In April 2023, as Donald Trump continued to delay submitting a personal financial disclosure required for all presidential candidates, federal government officials responsible for compelling Trump’s compliance mused over whether the former president would simply ignore them.

After all, these government officials are lawyers at the U.S. Office of Government Ethics — the very kind of “deep state” denizens that Trump has vowed to purge if he wins the White House in November.

And they had good reason to believe Trump might simply go rogue: the former president and 2024 Republican presidential candidate had already blown past a final, mid-March federal deadline for offering up details about his personal wealth.

ALSO READ: Prison president: How Donald Trump could serve from behind bars

Trump’s actions prompted staff at the Office of Government Ethics to circulate a Mother Jones article headlined, “What Happens if Donald Trump Simply Refuses to Disclose His Finances?”

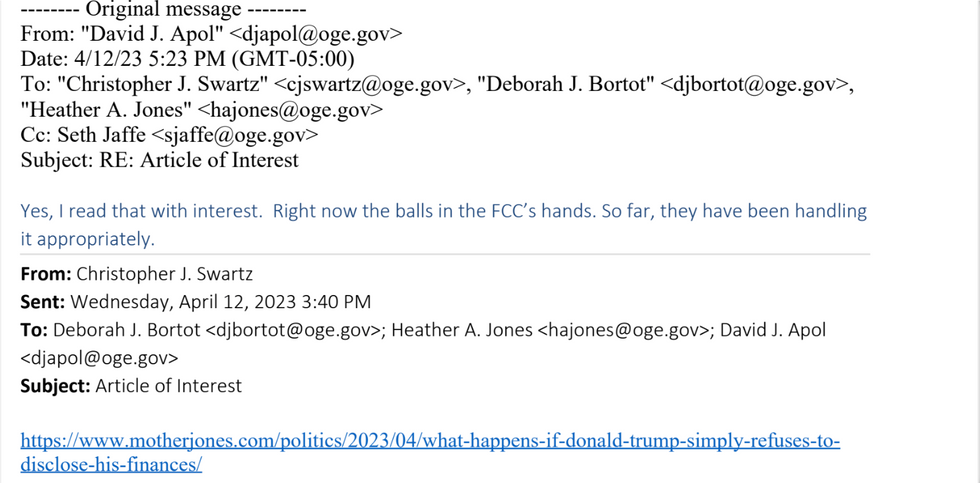

According to emails obtained by Raw Story through a Freedom of Information Act request, Christopher J. Swartz, senior associate counsel for the U.S. Office of Government Ethics, first sent around the article, citing Raw Story’s scoop that the Federal Election Commission was threatening to fine Trump for not filing his public financial disclosure.

“I read that with interest,” wrote David J. Apol, general counsel for the U.S. Office of Government Ethics on April 12. “Right now the balls in the FCC’s hands. So far, they have been handling it appropriately.”

“Yes - FEC,” corrected Seth Jaffe, chief, ethics law and policy branch for the U.S. Office of Government Ethics, on April 12, using the acronym for the Federal Election Commission.

Screen grab from U.S. Office of Government Ethics emails

Screen grab from U.S. Office of Government Ethics emails

Concurrently, Trump’s finances were already under scrutiny elsewhere.

Manhattan District Attorney Alvin Bragg indicted Trump days prior in a civil fraud case related to an alleged hush-money payment made to adult film star Stormy Daniels, and another New York civil fraud case related to the Trump Organization’s inflation of asset values to receive favorable tax breaks and loans was underway.

Trump violates law designed to flag conflicts of interest

Trump last year violated a federal law for the timely filing of his personal financial disclosure.

He did end up eventually filing his public financial disclosure on April 14, nearly a month past his final extension, news that Raw Story broke. Trump had exhausted 90 days of extensions for filing his report, which was initially due within 30 days of him declaring his candidacy for president on Nov. 15, 2022.

Trump needed to file a second report last year on May 15, the deadline for all presidential candidates. He again exhausted 90 days of extensions, with the Office of Government Ethics receiving the report and the Federal Election Commission making it public on Aug. 14, Raw Story reported.

The 170-page filing was a beast — much larger than that of any other 2024 presidential candidate then running, including Florida Gov. Ron DeSantis and former South Carolina Gov. Nikki Haley.

ALSO READ: No, Donald Trump, fraud is not protected by the First Amendment

Trump’s financial bulk prompted staffers in the Office of Government Ethics to ask each other — and Trump’s lawyers — a series of questions that played out over two months.

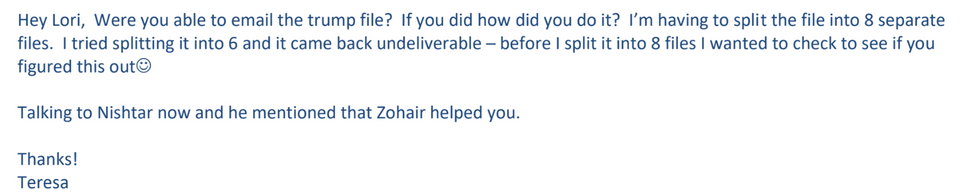

Some questions were painfully technical.

“Were you able to email the Trump file? If you did, how did you do it?” wrote Teresa L. Williamson, nominee coordinator, presidential nominations branch for the Office of Government Ethics, on July 12. “I’m having to split the file into 8 separate files. I tried splitting it into 6 and it came back undeliverable – before I split it into 8 files I wanted to check to see if you figured this out.”

Numerous questions revolved around the accuracy of Trump’s figures, asking questions such as if there was a “copy and paste error” with an asset entry. (Yes, there was, Trump’s lawyers said.)

Screen grab from U.S. Office of Government Ethics emails

Screen grab from U.S. Office of Government Ethics emails

While the U.S. Office of Government Ethics doesn’t audit the report, the agency oversees ethics for the executive branch and identifies potential financial conflicts of interest “to help ensure government decisions are made free from personal financial bias,” according to its website.

The agency’s certification process provides a second line of review for completeness and looks for any apparent violations of U.S. code that deals with “bribery, graft and conflicts of interest.”

Prior to a Sept. 13 deadline to certify the public financial disclosure, Heather Jones, senior counsel for the Office of Government Ethics, sent 13 pages of questions on Aug. 18 to Trump’s lawyers, Scott Gast and Derek Ross at Compass Legal Group, asking about inconsistencies between Trump’s latest filing and previous reports.

Gast responded to Office of Government Ethics’ questions a week later. But the Compass Legal Group’s answers were decidedly terse, with many of their 150 responses to Office of Government Ethics questions constituting a single word.

“Can the filer direct campaign funds to himself for personal use?” the Office of Government Ethics asked.

“No,” Trump’s lawyers replied.

“Is the filer personally liable for campaign debt?”

“No,” the Compass Legal Group wrote.

The document with questions from the Office of Government Ethics continued, “Based on OGE’s review, it appears that several assets are missing from the filer’s prior report.”

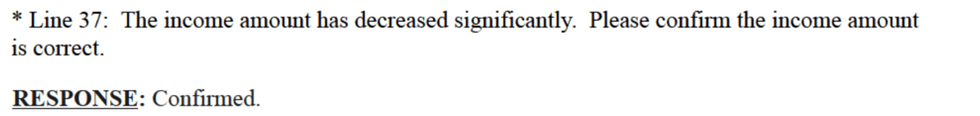

Line-by-line questions ensued.

“Were these assets sold during the reporting period with no income from the sale?” the Office of Government Ethics continued.

“Confirmed,” Trump’s lawyers said.

“The income amount has decreased significantly. Please confirm the income amount is correct.”

Screen grab from U.S. Office of Government Ethics emails

Screen grab from U.S. Office of Government Ethics emails

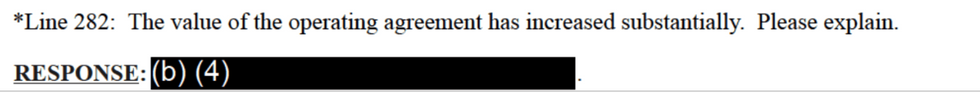

“The value of the operating agreement has increased substantially. Please explain.”

Screen grab from U.S. Office of Government Ethics emails

Screen grab from U.S. Office of Government Ethics emails

“The income amounts are exactly the same as the 2022 report despite different reporting periods. Please explain.”

“We have made the appropriate adjustments to the 278(e),” the Compass Legal Group replied, referencing the form for the executive branch personnel public financial disclosure report.

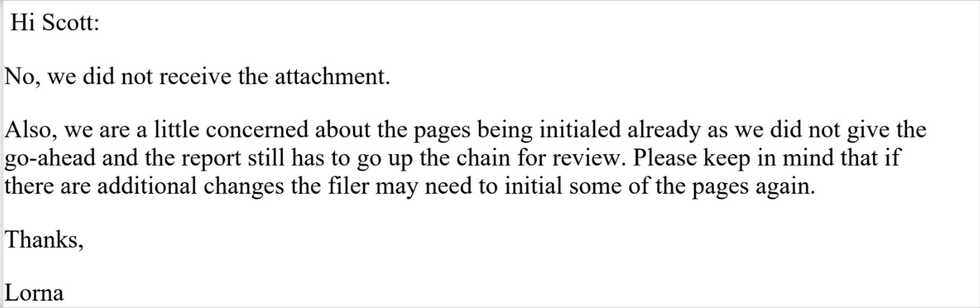

By September 12, Gast submitted revised reports initialed by Trump, approving changes before the report went public.

“We are a little concerned about the pages being initialed already as we did not give the go-ahead and the report still has to go up the chain for review,” wrote Lorna Syme, one of the reviewers at the Office of Government Ethics. “Please keep in mind that if there are additional changes the filer may need to initial some of the pages again.”

Screen grab from U.S. Office of Government Ethics emails

Screen grab from U.S. Office of Government Ethics emails

Gast agreed to address any additional questions, and ultimately, the Office of Government Ethics would certify the report, meaning that a reviewing official signed off that the report was complete and believed to be in compliance with relevant laws.

The certification came on Oct. 17, but with a notable caveat, Raw Story reported.

“OGE notes that several of the assets on this report are the subject of dispute in the case of New York v. Donald Trump, et al.,” said an notation on Trump’s public financial disclosure report, certified by Shelley K. Finlayson, acting director, chief of staff and program counsel for the Office of Government Ethics.

“However, the time period at issue in that case does not appear to overlap with the reporting period of this report. OGE does not independently verify the value of the reported assets. In certifying this report, OGE relied on the valuation of assets reported by the filer,” the Office of Government Ethics’ notation continued.

When asked about Trump’s certification process, Elizabeth Horton, a spokesperson for the U.S. Office of Government Ethics, told Raw Story, “We do not comment on specific individuals.”

Last week, Trump posted his $175 million bond, a fraction of the more than $450 million in damages he was ordered to pay in the New York civil fraud case that found Trump liable for fraud by inflating his properties’ valuations to get more favorable loans and tax breaks.

Trump’s next annual disclosure will be due May 15.

The Compass Legal Group declined to comment.

Trump’s spokespeople did not respond to Raw Story’s request for comment.