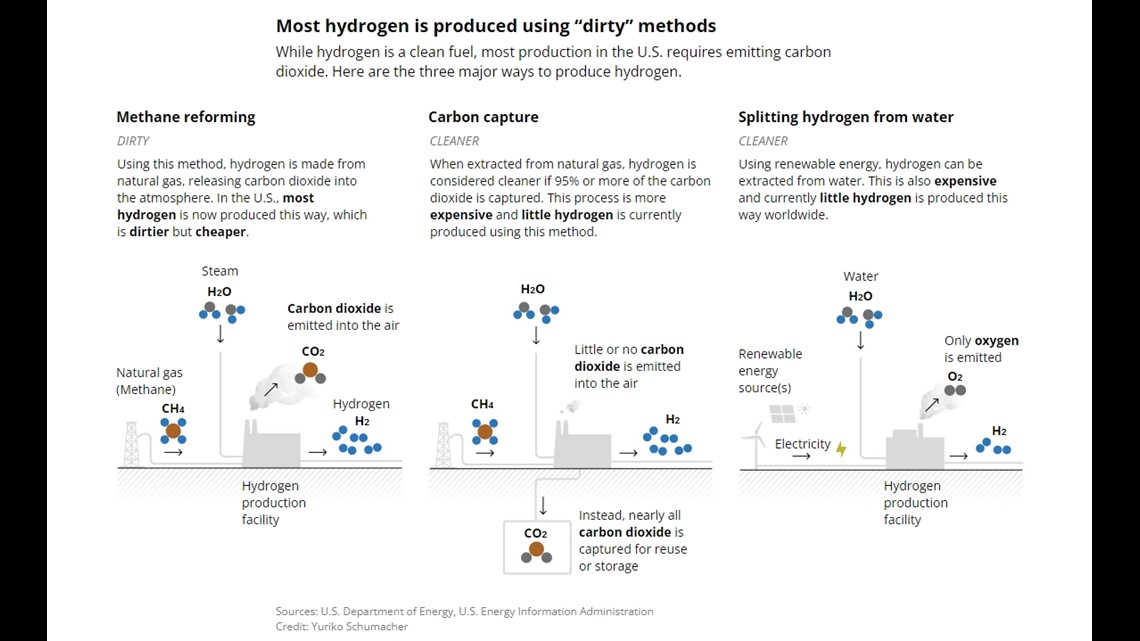

Hydrogen is among the most common elements in the universe, but on Earth it’s typically found bonded with something else, such as carbon. Today, hydrogen is often obtained by isolating it from methane, a mix of carbon and hydrogen that is the main component of natural gas. This process leaves behind carbon dioxide, which worsens climate change if released into the air.

Engineers say it’s possible to clean up that process by catching the extra carbon dioxide and reusing it — to get more oil out of a well, for example — or injecting it into the earth to store it. Another less polluting method is to split hydrogen from water, which is made up of hydrogen and oxygen, using electricity generated by wind, solar or nuclear power.

Texas has emerged as a leader in producing hydrogen the cheaper way using abundant supplies of natural gas without capturing the carbon dioxide. Air Liquide makes hydrogen at facilities along the state’s coast, from Beaumont to Corpus Christi. More than 100 miles of pipelines move that hydrogen to companies that buy it for processes such as removing sulfur from crude oil.

Little hydrogen is made from gas with carbon capture or from water in the state — or the rest of the country.

Some academics, policy advisers and companies that make hydrogen say Texas and the Gulf Coast should be where hydrogen created with fewer emissions takes off. A majority of the country’s hydrogen pipelines are already here, Texas’ petrochemical workers have skills that easily transfer to hydrogen production — which involves chemical reactions — and the state has the natural gas and renewable energy needed to produce it.

“We can be the breadbasket for not only the U.S. but for the world in providing hydrogen,” said Bryan Fisher, a managing director with RMI, a nonprofit that supports the clean energy transition.

But producing enough hydrogen cheaply, building the pipelines to move it and the subterranean caverns to store it and finding the customers to buy it requires companies to take some financial risk.

That effort is getting a boost from the federal government, which is offering billions of dollars’ worth of tax credits to kick-start production of hydrogen from gas with carbon capture or water. The government also plans to divide as much as $7 billion among seven regional clusters of projects to build hydrogen infrastructure, including up to $1.2 billion for projects in Texas and Louisiana that plan to make hydrogen largely from natural gas.

Competing to break into the industry are traditional fossil fuel companies, including Chevron and ExxonMobil. Hydrogen advocates say interest by the oil giants is good because they have the money and expertise to tackle such an ambitious project.

But environmental groups doubt that fossil fuel companies can make hydrogen from natural gas as cleanly as they say they can. They worry the federal funding will prop up oil and gas companies, when the emphasis should be on making hydrogen from water or creating clean power another way.

“Producing hydrogen from natural gas is not clean, not low-carbon and cannot and should not be considered a solution in our efforts to solve the world’s worsening climate change crisis,” David Schlissel, the co-author of a report from the Institute for Energy, Economics and Financial Analysis, said in a webinar.

Sitting in a mobile office at the Spindletop site, Katie Ellet, president of hydrogen energy and mobility for Air Liquide, urged critics not to be so puritanical about hydrogen production. She described hydrogen as part of a centuries-long evolution toward progressively cleaner fuels: coal replaced wood, then oil replaced coal.

Ellet believes now is hydrogen’s Spindletop moment. She believes the technology, economics and interest are in place to allow the industry to boom.

“We transition through these different energy cycles,” Ellet said. “And we’ve gotten better. We’ve learned, and we’ve gotten better. This is us … evolving into that next generation.”

Hydrogen hype grows in Texas

One weekday in October, Brian Weeks, senior director of business development at GTI Energy, walked onto a Houston hotel’s conference room stage to discuss hydrogen. GTI Energy used to be known as the Gas Technology Institute and researched natural gas. Now it promotes low-carbon energy.

Weeks faced a standing-room-only crowd at the Hydrogen North America event. He remembered when, maybe a decade earlier, only seven people at a conference showed up to hear him speak on the topic.

People have predicted hydrogen was about to take off before. Weeks worked on the idea off and on since the late 1990s, when he was at Texaco and the company believed hydrogen could power cars. At the time, they worried energy prices would keep rising. Weeks recalled it as a heady time for hydrogen, with actors from the hit TV series Baywatch starring in promotional videos.

But hydrogen didn’t catch. Technology for producing it remained expensive, while oil production instead got a giant boost. Hydraulic fracturing technology allowed the United States to rapidly increase how much oil it produced.

Still, Weeks wouldn’t have spent so much of his life on hydrogen if he didn’t believe it had a future, he said. Like Ellet, he said the circumstances feel different now. That’s in large part because of the federal government’s big investment: By 2030, the Biden administration wants America to produce 10 million metric tons per year of hydrogen made from water using renewable energy or from gas using carbon storage — about how much is produced now largely from gas without carbon capture.

“It’s been a roller coaster, really, for the last at least 20 years,” Weeks said in an interview.

Over the past few years, Weeks has helped a coalition of businesses, researchers and others apply for the federal funding earmarked in the 2021 Infrastructure Investment and Jobs Act for regional hydrogen projects, called “hydrogen hubs.”

But hydrogen didn’t catch. Technology for producing it remained expensive, while oil production instead got a giant boost. Hydraulic fracturing technology allowed the United States to rapidly increase how much oil it produced.

Still, Weeks wouldn’t have spent so much of his life on hydrogen if he didn’t believe it had a future, he said. Like Ellet, he said the circumstances feel different now. That’s in large part because of the federal government’s big investment: By 2030, the Biden administration wants America to produce 10 million metric tons per year of hydrogen made from water using renewable energy or from gas using carbon storage — about how much is produced now largely from gas without carbon capture.

“It’s been a roller coaster, really, for the last at least 20 years,” Weeks said in an interview.

Over the past few years, Weeks has helped a coalition of businesses, researchers and others apply for the federal funding earmarked in the 2021 Infrastructure Investment and Jobs Act for regional hydrogen projects, called “hydrogen hubs.”

Local and state leaders are cheering on the industry’s growth. Brett Perlman, CEO of the nonprofit Center for Houston’s Future, supported the hydrogen hub effort. Perlman’s job is to consider Houston’s economy and what will happen to it as the world works to address climate change and wean itself off fossil fuels.

Perlman wrestles with how to make Houston the low-carbon energy capital of the world. He speaks at conferences, too, to build the case that hydrogen should be part of maintaining the city’s success.

“The energy transition is going to happen, and Houston will have a role,” Perlman said at his office. “The real question is can Houston be, continue to be, a leader?”

Back at the same conference where Weeks spoke, Texas Public Utility Commissioner Lori Cobos, whose agency regulates the electricity industry, explained that because it has huge natural gas reserves and is a top producer of wind and solar energy, Texas is “uniquely positioned to be a national and global leader in hydrogen.”

The easy path to selling hydrogen made in these new ways would be to start by converting places already using hydrogen for purposes such as making fertilizer, refining petroleum and treating metals. But even more environmental benefits would come if it could also be used in new applications, said John Hensley, vice president of markets and policy analysis for the industry advocacy group American Clean Power Association.

Hydrogen believers envision the fuel could decarbonize industries that are considered hard to electrify. Hydrogen would power planes and trucks that heavy electric batteries would slow down. It would supply the high heat needed to make cement that electricity could not provide.

The new federal tax incentives get hydrogen close, if not all the way, to being able to compete with fossil fuels on price, said Fisher of RMI. The government plans to pay up to $3 per kilogram of what it defines as clean hydrogen, such as that made from water, or up to $85 per metric ton of stored carbon dioxide that’s captured after making hydrogen from natural gas.

With the subsidies, producing hydrogen from water would cost generally from $4 to $6 per kilogram, and producing it from natural gas would cost generally from $2 to $4, Fisher said. He stressed that it would depend on the specifics of the project. The government’s goal is to get the cost to $1 per kilogram for both types.

Environmental groups and critics raise concerns

The hydrogen solution does not sound so promising to environmental groups, especially when it comes to making it from natural gas using carbon capture. A number of critics came together in a windowless Houston conference room of their own later in October to build the case to journalists that carbon capture in hydrogen production shouldn’t be seen as a way to address climate change but instead as a boost to the oil and gas industry.

“This is not a transfer off of fossil fuel dependency,” said Jane Patton, campaign manager for U.S. fossil economy at the Center for International Environmental Law. “This is a perpetuation of fossil fuel dependency.”

With money from the Rockefeller Family Fund, which has an initiative focused on slowing oil and gas production because it drives climate change, organizers brought in the big guns to tell the other side of the story. The day began with a speech from Bob Bullard, founding director of the Bullard Center for Environmental and Climate Justice at Texas Southern University, known by many as the father of environmental justice.

Bullard has passionately told many versions of the same narrative. He pioneered his environmental justice work decades ago when he highlighted that the city of Houston primarily built its trash incinerators and landfills in Black neighborhoods. And he brought attention to one example after another of companies polluting poor communities of color rather than wealthy, white ones.

Now a member of the White House Environmental Justice Advisory Council, Bullard said he’s seen no proof that a build-out of hydrogen and carbon storage will be any better for local communities than the expansion of the petrochemical industry was over the past century, bringing more pollution than benefits to surrounding communities. He continued to call for a federal study to find out whether hydrogen production with carbon capture is safe for the people who live around it.

“You’re asking the same people to sacrifice in the same way,” Bullard said at the event. “Can we trust the oil and gas industry to be truthful? I don’t have to write a book on that. We know the answer.”

Schlissel, the director of resource planning analysis for the Institute for Energy, Economics and Financial Analysis, believes the government is using a badly built model to judge how clean hydrogen projects are when they’re evaluated for federal support.

One problem is that the model inappropriately leaves out the fact that hydrogen pipelines could leak, Schlissel says. Hydrogen can react with the molecule that breaks down harmful methane in the atmosphere and make the methane last longer, contributing to climate change.

Schlissel also says the model assumes companies can catch a lot of carbon dioxide — which he believes is totally unrealistic. While companies using carbon capture technology don’t typically publicize their capture rates, Schlissel and his colleagues dug up what they could and concluded that the technology was far short of where it needs to be.

Speakers at the event also expressed little confidence in the Railroad Commission of Texas, which regulates the state’s oil and gas industry, to regulate hydrogen pipelines and underground storage. Commission Shift, a watchdog group that calls for reforming the Railroad Commission, says the agency has a poor track record when it comes to protecting Texans from explosions, leaks and other problems with wells and pipelines.

In a statement, commission spokesperson Patty Ramon said the agency has "protected public safety and the environment for more than a century." The agency does pipeline inspections regularly and has exceeded Legislative performance goals, Ramon added.

These advocates are up against wealthy, politically powerful companies that say making hydrogen from natural gas with carbon capture is a ready solution to start lowering how much carbon dioxide escapes into the atmosphere — even if it’s imperfect.

“I find this polarization of seeking perfect at the expense of very good is problematic,” Chris Greig, a senior research scientist with the Andlinger Center for Energy and the Environment at Princeton University, said in an interview.

“And, to be clear, the distrust (of oil and gas companies) is not unwarranted, right? There’s been some wrongs done,” Greig added. “But somehow we have to set that aside and find some sort of middle ground.”

The Texas Tribune is a nonprofit, nonpartisan media organization that informs Texans and engages with them about public policy, politics, government and statewide issues.

Disclosure: Exxon Mobil Corporation and Texas Southern University - Barbara Jordan-Mickey Leland School of Public Affairs have been financial supporters of The Texas Tribune, a nonprofit, nonpartisan news organization that is funded in part by donations from members, foundations and corporate sponsors. Financial supporters play no role in the Tribune's journalism. Find a complete list of them here.