Kenyan Man Laments Having Zero M-Shwari Limit after Clearing Loan 5 Years Ago

- Kenyan man raised concerns over KSh 0 loan limit he has been receiving from Safaricom M-Shwari and KCB M-Pesa loan facilities

- The man lamented that for the last five year since he repaid his last loan balance, the company is yet to allocate another limit

- Speaking to TUKO.co.ke, Safaricom explained that one needs to save regularly without withdrawing for a long time to grow the limit

TUKO.co.ke journalist Wycliffe Musalia brings over five years of experience in financial, business, and technology reporting, offering deep insights into Kenyan and global economic trends.

Safaricom customer has raised concerns over zero (0) M-Shawari and KCB-M-Pesa loan limit.

Source: Twitter

The man said he cleared his last loan balance five years ago but is yet to be allocated another limit.

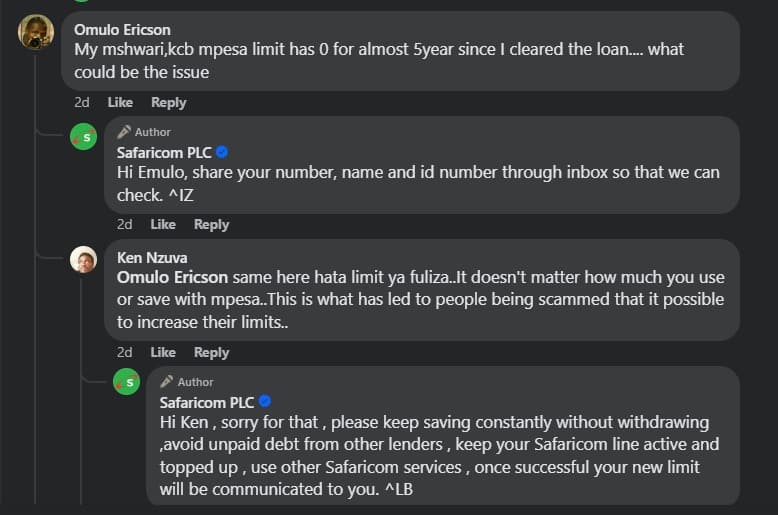

"My M-Shwari, KCB M-Pesa limit has zero (0) for almost five years since I cleared the loan... what could be the issue?" Omulo Ericson posed the question in the Safaricom Facebook post comment section.

Source: UGC

Why is your M-Shwari loan limit zero?

Speaking to TUKO.co.ke Safaricom explained that the customer could have defaulted on his previous loans to get a zero limit.

The company revealed it has set a loan limit reinstatement promotion for select defaulters once they clear their loans.

"For your limit to be reduced to 0, it means you had defaulted your previous loan for more than 90 days. This is an ongoing promotion of the current defaulters, and text messages were sent out to the ones eligible for the loan limit reinstatement once they fully settled their loan. If we note your account is OK, you get a new loan limit," said Safaricom Customer Care.

How to grow M-Shwari, KCB M-Pesa loan limit

The customer care desk added that to grow your M-Shwari and KCB M-Pesa loan limit, one needs to improve his usage of the services and credit score by paying any loan promptly, including Okoa Jahazi.

Read also

Data Scientist Shares Frustrations Over KSh 173k Tax Deductions: "More Than Someone's Salary"

It also recommended long-term savings on M-Shwari and KCB M-Pesa without withdrawals.

"However, M-Shwari is a social collateral service that allocates loan limits at the bank's discretion. Kindly improve on your line usage, repay any loans on time, including Okoa Jahazi, and ensure you have done long-term savings with no withdrawals of the funds saved. This way, you will have a positive review of the loan limit," Safaricom care urged customers.

How long does it take to restore Fuliza limit?

In related news, TUKO.co.ke reported that Kenyans turned to short-term loans to meet pressing needs such as food as the cost of living continued to rise.

The majority used Fuliza M-Pesa, an overdraft loan facility offered by Safaricom PLC and mostly used to complete transactions in case of limited funds.

However, those unable to access the loan raised concerns over the time they have spent with Safaricom lines without being allocated the limit.

Source: TUKO.co.ke