Canadian Solar (CSIQ), Sol Systems Ink Deal for Module Supply

Canadian Solar Inc. CSIQ recently announced that it has signed a framework agreement with Sol Systems to supply its high-efficiency N-Type TOPCon (Tunnel Oxide Passivated Contact) solar modules to the latter. These modules will be supplied from CSIQ’s Texas factory, wherein ramped-up module production started in December 2023.

The agreement is expected to boost Canadian Solar’s module production and procurement in the United States.

CSIQ’s Role in the Project

Per the terms of the deal, Canadian Solar will supply its solar modules to support Sol Systems’ project pipeline in the United States between 2024 and 2025.

The modules that are set to be supplied to Sol Systems are the TOPBiHiKu7 dual-cell N-type TOPCon bifacial module. Notably, these modules offer higher energy yield and lower Levelized cost of electricity compared to the “Passivated Emitter and Rear Contact” modules.

Canadian Solar’s Prospects in the U.S. Solar Market

With the United States rapidly adopting renewable energy as its preferred source of energy, solar power has emerged as the largest constituent of this transition. The declining installation costs and favorable government policies are expected to drive the nation’s solar industry in the coming days. To this end, a report from the Mordor Intelligence firm estimates that the U.S. solar energy market will register a CAGR of more than 16.5% during the 2024-2029 period.

To reap the benefits of such solid growth opportunities offered by the U.S. solar market, Canadian Solar has been expanding its footprint through capacity maximization as well as valuable partnerships, like the recent one that it has signed with Sol Systems.

Impressively, as of Sep 30, 2023, Canadian Solar’s Recurrent Energy had a 6,975 megawatt (MW) peak of solar development project pipeline in North America. This region accounted for 28% of CSIQ’s total revenues during 2022. Moreover, on Feb 6, 2024, Recurrent Energy secured a project financing worth $160 million for its 127 MW direct current Bayou Galion Solar project in Northeast Louisiana, expected to be operational by fall 2024.

Peer Moves

Other solar players in the industry that are indulging in the expansion strategy to meet the growing demand of the U.S. solar market are as follows:

Enphase Energy ENPH: The company has existing contract manufacturing partners in South Carolina and Texas. Once fully ramped up, these facilities will have a global capacity of approximately 7.25 million microinverter units per quarter. In fourth-quarter 2023, Enphase began shipping IQ8P microinverters with peak output AC power of 480 watts (W) for the small-commercial market in North America and IQ8X microinverters with peak output AC power of 384 W for panels with high DC voltage in the United States.

ENPH’s long-term (three-to five-years) earnings growth rate is 17.3%. The firm delivered an average earnings surprise of 7.24% in the last four quarters.

SolarEdge SEDG: The company has a good presence in the United States, with 25.5% of its total revenues during 2023 coming from this region. SolarEdge shipped 2,667 MW of solar energy to North America in 2023. On Feb 14, 2024, the United States became the first customer to receive the new high-power DC-optimized SolarEdge 330kW Inverter system for community and ground mount solar.

SEDG boasts a long-term earnings growth rate of 14.8%. Its share price has surged 70.7% in the past five years.

Emeren Group SOL: Emeren has developed, sold and constructed multiple community and utility solar projects in the United States. As of Sep 30, 2023, it had 1,603 MW of solar development project pipeline in this nation. The region accounted for 2% of the total revenues in third-quarter 2023.

The Zacks Consensus Estimate for SOL’s 2024 sales implies a rise of 48.8% over 2023’s estimated figure. Its share price has surged 32% in the past month.

Price Performance

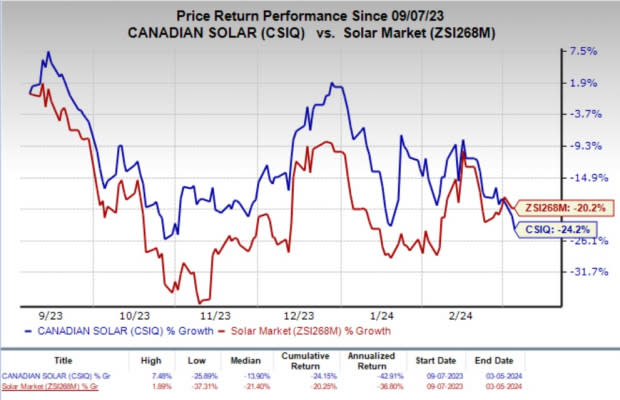

Over the past six months, shares of CSIQ have lost 24.2% compared with the industry’s 20.2% decline.

Image Source: Zacks Investment Research

Zacks Rank

Canadian Solar currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emeren Group Ltd. Sponsored ADR (SOL) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report