The US job market is on fire.

- With 39 straight months of job growth, America is in the middle of its fifth-longest stretch of employment gains in history.

- The 303,000 jobs created last month were about a third higher than economists expected.

- The historically low 3.8% unemployment rate continues America's longest stretch of a sub-4% jobless rate in more than five decades.

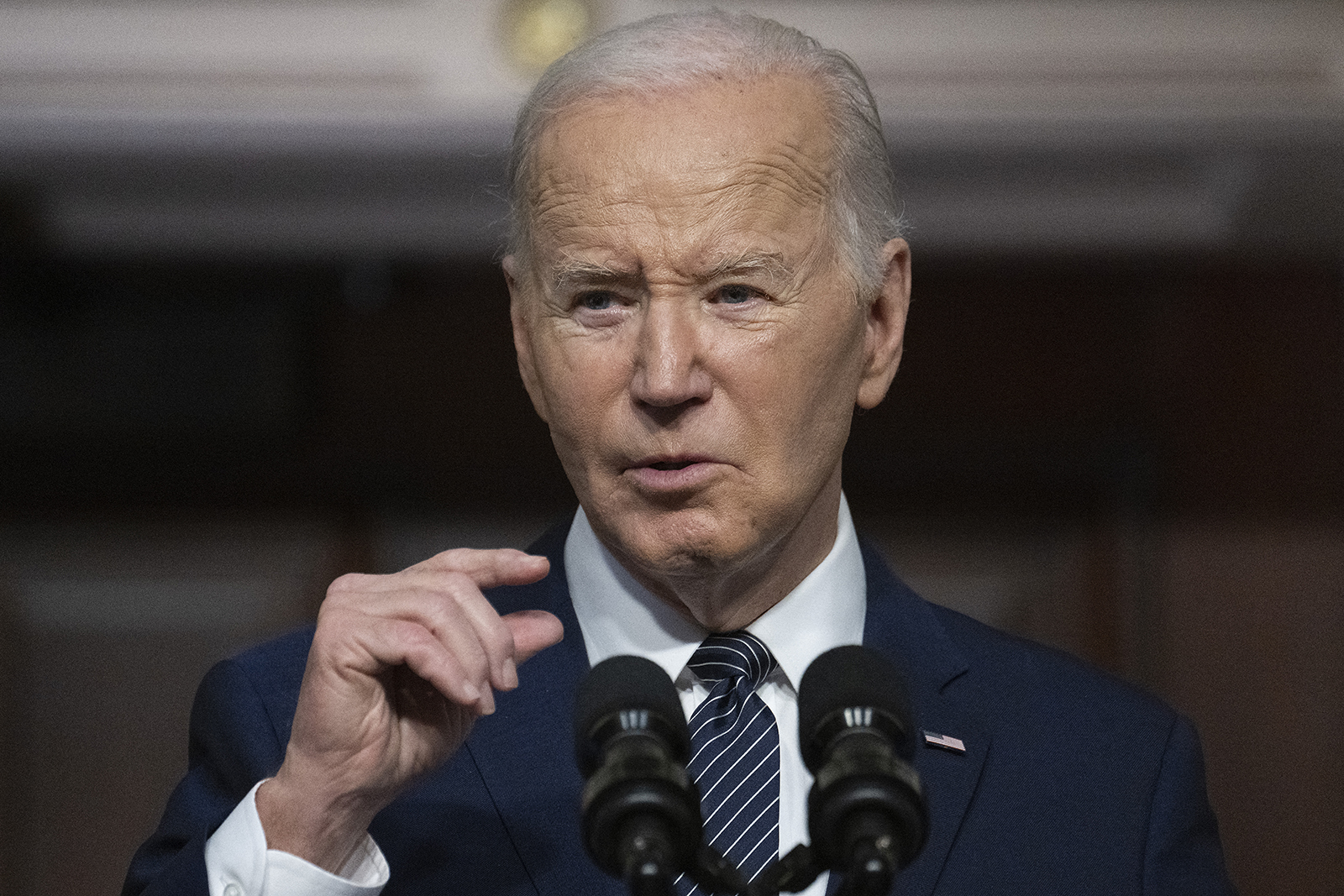

And yet... Americans continue to pooh-pooh the economy. In a February CNN poll, nearly half of people surveyed said they believe the economy remains in a recession. This past week, a Wall Street Journal poll showed Americans' approval rating of the US economy was underwater by a stunning 31 percentage points. That's a big risk to President Joe Biden's reelection campaign.

The reason: stubborn inflation. Although price hikes have subsided dramatically over the past year, costs still sting. Gas prices, emblazoned on signs all around towns and cities and highways, are on the rise again, with a national average marching toward $3.60, the highest in six months. Grocery prices have remained frustratingly high, and dining out still far outpaces overall inflation, even as the surge in overall food inflation has subsided.

In the Journal's poll, 74% of respondents said inflation progress was headed in the wrong direction over the past year.

That's not a problem that the Fed can easily solve. Historically high interest rates have punished the economy, sending mortgage rates near 7% and practically freezing the housing market. Inflation has come down to near-normal levels from a four-decade high.

But Americans keep spending and employers keep hiring, and costs are not going to come down, even as inflation — the pace of price increases — slows. So, every time folks go shopping and see the alarmingly big receipt, they'll get a reminder of frustrating inflation, souring their view of what's a remarkably strong US economy.