New figures from the Central Statistics Office show that the country's GDP shrank by 3.2% last year on the back of a contraction in the multinational dominated industry sector.

This compared to an initial estimate of a fall of 0.7% and was down from growth of 9.4% in 2022.

Modified Domestic Demand, which more closely tracks the domestic economy, grew by 0.5% in 2023, but this was far below the 2.2% expected by the Department of Finance and came after a continued fall in investment in the final quarter of 2023.

The CSO said the impact of ongoing global events and decelerating inflation varied across the sectors of the economy last year.

It noted that the more globalised sectors of the economy contracted for the first time since 2013 with Industry shrinking by 11%, but added that the Information & Communication sector continued to grow and increased by 8%.

Within the industry sector, the CSO said the contraction was predominantly driven by a shrinking pharma sector, as the production and export of medicines from here during the Covid pandemic eased back to more normal levels.

We need your consent to load this rte-player contentWe use rte-player to manage extra content that can set cookies on your device and collect data about your activity. Please review their details and accept them to load the content.Manage Preferences

Among the sectors focused on the domestic market, economic activity in the Financial & Insurance sector grew by 7.5% in the year, while the Distribution, Transport, Hotels & Restaurants sector increased by 4.5% and the Agriculture, Forestry & Fishing sector expanded by 15.4%.

With Ireland's large multinational sector often distorting GDP, officials prefer to use MDD to gauge the strength of the economy. MDD had jumped by 9.5% in 2022 thanks to a post-pandemic surge in investment.

The growth in domestic economy last year was spurred on by a 3.3% increase in wages and a 3.1% rise in consumer spending.

l

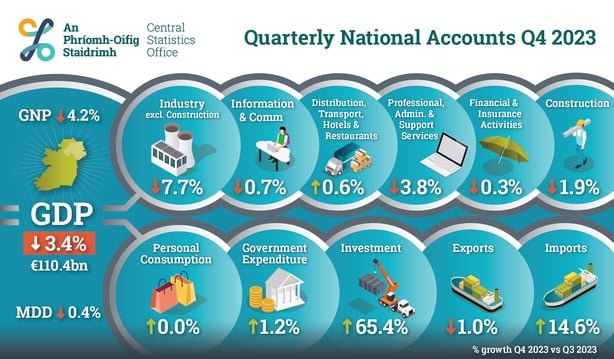

Commenting on today's figures, Minister for Finance Michael McGrath said a 0.4% fall in Modified Domestic Demand - his preferred metric of economic performance - in the final quarter of last year was driven entirely by a fall in private sector investment spending.

But he noted that investment in housing remained robust, up at an annual rate of 12% in the fourth quarter.

"I expect housing supply to continue expanding in the year ahead, with over 34,000 new units commenced in the 12 months to January 2024. We should see these units coming on-stream as the year progresses," he added.

He also said that consumer spending grew at a solid pace of 3.1% on the back of strong employment growth.

"The strength of the labour market - with 90,000 jobs added in the last 12 months - is a good measure of the underlying health of the domestic economy," he added.

"That said, today's data show that consumer spending was flat at tail-end of last year – with the tightening of monetary policy weighing on spending," he said.

"In this context, I would highlight the easing of inflation - to 2.2% in February, its lowest rate since July 2021 - which will help support the purchasing power of households and underpin spending over this year. Ireland's estimated inflation rate is now 0.4% the euro area rate," the Minister added.

He also said the 3.4% fall in GDP continued a trend seen in recent quarters.

"As is widely acknowledged, GDP is not a useful measure in assessing the living standards of domestic residents, given the outsized role the multinational sector plays in our economy," he said.

"The decline reflects a re-normalisation of activity in some sectors - mainly pharmaceutical - following a Covid-related boost in demand in 2021 and 2022. Indeed the trend in GDP contrasts sharply with employment which was up by 3.5% in 2023," he added.

This was echoed by chief economist at Goodbody, Dermot O'Leary, who said the GDP figures give a false picture of the underlying dynamics of the Irish economy due to distortions caused by multinationals.

"This is a well-worn story," he said.

"The economy did slow in 2023, but not to the extent suggested by the headline GDP data."

"The cleanest gauges of domestic economic activity in Ireland are wages and consumer spending. Real compensation of employees grew by 1.8% yoy in Q4, while consumer spending grew by 1.5% yoy."

"This is a realistic range of the rate of growth in domestic spending in Ireland at the turn of the year. This is the slowest in the post-COVID period but compares to the flat outturn seen in the euro area overall."