US House reauthorises controversial spying law for 2 years

US and UK launch crackdown on Russian metals trade

The US and the UK have launched a crackdown on trades in Russian metals, in a move designed to limit Moscow’s export revenue and restrict its ability to fund the war in Ukraine.

The action, announced by the two countries on Friday, marks an aggressive effort by the allies to damage Russia’s income — but could disrupt trading at exchanges including the London Metal Exchange and Chicago Mercantile Exchange.

“Our new prohibitions on key metals, in co-ordination with our partners in the United Kingdom, will continue to target the revenue Russia can earn to continue its brutal war against Ukraine,” said Janet Yellen, the US Treasury secretary.

Jane Street accuses Millennium Management and two ex-employees of stealing trade secrets

Jane Street is suing Millennium Management and two former employees for allegedly stealing trade secrets in a rare public spat between two big Wall Street investment firms.

In a complaint filed in federal court in Manhattan on Friday, Jane Street alleged that Douglas Schadewald and Daniel Spottiswood, two former employees who defected to the multi-manager firm earlier this year, had stolen a “highly valuable, unique, and proprietary” trading strategy.

Jane Street said in the complaint, parts of which were redacted, that its profits from the secret strategy plummeted by 50 per cent within weeks of Schadewald joining Millennium, and that a “new entity . . . started placing orders mirroring the trading strategy”.

Read more here

US says China is supplying missile and drone engines to Russia

The US has accused China of providing Russia with cruise missile and drone engines and machine tools for ballistic missiles, as it urges Europe to step up diplomatic and economic pressure on Beijing to stop the sales.

In disclosing previously classified intelligence, senior US officials said Chinese and Russian groups were working to jointly produce drones inside Russia. They said China had also supplied 90 per cent of chips imported by Russia last year, which were being used to make tanks, missiles and aircraft.

The officials added China was also helping Russia to improve its satellite and other space-based capabilities to help prosecute its war in Ukraine, and Beijing was also providing satellite imagery.

Read more here

US stocks notch weekly loss as inflation proves sticky

US stocks notched a weekly loss as fresh economic data indicated that a robust US labour market and persistent inflation would lower the need for interest rate cuts.

The benchmark S&P 500 fell 1.5 per cent on Friday, for its worst one-day drop since January 31, and 92 per cent of its stocks sliding. The tech-heavy Nasdaq Composite dropped 1.6 per cent, its worst day in more than a month.

Traders picked up Treasuries after a major sell-off on Wednesday. The yield on the two-year note fell 0.06 percentage points to 4.90 per cent, while that of the 10-year bond fell by the same amount to 4.52 per cent.

-2.9%

Russell 2000

-1.6%

S&P 500

-0.5%

Nasdaq Composite

Kristalina Georgieva set to serve second term leading the IMF

Kristalina Georgieva has won a second five-year term as IMF managing director, ahead of the start of the fund’s spring meetings in Washington next week.

Georgieva, who has been in the role since the autumn of 2019, was the sole candidate for the position.

“In taking this decision, the board commended Ms. Georgieva’s strong and agile leadership during her term, navigating a series of major global shocks,” board coordinators Afonso Bevilaqua and Abdullah BinZarah said.

Georgieva was widely expected to remain at the fund after European leaders signalled that they would back her.

Europe tends to hold sway in nominating successful candidates for the top job at the fund. World Bank presidents tend to hail from the US or hold US citizenship.

CVC poised to launch IPO as early as Monday

The European private equity group CVC Capital Partners is poised to announce its plans for an initial public offering as soon as Monday, kicking off one of the continent’s most highly anticipated listings this year.

CVC is targeting early next week to publicly launch its plans to list in Amsterdam, according to people familiar with its plans, who cautioned that no final decision had been made and an announcement could yet slip again.

Luxembourg-based CVC has €186bn of assets under management, with the bulk of that in its private equity strategy. The group gained prominence buying stakes in household-name brands from Debenhams to Formula One to the maker of PG Tips tea.

CVC has previously come close to going ahead with a listing, only to pull back because of tumultuous markets — first in May 2022 and then in November 2023.

Read more here

S&P 500 heads for biggest one-day drop in more than two months

The S&P 500 was on course for its biggest one-day drop since January as the dollar climbed to its highest level since the start of November.

The benchmark S&P 500 was down 1.5 per cent in Friday afternoon trading. Every sector weakened, with financials the worst performing sector following mixed earnings results from some of the largest lenders in the US.

The Nasdaq Composite was down 1.8 per cent, on track for its biggest drop since mid-February. Apple was the only gainer in the Magnificent Seven group of big tech stocks.

Meanwhile, the dollar was up 0.6 per cent against a basket of six peers and on track for a four-session winning streak.

Biden administration raises cost of drilling on public lands

The Biden administration has for the first time in several decades ratcheted up the cost of drilling on public lands in a landmark new regulation as it seeks to crack down on the oil and gas industry ahead of November’s election and force it to pay for clean-ups.

The Bureau of Land Management said on Friday it had finalised a rule that would raise royalty rates companies must pay the government as well as increase the minimum bond associated with the clean-up of abandoned wells. The move is likely to prompt criticism from lobbyists and some congressional Republicans.

“These are the most significant reforms to the federal oil and gas leasing program in decades, and they will cut wasteful speculation, increase returns for the public, and protect taxpayers from being saddled with the costs of environmental clean-ups,” interior secretary Deb Haaland said.

Additional reporting by Aime Williams in Washington

European equities mixed as fortunes of commodities and consumer stocks diverge

European equities were mixed on Friday as energy and mining stocks jumped while consumer groups sank.

London’s commodities-heavy FTSE 100 gained 0.9 per cent, boosted by rising oil and metals prices. The index had traded above its all-time closing high of 8014.31 earlier in the day but retreated before the end of the session.

The region-wide Stoxx Europe 600 closed 0.1 per cent higher, France’s Cac 40 dropped 0.2 per cent, and Germany’s Dax fell 0.3 per cent.

Sticky inflation weighs on US consumers’ economic outlook

US consumers’ perception of the economy slipped in April as recent economic data has shown a stall in disinflation at the start of 2024, lowering the chances of the Federal Reserve cutting interest rates.

The University of Michigan’s consumer survey showed on Friday that participants’ reading of current economic conditions fell to 79.3 in its preliminary report for April, down from 82.5 in March.

A slight uptick in year-ahead inflation expectations to 3.1 per cent in April from 2.9 per cent “reflects some frustration that the inflation slowdown may have stalled”, said Joanne Hsu, the director of the Michigan survey.

Traders have responded to inflation data and a blockbuster payrolls report in March by selling US government debt and scaling back bets on how many times the Fed will cut rates this year.

UK climate change minister Graham Stuart resigns

The UK’s net zero minister has resigned from his role in a surprise move only a few weeks after the government was forced to initiate a mini reshuffle.

Graham Stuart, MP for Beverley and Holderness, said in a letter to Prime Minister Rishi Sunak that he would step down from the ministerial role after nearly 18 months in the post to focus on local issues ahead of this year’s general election.

Stuart served as a minister under four premiers and was appointed to the net zero brief in September 2022 during the shortlived premiership of Liz Truss.

His decision to step down followed the resignations of armed forces minister James Heappey and apprenticeship minister Robert Halfon late last month.

Oil prices touch six-month high as fears grow of widening Middle East conflict

Oil prices climbed above $92 per barrel for the first time since October on rising fears of a widening conflict in the Middle East.

Brent crude, the international benchmark, rose 2.7 per cent on Friday to a six-month high of $92.16 per barrel. The US equivalent West Texas Intermediate rose 3 per cent to $87.55.

The moves came amid mounting concerns that Tehran could launch a retaliatory attack on Israel for its air strike on the Iranian consulate in Syria.

Markets update: US stocks dip as banks report mixed set of results

US stocks slipped in early trading, pulled lower by bank stocks as traders weighed mixed earnings reports from major lenders.

Wall Street’s benchmark S&P 500 was down 0.6 per cent shortly after the opening bell in New York. The tech-heavy Nasdaq Composite fell 0.8 per cent.

Shares in JPMorgan Chase — the biggest bank in the US by assets — fell 3.7 per cent after its latest earnings underwhelmed investors, even as profits surpassed analysts’ forecasts. Citigroup, by contrast, gained 1.1 per cent after reporting better than expected quarterly profits.

Citi beats profit forecasts as revamp shows signs of paying off

Citigroup reported better than expected profits in the first quarter, in a sign that the recent revamp of the US’s fourth-largest lender may be starting to pay off.

Citi reported net income of $3.4bn in the quarter, down 25 per cent from a year ago but better than the $2.3bn analysts had forecast.

The bank last year instigated its most significant reorganisation in nearly two decades in an effort to reverse years of lacklustre share price performance.

Profits in the quarter were weighed down by hundreds of millions of dollars in severance and other one-off charges, as well as $250mn in additional charges related to last year’s regional bank failures.

Former UK Ministry of Defence employee sentenced to prison after bribery case

A former UK Ministry of Defence employee has been sentenced to more than two years in prison after being convicted in a long-running Saudi bribery investigation.

Jeffrey Cook, 67, was handed a 30 month sentence at Southwark Crown Court in London on Friday. A jury found him guilty last month on one count of misconduct in public office between September 2004 and November 2008 over £70,000 of kickbacks in cash and cars that he received while he was a government employee.

His imprisonment brings an end to a more than decade-long investigation by the UK Serious Fraud Office into bribes paid to Saudi officials to secure lucrative defence contracts with the UK government.

Wells Fargo profits slip as benefits of high interest rates wane

Profits at US bank Wells Fargo fell in the first quarter, in a sign that the benefits of high interest rates are waning for the big lenders.

Lending profits shrank even as the bank said it was able to put less away to cover potential bad loans, given the continued strength in the economy.

The bank earned $4.6bn in the quarter, down from $5bn in the same period a year ago. Earnings beat expectations, but the bank’s shares fell 2 per cent in pre-market trading following the announcement.

Bernanke says Bank of England needs urgent reform to avoid forecasting errors

The Bank of England needs to urgently overhaul its outdated IT systems, revamp its main economic model and transform the way it communicates policy decisions to avoid a repeat of its recent failure to forecast surging inflation, former Federal Reserve chair Ben Bernanke said.

Bernanke’s recommendations, published on Friday, suggest radical change is needed to equip the BoE for a more volatile economic environment in which shocks such as the pandemic and Ukraine war may be bigger and more frequent.

The Nobel laureate was called in to review the central bank’s forecasting and related processes last year after UK policymakers came under heavy fire for failing to foresee a post-pandemic jump in inflation.

Read more here.

JPMorgan profits beat analysts’ forecasts despite extra charges

Profits at JPMorgan Chase rose 6 per cent in the first three months of 2024 from a year earlier, despite the bank paying an extra $725mn charge by US regulators to cover the costs from last year’s regional bank failures.

The largest US bank by assets reported first-quarter net income of $13.4bn, up from $12.6bn a year earlier and more than analysts had expected. JPMorgan set aside less than analysts had anticipated to cover loan losses.

Read more here

Former Post Office boss said sub-postmasters had ‘their hand in the till’

The Post Office’s former chief told colleagues sub-postmasters were probably stealing amid a recession when allegations were first brought to his attention.

Emails between Alan Cook and colleagues at parent company Royal Mail in 2009 shared with a public inquiry showed the former Post Office boss raised doubts around the veracity of claims made by sub-postmasters in a Computer Weekly article, alleging the business’s Horizon IT system was responsible for account shortfalls.

“My instincts tell that, in a recession, subbies [sub-postmasters] with their hand in the till choose to blame the technology when they are found to be short of cash,” Cook wrote in one email.

More than 900 sub-postmasters were convicted in cases brought by the Post Office using data from a faulty IT system in 1999.

Markets update: FTSE 100 on track for all-time closing high

The FTSE 100 climbed above its all-time closing high in morning trading on Friday, as rising commodities prices boosted index heavyweights in the energy and mining sectors.

The UK’s blue-chip index was last up 1.3 per cent at 8023.46, above the record closing high of 8014.31 it hit in February 2023 but short of its all-time intraday high of 8047.06, also notched last February. The index will set a new record if it holds on to these gains to the end of the trading session.

The region-wide Stoxx Europe 600 rose 1 per cent. France’s Cac 40 and Germany’s Dax both gained 0.8 per cent.

BlackRock rides stock market rally to record $10.5tn in assets under management

Roaring equity markets and the popularity of its new spot bitcoin exchange traded fund powered BlackRock to record assets under management of $10.5tn and net income of $1.57bn that was up 36 per cent year on year.

Revenue of $4.7bn and adjusted net income of $1.47bn during its fiscal first quarter beat the expectations of analysts polled by Bloomberg, but net inflows of $57bn disappointed, dragged down by $19bn of outflows from BlackRock’s cash management products. While flows into fixed income have picked up, the wholesale rotation into bonds that some had hoped for has not materialised.

Chief executive Larry Fink pointed in a statement to a “strong pipeline” of opportunities. “We see significant growth potential in infrastructure, technology, retirement and whole portfolio solutions.”

Read more here

Police launch investigation into deputy Labour leader Angela Rayner

Angela Rayner, deputy Labour leader, is facing a police investigation into events surrounding the sale of her former council house in 2015.

Rayner was reported to police by Tory MP James Daly, over concerns she may have committed an offence in the early 2010s by giving false information about where she was living.

A Greater Manchester Police spokesperson said this morning: “We’re investigating whether any offences have been committed. This follows a reassessment of the information provided to us by Mr Daly.”

Rayner has faced claims she may have broken electoral law over details she gave about her living situation in the early 2010s.

Rayner has been contacted for comment.

Read more here.

Former Post Office boss says evidence against prosecuted sub-postmasters was ‘compelling’

Prosecutions brought by the Post Office in the Horizon scandal had been “quite compelling”, a public inquiry has heard.

Alan Cook, managing director of the business between 2006 and 2010, said that cases brought by the Post Office had featured strong evidence but he had been unaware for a period in the job that the organisation was initiating private prosecutions.

“A lot of the evidence in these cases, on the face of it, was quite compelling,” he said, before acknowledging that the business’s ability to decide whether to prosecute sub-postmasters raised questions about its independence.

More than 900 sub-postmasters were convicted in cases involving data from Fujitsu’s faulty Horizon IT system following its introduction in 1999.

Japan’s population falls by almost 100 people per hour

The Japanese population fell at a rate of almost 100 people per hour in 2023 as the country logged its biggest ever annual drop since comparable records began in 1950.

According to government data, the number of Japanese nationals fell by 837,000 in the 12 months to October 2023 — a drop that marked the 13th consecutive year of decline for a nation that has led the developed world in demographic contraction and ageing.

The population of under-15s in Japan now stands at a record low of 11.4 per cent of the overall population, while the number of over-75s stands at a record high of 16.1 per cent.

UK director bans for abusing Covid support scheme rise 80% in a year

The number of UK company directors to be disqualified for abusing Covid support schemes has risen 80 per cent in the past year, the Insolvency Service said on Friday.

In 2023-24, 831 directors were banned for abusing the Covid Bounce Back Loan Scheme, the highest number on record, with the average ban being almost 10 years.

Financial support was introduced at the start of the pandemic to help small and medium-sized businesses borrow between £2,000 and £50,000 at a low interest rate, guaranteed by the government.

The Insolvency Service started investigating potential financial wrongdoing in this area in 2021 and, to date, 1,430 company directors have been disqualified.

Belgium probes Russian payments to MEPs

Belgium has opened an investigation into lawmakers who allegedly took money from Russia to spread propaganda ahead of elections to the European parliament in June.

Prime Minister Alexander De Croo told journalists that prosecutors were examining cash payments to MEPs. He warned that Russia intended to pack the parliament with sympathetic lawmakers by using disinformation.

Risers and fallers in Europe

Big share price moves in Europe today include UK energy infrastructure company Petrofac, French bank Société Générale and London-listed insurer R&Q:

Petrofac: Shares in the energy infrastructure business dropped 26 per cent after the Jersey-based company said it was in discussions with its lenders to restructure its debt and was seeking fresh capital from prospective investors.

Société Générale: Shares in the French financial services group rose 4.5 per cent after it announced a deal with Saham Group to sell Société Générale Marocaine de Banques and La Marocaine Vie in a transaction worth €745mn.

R&Q: Shares in the London-listed insurer plummeted 45 per cent after the Bermuda-based company warned that it expected to “realise a significant pre-tax loss for the year”.

Growth in oil demand slowing, says IEA, even as supply concerns drive prices higher

World oil demand growth continues to fall, the International Energy Agency insisted on Friday, even as concerns over a supply shock have driven prices up by nearly a fifth this year.

The IEA now predicts that oil demand will grow by 1.2mn barrels per day this year, a 130,000 bpd reduction on its previous forecast. It said China’s oil demand had normalised, after a post-Covid spurt, and that a mild winter had moderated demand.

It also trimmed its forecast for 2025 to 1.1mn bpd, citing greater fuel efficiencies and more electric vehicles as a drag on oil use.

In early trading on Friday, Brent crude climbed above $90 a barrel while West Texas Intermediate rose towards $86.

European stocks rebound, following Wall Street higher

European stocks rose in early trading on Friday, following Wall Street higher and rebounding from a steep sell-off in the previous session.

The region-wide Stoxx Europe 600 was up 0.9 per cent shortly after the opening bell, pulled higher by gains for rate-sensitive real estate stocks and energy groups. France’s Cac 40 and Germany’s Dax both gained 1 per cent, while London’s FTSE 100 rose 0.8 per cent.

Contracts tracking Wall Street’s benchmark S&P 500 and the tech-heavy Nasdaq Composite were close to flat ahead of the New York trading session.

UK regulator warns lenders over motor finance probe

Financial regulators have warned UK lenders that they should be preparing to cover the costs of an increase in complaints linked to a regulatory probe into the potential mis-selling of car finance loans.

In a letter published on Friday, the Financial Conduct Authority told lenders it would monitor their financial resources and use “regulatory tools to intervene if we find your firm has not undertaken any assessment of adequacy of financial resources or may be at risk of not having adequate financial resources”.

“We have observed firms taking different approaches to account for the potential impact of [the probe] . . . so, we are writing to firms to remind them they must maintain adequate financial resources at all times,” the FCA added. The watchdog said it would update the market on the probe in September.

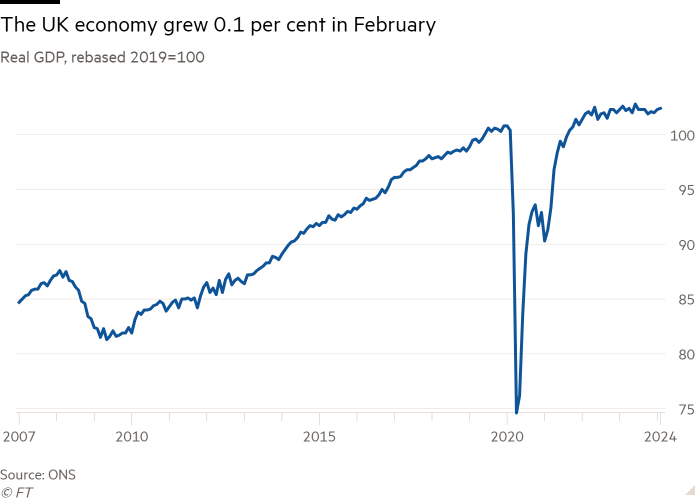

UK economy grew by 0.1% in February

The UK economy grew for the second month in a row in February, driven by expansion in the services sector.

Gross domestic product rose 0.1 per cent between January and February, the Office for National Statistics said on Friday.

This was in line with analysts’ expectations and down from January’s 0.3 per cent monthly growth.

Markets update: Asian equities sell off on reduced expectations for US rate cuts

Asian markets declined on Friday with the exception of Japan, as traders reacted to the increased likelihood of fewer interest rate cuts in the US.

Stock markets in India, China and South Korea all declined. Hong Kong’s benchmark Hang Seng index underperformed the region, falling 1.4 per cent. Insurer AIA led losses, shedding 4.6 per cent.

Currencies also fell, with the South Korean won sliding 0.48 per cent against the dollar to Won1373.51, its weakest level since November 2022.

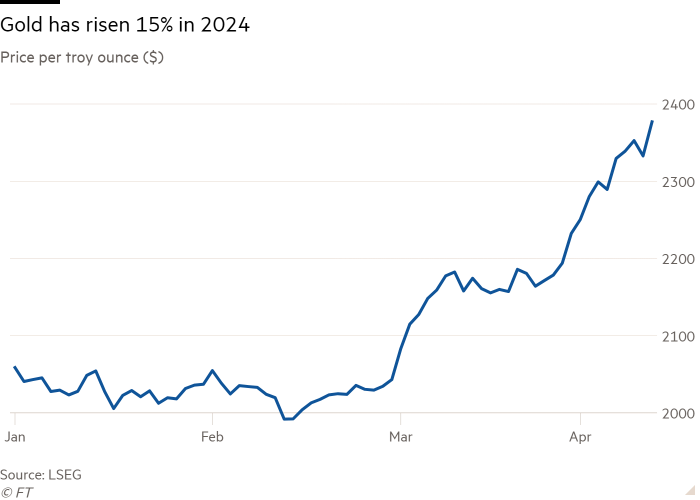

Gold continued rising to reach new all-time highs, adding 0.7 per cent to $2389.60 per troy ounce.

What to watch in Europe today

UK growth: The National Institute of Economic and Social Research publishes its latest estimate for the previous month’s gross domestic product. The NIESR forecast in March that GDP would grow by 0.3 per cent in the first quarter of 2024.

Swedish inflation: The Riksbank is predicted to report a March annual inflation reading of 2.6 per cent, according to analysts polled by the London Stock Exchange Group. The Swedish central bank’s inflation target is 2 per cent.

UK industrial output: Official data for February is expected to show that output increased 0.6 per cent year on year but remained flat on the previous month. Analysts polled by LSEG predict manufacturing will have risen 2.1 per cent in the 12 months to February, while construction output is expected to have dropped 1 per cent.

Singapore’s economy grows less than expected as manufacturing slows

Singapore’s economy grew 2.7 per cent year on year in the first quarter, missing forecasts despite a surge in tourism.

On a quarter-on-quarter basis the economy grew 0.1 per cent, according to early estimates from the Ministry of Trade and Industry. A Bloomberg poll had forecast the economy to grow 0.5 per cent quarter on quarter.

The services sector was lifted by a 50 per cent increase in the number of tourists, boosted by concerts from Taylor Swift and Coldplay. But growth in the manufacturing sector slowed to 0.8 per cent year on year, down from 1.4 per cent in the previous quarter.

On Friday the Monetary Authority of Singapore kept monetary policy unchanged due to lingering inflation concerns.

Markets update: Gold hits fresh high and Japanese equities track US upwards

Japan’s stock markets rose early on Friday, tracking US markets higher, while gold hit a new all-time high.

The country’s benchmark Topix rose 0.6 per cent in early trading, making it the best-performing stock market in Asia-Pacific. The real estate sector was the strongest performer, adding 4.2 per cent.

The yen continued to slide against the dollar, falling 0.15 per cent to ¥153.04 despite remarks from officials on Thursday suggesting the government was prepared to intervene.

Gold continued to rise, gaining 0.6 per cent to $2,387.85 per troy ounce, an all-time high. Stronger than forecast US inflation data has led to a rally in gold, which is considered a hedge against inflation and uncertainty.

What to watch in Asia today

Events: Singapore and South Korea’s central banks announce interest rate decisions.

Economic data: China releases trade figures for March. Singapore publishes first-quarter gross domestic product data.

Corporate results: India’s Tata Consultancy Services and China’s Bank of Beijing release results.

Gold’s latest record high takes 2024 gain past 15%

Gold’s latest record high has taken the metal’s 2024 gain past 15 per cent, building on its best start to a year since 2017.

The metal was up 1.7 per cent in late New York trading at $2,373.23 per troy ounce. Gold has notched up almost 20 record high closes since the start of the year.

Gold is up 6.3 per cent so far this month, building on an 8.2 per cent rise in the first quarter that marked its best start to a calendar year since 2017.

Gold’s rally has picked up since late last year, particularly since the start of the Israel-Hamas war and as inflation in big economies proves sticky.

US stocks climb in reversal from Wednesday sell-off

Wall Street stocks rose on Thursday, marking a sharp reversal from the previous session as shares in big tech companies led the march higher.

The benchmark S&P 500 gauge closed up 0.7 per cent, after a drop of almost 1 per cent on Wednesday triggered by a hotter than expected US inflation reading for March.

The Nasdaq Composite rose 1.7 per cent, more than reversing a 0.8 per cent decline a day earlier.

Large tech companies were among the biggest risers, with Amazon, Alphabet and Microsoft adding 1.7 per cent, 2 per cent and 1.1 per cent respectively. Apple and Nvidia both gained more than 4 per cent.

In government bond markets, the two-year Treasury yield slipped 0.02 percentage points lower to 4.95 per cent, following a heavy sell-off a day earlier.

Amazon shares close at record high from previous 2021 peak

Amazon shares closed at a record high on Thursday, extending a six-month rally that has lifted several of Wall Street’s biggest tech stocks and has helped the ecommerce group surpass its previous peak from July 2021.

Shares closed 1.7 per cent higher at $189.05, leaving them up almost one-quarter in 2024.

The company, with a market capitalisation of $1.96tn, is the fourth most valuable company on Wall Street behind other so-called Magnificent Seven groups Microsoft, Apple and Nvidia.

More US regulators join Morgan Stanley wealth management probe

Three more US regulators have opened investigations into how Morgan Stanley’s wealth management division handles potentially risky clients, according to a person familiar with the matter.

The business, which has been central to the bank’s growth in recent years, was already in the sights of the Federal Reserve over money laundering controls. Now the Securities and Exchange Commission, the Office of the Comptroller of the Currency and the Treasury are also involved, the person said.

Regulators are looking into the level of thoroughness of the investigations Morgan Stanley conducted around the source of clients’ wealth and their financial activity.

Read more here

Comments