Closing post

With City traders reeling from a bad day, it’s time to wrap up.

Here are today’s main stories:

IMF scenario shows how a 15% jump in oil prices would push up global inflation by 0.7 percentage points

With City traders reeling from a bad day, it’s time to wrap up.

Here are today’s main stories:

Thames Water is preparing to tap debt markets within weeks in an attempt to fund a rescue plan and repair its threadbare finances, the Guardian can reveal.

It is understood the embattled water company is planning to publish a revised five-year spending plan within days, ahead of a deadline next month. Its board is expected to meet on Thursday to rubber-stamp the plan, and executives hope to release it on Friday.

Sources said the company then intends to wait for up to a week before approaching lenders to fund the proposals and has sought advice from City bankers and lawyers on the debt issuance. Financiers said the proposed timing of the fresh borrowing was surprising, given huge uncertainty around Thames’s future.

Britain’s biggest and most heavily indebted water company is fighting to secure its financial future, and has already said it only has cash reserves to fund its operations for the next 15 months without a substantial increase in bills.

Newsflash: Britain’s blue-chip share index has racked up its biggest one-day fall since last summer.

Anxiety over the Middle East crisis, and concerns that central banks will not cut interest rates soon, combined to drive shares lower.

The FTSE 100 has closed down 145 points, or 1.8%, at 7820.

That’s a three-week low, and quite a change in fortune since last Friday when the index almost hit its record high of 8,047 points.

It’s the biggest drop in points, and percentage, since 6th July 2023.

ING’s global head of macro Carsten Brzeski fears the IMF are too optimistic in their forecasts for European growth, and for inflation across major economies:

“The IMF’s latest economic outlook acknowledges the strong resilience of the US economy but remains a bit too optimistic regarding the European growth outlook and inflation outlook for all developed economies.

In my view, the IMF’s mildly optimistic outlook slightly overlooks the structural transitions that are likely to weigh on Europe over the coming years and could prevent the European economy from returning to potential growth already next year. The rather benign take on inflation seems to underestimate the risk of reflation, either as a result of rebounding economic activity, longer transmission lags for monetary policy or simply new energy price shocks.

The events of the last days and the worsening conflict between Iran and Israel are a good reminder of how fast energy-driven inflation could return.”

Eric LeCompte, executive director of the religious development group Jubilee USA Network, says high debt levels are holding back growth:

“Five years after the pandemic began, the IMF forecasts weak global growth for the next five years.

“In addition to the suffering caused by wars and conflicts, it is more difficult to have accurate economic outlook predictions.

“High debt levels across developing countries and the lack of debt relief means we can’t achieve a strong global economy.”

Britain’s stock market is on track for its worst day since last July, as investors grow more fearful.

The FTSE 100 index is now down 155 points this afternoon, or 1.95%, at 7809 points, which is a three-week low.

This would be the biggest one-day fall in nine months, as investors continue to worry that central bankers will be slower to cut interest rates than hoped.

Grocery technology firm Ocado are the top riser, down 5.2%, followed by tech investor Scottish Mortgage (-4.3%). Mining giants are also among the top fallers

Nearly every one of the hundred stocks in the index are in the red, with only chemicals maker Croda (+2.5%) and energy firm Centrica (+0.7%) keeping above water.

Market sentiment has been hit by “simmering Middle East tensions, a tepid opening to the earnings season and further economic data showing little evidence that the need for interest rate cuts is approaching”, says Richard Hunter, head of markets at interactive investor.

Hunter adds:

Investors are keeping a close eye on the developing situation in the Middle East and assessing the likelihood of retaliatory action from Israel following the weekend’s Iran attack.

One such side effect has been an oil price which remains up by 17% this year, despite flattening out after its recent hike, but which nonetheless remains an inflationary factor which complicates the desired direction of travel for global central banks.

European stock markets are also a sea of red, with Germany’s DAX and France’s CAC both down 1.6%.

This follows losses in Asia-Pacific markets, after falls on Wall Street yesterday:

⚠️BREAKING:

— Investing.com (@Investingcom) April 16, 2024

*ASIAN STOCKS SINK ACROSS THE REGION ON MIDDLE EAST WORRIES, FED RATE JITTERS

🇯🇵🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳 pic.twitter.com/JgMAuPh37x

Wall Street Fear & Greed Index: 39/100 ⚠️⚠️

— Jesse Cohen (@JesseCohenInv) April 16, 2024

We are back in 'FEAR' territory.$SPY $QQQ 🇺🇸🇺🇸 pic.twitter.com/yjFwhxCIAc

The International Monetary Fund has predicted that central banks would raise interest rates if the Middle East crisis triggered a sharp surge in the oil price.

My colleague Larry Elliott pressed the Fund on this issue in Washington today, asking:

Q: Is there a risk that the conflict between Israel and Iran will be the next malign shock to the global economy? How do you think it would affect the global economy?

IMF chief economist Pierre-Olivier Gourinchas replies that the Fund is watching developments, and adjusting its scenarios and analysis.

It is evaluating various possible trajectories for the global economy, including a scenario where there is fairly significant disruption in oil markets that leads to a 15% rise in oil prices, and increased shipping costs.

Under that scenario, the 15% rise in oil prices lifts global inflation by 0.7 percentage points.

Gourinchas says this scenario would impact business confidence, and investment.

And it would lead to higher borrowing costs, he predicts, as central banks tried to dampen down inflationary pressures.

Gourinchas says:

The increased inflation that would come from higher energy prices would trigger a response from central banks that would tighten interest rates in order to secure inflation coming back to target, and that would weigh down on activity.

It would do so in a context in which, in some countries, activity and growth is already fairly weak, so that might also have a strong effect there.

Q: What’s the energy price outlook, as the US considers new sanctions on Iran?

The IMF has drawn up a scenario exploring the impact of rising geopolitical tensions, with elevated energy costs and higher shipping costs.

This would lead to higher price pressures in the global economy, higher inflation, and lower output, says Pierre-Olivier Gourinchas.

Gourinchas tells reporters in London that the IMF believes a 15% increase in oil prices would increase inflation globally by 0.7 percentage points.

We are not in that scenario now, though, he insists, adding it is too early to say if the current increase in oil prices will be sustained.

The IMF are now taking questions in Washington on its new World Economic Outlook.

Q: What scarring is occuring in low-income developing countries, as they try to recover from the pandemic?

IMF chief economist Pierre-Olivier Gourinchas says the Fund has lowered its estimate of economic scarring for most regions and countries, but increased for low-income developing countries.

Those countries are suffering an impact both on output, and on high price pressures, he says. That’s due to high energy and food prices, an increase in food insecurity, in a region that had smaller buffers to protect their population.

Rising interest rates mean these countries have less fiscal space too.

The World Bank warned this week that the pandemic has brought poverty reduction to a halt:

Britain’s households will endure a second year without an improvement in their living standards in 2024 as the effects of high inflation take time to abate, the International Monetary Fund has revealed.

In its flagship World Economic Outlook (WEO), the Washington-based IMF said it was forecasting modest 0.5% UK growth this year – but only as a result of a rising population.

Growth per head – one of the key measures of living standards – is expected to remain flat this year after a 0.3% drop in 2023.

The IMF said there would be a pick-up in the economy as 2024 wore on – something the government is banking on to reduce its opinion poll deficit with Labour – but it would not be until 2025 that the cost of living crisis would be over.

Although official figures due out on Wednesday are expected to show a fall in the UK’s annual inflation rate to about 3%, the IMF believes the Bank of England will be cautious about cutting interest rates, and has pencilled in only two 0.25 percentage point cuts in official borrowing costs this year.

Newsflash: the UK is set to be one of the slowest growing major economies this year, although Germany will lag further behind.

The International Monetary Fund’s latest World Economic Outlook, just released, shows that the global economy is set to grow by 3.2% in both 2024 and 2025, matching its expansion in 2023.

Advanced economies are seen expanding by 1.7% this year, rising to 1.8% in 2025.

But Britain will be towards the back of the pack; UK GDP is forecast to rise by 0.5% this year, before accelerating to 1.5% next year. That’s a small downgrade on the Fund’s forecasts back in January.

Germany will be even slower though, with GDP set to rise just 0.2% in 2024, and 1.3% in 2025.

Italy is expected to grow by 0.7% in each year, while Japan’s GDP is seen rising 0.9%, and then 1%.

France is expected to grow by 0.7%, and then 1.4%.

While the US will continue to lead the way, expected to expand by 2.7% and then 1.9%.

IMF Growth Forecast: 2024

— IMF (@IMFNews) April 16, 2024

🇺🇸 US: 2.7%

🇩🇪 Germany: 0.2%

🇫🇷 France: 0.7%

🇮🇹 Italy: 0.7%

🇪🇸 Spain: 1.9%

🇬🇧 UK: 0.5%

🇯🇵 Japan: 0.9%

🇨🇳 China: 4.6%

🇮🇳 India: 6.8%

🇷🇺 Russia: 3.2%

🇧🇷 Brazil: 2.2%

🇲🇽 Mexico: 2.4%

🇸🇦 KSA: 2.6%

🇳🇬 Nigeria: 3.3%

🇿🇦 S. Africa: 0.9%https://t.co/tPL4fgygu4 pic.twitter.com/Y99bDg17oJ

An activist hedge fund has stoked concerns over a corporate flight from the London Stock Exchange after calling on British oil services firm Wood Group to reconsider its UK listing or sell itself off.

In a letter to Wood’s board Franck Tuil, the founder of Sparta Capital Management, he was “frustrated by the continued underperformance of the shares” when compared to rival engineering companies listed in the US.

The intervention by Tuil, a former senior portfolio manager at hedge fund Elliott, comes amid rising fears in the City that oil giant Shell may abandon its place at the top of the FTSE 100 in favour of a listing in the US because it believes European investors undervalue the company.

BP’s future on the LSE has also come into doubt after reports that the UAE’s state oil company, Adnoc, had considered a multi-billion pound takeover bid of the company which has also contended with a lagging share price in recent years.

Wood Group’s market valuation has tumbled by over a third in the last year following the collapse of a takeover bid by US-based Apollo Global Management. Since the $2.1bn takeover bid fell apart Wood’s share price has slumped to value the company at $1.21bn.

Tuil said:

“We believe that the board must be realistic on how it can best achieve fair value for shareholders; if the UK public markets are unwilling or unable to engage in Wood’s story, we believe you should undertake a strategic review and actively seek alternative solutions.”

Wood Group declined to comment.

With a general election no more than nine months away, Britain may have soon have a new chancellor.

And the Institute for Fiscal Studies have produced an excellent interactive tool to show the challenge she, or he, will face to manage the nation’s finance.

Their ‘Be the Chancellor’ tool launched today shows the trade-offs and fiscal challenge awaiting the next government. It shows the impact on the public finances of changing departmental spending, and of altering a wide range of taxes.

It also shows how faster, or slower, growth affects the tax take.

Picture the scene. You've just won a stonking election victory. You're appointed Chancellor. You triumphantly enter the Treasury. What's next?

— Ben Zaranko (@BenZaranko) April 16, 2024

We've built a new interactive tool that lets you take the reins of the all-important post-election Budget 👇https://t.co/5dnNwRc0ZB

Calculating the cost, or fiscal benefit, of each decision, it shows whether your Treasury would hit the target of having debt falling, as a share of national income, in five years.

The tool even lets you add your own fiscal policy, if there’s something you’re desperate to tax (or stop taxing).

You can try it here.

This is brilliant from @TheIFS - could easily spend hours on this, but also illustrates the challenge ahead for a future Chancellor.https://t.co/DckSbtAjDi

— Nimesh Shah (@nimshah14) April 16, 2024

Hitting the fiscal mandate became easier this month, as the UK entered a new fiscal year in April. That means the target to get debt/GDP falling moved a year into the future.

The IFS says this could create an extra £12bn of fiscal firepower for spending increases or tax cuts:

While difficult to predict with precision, we estimate that this mechanical rolling forward of the forecast could, all else equal, add something like £12 billion to Chancellor Jeremy Hunt’s ‘headroom’ against his fiscal mandate – a target that Rachel Reeves has promised to retain if Labour forms the next government

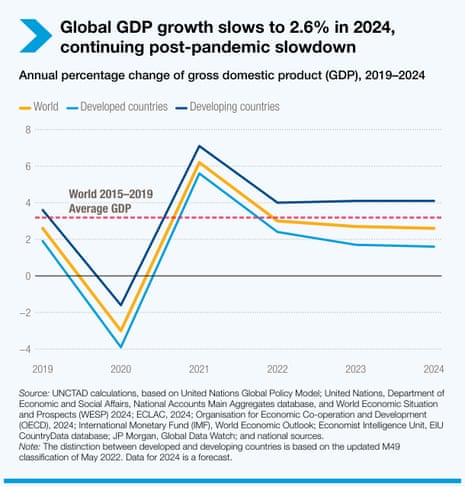

The global economy is likely to slow further this year, the United Nations trade body has warned today.

UN Trade and Development predicts global growth will slow to 2.6% this year, down from 2.7% in 2023, as falling investment and subdued trade dynamics hit the world economy.

In a new report, it warns that monetary policy alone cannot solve all pressing global challenges, even if higher interest rates do bring down inflation.

UN Trade and Development warns that the better-than-expected growth recorded in 2023 is now being ‘squandered’, saying:

Policy discussions continue to centre on inflation, conveying confidence that anticipated monetary easing will heal the world’s economic woes.

Meanwhile, the pressing challenges of trade disruptions, climate change, low growth, underinvestment and inequalities are growing more serious.

Airline easyJet has announced that it is to suspend all flights to and from Tel Aviv until 27 October, following the Iranian missile and drone strike on Israel over the weekend.

In a statement, the carrier said:

“As a result of the continued evolving situation in Israel, easyJet has now taken the decision to suspend its flights to Tel Aviv for the remainder of the summer season until 27 October.

“Customers booked to fly on this route up to this date are being offered options including a full refund.”

On Monday, easyJet announced that it would look to resume flights to the Israeli city on Sunday after suspending flights after the attacks.

It comes just after easyJet resumed flights to Israel on 25 March after cancelling all flights following the 7 October Hamas attacks on the country.

The weekend saw a number of other major airlines suspend flights, including WizzAir, Air Canada, Delta, Iberia and Lufthansa.