The end of Panama’s dry season is in sight, and the Panama Canal Authority (ACP) plans to welcome more vessels in the coming weeks.

Over six months since the Panama Canal’s reservoir system suffered from the driest October in at least 73 years, the ACP finally sees a path to normalizing operations. On March 25, the ACP allotted three additional transit slots to Panamax vessels, bringing the total number of reservations to 27 per day.

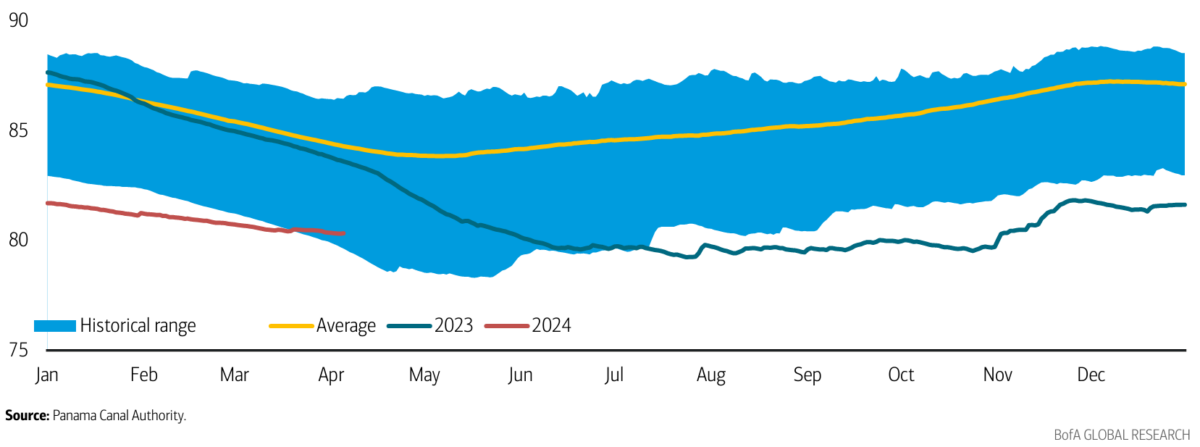

A recent downpour was gladly received by the man-made Gatun Lake, from which the canal gets its supply of water. Traffic has seen an uptick in the past few days: Per data from Clarksons, transits are currently at 60% of where they were in 2022, a year in which conditions were more or less normal. Transits of product tankers and container ships have almost fully recovered, with both types trending near 90% of normal activity.

While the ACP is careful to stress that all of its plans are ultimately contingent on the weather, it is optimistic that canal operations will return to normal by 2025.

Not a drop to drink

One of the strongest headwinds that the Panama Canal has faced over the past six months has come from El Niño, a climate pattern that brings high temperatures to surface waters in the region. This heat has contributed to the evaporation of Gatun Lake, bottlenecking the number of ships that can traverse the canal’s 51 miles of navigable water.

But Gatun Lake is not only used for canal operations — it is also a source of drinking water for roughly half of Panama’s 4.4 million people.

This dual function has made the canal’s utility a critical issue ahead of an already contentious presidential election, which will be held on May 5. Former president Ricardo Martinelli, whose administration made substantial investments in Panama’s infrastructure so as to attract foreign business, was a clear front-runner in the polls despite being convicted of money laundering. Panama’s Supreme Court disqualified his candidacy in February.

His running mate, José Raúl Mulino, has inherited both Martinelli’s bid and his lead, albeit one slightly narrower than it once was. It is safe to assume that Mulino would prioritize the canal’s economic uses where possible, as his platform promises a return to heavy investment in public works.

The ACP recently proposed a $2 billion project that would dam the nearby Indio River and then drill a five-mile mountain tunnel connecting the newly constructed reservoir to Gatun Lake. This six-year project is estimated to allow 11 to 15 additional transits per day through the canal. It has, however, faced heavy criticism from local farmers, whose lands risk being flooded by the adjacent reservoir.

All of Panama’s presidential candidates have vowed to secure access to potable water for the country’s population — with water being a necessity, such a stance tends to garner support in the polls. It is worth noting that the ACP claims that the Indio River proposal would also secure drinking water for Panama City, which has seen steady population growth in recent years.

Let the rain fall down

Thankfully, Panama’s future president might not have to choose between filling the locks and filling the taps, at least in the short term.

The U.S. National Weather Services’ Climate Prediction Center forecasts a swift end to El Niño conditions in the coming months with 85% confidence. Even better, they also predict a 60% chance for La Niña conditions to develop by August at the latest.

La Niña would bring cooler surface temperatures and potentially more precipitation to Panama, an encouraging start to the nation’s wet season that lasts from May to December. Such a bounty could accelerate the ACP’s timeline towards a full recovery, and so remove one of the many bottlenecks to international trade.

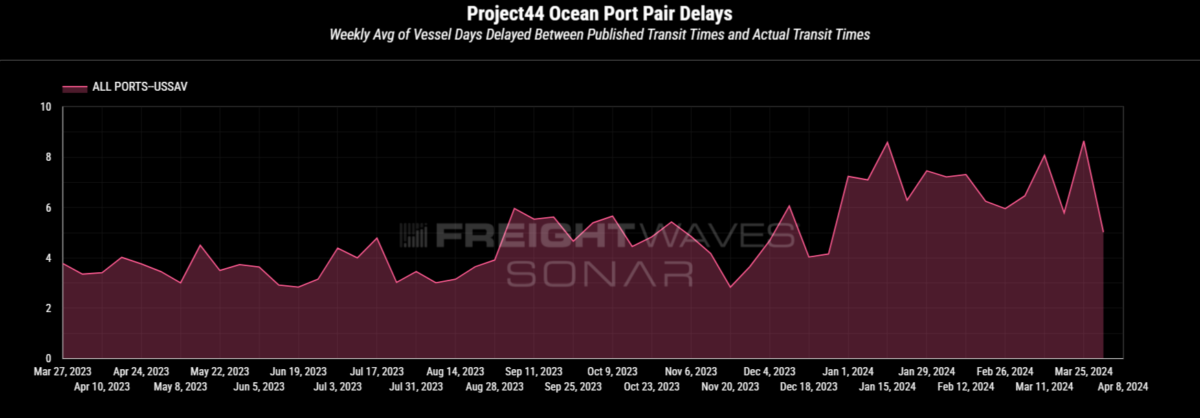

The Panama Canal sees nearly half of all container volumes from China and East Asia pass through to the U.S. East Coast. The current drought and ensuing operational impediments have caused delays to the Port of Savannah to rise from an average of three days in May 2023 to nearly nine in late March — though the Port of Baltimore’s closure has certainly had no small impact on other East Coast ports.

The Port of Savannah has bet the house on its expansion in recent years, but its growth is tethered to that of the Panama Canal.