As the highly anticipated Bitcoin halving approaches, a number of leading platforms are offering Bitcoin halving promotions. These offers are designed to attract both seasoned traders as well as newcomers to the digital currency sphere.

These promotions offer a unique blend of rewards, challenges, and giveaways, allowing participants the chance to reap significant benefits. Here’s our round-up of the top offers in 2024.

Methodology

BeInCrypto has highlighted seven cryptocurrency platforms that offer multiple Bitcoin halving promotions. Our product team tested these platforms for more than six months, focusing on trustworthiness, security and reliability. Here are the platforms along with the main reasons that led to choosing each.

YouHodler

Innovative financial products: Offers unique features such as crypto savings accounts, multi-HODL strategies, and turbocharge loans, providing users with diverse ways to grow their holdings during the halving event.

High level of security: Implements industry-leading security measures, including cold storage of assets, advanced encryption, and multi-factor authentication to ensure user funds are protected.

User-friendly interface.

Designed with simplicity in mind, making it accessible for both beginners and experienced traders to engage with Bitcoin halving promotions effectively.

Uphold

Transparent pricing: Offers clear, upfront pricing with no hidden fees, making it easier for users to participate in promotions without worrying about unexpected costs.

Versatility in trading: Supports a wide range of assets beyond cryptocurrencies, including precious metals, equities, and environmental assets, allowing for diversified investment strategies.

Automated trading tools: Features like AutoPilot and Repeat Buys help users take advantage of dollar-cost averaging (DCA), which can be particularly beneficial during the Bitcoin halving period.

Bitpanda

Comprehensive asset selection: Provides a vast selection of digital assets, including a variety of cryptocurrencies, enabling users to diversify their portfolios while participating in halving promotions.

Educational resources: Offers a wealth of learning materials and quizzes through its Bitpanda Academy, empowering users to make informed trading decisions during the Bitcoin halving event.

Robust security framework: Prioritises user security with state-of-the-art technology, including two-factor authentication (2FA) and cold storage solutions.

Binance

Extensive market depth: As one of the largest cryptocurrency exchanges globally, Binance offers unparalleled liquidity, making it easier for users to execute large trades during Bitcoin halving promotions.

Innovative trading features: Introduces cutting-edge trading options such as futures, margin trading, and staking, catering to advanced traders looking to capitalise on the halving.

Dedicated promotional events: Regularly hosts a variety of promotional events specifically designed around significant crypto milestones like the Bitcoin halving, providing substantial rewards and incentives.

Bitget

Focus on derivatives trading: Specialises in futures and derivatives trading, offering traders the chance to leverage Bitcoin halving events with advanced trading tools and strategies.

Community engagement: Actively involves the community with challenges and competitions, making the halving event more engaging and potentially profitable for participants.

User protection fund: Maintains a robust protection fund to safeguard users’ interests in the event of extreme market volatility, particularly important during events like the Bitcoin halving.

Nexo

Instant crypto credit lines: Allows users to borrow against their crypto assets instantly without selling, providing a unique way to access liquidity during the Bitcoin halving without missing out on potential price increases.

High-yield savings account: Offers competitive interest rates for users holding cryptocurrencies, enabling participants to earn passive income on their holdings during the halving promotions.

Comprehensive insurance: Provides one of the highest levels of insurance coverage in the industry, ensuring users’ assets are protected throughout the halving event and beyond.

Leveraged trading options: Offers up to 200x leverage on crypto trades, allowing users to amplify their exposure to Bitcoin halving market movements.

Mining feature: Unique to StormGain, users can mine cryptocurrency directly within the platform, providing an additional way to increase holdings during the halving period.

All-in-one solution: Combines exchange services, wallet functionality, and trading tools in a single platform, making it convenient for users to engage with Bitcoin halving promotions without needing multiple services.

These features underscore why the BeInCrypto team has identified these seven platforms as the best for engaging with Bitcoin halving promotions, based on their ability to offer security, reliability, and unique opportunities to their users.

To learn more about BeInCrypto’s verification methodology, click here.

Best Bitcoin halving promotions in 2024

1. YouHodler

To join the Bitcoin halving promotion and aim for the leaderboard, you must hit at least $1,000 in trade volume during the promotion, which runs from March 19 to April 30, 2024. You can start a trade with just $100 and leverage it with a 5x multiplier. Your trading volume is the sum of your input and output, multiplied by the chosen multiplier plus any profit. For instance, a $500 deal with a 2x multiplier that ends with $100 profit equals a $2,100 trade volume.

The campaign starts on March 19, 2024, and ends on April 30, 2024. Lucky draws are on March 27, April 3, 10, 17, and 24, with the grand finale in May.

All trading pairs are eligible. Trades must last at least one minute. Use Take Profit and Stop Loss to manage risk.

Each MultiHODL deal can earn you tickets, e.g., a $10,000 deal with a 10x multiplier gives 100 tickets. The maximum number of tickets you can get is 5,000.

Find your ticket count on the participants’ board on the promo page using your account number’s first eight characters.

Weekly draw winners are chosen randomly and announced on the promotion page. You can win multiple times. Winners will be declared on the promotion page after April 30, 2024, and contacted via chat or email.

Prizes range from $10,000 to $50, with 200 winners sharing half a Bitcoin. Winners are randomly chosen, and prizes are credited within three working days post-final draw.

The more you trade, the higher your chances of winning!

2. Uphold

This promo encourages investing in Bitcoin (BTC) long term using a method known as dollar-cost averaging (DCA). DCA is about making regular investments in BTC to potentially reduce the impact of volatility on the overall purchase. It’s designed for those who wish to invest without the stress of timing the market.

Here’s how to participate in this Bitcoin halving promotion.

1. Setup Repeat Buys. Decide how often you want to invest in Bitcoin — daily, weekly, or monthly. This automated investment schedule helps you build your BTC holdings over time without having to monitor the market constantly.

2. Follow the promotion’s minimum requirements. The minimum amount is $100. Earn rewards. By participating in Repeat Buys, you can earn rewards. Use debit/credit cards for purchases and get 3% back in BTC. For other payment methods, receive 1% back. You can start with as little as $100. There’s a cap of earning up to $1,000 in BTC rewards per month.

Note that this promotion is not available in the U.K. & E.E.A,, and terms and conditions apply. Be sure to read these carefully to ensure you’re eligible and understand the details of the offer.

3. Bitpanda

To participate in Bitpanda’s Bitcoin halving celebration and have a chance to win half a Bitcoin, you need to follow these guidelines:

1. Be a fully verified and registered client on Bitpanda. This promotion is not open to residents of the Netherlands, Belgium, the U.K., or any other restricted jurisdictions.

2. Invest in any crypto assets on Bitpanda at least three times between April 1, 2024, and April 30, 2024. Each transaction must occur on separate occasions within this period.

Two participants will be randomly chosen to each win half a Bitcoin. The prize’s value is based on the market value at the time of transfer. There’s no option for a cash substitute or prize exchange. Winners will be notified via the email associated with their Bitpanda account. Instructions for claiming the prize or any additional rewards, such as tickets, will be communicated through email.

Remember, participation involves making separate investments in crypto on Bitpanda during the specified period, adhering to the eligibility criteria, and accepting the promotion’s terms and conditions. Good luck!

4. Binance

To take part in Binance’s Bitcoin Halving giveaway and potentially grab a share of $50,000 in BTC, here’s what you need to know:

1. The first 10,000 new users who sign up for a Binance account through the Halving Horizon welcome gift link and complete their identity verification (KYC) within the activity period will receive a welcome gift. This gift ranges between 0.00005 to 0.0001 BTC each from a total pool of $50,000 in BTC.

2. New users who don’t make it into the first 10,000 but sign up using the “HALVING24” referral code or through a specific referral link, and complete KYC, will enjoy a 10% discount on spot trading fees.

3. To claim the welcome gift, eligible users must complete KYC before the end of the activity period. The welcome gifts will be distributed automatically upon qualified registration. You can check your received gift by navigating to Account Center > More Service > Gift & Campaign > My Gifts in the Binance App.

4. The tokens received as part of the welcome gift are initially locked. To unlock them for withdrawal, you must reach a total trading volume of 50 USDT across any spot and margin trading pairs after receiving the welcome gift. Once the trading volume is reached, the tokens can be withdrawn starting from 07:00 (UTC) on the following day.

5. Long-term discount. The 10% spot trading fee discount obtained through the “HALVING24” code is valid for as long as the Binance referral program exists.

Remember, this is a time-sensitive offer, so if you’re interested, make sure to sign up and complete the necessary steps before the end of the activity period to qualify for the rewards.

5. Bitget

Celebrate the upcoming Bitcoin halving with Bitget and seize the chance to share in a huge prize pool of 500,000 USDT through a variety of engaging activities. Here’s what you need to know to participate:

BTC CandyBomb promotion

Period: March 25 – April 9, 2024

Prize: Share of 4.3 BTC

Details: Make BTC or USDT net deposits and complete tasks designated for new users to earn tickets.

Futures trading challenge

Period: March 25 – April 25, 2024

Prize: Share of 2 BTC

Details: Enter by completing your first futures trade, participating in futures trading tasks, or competing in the futures ROI competition.

Bitcoin halving Learn2Earn promotion

Period: March 25 – April 8, 2024

Prize: 10,000 BGB

Details: Complete the Learn2Earn task about Bitcoin halving. Pass the quiz to win 5 BGB in crypto vouchers and 10 points. New users who finish the quiz and make any spot trade will receive an additional 5 BGB.

BTC collateral loan offer

Period: March 25 – April 25, 2024

Details: Borrow 1,000,000 USDT using BTC as collateral to reduce your interest rate by half (up to a 200,000 USDT reduction per user).

Bitget BTC earn

Period: March 25 – April 25, 2024

Details: Subscribe to BTC Flexible Savings products during the promo period to enjoy up to 10% APR.

Community carnival for BTC airdrops

Period: March 25 – April 25, 2024

Details: Join the Bitget community for exclusive new user benefits.

Social media repost reward

Period: March 25 – April 25, 2024

Prize: Share of 2,000 USDT

Details: Follow Bitget on social media (platform X) and repost the designated content.

Bitcoin halving quiz

Period: March 25 – April 25, 2024

Prize: Share of 2,000 USDT

Details: Take a quiz about Bitcoin halving to earn your share.

Joining Bitget’s series of promotional activities offers a unique opportunity to celebrate the Bitcoin halving while potentially earning part of a significant reward pool.

6. Nexo

Nexo is celebrating the upcoming Bitcoin halving event with an exciting promotion that includes a 10 BTC prize pool. Here’s how new and existing users can participate and earn rewards:

New users get a 10,000 Satoshi kick-off bonus, from Feb. 15, 2024, 14:00 UTC to April 19, 2024, 23:59 UTC.

Users must create a Nexo account and complete the verification process. Then, use one Nexo product. Choose from the following options:

Earn: Deposit assets worth at least $50 into any duration Fixed Term.

Exchange: Execute swaps totaling $100 or more.

Borrow: Take out your first crypto-backed credit.

Nexo Card: Make your first purchase with the Nexo Card.

Get rewarded: Receive 10,000 Satoshi simply by using one of these products.

Transfer a minimum of $500 in digital assets into any duration Fixed Term using the Nexo App or platform.

Make sure your transfer is done between April 1, 2024, at 14:00 UTC and April 14, 2024, at 23:59 UTC to be eligible.

Every $500 moved into a Fixed Term grants you one entry into the random draw. The more you transfer, the higher your chances of winning. For instance, moving $5,000 into a Fixed Term gives you 10 entries.

You can also combine smaller Fixed Term deposits to reach the $500 threshold for an entry. For example, creating Fixed Terms of 100 USDT, 200 USDT, and 200 USDT will count as one entry.

Only Fixed Terms created within the promo period qualify. Previous or auto-renewed Fixed Terms won’t be considered.

The promotion counts new transfers into Fixed Terms. Pre-existing or auto-renewed terms are excluded.

Prize breakdown:

One winner: Receives 20% of the prize pool (0.1 BTC)

One winner: Gets 15% (0.075 BTC)

One winner: Awarded 10% (0.05 BTC)

One winner: Takes home 5% (0.025 BTC)

20 winners: Each win 2.5% (0.0125 BTC)

Reward allocation: If you’re among the lucky winners, expect your share of the 0.5 BTC prize pool to be credited to your savings wallet by April 19, 2024.

Whether you’re starting with the 10,000 Satoshi kick-off bonus or participating in the fixed-term promo, there’s something for everyone leading up to the Bitcoin halving event.

7. StormGain

StormGain is celebrating the Bitcoin halving with a special promotion designed to offer both guaranteed rewards and a chance to win big. Here’s how you can participate and make the most out of this exciting opportunity.

To be part of the BTC havling giveaway, simply make a minimum deposit of 50 USDT to your StormGain account.

Upon making the minimum deposit, you’ll receive a Mystery Box containing a guaranteed gift. These gifts vary, offering a range of rewards:

Up to 100 USDT in cash airdrop bonuses.

Enhanced loyalty status upgrades, including Gold, Platinum, or Diamond, providing up to 12x mining speed for a duration of seven days.

BTC lucky draw

Your deposit not only secures you a Mystery Box but also automatically enters you into the BTC Lucky Draw.

The lucky draw features a prize pool of 0.1 BTC, which will be evenly distributed among 10 randomly selected winners the day after the halving event.

With guaranteed gifts for every participant and a chance to win a significant amount of BTC, it’s an attractive opportunity for anyone looking to enhance their cryptocurrency experience around the Bitcoin halving.

Impact of Bitcoin halving

Bitcoin halving is an event that happens approximately every four years. It’s like a scheduled pay cut for Bitcoin miners. Miners use powerful computers to solve complex math problems and keep the Bitcoin network running smoothly and securely. In return for their work, they earn Bitcoin.

When a Bitcoin halving occurs, the amount of Bitcoin that miners receive for their work is cut in half. This means if they earned 10 Bitcoins for solving a problem before the halving, they would earn only five BTC for the same work after the halving.

The impact of this event is significant for a number of reasons. Let’s take a quick look at its implications:

1. Supply and demand

Since new Bitcoins are produced at a slower rate after each halving, fewer new coins are entering the market. If demand for Bitcoin remains the same or increases, the reduced supply can lead to a price increase. It’s like if there’s only a limited number of tickets for a concert, the price of those tickets might go up.

Investors often use technical analysis to predict future price movements by examining historical price charts and market data. Learning about crucial indicators such as the RSI indicator or the cup and handle pattern is key, especially for crypto traders. This is especially true in scenarios where the reduced supply from a Bitcoin halving could potentially lead to a price increase.

2. Miner’s income

Since miners earn fewer Bitcoins for their work, their income reduces instantly after the halving. This can be challenging for miners, especially those with high costs, as their earnings drop while their expenses (like electricity and equipment) stay the same or even increase.

/Related

More ArticlesSome miners may stop mining because it’s no longer profitable, which can lead to less competition and more centralized control of the Bitcoin network.

2. Public interest

Halving events often bring media attention to Bitcoin, sparking public interest and attracting new investors to the cryptocurrency market. This increased attention can also contribute to changes in Bitcoin’s price.

To mitigate the impact of market volatility, investors might adopt a strategy known as dollar cost averaging. This involves regularly buying a fixed dollar amount of Bitcoin over time. This approach can help investors spread out their purchases, potentially reducing the risk of investing a large amount at an unfavorable price before or after a halving event.

What is the next Bitcoin halving event?

The next Bitcoin halving event is a significant moment for the cryptocurrency, marking a reduction in the reward miners receive for verifying transactions on the blockchain. It is thought this will take place on April 20, 2024.

Currently, as of the beginning of April 2024, miners are awarded 6.25 BTC for each block they successfully add to the blockchain. This reward is halved approximately every 210,000 blocks or roughly every four years.

This halving event directly influences the supply and demand dynamics of Bitcoin. Market participants should build a Bitcoin halving investment strategy ahead of the seminal event. It is important to assess one’s risk tolerance, as the periods around halving events may increase market volatility and price fluctuations.

What is the reward of Bitcoin mining halving?

The first Bitcoin was mined on Jan. 3, 2009. This very first block mined is known as the Genesis Block or Block 0. It was mined by Bitcoin’s creator, who is known by the pseudonym Satoshi Nakamoto. The Genesis Block marks the beginning of the Bitcoin blockchain and the start of the cryptocurrency era. Initially, the reward for mining a block was 50 bitcoins.

After the first halving, it dropped to 25 BTC, then to 12.5 BTC, and after the 2020 Bitcoin halving, the reward stands at 6.25 BTC per block. However, this will once more be cut in half in April 2024.

The purpose of this halving is to control the supply of Bitcoin, ensuring that the total number of coins ever created is limited to 21 million.

This mechanism helps to mimic the scarcity and deflationary characteristics similar to precious metals like gold, potentially increasing the value of Bitcoin over time as the rewards for mining decrease and new coins become more scarce.

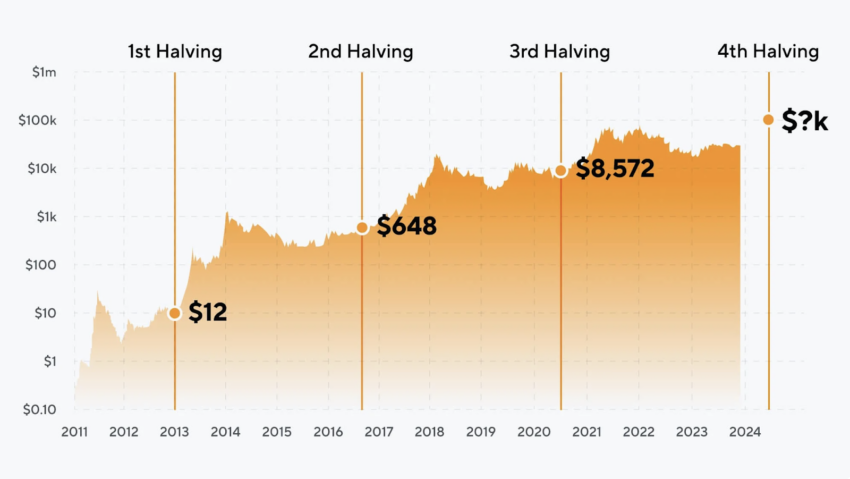

If we observe the BTC price evolution over the last three Bitcoin halvings, the price has consistently gone up. While the price increase following past halvings has been exponential, nobody can tell for sure what will happen next.

Will BTC price go up after Bitcoin halving?

Bitcoin halving is a pivotal event that significantly impacts the crypto ecosystem. By reducing the reward for mining new blocks, halving events decreases the rate at which new Bitcoins are generated. This impacts the supply of Bitcoin and can potentially lead to price increases if demand remains steady or grows. Users who successfully take advantage of Bitcoin halving promotions can thus potentially benefit twofold: from the promotions and prizes themselves and the potential growth in asset/portfolio value.

However, the precise impact on Bitcoin’s price and the broader crypto market is not guaranteed. Investor sentiment, market conditions, and global economic trends also play a part. In a volatile market like crypto, profits are never guaranteed.

Frequently asked questions

Will Bitcoin halving increase price?

Is Bitcoin halving bullish?

Does crypto go up after halving?

What happens to BTC price after halving?

Trusted

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.