John, a 62-year-old father living in northwest Ohio, is one of the millions of parents that took on a Parent PLUS loan in hopes of giving his daughter a better life. Now unemployed, he says he'll likely be paying them off well into his 80s.

Borrowers who took on Parent PLUS loans remain one of the student debt holders with the highest interest rates, but they've been largely left out of any student debt forgiveness plans under Biden's administration.

John, who preferred to be only known by his first name, told Newsweek that he lost his job as an electrical estimator and test technician, and now fears the debt will hang over his head well into his 80s.

John was initially convinced to take on the loan in his name after a community college counselor told him and his daughter she should attend a state school based on her academic achievements.

"I'm blessed with a brilliant daughter," John told Newsweek. "She graduated in the top 10 students in her class."

Once looking at their college options, John took on the payments so that his daughter could live on campus and pay for tuition and textbooks.

"They saw her transcript and said, 'You've got a 4.0 GPA student and you're not going to the state university for a Bachelor's degree? So she hooked us up with the admissions at the state university," John said. "She finished in four years with a 3.97 GPA, and good to go."

John ended up with four separate federal Parent PLUS loans, with a beginning balance of just under $37,000. At the time, John said he had a credit score in the top tier and could have qualified for a 3 percent private bank loan instead of the 7.99 percent rate he faces now.

The plan was to get the debt paid off in 25 years. John had paid $20,000 of the debt until he became ill with a life-threatening illness a few years before the pandemic. That's when he paused his payments for a year due to medical expenses.

During the pandemic, federal borrowers saw all payments paused. But now, John is facing down $40,500 still owed despite already making $20,000 in payments for the initial $37,000 loan.

During the pandemic, John also lost his job and his financial situation quickly derailed.

"COVID destroyed life as we knew it," he said. "Corporate edict [was] to remove 20 percent of the workforce wages, so I was dumped."

After searching for a new job, John said he was only able to find one that paid 39 percent less than his previous salary. He also shouldered the burden of two deaths of immediate family members and high medical insurance premiums.

"All the sudden, I'm in a financial bind," John said, adding things only got worse when he got another surprise layoff.

As of today, John has sent 80 job applications out, done three interviews and still has no job.

"Nobody wants to hire someone in their 60s anymore," he said. "Since technical jobs aren't biting, I'm at the point where it's going to be $13 an hour at McDonalds or Wendy's."

Looking for a way out of his situation, John sent a letter to his loan servicer explaining the current hardship he's facing and hoping for some relief.

"They did call me back and say, 'too bad for you that's not hardship,'" John said, adding they wanted him to make an extended payment plan that will have him paying until he's 85 years old.

John said he has serious regret that he didn't finance the college loans with a regular bank, remembering that a bank vice president once told him not to in case the government could give him help down the road.

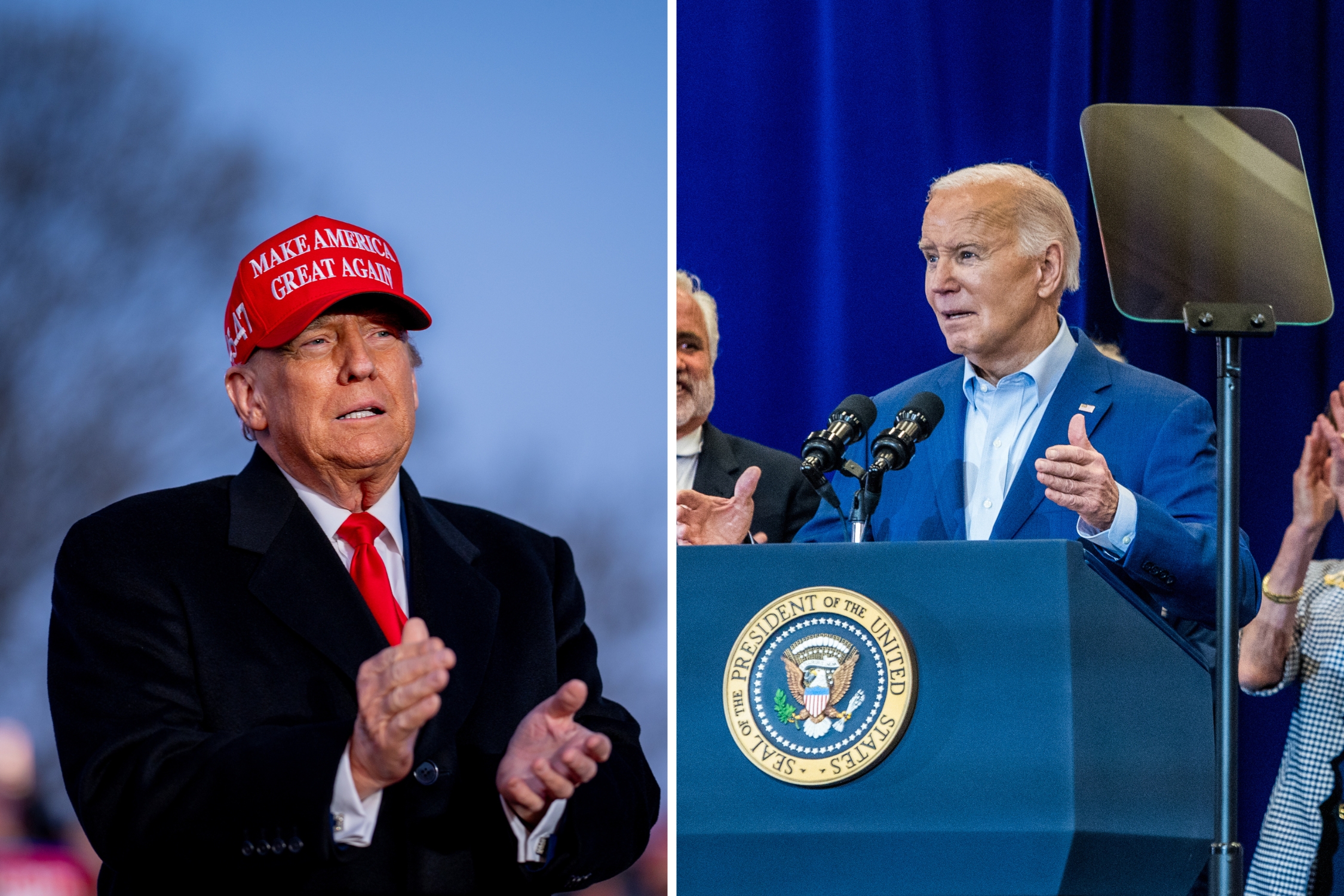

Despite the fact that President Joe Biden and the Department of Education have offered loan forgiveness plans for several groups facing hardship, Parent PLUS borrowers have been entirely left out of the relief so far.

The income-driven repayment plans available to student borrowers have been kept out of parent borrower hands. Instead, they face higher monthly payments over the course of 25 years.

According to Student Loan Planner, those making $50,000 yearly with $100,000 in Parent PLUS loans would have to pay $590 each month whereas SAVE plan holders would only pay $143.

"Congress, Senate and the President have not given any of these new SAVE plans or the 5 percent maximum income plans to the Parent PLUS people, only available to the students," John said. "So the ma's and pa's out there are out of luck."

Even when John looked into bankruptcy, he was disappointed to find it wouldn't reduce his loan or gain him access to the new Biden relief programs.

"How are they going to extract the money from me?" John said. "I start Social Security next year. Are they going to forcibly take my Social Security payments for 20 years to satisfy the Parent PLUS loans?"

According to the Social Security Administration (SSA), Social Security benefits can be garnished by the government for federal loans in default. Specifically, up to 15 percent of the benefit can be withheld even as retirees depend on the income for their daily living expenses.

"Parent PLUS Loans are exceptionally challenging for parent borrowers because the options for repayment and forgiveness are so limited compared to other loans," Robert Farrington, the founder of The College Investor and a millennial money and student loan debt expert, told Newsweek.

So far, Biden has approved billions in federal student loan forgiveness, including a recently designated $5 billion to those who have worked 10 years or more in public service and people repaying their loans for at least 20 years who haven't been able to get help through income-based plans.

Nationally, more than 3.7 million Americans have seen student debt forgiveness, which was an early promise Biden made when he first took office. But so far, parents who took out loans under Parent PLUS plans are still waiting.

Newsweek reached out to the White House via email for comment.

"Like other attempts at loan forgiveness, Biden cannot unilaterally forgive these loans," Farrington said. "However, he can work to improve their repayment plan options and forgiveness options in existing programs."

Looking back at the situation, John advises others to let their kids go to community college and to avoid a Parent PLUS loan at all costs.

"I have had every intention of paying my Parents Plus loans, but then, life happens, multiple losses happen, and I see no relief for Parent's Plus loan holders," he said.

John said if he does end up with his Social Security money taken away in retirement, he's unsure what the future will look like.

"Then I will have nothing... All I wanted to do was help get my brilliant daughter a degree so she will be better off than me," he added.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Suzanne Blake is a Newsweek reporter based in New York. Her focus is reporting on consumer and social trends, spanning ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.