5 Ways to Short Bitcoin in 2024 – Complete Guide

If you think the current price of Bitcoin is a bit optimistic or the market is due for a correction, you can consider shorting crypto markets like Bitcoin. In traditional markets, shorting an asset (betting on a downturn) can be more difficult depending on your location. However, in crypto trading, you have some additional options. In this guide, we’ll discuss how to short Bitcoin and the reasons why short-selling Bitcoin can be a useful trading strategy.

In late 2021, Bitcoin reached its previous all-time high of just over $69,000. By early 2023, the crypto market’s leading asset had crashed as low as $15,500. Betting long on Bitcoin meant a long-term waiting game, while well-timed short sellers made money all the way down. Investing in Bitcoin is easy; let’s explore the various ways to play the other side of the market.

What is Bitcoin Short Selling?

Short selling refers to an advanced trading strategy that bets on a downturn in market prices. When short-selling stocks, for example, you would borrow shares to sell and then buy back the shares to cover and close out your short position. In other words, you make money from selling high and buying low, assuming your trade works according to plan.

Crypto markets offer some additional ways to short the market, which we’ll cover in a bit. But regardless of which method you choose, the strategy still centers on profiting from a market downturn. This strategy can be useful toward two key goals: profit from downtrends and hedging.

The first reason to short Bitcoin is straightforward: you can profit from market downturns. If the market price is at $70,000 and your charts indicate that BTC should revisit support at $55,000, you could earn $15,000 in profit on a 1 BTC position. Leverage (borrowing) can increase this return, but it also comes with its own risks, which we’ll cover in more detail later.

Hedging allows you to play both sides of the market, potentially offsetting losses if the market goes against your other open trades. For example, you might have a long position in Bitcoin and use leveraged futures to make a short bet in the event the market turns downward. Hedging acts like insurance in this respect. However, once you have a safe profit level, you may not need to hedge your position.

How Does Bitcoin Shorting Work?

Although there are several ways to short Bitcoin or profit from downturns, let’s discuss how the traditional method works in five basic steps.

- Predict a drop in Bitcoin’s price: Several indicators can point to a possible drop in price. In an earlier chart, the Moving Average Convergence Divergence indicator suggested a drop in price before the downward slide gained momentum. You can use other indicators to bolster or disprove your thesis.

- Borrow Bitcoin: Once you’re convinced that Bitcoin will see a downturn, the next step is to borrow Bitcoin for the short trade. You might want to hold your long positions, or you might not have an open Bitcoin position. To sell short, you’ll need to borrow Bitcoin. Note: To borrow Bitcoin, you’ll need to provide collateral.

- Short-sell Bitcoin at the current market price: Use a market or limit order to place a sell order for Bitcoin. On platforms that support this traditional short-selling method, borrowing and selling may be combined.

- Repurchase BTC at a lower cost: You can watch the price action to choose your repurchase cost with a manual order. Alternatively, you can set a limit order to automatically close your position using triggers to lock in profits or reduce losses if the market turns against your trade.

- Pocket the difference as profit: When you close your position, you earn the difference in price from the level at which you opened the short trade to the point where you close out your trade. For example, if you short 1 BTC at $70,000 and BTC falls to $60,000, you earn $10,000 on the trade, less fees.

How to Short Bitcoin: 5 Different Methods

While crypto markets offer more ways to short Bitcoin and other crypto assets, the methods available to you can vary based on your location and local regulations. We cover five different ways you can short crypto below. However, some may not be readily available in all regions of the world.

In the US, for example, you’ll have fewer options due to regulatory restrictions. Decentralized trading platforms offer one option, as do inverse ETFs, which provide an easy way to enter and exit a short position. Other options readily available in many markets include Contracts for Difference (CFDs) or options trading.

1) Margin Trading

With margin trading, you borrow Bitcoin to sell using other assets as collateral. This collateral provides a “margin” of error, meaning your collateral will cover losses if the market turns against your trade. Using lower amounts of leverage can help reduce risk to your collateral, although lower leverage also limits your profit opportunity.

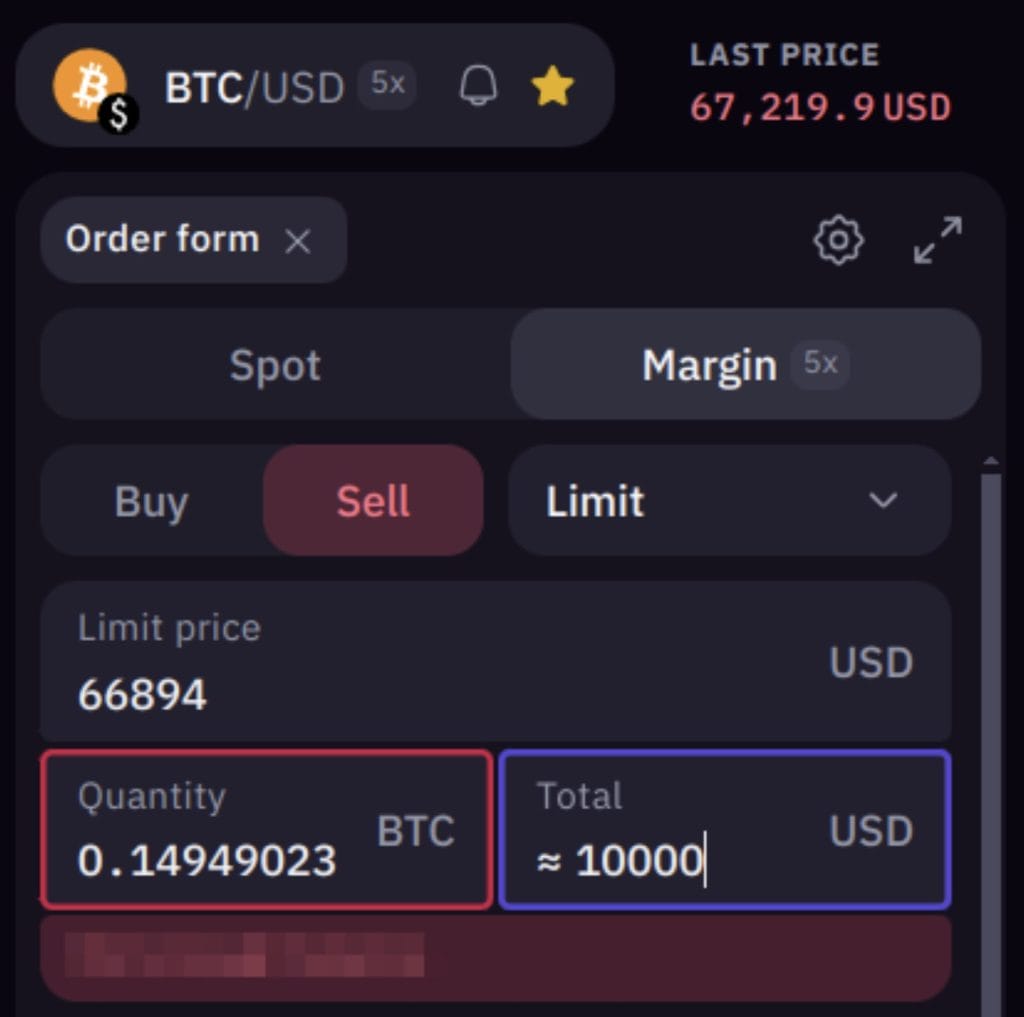

For example, Kraken offers margin trading for qualified accounts with 5x leverage on the Kraken Pro advanced trading platform. This leverage limit is conservative compared to many other platforms, but the lower leverage can be much safer in fast-moving markets like Bitcoin. If the trade loses money, your collateral could be liquidated to close out the trade and recoup the value of the borrowed BTC.

On Kraken, you can choose an entry point for your short position using a limit or market order. You also have the option to close your position automatically using price triggers. The platform also supports iceberg orders that let you scale into larger positions discreetly without advertising the size of your order.

2) Short Bitcoin ETFs

ETFs make it possible to short Bitcoin without risking more than you invest in the trade and without risking other collateral. If you put $100 into a short Bitcoin ETF, for instance, $100 is your maximum exposure. Short ETFs, also called inverse ETFs, take the other side of a trade automatically without a need to borrow. Instead, the price of the ETF reflects the profit or loss.

If you have a trading account with a stock brokerage, you can enter or exit an inverse ETF position with a few clicks. However, beware of settlement rules for your jurisdiction. In the US, a recent rule change lets you use funds from a closed trade one day after the transaction.

The ProShares Short Bitcoin Strategy ETF provides a simple way to short Bitcoin without putting margin assets at risk.

In the example above, the ETF shows a gain approaching 4% on a down day for the Bitcoin market.

As an alternative for crypto natives, some platforms offer leveraged tokens to short crypto. Binance recently discontinued its leveraged tokens, but you can still find similar tools on other platforms outside the US.

For example, MEXC offers BTC3S, a 3x leveraged BTC short ETF token specific to the MEXC exchange. In the case of the MEXC leveraged tokens, the token undergoes rebalancing to maintain a 50/50 value in the trading pair while keeping 3x leverage. In plain English, if the trade goes against you, your equity in the token drops. Profitable trades earn three times the profit compared to non-leveraged trades, less fees.

3) Bitcoin Futures

Futures trading offers yet another way to short Bitcoin by betting on the future price. Traditional futures have an expiration date and allow you to buy or sell contracts for Bitcoin. However, the contracts settle in various currencies.

CME Group Bitcoin futures contracts, for example, settle in USD. Trading traditional futures also requires approval from the trading provider to trade derivatives. For this reason, many choose to trade futures on crypto exchanges, and perpetual exchanges, in particular, have become very popular.

Perpetual exchanges let you short Bitcoin without borrowing Bitcoin and don’t have expiration dates. Instead, you purchase the perpetual contract (long or short) and earn a profit based on the price difference if the trade goes your way.

Coinbase now offers perpetual futures to non-US customers, allowing you to take a short or long position using other assets as collateral. Binance, Bybit, and MEXC are also popular options for perpetual futures trades.

As another alternative, decentralized platforms like GMX and dYdX let you trade perpetual futures using smart contracts from anywhere in the world, although the terms of service may restrict certain jurisdictions. With decentralized exchanges, you’re trading from your crypto wallet rather than trading with USD on a centralized exchange.

4) Bitcoin Options

Options do what they say on the tin: offer the option to buy or sell at a certain price. For example, a $70,000 put option for BTC allows you to sell BTC for $70,000 even if the price falls to $60,000. If the price rockets to $80,000 instead, your loss is limited to the cost of the option, not the $10,000 price difference. You don’t have to exercise the option.

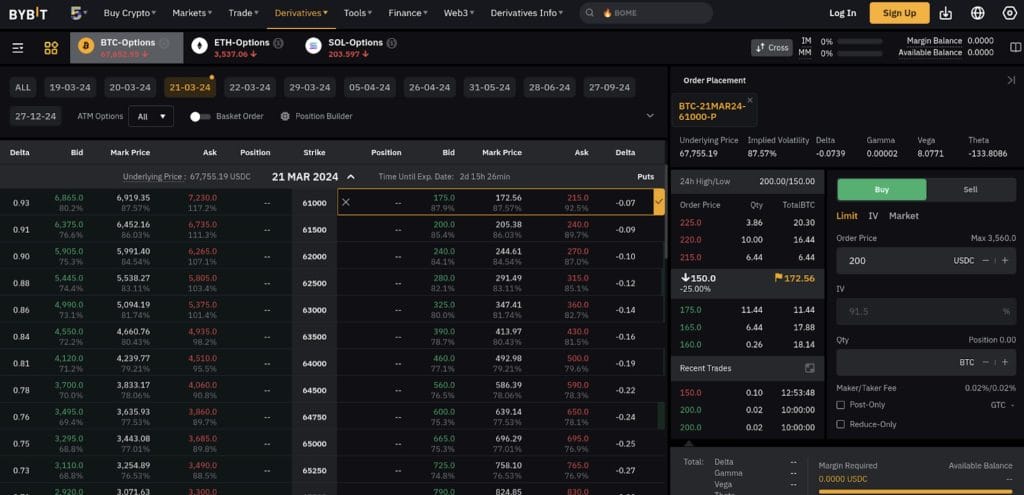

Options trading through traditional brokerages requires approval by the provider, so many crypto options traders use crypto exchanges like OKX, Binance, or Bybit.

Options trading also introduces a new series of terms.

- Call options: the option to buy at a set price

- Put options: the option to sell at a set price

- Strike price: The price at which you can exercise the option

- Expiration date: the date on which your contract becomes void.

However, European options (used by Bybit, for example) treat the expiration date differently. The expiration date instead reflects the date on which you can exercise your right to buy or sell at the set price.

You can also sell your options before expiration. However, as the expiration date draws closer and the price direction becomes clearer, it’s possible your options will be worth less than when you purchased them, or that you may not find a buyer at all.

5) Bitcoin CFDs

While one of the easier ways to short Bitcoin, CFDs (Contracts for Difference) are one of the more controversial ways to trade. Instead of taking a position on the actual asset, you’re just betting on the price, earning the difference in price if the trade goes your way. When the trade closes, no Bitcoin changes hands. Trades settle in traditional currencies.

The availability of CFDs depends on your location. For example, eToro supports short selling through CFDs. However, this type of trade isn’t supported in all markets, with the US being one example.

While CFDs don’t confer ownership of the asset at the end of a long trade, they offer a viable option for short-selling assets like Bitcoin. Most CFD brokers also offer leverage, which lets you amplify your gains from your short trade. As a caveat, the European Securities and Markets Authority (ESMA) advises that up to 89% of retail traders lose money on CFDs, suggesting that leverage plays a role in these frequent losses.

eToro, one of the leading online brokerages, offers CFDs with or without leverage. The platform also provides a $100,000 demo account that lets you practice trading without risking real money.

Is it Worth Shorting Bitcoin? Pros and Cons

Volatile assets like Bitcoin offer opportunities to make money on either side of the trade. Even during extended uptrends, double-digit percentage declines are common, providing active traders with more trading opportunities. Short-selling techniques can also be used to hedge an existing position to reduce market risk.

However, short selling brings some risks of its own, including leverage-related losses and market-timing mishaps. While shorting brings the opportunity to make money on the way down, the market can turn on a dime, piling up losses on trades plagued with unfortunate timing. Short selling is best left to experienced traders who can afford the potential loss.

Advantages of Shorting Bitcoin

As of this writing, Bitcoin is in a downtrend, having fallen from over $73,000 to just above $67,000. A well-timed short trade would have captured more than 8% in gains without leverage while the rest of the market rode the price down. Short-selling Bitcoin provides several potential advantages.

- Profit from Price Declines: When short-selling, you profit from the difference between the selling price and the lower price of the asset when you close the position.

- Portfolio Diversification: Similar to how you might mix assets in your portfolio to diversify your holdings, you can also diversify your portfolio by mixing market sentiments. Perhaps you’re bullish on tech stocks but bearish on crypto. Shorting Bitcoin can help you diversify your portfolio to reflect both investment expectations.

- Opportunities for Active Traders: Active traders with reliable indicators can make money on either side of the trade by trading long or short, depending on market conditions.

Risks of Shorting Bitcoin

Shorting Bitcoin or other cryptocurrencies comes with some risks as well. Generally, risks center on leverage trading, but market timing can be a risk as well.

- Unlimited Losses: With some types of short trades, it’s technically possible to lose more than you invest in the trade. Whatever you’re shorting can have unlimited upside if the price continues north, but the downside for long trades is limited to your investment amount. The asset value can’t go below zero. However, most types of short trades limit your risk to the margin you offer as collateral, closing the trade once the value of your trade falls to a certain threshold.

- Margin Calls and Liquidation: Short trades with borrowed funds can be subject to margin calls, which are requests to increase your collateral. In practice, no one will call you, although you might get an email if you’re using a centralized platform. When the trade reaches a certain low-margin threshold, your collateral will be liquidated to close the trade.

- Timing Risk: Market news or even just mixed signals can cause Bitcoin to move in an unexpected direction. Shorting may bring more risk in this situation compared to holding Bitcoin through temporary market volatility.

What Trading Strategies Is Bitcoin Shorting Used For?

The simplest strategy for short-selling Bitcoin is a one-sided trade. However, various short-selling methods can be used in more sophisticated strategies and can help investors protect themselves. For instance, you can pair short positions with long positions in the same asset or different assets. Let’s explore some of the strategies traders can use.

Long/Short Trading Strategies

Bitcoin’s price movements often move the broad crypto market. However, crypto markets don’t always move in lockstep. If you think the BTC market is losing steam and may turn but also see an uptrend for key altcoins, you can use a long-short strategy to profit from both sides.

In this scenario, you might short BTC while going long on SOL or whichever asset you think is due for an upswing. Traditionally, some capital invested in BTC rotates to altcoins following a big BTC runup.

Portfolio Hedging

Shorting Bitcoin or another crypto can also help you hedge your portfolio to protect against downside risk. For example, if Bitcoin falls by $10,00, you lose that entire amount (on paper) without hedging. However, if you take a smaller short position, you can reduce the downside risk.

Put options are a popular way to accomplish this strategy, but you can also use futures, CBDs, or margin trades. However, hedging through short-selling strategies can also slow overall gains in an upward-trending market.

Portfolio Hedging

Shorting Bitcoin or another crypto can also help you hedge your portfolio to protect against downside risk. For example, if Bitcoin falls by $10,00, you lose that entire amount (on paper) without hedging. However, if you take a smaller short position, you can reduce the downside risk.

Put options are a popular way to accomplish this strategy, but you can also use futures, CBDs, or margin trades. However, hedging through short-selling strategies can also slow overall gains in an upward-trending market.

When Should You Consider Shorting Bitcoin?

Short-selling often comes with greater risk compared to buying long, so it’s essential to choose your opportunities wisely. Several market conditions could suggest an opportunity to profit from shorting Bitcoin, but consider the big picture and do your research before opening a trade.

Possible trading opportunities can come from overbought conditions, bearing chart patterns, stubborn resistance that suggests a fall in prices, or even market news that could create selling pressure.

Overbought Conditions

Market exuberance can lead to overbought conditions, suggesting that the asset price may be ready for a correction. Two commonly used indicators to investigate overbought (or oversold) conditions are RSI (relative strength indicator) and stochastics. In the chart below, there were signs before the pullback in BTC price. However, it’s best to utilize additional indicators to confirm or disprove price movement theories.

Bearish Chart Patterns

From candlestick patterns to oscillators like MACD, chart patterns, and indicators often tell a price story before it unfolds. In the example below, the MACD signals a pullback, although it is always safer to seek confirmation with additional trading indicators or the candle stick chart patterns themselves.

Strong Price Resistance

Bitcoin’s previous all-time high was about $70,000 before falling to $15,500 over the course of several months. While Bitcoin has recovered and even set new all-time highs since that crash, resistance at the previous all-time highs is proving difficult to break through convincingly. If you expect a larger pullback before BTC makes another try for new all-time highs, you might consider shorting at resistance.

Negative News or Events

News and events can lead to a change in market sentiment or even dramatic dips as leveraged positions are liquidated by sudden price moves. There may be an opportunity to capitalize on bad news through short selling.

For example, Bitcoin’s months-long crash to $15,500 followed a number of events in the crypto industry, including the collapse of the Celsius Network, Genesis, BlockFi, and FTX. Short sellers found a profit opportunity.

How to Short Bitcoin on Kraken: Step-by-Step

To illustrate how to short Bitcoin, we can use the Kraken exchange. Kraken offers margin trading to qualified investors, which requires an attestation. If you choose to use another platform, the steps are similar.

Step 1: Open an account and verify your account information.

Visit Kraken to open an account. You’ll need to provide basic information such as your name and address. Kraken also performs KYC, a government-mandated identity verification. Follow the instructions to upload a copy of an accepted ID, such as a driver’s license or passport.

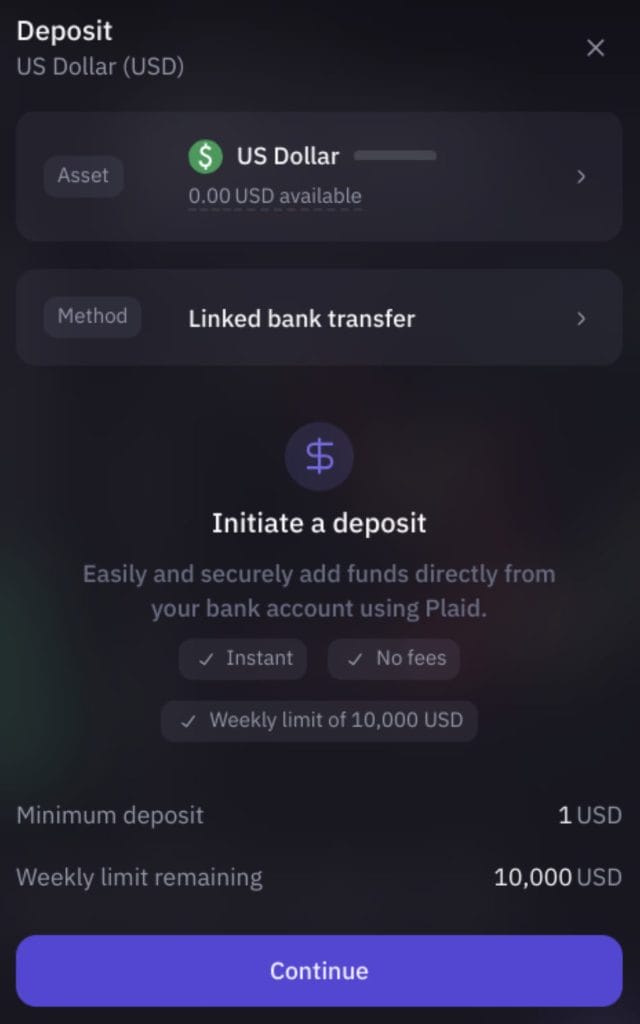

Step 2: Fund your account.

Kraken supports direct bank transfers in many countries, which is often the most affordable way to fund your account. Allow a few days for your funds to clear.

Step 3: Switch to Kraken Pro and Locate BTC

Kraken Pro provides advanced trading and lower fees. New accounts will see an invitation to apply for margin trading. Complete the attestation.

Next, look for the BTC/USD trading pair. Optionally, you can add indicators to the chart to help guide your trade timing.

Step 4: Choose Margin Sell and Set Your Trade

On the top left, you’ll find the trade details. In this case, you’ll want to choose margin and sell. You may also want to set a limit order to fine-tune your trade by setting an exact price. Market orders, the other alternative, come with higher fees and don’t allow you to set your price.

Enter your trade amount in BTC or USD. With 5x leverage, you’ll use your deposited funds as collateral for the short trade. This allows you to trade a larger position and amplifies your gains. On the other hand, it puts your collateral at risk and amplifies your losses as well.

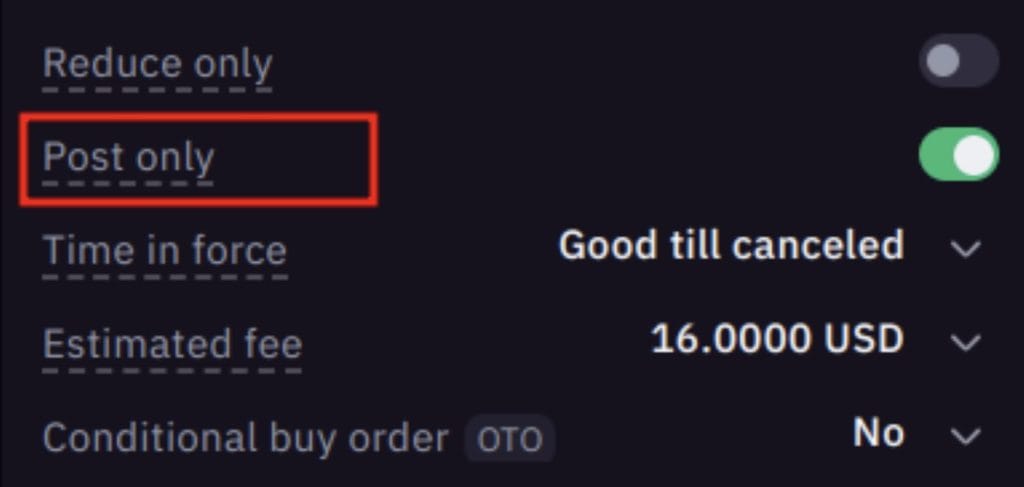

Check the other trade settings below the trade size. By default, the “Post only” setting is toggled off. If the trade is executed as a market order, this could result in higher fees.

Step 5: Complete and Manage Your Trade

If your order looks correct, complete the order. Open orders will be shown below the price chart, with an option to close your position or add additional orders to close your position when BTC reaches a price you define. For example, Kraken lets you set stop-loss limits for your order, trailing stops, and take profit orders. These options allow you to make your trade without watching the screen.

Conclusion

Shorting Bitcoin lets you take the other side of the trade to make a profit during market downturns. Other common uses for short trades are as a hedge against unexpected market moves or as a way to diversify your holdings.

While shorting Bitcoin or other assets can be profitable, many of the ways to profit from these trades bring risks of their own, often related to leverage or unfortunate timing. Remember, short selling is an advanced trading strategy and should be used with caution. Consider using a platform that offers a demo account to practice against real-world prices before making trades with real funds.

FAQs

Can you short Bitcoin?

Yes. Options for shorting Bitcoin include exchanges that support margin trades, perpetual futures exchanges, options trading, inverse ETFs, and CFDs. However, not all of these options are available in all regions of the world.

Is shorting crypto risky?

Yes. Shorting crypto comes with two primary risks, both of which stem from the crypto market’s volatility. Leveraged trades can lead to a loss of collateral, and imperfect trade timing can find you on the wrong side of the market.

Is there a Bitcoin short ETF?

Yes. The ProShares Short Bitcoin Strategy ETF offers an easy way to take a short position on Bitcoin without risking collateral or needing to apply for margin or derivatives approval with a broker. The price of this inverse ETF reflects the change in Bitcoin’s price, with falling prices adding profit to your position.

What is the best way to short Bitcoin?

For less experienced traders, an inverse ETF like The ProShares Short Bitcoin Strategy ETF offers the easiest way to profit from a market downturn. However, more experienced traders can earn greater returns with perpetual futures trades that allow leverage and provide more control over your trade.

References

- Securities Operations: Shortening the Standard Settlement Cycle (occ.gov)

- Introducing Perpetual Futures (coinbase.com)

- Notice of ESMA’s Product Intervention Renewal Decision in relation to contracts for differences (esma.europa.eu)

- Celsius Network, Inc., et al., FTC v. (ftc.gov)

- BITCOIN FUTURES – CONTRACT SPECS (cmegroup.com)

Kane Pepi

Kane Pepi

Elliott Lee

Elliott Lee