Disney Proxy Fight Gets Ugly as Mystery Investor Offers To Buy Shareholder Votes

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

With the Walt Disney Co. facing a proxy fight on two fronts against activist hedge funds trying to seed the company’s board of directors with their own candidates, Business Insider reported that an unknown investor is offering to buy votes at the company’s April shareholder meeting at a rate of $100,000 per 500,000 votes under a controversial “Shareholder Vote Exchange.”

Five hundred thousand votes works out to roughly $55 million in shareholder equity, and, yes it is perfectly legal.

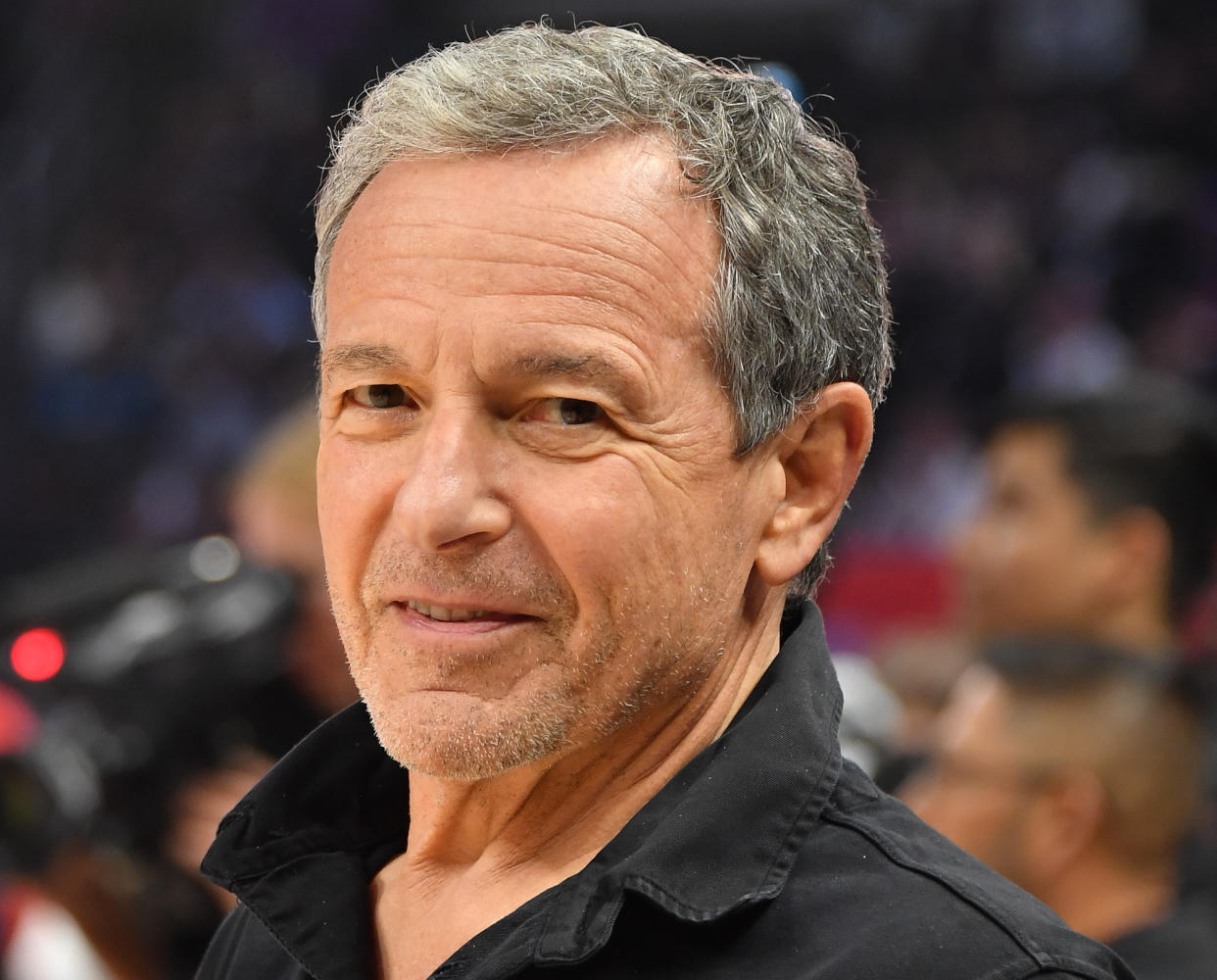

Morning Brew pointed out that the buyer could be Blackwells Capital or Nelson Peltz’s Trian Fund Management, both of which are fighting for more control of the Magical Kingdom, or it could be a group backing CEO Bob Iger’s vision to restore Disney to its former glory.

The publication also noted that as of Wednesday there over 20,000 Disney shareholder votes had been offered for sale and that the company has a large percentage of smaller shareholders who may be less involved or even aware of the high-end drama going on.

The company was battered by a disastrous series of missteps from Iger’s predecessor (and one-time successor) Bob Chapek, who was unceremoniously ousted from the CEO’s office after just 18 months on job.

Earlier this week, Nelson Peltz’s Trian Fund Management released a 130-page manifesto trashing Bob Iger’s current strategy and outlining what they would do differently if their candidates are elected.

Iger responded that he and his senior managers were trying to stay focused on making the complex company more profitable amid such distractions.