Joe Biden’s new student loan relief, explained

The current administration’s new proposal would benefit about 30 million people. But who will have their debt forgiven?

President Joe Biden has unveiled a plan to relieve student debt. More than 43 million people in the country owe about $1.77 billion, and many of them have found themselves in financial trouble because they can’t pay the installments, which can increase over time due to interest. More than 25 million students must pay back more than they borrowed.

The Biden administration has taken some steps to alleviate the debt, such as canceling debt for thousands of borrowers, in addition to its Saving on a Valuable Education (SAVE) plan, which cut some borrowers’ monthly payments in half and eliminated the monthly bill for others.

What is different with this new plan is that Biden and his administration seek to ensure that it will hold up in the face of any legal roadblocks. To this end, he has established specific groups of beneficiaries, focusing on those who have financial difficulties in paying their debts.

When will it begin?

No date has yet been set for the start of this new program. However, the Biden administration has mentioned that it expects it to be implemented before the November elections, which could help attract more votes for the president to be reelected for a second term.

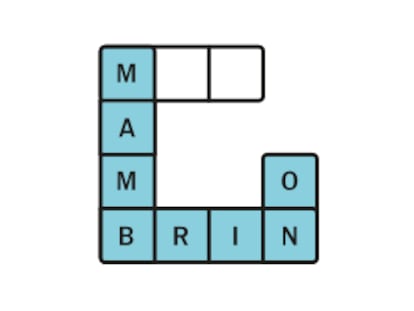

Who will benefit?

This new plan would reduce payments for 25 million borrowers, and eliminate the debt of more than four million. Under the plan, 10 million borrowers would see relief of $5,000 or more.

Those whose loan balances have ballooned due to interest would have up to $20,000 of their interest balance written off.

Debtors considered “low- and middle-income” who are enrolled in income-driven repayment plans would have their entire interest balance wiped out. According to administration estimates, 23 million borrowers would have their interest balance forgiven.

Those who meet the requirements for loan forgiveness, but have not yet applied for it under programs such as the Public Service Loan Forgiveness or SAVE program, will have their debts cancelled.

Also, debts will be cancelled for undergraduate students who began repaying their loans more than 20 years ago, and graduate students who began repaying their loans 25 years ago or more.

Similarly, people who enrolled in programs or colleges that lost federal funding due to deception or fraud will have their debt forgiven, while those who attended institutions that left them with a large debt but few job opportunities will be eligible.

Finally, borrowers who have trouble repaying their loans for medical or child care expenses would also benefit. However, it has not been specified how these beneficiaries will be chosen.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition