INWOOD, W.Va. — It's important, Riley Moore says, for people to know that his father was a banker.

Tall, sharp-eyed and clear-spoken, Moore is every bit a favored son of one of the most powerful political dynasties in West Virginia. But despite having an aunt in the U.S. Senate, a former governor for a grandfather and a cousin who may very well take the governorship of the state in 2024, that's not the family that Riley Moore wants to talk about.

His dad, Moore says in an interview before a town hall event in Inwood, West Virginia, last worked at Bank of Charles Town, a roughly $790 million institution originally founded in 1870.

"I've been around this my whole life, so I think that's important context for people to understand where I'm coming from," he said. "I have a very good working relationship with the banks in West Virginia, I really do."

Moore shows up to the aptly named Heritage Hall, a brightly lit event center that typically hosts weddings with its small makeshift chapel in the corner, with a cup of Black Dog Coffee in hand. Shortly, the owners of that coffee shop will join Moore onstage, alongside other local small businesses in West Virginia's eastern panhandle, to talk about the pushback against environmental, social and governance policy, or the anti-ESG movement.

As guests mingle before Moore's town hall, it's not environmental investing or corporate "wokeness" that initially has the crowd talking.

Inwood, nearby Harpers Ferry and the surrounding is quickly becoming an exurb of Washington, D.C., thanks to a nearby commuter line, remote work's boom during the pandemic and West Virginia's affordability compared to the Maryland and Virginia suburbs.

Newly built neighborhoods and townhouses now dot West Virginia's eastern hills, and the kind of anxiety that accompanies deep-rooted economic change is palpable among Moore's town hall attendees. The development is good, they suppose. It brings at least some measure of growth to the state that, for years, has declined economically alongside employment in the coal industry. But it also means there are fewer open and remote places to hunt, Moore adds, and increasingly, to find the isolation from neighbors that West Virginia is famous for, people must travel further west.

It might sound strange to hear Moore, who is running to represent West Virginia's 2nd Congressional District in the U.S. House, say that he has such a great relationship with his local bankers. In fact, he's made a name for himself on the national stage by blacklisting banks from contracts in his state.

As West Virginia's treasurer, he's been one of the leading officials in Republican's front against so-called "woke" corporations, or ESG investing.

"The issue that we run into is really a conflict of interest, and that's an important term to keep in mind, where we have financial institutions that are boycotting the fossil fuel industries through prohibitions, on lending, investing or otherwise, not based on some risk evaluation, but based on what I view as just political policies," Moore said.

Most recently, in February, Moore warned six financial institutions that they may be placed on the state's Restricted Financial Institution list if they are found to be "boycotting" the fossil fuel industry. Those firms are Citibank, TD Bank, BMO Bank, Fifth Third Bank, Northern Trust and HSBC Holdings.

A bank could wind up on the list for refusing to do business with coal, oil and gas companies, or by limiting business with fossil fuel sectors, "without a reasonable business purpose," according to the letters sent by Moore's office to the financial institutions.

The list was originally established in 2022 following a new law that Moore helped usher through the state legislature that allowed him to create it. BlackRock, Goldman Sachs Group, JPMorgan Chase, Morgan Stanley and Wells Fargo are already on the blacklist.

"Now, many of these banks have a First Amendment right to expressive activity just as any company does," Moore said. "And by no means am I trying to stop them, but you're not going to be able to do business with us if that is your position."

Conservatives' practical fight against ESG has mostly been limited to the states, and Moore is far from alone. States like Texas and Florida have passed, or tried to pass, similar laws, but West Virginia has been among the most aggressive.

"We've seen a lot of interest in being vocal and taking the political win rather than the policy win," said Jennifer Schulp, director of financial regulation studies at the Cato Institute's Center for Monetary and Financial Alternatives. "West Virginia is an exception to that."

'We don't need to be fixed'

Only a few of the small businesses at Moore's town hall had concerns they wanted to air related to banking.

Tom Goheen, who works with the Harpers Ferry Armory in Ranson, West Virginia, said that the firearm seller had difficulty securing financing when they needed it because the business lacked a diversity, equity and inclusion program.

"We were told our ESG score wasn't high enough because we don't have a diversity, equity and inclusion program, and I feel like our organization and other organizations are diverse and equitable enough where we wouldn't need a program in place because we're decent human beings," he claimed.

But much of the anti-ESG rhetoric at the town hall — and the definitions being thrown around of ESG itself — wouldn't necessarily sound familiar in a bank boardroom, and instead fit neatly into the Republican focus on culture wars.

The Black Dog Coffee owners, for example, wanted to talk about organic labeling for some of their products, and how onerous they found that process. Others brought up feeling "canceled" for trying to advertise shooting ranges on social media sites.

Most of the attendees at the town hall were not, as it turns out, originally from West Virginia. Inwood is just a 30-minute drive west of Harper's Ferry, part of that fast-growing eastern panhandle.

That doesn't mean, however, that the area is becoming more liberal, or that it's more likely to elect Democratic policymakers. In fact, Greg Thomas, a Republican strategist based in West Virginia, said it might be the opposite.

"If there's any place that isn't made up of homegrown West Virginians, it's there, but I do think some of those people tend to be more conservative, because they're people who are being pushed out of the D.C. suburbs even farther," he said.

They come here looking for a certain kind of life, leaving behind more Democratically controlled cities, and disavowing things like ESG policies and oversight from the federal government, or even from large companies like national banks.

"We don't want to be controlled, right?" Moore said to the town hall crowd. "This all comes down to at the end of the day to control in, like, a paternal way where they know better than us. We're a bunch of dumb hillbillies. We don't know what we're doing. They're here to solve all our problems and fix us.

"Well we don't need to be fixed," he said.

The coal question

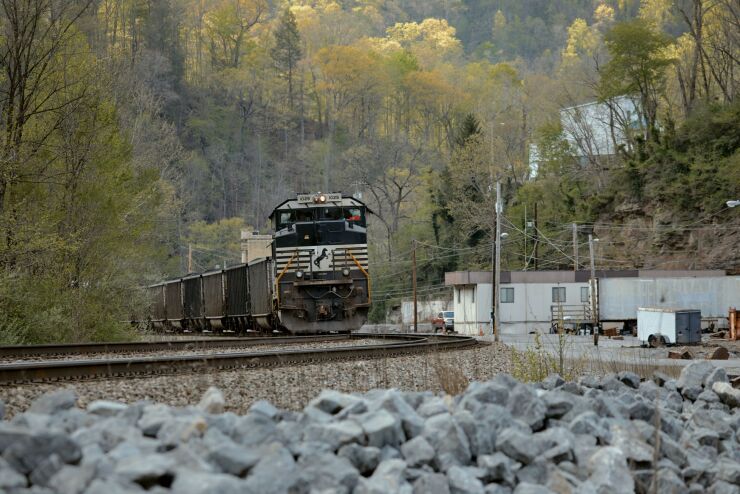

There are two figures on the West Virginia state flag, Moore says in the interview: a farmer and a coal miner.

Fossil fuel, or extractive, industries play a huge role in the culture and politics of the state, and it's central in the fervor against ESG policies.

"The reality is West Virginia is an energy state, we have a ton of coal and a ton of gas," Thomas said. "I think that West Virginians certainly appreciate having someone push back."

But it's deeper than politics or culture, Moore said. It's money.

Severance taxes alone from coal, gas and oil in the last fiscal year generated a billion dollars — a lot of money for a state that has an overall budget of $4.7 billion. That's not even including income taxes on coal miners, gas and oil workers and property taxes on coal power plants, he said.

"I think it's important for people to understand that look, I'm not out here to be punitive towards banks, asset managers and everything else," he said. "But I do have a fiduciary duty to the taxpayers of West Virginia and that's what I'm trying to do."

The reasoning behind this is simple, Moore said: If banks aren't supporting the industries that bring in tax revenue to the state, then why should the state, in return, give state contracts to the banks?

"So if I am handing tax dollars generated from these industries over to banks, that are trying to diminish those funds through ESG activity," he said, "there's a conflict of interest there. They don't have our best interest in mind and our industries that have created those tax dollars."

But Moore has balanced that conviction with passing policy that banks in his state want, he said. For instance, he has introduced legislation that would make it easier for banking institutions to maintain the collateral levels needed to serve as depositories of public funds. It's an important issue, Moore said, for local banks.

"I'm a free market guy, and what I'm trying to do, because I do have a number of those public deposits in the state Treasury, is I want private institutions to bid on that in a competitive manner, where I don't have that collateralization requirement so my rates are better and I can outbid them.

"I don't want that," he added.

Aside from West Virginia's local community banks, the blacklists implemented by Moore's office, and ones like it across the country, could change how larger banks that operate across states do business.

The impact of blacklists can be "moderate to more than moderate" on a bank, said Schulp of the Cato Institute. Plus, on its own, a single state that's making these demands might not cut into a financial institution's bottom line, but once it starts becoming a major trend, that can cut off opportunities for business across wide swaths of the country.

"West Virginia is not that big of a state, but Texas is," she said. "So there can be real business impacts, particularly depending on what the existing business contacts with the state were in the first place."

It's particularly problematic when there's competing priorities among red states and blue ones. That's further complicated for multinational companies, which must choose between complying with climate policies in places like Europe, and getting shut out of doing business with a Republican-controlled state government.

"It's hard to say in West Virginia or any other state if BlackRock is severely impacted because it can't do business there," Schulp said. "But when you start to see more and more states looking like that, it becomes an increasing problem. And there's at least noise and a lot of red states that they would like to move that direction."

Anti-ESG goes (more) national

At this point, it'd be surprising if Moore didn't win the seat he's campaigning for. (The state's primary will be held in May.)

So far, he's handily outraised his Republican competitors and gotten high-profile endorsements. Although there is one Democrat in the race, a retired naval officer named Steven Wendelin, West Virginia, alongside its 2nd Congressional District, is expected to turn even deeper red in 2024.

That means that Congress is likely to get at least one more vocal anti-ESG advocate, and given Moore's experience as state treasurer, there's a good chance he could have a place on the House Financial Services Committee.

"At the end of the day, we have accomplished a lot at the state level, but there are fights that need to be won at the federal level," Moore said.

As a single member of the House, Moore can't affect much change alone. But he'll be joining a Republican caucus that's expected to increasingly focus on ESG pushback as a main feature of its financial policy priorities. While House Financial Services Committee Chairman Patrick McHenry is stepping down from Congress at the end of his current term, there's a few candidates to take that top Republican spot on the panel who have a track record of focusing on the issue.

"One avenue is having more vocal anti-ESG members taking up positions on a committee like House Financial Services and leadership with whatever that changeover is going to be in the fall if the Republicans manage to keep the house," Schulp said. "So far, House Financial Services Committee Chairman Patrick McHenry hasn't been the most strident in looking for anti-ESG legislation, but different Republican leadership might have a different view."

It's easy, for example, to see a potential House Financial Services Committee Chairman Andy Barr, R-Ky., make anti-ESG policy a central feature of his chairmanship. He's already introduced several bills targeting various environmental efforts by the Biden administration and by banks themselves. Another top candidate to take over the committee, Rep. French Hill, R-Ark., has also made comments and signed on to bills that push back against ESG policies. But he's also been less fervent in his opposition, Schulp said.

In Moore's mind, there are big fights to be won on federal preemption issues.

"There are big movements in the states, but there are cracks in between those that need to be filled in at the federal level," he said.

One of the biggest examples of federal preemption on ESG issues is a lawsuit filed by the attorneys general of 26 states challenging the Department of Labor over a rule that said fiduciaries under the Employee Retirement Income Security Act (ERISA) can — but do not need to — consider ESG factors when evaluating plan investments. That affects things like 401(k)s and other private retirement funds.

The issue has already grabbed attention on the Hill.

"There have been multiple hearings in various House committees and subcommittees addressing the concerns with the role of ESG in retirement plan investing," said Jonathan Reinstein, an attorney at the law firm Ropes & Gray, which tracks state-level anti-ESG policies. "You might just say that's just political theater, it's not like there's an actual bill that's going to be signed anytime soon, but I think that it is an area that members of Congress are very much focused on, and we'll probably see more of that going forward."

Moore, and most Republicans, would prefer the Department of Labor to go back to the Trump administration rule, which restrained fiduciaries' ability to weigh ESG factors when choosing investments for retirement plans.

Moore also said he's concerned about ratings agencies giving states an ESG rating. One example is S&P Global, which had said in 2022 that it would use ESG factors in public ratings, though the firm has since pulled back on that decision. Still, Moore said he's worried that it could come back under a different name.

"That's like an extortion racket," he said. "The state of West Virginia, our bond rating can get hurt if we don't comply with their ESG measures."

He, alongside his potential future House Financial Services Committee members, want to crack down further on the rules made by Securities and Exchange Commission Chairman Gary Gensler, particularly the agency's climate reporting rule, which requires large corporations to disclose greenhouse gas emissions deemed materially significant to their business.

"In terms of compliance, it reminds me of DoddFrank, right, it's a regime that is too onerous for smaller businesses and institutions to comply with who can't get lawyered up enough to be able to figure it out," Moore said "So what do they do? They end up going under and then getting subsumed by larger entities and you have consolidation. You saw that in the banking industry, my father went through Dodd-Frank and massive bank consolidation. That's not a good thing."

Among banking regulators, the anti-ESG debate mostly looks like a fair access rule, similar to the one that former acting Comptroller of the Currency Brian Brooks tried to greenlight during the Trump administration. That rule would have punished large banks for cutting off services to firms in politically unpopular industries. It was widely seen as a response, in part, to some banks' decisions to curtail lending to gun manufacturers and energy firms seen as contributing to global warming.

"I think we see that at least come back into play," Schulp said. "Whether it happens or not, that's a different story, but I think it gets talked about."

Regardless, depending on the results of the 2024 election, it's a trend that's had staying power over the years, Reinstein said.

"It is an area that I don't think is going away anytime soon," he added.