BIMCO — a trade group representing shipowners — states that capacity has been overtaxed by the Red Sea crisis, which has forced shipping lines to take a longer route around Africa's Cape of Good Hope. Prior to the emergence of this latest choke point, BIMCO points to the impact of Western sanctions on Russian oil and coal, which similarly stressed tanker and bulker fleets, as well as the sudden surge of consumer demand for imported goods during the pandemic, which threw a wrench into the operations of container ships.

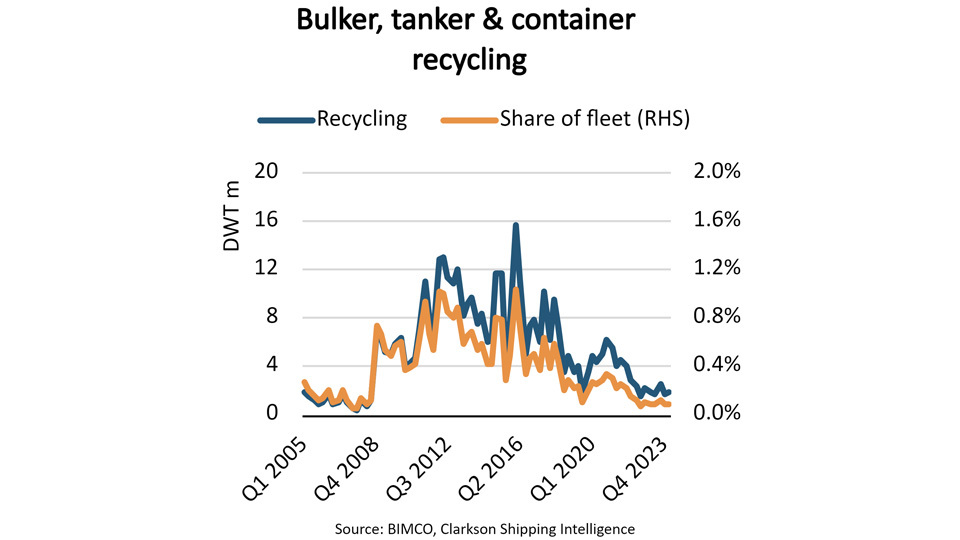

This rapid succession of upheavals has led shipowners, BIMCO argues, to delay the recycling of their oldest vessels, especially as they await the delivery of newbuilds. "During the first quarter of 2024" the report states, "only two million deadweight tonnes (DWT) ship capacity were recycled" the ninth consecutive quarter in which recycled capacity was below 3 million DWT.

BIMCO also notes that the last time recycling activity was this low over an extended period was in the run-up to the 2008 financial crisis. But since fleets are far larger now than they were then, the relative dearth of recycling has had an outsize effect.

Global capacity proves shock-absorbent

Despite the geopolitical stress points that the report cites as having a dramatic effect on ship capacity, the market reality is that shipping companies have had more than enough capacity to spare throughout the recent disruptions.

Even back in January, a month in which many of the largest shipping companies exited the region, industry analysts were already downplaying the Red Sea crisis.

"The market globally is so heavily oversupplied that it has ample cover for disruptions such as this" said Simon Heaney, senior manager of container research at Drewry. "Yes, more ships are needed to maintain weekly service. But there is ample spare capacity from the idle fleet, from the newbuilds that are coming in thick and fast, and from existing tonnage in other oversupplied trades that can be transferred across."

With the benefit of hindsight, we can see that the impact of the Houthi attacks on global container rates was brief and limited.

SONAR: Freightos Baltic Daily Index, global composite (blue) and Drewry World Container Index, global composite (teal)

In fact, some analysts argue that the initial jolt to rates was largely aided by expected seasonal pressures, such as China's celebration of Lunar New Year. That an escalation in Houthi attacks happened to coincide with such annual disturbances created a perfect storm for shipping rates to see short-term gains, but does not provide evidence that container lines kept aging fleets in service primarily because of recent geopolitical unrest.

"The initial shock was due to ships being in the wrong place or out of schedule" said Philip Damas, head of Drewry's Supply Chain Advisors. "But the second point is that the timing was really unfortunate. Ship capacity was tight because many companies were trying to import from China before the Chinese New Year closure. This timing made the bottleneck worse. There was frankly a bit of a panic in China, with everybody trying to get their containers out, and with a shortage of box equipment for exports."

Slowly, then all at once

Demand for ship recycling — much like demand for aircraft — is somewhat irregular, seeing gains not on a quarterly or annual basis but once every five to 10 years. When demand does spike, however, it spikes significantly.

Take 2009, the year that followed the recycling industry's previous lull, according to BIMCO. In 2009 alone, more than 200 vessels totaling over 370,000 twenty-foot equivalent units were scrapped. In other words, a decade's worth of capacity was recycled in a single year.

There are numerous reasons to believe that ship recycling will see a similar surge in the not-so-distant future. BIMCO itself believes that the amount of capacity recycled between 2023 and 2033 will be double that of the decade prior.

In January 2024, the European Union began to enforce its new carbon tax system on all large ships docking at EU ports. Similarly, the International Maritime Organization has issued requirements for ships to calculate their carbon emissions and energy efficiency ratings, with the stated goal of reducing carbon intensity of all ships by 40% come 2030.

Simply put, shipping companies know that their fleets need to be modernized and more fuel-efficient, which explains why they have gone on a spending spree with much of their profits from the COVID-era boom.

In October 2023, maritime consultancy firm Clarksons reported that there were 902 newbuild container ships on order — not only an all-time high but also equivalent to 25% of companies' extant fleets.

Once these new vessels are integrated into the fleets, ship recycling should pick up steam until it reaches a boiling point, at which time a year's activity will likely equal that of an entire decade.

The post Demand shocks keeping aging fleet afloat, argue shipowners appeared first on FreightWaves.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.