B.C. introduces home-flipping tax as critics question effectiveness

The B.C. NDP government has introduced legislation that will tax home-flipping – starting next year.

But some critics are already questioning whether it will make much of a difference.

The tax is aimed at people who buy homes and sell them within two years.

Initially announced in February’s budget, the tax will impose a 20 per cent tax on profits of homes sold within a year of purchase. That slides to 10 per cent if sold after 18 months – and if an owner sells after two years, there’s no penalty.

“We don’t think families should have to compete against speculators when they’re making such an important decision,” B.C. Finance Minister Katrine Conroy said Wednesday. “So we’re making profiteers think twice about their flipping behaviour.”

The Condominium Homeowners Association of B.C. is welcoming the levy, arguing speculators have caused problems for long-term homeowners living in condos.

“Simply put, speculators are often more interested in profit and not necessarily what is in the best interest of the strata corporation,” Heidi Marshall with the association said. “The result is they often vote against needed repair and maintenance or an increase in strata fees.”

But some argue the policy won’t do much for affordability given the government only anticipates 4,000 flips in the first year the tax is in effect.

“It’s just a very small share of the market, especially right now, when things are a little slower,” B.C. Real Estate Association chief economist Brendon Ogmundson said Wednesday. “So I don’t expect we’re going to see much of an impact. There’s a not a lot of flipping activity happening right now.”

Concerns about the tax’s effectiveness are shared by the official Opposition.

“What people expect when they hear these types of taxes' titles is the end result to be delivered on what they’re talking about,” B.C. United finance critic Peter Milobar said. “In this case, it’s probably not going to deliver certainly any more housing units onto the market. It’s not going to do much to address affordability.”

But the government insists this is just one piece in a larger housing affordability strategy.

“Seven per cent of transactions in the last two years, on average, have been what we would call speculation and would be captured by the flipping tax, and that’s significant,” countered Housing Minister Ravi Kahlon when asked about the criticism. “Not one (individual) measure is going to address housing prices overall.”

There are exemptions to the tax including for divorce, death, illness and relocation for work.

CTVNews.ca Top Stories

Air Canada walks back new seat selection policy change after backlash

Air Canada has paused a new seat selection fee for travellers booked on the lowest fares just days after implementing it.

Province boots mayor and council in small northern Ont. town out of office

An ongoing municipal strike, court battles and revolt by half of council has prompted the province to oust the mayor and council in Black River-Matheson.

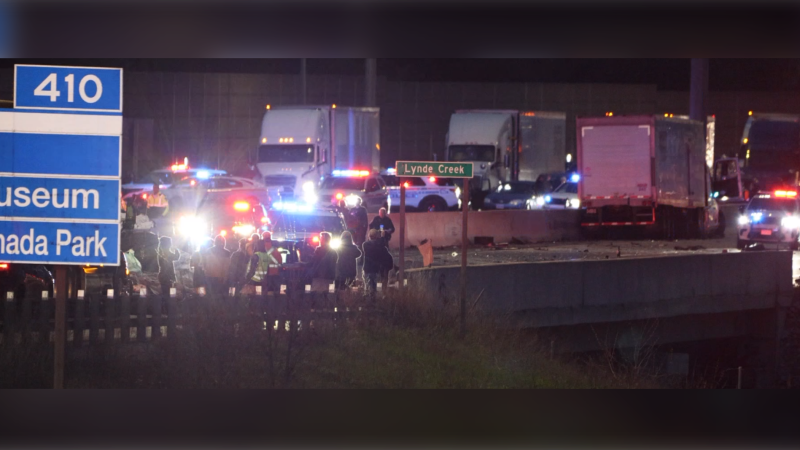

3 law officers serving warrant are killed, 5 wounded in shootout at North Carolina home, police say

Three officers on a U.S. Marshals Task Force serving a warrant for a felon wanted for possessing a firearm were killed and five other officers were wounded in a shootout Monday at a North Carolina home, police said.

'Shocked and concerned': Calgary principal charged with possession of child pornography

A Calgary elementary school principal has been charged with possession of child pornography, authorities announced Monday.

Health authority confirms cockroaches at B.C. hospital, insists they 'do not bite'

The Vancouver Island Health Authority is downplaying what staff describe as a cockroach infestation in a medical unit of Saanich Peninsula Hospital.

Toronto police arrest 12 people, lay 102 charges in major credit card fraud scheme

Toronto police say 12 people are facing a combined 102 charges in connection with an investigation into a major credit fraud scheme.

Winner of US$1.3 billion Powerball jackpot is an immigrant from Laos who has cancer

One of the winners of a historic US$1.3 billion Powerball jackpot last month is an immigrant from Laos who has had cancer for eight years and had his latest chemotherapy treatment last week.

Britney and Jamie Spears settlement avoids long, potentially ugly and revealing trial

Britney Spears and her father Jamie Spears will avoid what could have been a long, ugly and revealing trial with a settlement of the lingering issues in the court conservatorship that controlled her life and financial decisions for nearly 14 years.

WATCH 'Double whammy': What happens if you don't file your taxes by the deadline

The clock is ticking ahead of the deadline to file a 2023 income tax return. A personal finance expert explains why you should get them done -- even if you owe more than you can pay.