China’s yuan: central bank sees resolve for stable currency, stimulus tested as Fed holds firm on rates

- The People’s Bank of China has expressed an interest in more rounds of monetary easing, but pressures on the yuan could stall those actions

- With no clear date set for Federal Reserve cuts, depreciation of the yuan against the US dollar remains the major priority for China’s central bank

Although China’s central bank has hinted at plans for more monetary easing, uncertainty over the exact timing of US interest rate cuts and renewed depreciation pressures on the yuan are likely to delay any moves in that vein, analysts said.

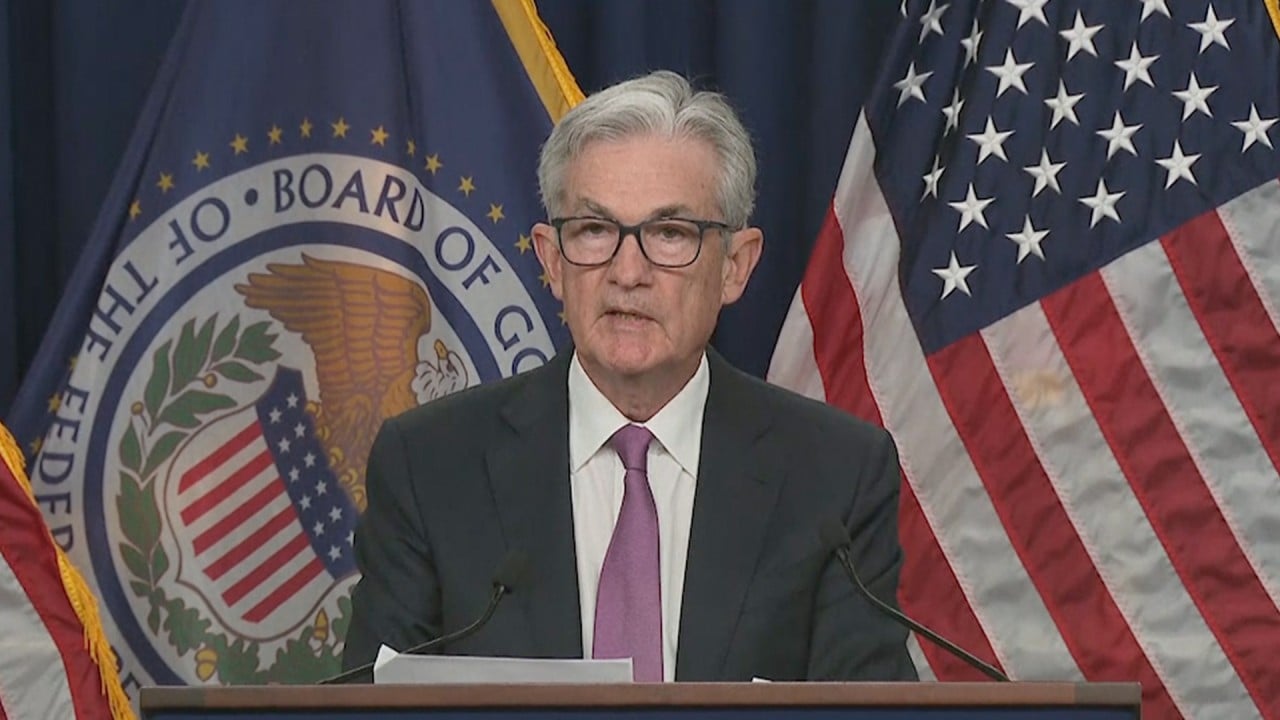

Stress has piled on the yuan as the US Federal Reserve holds interest rates steady following a two-day policy meeting that ended on March 20.

The yuan has plunged an average of 0.53 per cent against the US dollar since March 20, despite strong fixing rates being set by the People’s Bank of China (PBOC) for the national currency.

Louise Loo, China economist at Oxford Economics, said that the PBOC is still in a relatively “accommodative” mode when it comes to yuan exchange rate management.

“The currency weakness is also, to a large degree, driven by dollar strength and still-weak domestic fundamentals, and a weak currency can provide a helpful economic boost – so we think they could still tolerate further weakening,” Loo said.

Most analysts expect interest rate differentials between China and the US to remain significant until the Federal Reserve begins its first rate cut this year.

Money and credit growth slowed for China in February as the PBOC seeks to manage the fallout from a property market downturn while countering deflationary pressures.

The Chinese central bank only made two “conservative” interest rate cuts in 2023, according to the US-based Institute of International Finance (IIF), a trade group for the financial services industry.

The PBOC has so far prioritised the stability of the yuan over easing. China’s trade surplus – a point of contention with the US and Europe over perceived overcapacity – hit 4.6 per cent of its gross domestic product (GDP) in 2023, the IIF said.

Further depreciation of the yuan, the group added, may trigger capital outflows and exacerbate trade imbalances.

“We think there is a chance for one more policy rate cut in 2024, especially if deflation stays entrenched and the Fed starts easing in the second half of this year,” said the institute in a note on March 28, adding that much of the PBOC’s monetary easing was achieved through quantity-based instruments, including credit policy tools.

The yuan exchange rate cannot only depend on the Federal Reserve and the US dollar index, but also the potential growth rate of China’s economy

Guan Tao, chief global economist for Bank of China International, said markets should not “misinterpret” the recent volatility of the yuan as a sign of depreciation.

“The trend of the yuan exchange rate cannot only depend on the decision of the Federal Reserve and the US dollar index, but also depends on the speed and quality of the potential growth rate of China’s economy,” said Guan, a former director of the State Administration of Foreign Exchange, in an editorial for Chinese media outlet Yicai on April 2.

Rory Green, head of Asia research at GlobalData TS Lombard, said while the PBOC is capable of taking steps to support growth and defend the yuan’s exchange rate simultaneously, there is a limit on how long such contradictory policies will hold out.

“We think that despite PBOC intervention, the yuan will trend weaker, as US and China growth differentials persist and traders price in Trump trade war risks,” Green said in a note on March 28.