Loan Tenure in Singapore: 6 Best Times To Change It (2024)

Understanding loan tenure in Singapore and how it works is important if you intend to finance your property purchase with a home loan. Unless you can pay off your entire home in cash, you will probably need to get a mortgage.

According to the Monetary Authority of Singapore (MAS), the allowable home loan tenure can go up to 30 years for HDB flats. Meanwhile, the maximum loan tenure for private property in Singapore is 35 years. In practice, however, a realistic mortgage loan tenure may be less.

In this guide, we will explain everything there is to know about your loan tenure and how it affects how much you pay for your home loan. If you’re already familiar with what a home loan tenure is and are ready to choose a home loan, then begin by browsing the best mortgage rates from all major banks in Singapore now:

Adjust Your Loan Tenure By Refinancing (Video)

What Is Loan Tenure in Singapore?

From the word “tenure” itself, which is a term of holding or possessing something, loan tenure is a duration or the pre-arranged time period given for the borrower to fully repay the principal loan and interest to the lender. For example, a 25-year tenure means you agree to fully off the loan (including interest) in 25 years.

Some borrowers decide their home loan tenure after seeing the interest rate offered by their bank of choice, or after they have done a breakdown of the possible monthly repayments in various tenure scenarios, using tools like the PropertyGuru Finance mortgage calculator.

[MortgageRepayment][/MortgageRepayment]

Possibly the most hassle-free approach during financing is to keep your original loan tenure. You can apply to change your tenure after that, although it will be subject to the bank’s approval.

The lender may put you through another round of credit assessment and underwriting to determine if they should allow you to change the mortgage loan tenure or not. If you intend to shorten your tenure, you should also take note that banks may also charge a fee for this to make up for the interest they will forego earning should they approve it.

How Loan Tenure in Singapore Affects Your Home Loan

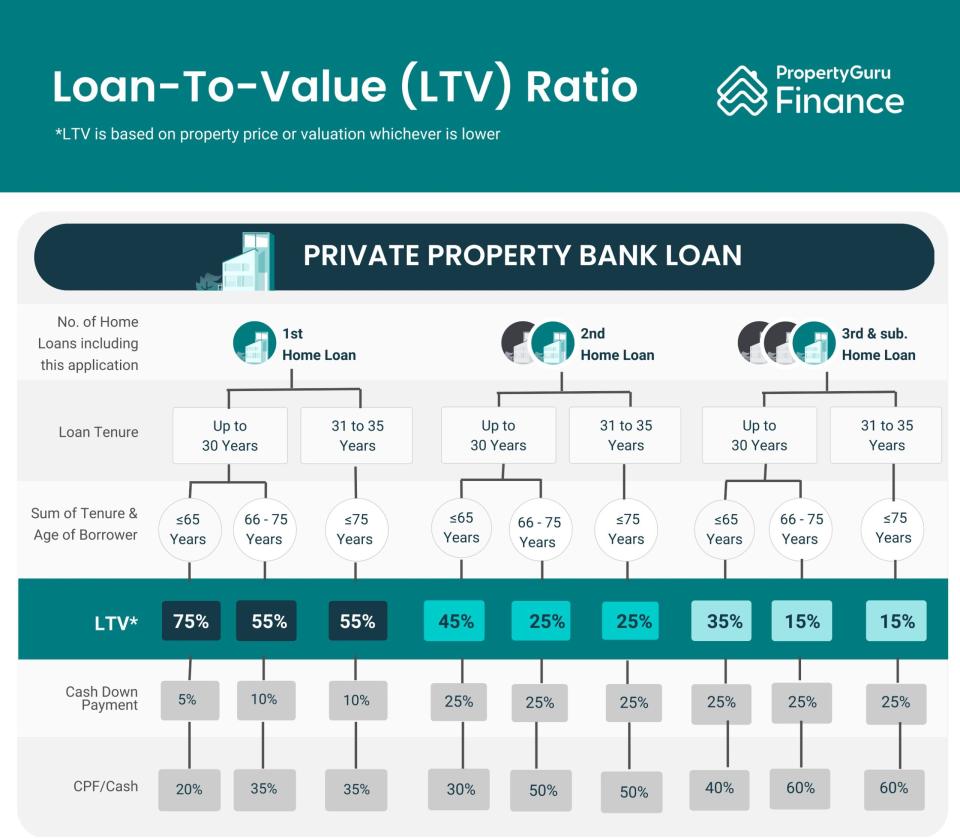

In Singapore, your LTV will be reduced if, due to your preferred loan tenure, the loan is only repaid after age 65. For bank loans, you would normally be allowed to borrow up to 75% LTV, but this is reduced to a maximum of 55% if your mortgage loan tenure is too long for your age.

For example, if you are age 40 and ask for a 30-year loan (i.e. your loan would be repaid at age 70), banks would only be allowed to offer you at most 55% of the loan amount, which may directly affect your ability to afford the property you were planning to get. On the other hand, asking for a 20-year loan would (assuming all other conditions are met) leave you eligible to borrow 75% of the property price.

The solution to this would, of course, be to ask for a shorter loan tenure, but there are limitations to this as well. Your mortgage loan tenure will also affect your Total Debt Servicing Ratio (TDSR) (as well as your Mortgage Servicing Ratio (MSR) if you are buying an HDB flat), which affects your eligibility for any home loan.

To be eligible for a home loan, your monthly debt repayments cannot exceed 55% of your monthly income. For HDB flats, there is an additional requirement of the MSR, which means your home loan cannot exceed 30% of the same.

Shorter loan tenures mean higher monthly instalments, which, depending on your financial situation, may exceed your TDSR and/or MSR. Hence, the home loan tenure you choose to apply for may also affect your financial eligibility for a loan.

When Is a Longer Home Loan Tenure Better?

1. You Want to Ensure Good Cash Flow

One of the best ways to manage your monthly cash flow better is by keeping your monthly repayments at a maximum of 30% of your monthly income. Although the MSR is only for HDB flats, it is a good guideline in general. Settle for a longer loan tenure if your repayments exceed this figure, so you may also lower your monthly dues, and have more cash ready for emergencies and other necessities.

Longer tenures can also help you keep an investment property cash-flow positive. If you’re looking to earn revenue from your property, then what you want to do is keep your property cash-flow positive, allowing you to earn more money than it costs you to own it. For example, suppose you’re earning $50,000 per year from rent, and your total expenses on that property (including the mortgage, property tax, maintenance, etc.) are just $40,000 per year. In that case, your property is considered cash flow positive.

The best strategy to make a property cash flow positive is to keep your mortgage repayments and your maintenance costs low. Choosing a longer tenure would be ideal if this is your goal since it may equate to paying for lower monthly repayments.

2. You Want to Reduce Your TDSR

TDSR is the maximum income percentage limit for servicing a loan, set by the MAS to also help keep borrowers from having too much debt. If you need more money to invest in another property or if you are planning for your next big purchase, choosing a longer tenure would be more strategic. Not only could a longer home loan tenure lower your monthly repayments, but also keep you within the TDSR threshold for your next loan application.

3. You Want to Have More Tenure to Shorten If Needed

Although you may pay more interest with a longer tenure, it can help keep your options open. It offers you the flexibility to shorten your mortgage loan tenure if you already have enough money for higher monthly repayments or if you’ve decided to pay off your home loan in full before your original tenure ends. This could also be ideal if you are thinking of refinancing your mortgage in the future.

When Is a Shorter Home Loan Tenure Better?

1. You Want To Reduce Total Interest Costs

As mentioned above, longer mortgage loan tenures usually cost you more in interest over the entire loan duration. Go for a shorter tenure if you want to keep the interest on top of your monthly instalments as low as possible, although another option to lower your interest fees if you can afford it, is to initially choose a longer tenure, then pay off your debt in full a few years before the completion.

2. You Can Afford to Pay Higher Monthly Instalments

If your income allows you to pay for larger monthly dues without feeling deprived or putting yourself at risk for late repayments, it may be more practical to choose a shorter tenure. Aside from helping cut down on interest payments, it can also help you avoid potential costs that having a long-term debt may cause (i.e., processing charges for refinancing, lump sum payment charges, etc).

3. You Want Better Rental/Investment Yields

Although you’ll be paying larger monthly repayments, a shorter mortgage loan tenure may also give you better investment yields from a long-term perspective, considering the amount you can save from interest and other potential fees.

And since you’ll pay off the debt quicker, all the money you’ll get from rent will go directly to your passive income and the property’s maintenance, so there’s a huge chance that you’ll also get your return on investment earlier.

Loan Tenure in Singapore, Age, and LTV Limits for Bank Loans

When to Change Your Loan Tenure in Singapore

Both longer and shorter mortgage loan tenures have advantages, but it all boils down to what’s best for you based on your financial capacity and future goals.

Just know that you can always change home loan tenure when your priorities change (i.e., you want to invest in a new property or start a business) or when your financial situation improves (but is still insufficient to pre-pay lump sums).

Refinancing is a great way to adjust your mortgage loan tenure to reflect your current financial situation. Refinancing your home loan to one with a shorter tenure can be useful if you can manage higher instalments and want to pay off your mortgage faster. Likewise, you can refinance your home loan to one with a longer tenure to accommodate lower instalments and ease cash flow.

Having a hard time deciding which home loan tenure in Singapore to go for? Need help with knowing if it is the right time to change your tenure or to refinance? Let our PropertyGuru Finance Mortgage Experts help you out. They can assess your financial situation, compare home loan refinancing offers across all major banks, and guide you to land the best home loan for you – all free!

Yahoo Finance

Yahoo Finance