OppLoans Review 2024 – No Credit Check Required

Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. To read our full disclosure, click here.

What are OppLoans?

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

How does OppLoans work?

Criteria to apply for an OppLoan

- You need internet access because the only way to apply for a loan is on their website. You can’t apply by mail or phone.

- You need to receive your paychecks via direct deposit.

- Your bank account needs to have been open for at least 40 days.

- You need to be employed with a monthly gross income of at least $1,500.

- You need to reside in a state where OppLoans or its lending partners operate.

- You must be 18 (or 19 in Alabama and Nebraska).

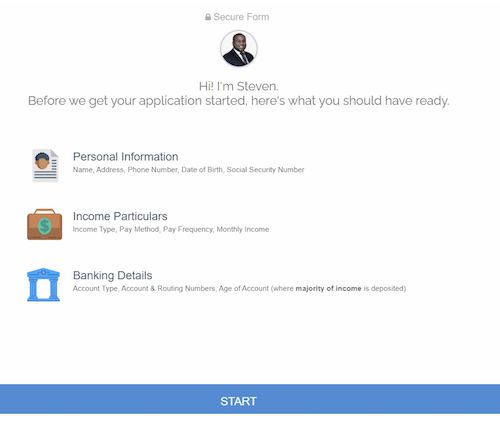

Things to prepare before applying for an OppLoan

Personal information

- Name

- Address

- Phone number

- Date of birth

- Social Security number

Income details

- Type of income

- Method of payment

- Frequency of payment

- Monthly income

Bank account information

- Account type

- Account number and routing number

- Age of account

Location | Phone number | Hours of operation |

Chicago | (800) 990-9130 | Monday to Friday: 7 am to 11:30 pm CST; Saturday and Sunday: 9 am to 5 pm CST |

Nevada | (618) 433-3475 | Monday to Friday: 7 am to 11:30 pm CST; Saturday and Sunday: 9 am to 5 pm CST |

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

How much does OppLoans cost?

Amount of Loan | APR | Duration | Monthly payment |

$2,000 | 160% | 9 months | $394.58 |

$3,000 | 160% | 12 months | $514.60 |

$4,000 | 160% | 18 months | $595.14 |

OppLoans features

No credit check

Apply online quickly

Loans are generally funded within three business days.

No prepayment penalty

No late fees

Financial literacy resources

Who are OppLoans best for?

- People with bad credit. Most lenders run a credit check before approving you for a loan, so if your credit is not optimal, a credit check not only disqualifies you from the loan but may also damage your credit score. With OppLoans, you don’t have to worry about either of these happening. You can get a loan if you live in a state where they offer loans and meet the requirements.

- People with no credit. Without any credit history, taking out personal loans is a challenge. Most lenders have a minimum credit score requirement. No credit is nothing to be ashamed of; everyone was there once. Maybe you just graduated and are alone for the first time. Perhaps you embraced a debt-free life and have never used credit cards. Maybe you’re new to America, and credit scores are just as foreign as pop culture.

Who shouldn’t use OppLoans?

- People who have a credit card. Let’s say you need new tires on your car, which will cost $500, and you only have $200 saved up for this expense. Pay $200 in cash or from your debit card, then charge the remaining $300 to your credit card. Even if it takes another month or two to pay it off, the interest rate on your credit card is in the 18% to 25% range. That’s a far smaller number than what you’d pay with an online loan. Plus, if you pay it off in a couple of months, the interest you’ll pay isn’t much.

- People who can get a loan from a family member. I’ll preface this by saying that it can be risky to mix finances with relationships. However, consider it if your sister offers to lend you $1,000 to pay your child’s hospital bill, with no interest requested. Even if she does ask for a modest amount of interest, it’s still likely to be less than a lender’s terms.

- People who need cash soon, but not for an emergency. When you know you’ll need cash, but it’s not quite an emergency, look for alternative ways to get money. Let’s say you need new glasses, which will cost $100. Try selling some clothes at a consignment shop or on Facebook. Sell unneeded hobby supplies (golf clubs, yarn, art supplies) on eBay. Offer your services cutting grass, babysitting, or doing household chores around your community to earn some cash.

Pros and cons

- There’s no credit check. This means there’s one less criterion to meet, and even if you aren’t approved, your application won't’ count against you.

- Successful repayment may boost your credit score. OppLoans reports most accounts to the three major credit bureaus. Successful and on-time payments of an installment loan will likely boost your FICO credit score.

- Loans are funded quickly. Most OppLoans loans are funded within one to three business days.

- Not available in all states. There are 16 states, plus Washington D.C., where OppLoans is unavailable. You can check availability on the rates and terms page of their website.

- These loans come with high-interest rates. Most payday loans and online lenders charge high-interest rates, which is no exception.

- You can only apply online. I’d expect this to be a minor disadvantage for anyone reading this since you are online and can easily access the online application. I feel there’s a significant portion of the unbanked community who aren’t online and thus unable to access these loan offers.

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

OppLoans vs. competitors

Provider | APR | Amount | Loan terms | Origination fee | Minimum credit score |

OppLoans | Up to 180% | $500 to $4,000 | Up to 18 months | $0 | None |

Upstart | 7.8% to 35.99% | $1,000 to $50,000 | 3 to 5 years | 0% to 10% | None |

Universal Credit | 11.69% to 35.99% | $1,000 to $50,000 | 3 or 5 years | 5.25% to 8.99% | 560 |

Upstart

Universal Credit

- If you're tight on cash right now, you may want to consider getting a personal loan. A personal loan is a loan that you can use for just about any purpose like: paying off other debt, renovating your home, or family needs like a wedding or adoption.

- TrustPilot Rating 4.6 out of 5

- Connect with lenders for $0

- 100% online experience.

FAQs

The bottom line

Joy Wallet is an independent publisher and comparison service, not an investment advisor, financial advisor, loan broker, insurance producer, or insurance broker. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. Joy Wallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. We encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Featured estimates are based on past market performance, and past performance is not a guarantee of future performance.

Our site doesn’t feature every company or financial product available on the market. We are compensated by our partners, which may influence which products we review and write about (and where those products appear on our site), but it in no way affects our recommendations or advice. Our editorials are grounded on independent research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

We value your privacy. We work with trusted partners to provide relevant advertising based on information about your use of Joy Wallet’s and third-party websites and applications. This includes, but is not limited to, sharing information about your web browsing activities with Meta (Facebook) and Google. All of the web browsing information that is shared is anonymized. To learn more, click on our Privacy Policy link.

Charlotte Edwards is an educator-turned-freelance writer based in Beijing, China. She writes personal finance and parenting content for both digital and print publications around the world.