WTI oil price pulls back from new 4 ½ month high ($83.10), down 1.6% for the day so far, as traders collected profits ahead of Fed policy announcement.

The oil price accelerated higher recently on fresh concerns about oil supply, following attacks on Russian refining installations and persisting threats of stronger disruptions.

Stronger than expected drop in crude inventories (API report) and lower build in crude stocks compared to the previous week (EIA report) contributes to signals of a healthy demand, with improving economic data from the world’s largest oil importer China, adding to supportive factors.

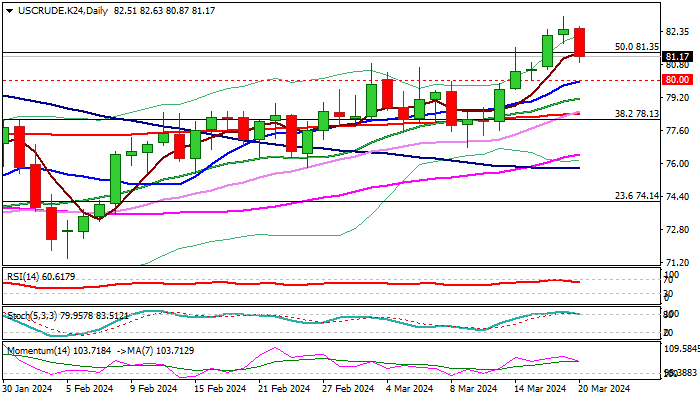

From the technical point of view, oil price continues to move within a larger uptrend from $67.70 (Dec 2023 low), with daily studies being firmly bullish, but overbought, which sparked the latest sell-off.

Pullback is likely to be a shallow and ideally to be contained by psychological $80.00 support, reinforced by rising 10DMA, though deeper drop cannot be ruled out, with extended dips to find ground above $78.63/43 (Fibo 38.2% of $71.40/$83.10 / 200DMA respectively) to mark a healthy correction and keep larger bulls in play.

Res: 82.63; 83.10; 83.58; 84.57.

Sup: 80.34; 80.00; 79.15; 78.63.

Interested in Oil technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.