Martin Lewis has said the number of people who have used an online tool on MoneySavingExpert.com (MSE.com) to generate a complaints letter for possible car finance refunds worth around £1,100 is “staggering” and “much more” than he expected, as it only launched last month.

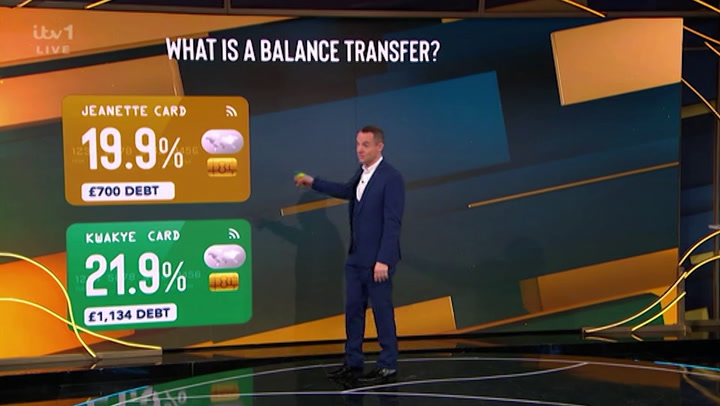

The Martin Lewis Money Show Live highlighted in February how millions of people who bought a car, van, campervan or motorbike on finance before January 28, 2021 may be owed thousands of pounds after being charged ‘hidden commission’. The consumer champion explained that drivers typically paid £1,100 more interest on a £10,000 four-year car finance deal when there was a discretionary commission arrangement - but the bigger the loan, the more money you could be owed.

And now the UK’s biggest consumer help website has announced that 1,080,000 complaint letters have been submitted since February 6 - equivalent to around 30,000 each day.

A back-of-the-envelope calculation means this could be at least £480,000,000 back for those consumers, or more, as over 25 per cent of complaints are from people with multiple agreements.

A decision by the Financial Conduct Authority (FCA) on whether or not payouts could be due is not expected until September 25, 2024.

However, Martin is urging people to log a complaint letter “sooner not later - as the unknown means there’s the risk people may be ineligible if they wait to claim”.

He explained: “It’s because we don’t know what the FCA will say in September that eligible people should look at logging a complaint sooner not later - as the unknown means there’s the risk people may be ineligible if they wait to claim. The regulator’s own website information indicates timing may be an issue and says ‘so, if you think you could be running out of time, you should consider complaining to your provider now’.”

Martin continued: “The number of complaints in not much more than a month is staggering - off the charts - far more than I expected. So, it’s not surprising that some firms are struggling to respond to complaints in a decent time. To frustrated complainers, I’d say for now we should be prepared to give companies some wriggle room on timings, but firms need to urgently step up their complaint handling resources.

“And this is just the beginning. Even though we were at the vanguard of PPI and bank charge reclaiming, in terms of numbers of complaints, this feels like it is building up even more quickly. In value terms, car finance mis-selling is potentially going to be the second biggest reclaim payout in UK history - possibly over £10bn repaid - which could even provide a fillip to the economy as PPI did.

“Lloyds has already put aside a provision of £450,000,000 towards potential costs and payouts for this. A strong indication that it thinks it, and by inference others, will probably need to pay back money due to DCA mis-selling. Though of course, we won’t know until the FCA’s ruling due in September.”

MSE.com's five car finance commission mis-selling need-to-knows

- This is for those who bought a car, van, campervan or motorbike on PCP or Higher Purchase deals (not leasing) for primarily personal use between April 2007 and 28 January 2021.

- Lenders said brokers and car dealers had discretion to push the interest rates higher, and the more they did that, the more commission they’d receive. These were called discretionary commission arrangements (DCAs) and customers were rarely told about them. Around 40% of these car finance deals had DCAs, meaning millions overpaid without knowing. So without checking, people won’t know if it happened to them.

- In January 2021, the FCA banned DCAs, and in January 2024, it launched a huge mis-selling investigation. The deadline for dealing with complaints has been extended until the FCA reports its findings on 25 September 2024.

- Martin Lewis believes it is unlikely the FCA would’ve launched such a huge public investigation unless it had strong evidence of systemic mis-selling. Yet he says until the FCA reports its findings, nothing is certain - and as one big risk is that there is a time bar placed on complaints, urges people to log a complaint as soon as possible, to avoid the risk of being timed out.

- There is no need to use a no-win, no-fee claims firm. With the totally free MSE tool, found here, you just answer a few questions on your car finance agreement (answers aren’t recorded, so as not to inadvertently data-mine) and then the tool builds an email to request information on whether you had a DCA, then logs a complaint.

Get the latest Record Money news

Join the conversation on our Money Saving Scotland Facebook group for energy and money-saving tips, the latest benefits news, consumer help and advice on coping with the cost of living crisis.

Sign up to our Record Money newsletter and get the top stories sent to your inbox daily from Monday to Friday, including a special cost of living edition on a Thursday - sign up here.

You can also follow us on X (formerly Twitter) @Recordmoney_ for regular updates throughout the day.

NEW - Get our money news alerts on your phone by joining our Daily Record Money WhatsApp community.

Breakdown of biggest lenders complained to using MSE car finance template tool

People who have already submitted a complaint letter, or those thinking about doing it, can find out more information on the MSE.com website here.

Lender (and manufacturers they work with) | % |

Black Horse (includes Jaguar, Land Rover and Suzuki) | 16.1% |

Volkswagen Financial Services (includes Audi, Seat and Skoda) | 14.1% |

Stellantis Financial Services (includes Citroen, Fiat, Peugeot and Vauxhall) | 8.4% |

Santander (includes Hyundai, Kia and Volvo) | 8.2% |

BMW Financial Services (includes Mini) | 7.4% |

MotoNovo | 6.8% |

Mobilize (includes Renault, Nissan and Dacia) | 4.3% |

Ford Credit Europe | 4.3% |

Mercedes Benz Financial Services | 3.6% |

Barclays Partner Finance | 3.1% |

Alphera | 3.1% |

Toyota Financial Services (includes Lexus) | 2.5% |

Close Brothers | 2.4% |

Northridge | 2.4% |

Blue Motor Finance | 1.1% |

Join our Daily Record Money WhatsApp community here to receive alerts on the latest money news from benefits to shopping deals.