Reply To:

Name - Reply Comment

Last Updated : 2024-05-01 11:03:00

This feature is based on a thought-provoking panel discussion hosted by Capital Alliance Limited which delved into the current trends in consumer spending and the post-crisis outlook for the consumer sector in Sri Lanka.

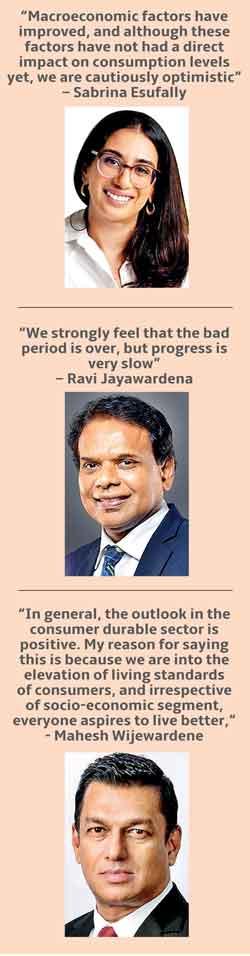

The panelists comprised esteemed industry experts including Maliban Group Chief Executive Officer Ravi Jayawardena, Hemas Consumer Brands Managing Director Sabrina Esufally and Singer Sri Lanka PLC Group Chief Executive Officer Mahesh Wijewardene.

The discussion touched upon critical aspects such as the changing undercurrents of post-crisis consumer spending, inflation dynamics, social welfare measures, and the role of government intervention. This article seeks to analyze the significant highlights from the discourse.

Historically high borrowing costs, rising inflation, significant currency devaluation, reduced tourism and the implementation of various tax reforms dealt a brutal blow to the working-class consumers

There have been notable shifts in consumer purchasing power and spending habits in Sri Lanka in recent years. Over a year ago, the economy hit rock bottom as it defaulted on international loans, faced rampant fuel and energy shortages and a short supply of food, medicine and other essentials.

There have been notable shifts in consumer purchasing power and spending habits in Sri Lanka in recent years. Over a year ago, the economy hit rock bottom as it defaulted on international loans, faced rampant fuel and energy shortages and a short supply of food, medicine and other essentials.

Historically high borrowing costs, rising inflation, significant currency devaluation, reduced tourism and the implementation of various tax reforms dealt a brutal blow to the working-class consumers. Having seen a drastic reduction in spending power following the impacts of multiple crises, Sri Lankans became very guarded when purchasing everyday necessities.

As reasonable improvements in macroeconomic behaviour caused many of the pressures of the financial crisis to ease towards the end of the previous year, it is worth looking into the changes in consumer patterns post-crisis.

Cautious optimism

Hemas Holdings PLC is a leading conglomerate, offering a portfolio of products in the consumer, healthcare and mobility sectors.

Hemas Holdings PLC is a leading conglomerate, offering a portfolio of products in the consumer, healthcare and mobility sectors.

The company is approaching the remainder of the financial year with a sense of hope, amidst the backdrop of a stabilizing national economy. Over the last year, consumers have seen the same basket of goods double in price while also experiencing a massive depletion in savings. However, a measured and gradual economic recovery has been observed in the form of the unwinding of tight monetary conditions, removal of import restrictions, easing of foreign exchange troubles, appreciation of the rupee against the dollar, influx of inbound tourist arrivals and a significant recovery of inward remittances. “Macroeconomic factors have improved and although these factors have not had a direct impact on consumption levels yet, we are cautiously optimistic,” said Esufally, proceeding to share her reasons for the same.

The first is that there is often a lag (of typically 4-6 months) between when macroeconomic stability is achieved and when consumption levels begin to reflect this stability.

More importantly, consumer confidence in Sri Lanka is showing signs of improvement, which is a positive sign for the economy as it indicates a potential increase in consumption

This is particularly significant as it marks the first time in over a year that consumer confidence has seen an improvement (largely due to a good agricultural season as well as the recent hike in value added tax (VAT) not affecting prices of essential goods and inflation levels as expected).

Lifestyle changes and emerging trends during the economic crisis

In light of the economic crisis, a notable shift in consumer behaviour emerged when it came to essential goods. This category experienced an unprecedented decline in consumption, with consumers reducing usage of home/personal care items such as washing powder and soap and allocating their limited resources elsewhere. The consumption of essential items will eventually rebound in a cyclical manner, although it may not reach the same levels as before the economic crisis or Covid pandemic. Typically, when the demand for essential goods picks up, consumers then also start considering non-essential items to complement their purchases.

While the broader macroeconomy has shown a turnaround and the rate of purchase of essential items is gradually increasing, the company is yet to see the migration to non-essential and discretionary products at this time.

Some personal care categories proved to be much more resilient than others – particularly baby care items, where mothers remained steadfast in their commitment to provide high quality products to their children, even in the worst of times. Categories with limited substitutes or high barriers to entry (due to level of expertise and infrastructure required to develop these products) such as oral care also displayed high degrees of resilience during the height of the crisis. In these categories of products, consumers are not willing to trade out of good quality products for the sake of a price point.

Gen Z consumers have remained resilient and adaptable in the face of economic uncertainty, finding creative ways to supplement their income through multiple jobs, side hustles and freelance work, while living with their parents and therefore avoiding the pressures of rising cost

of living.

As such, they are becoming increasingly powerful in terms of purchasing power and disposable income. Due to their affinity for social media this group of consumers is also well-informed and will often research and weigh up options before making a buying decision. They tend to look for product offerings that have been tailored to their own personal preferences and as such, brands that are more sharply positioned towards them have proven to be resilient amidst crisis. While Gen Z consumers are price conscious, they are not as price-centric as others – giving the company opportunities for premiumization of products.

Another trend noticed in consumption involves the increasing economic independence of women. As women’s lifestyles change, with more women joining the workforce, there is a corresponding diversification in the choices they seek in personal care, which has created substantial opportunities for innovation and product premiumization in categories such as beauty care, hair care and sanitary care.

Navigating challenges in the confectionery industry

The past few years have presented several challenges for confectionery powerhouse, Maliban. With business interests in several segments, such as biscuits, milk, cereals and agriculture, the rising costs of raw materials, increasing manufacturing and operational expenses, supply chain disruptions and import restrictions during the pandemic and economic crisis significantly affected profitability.

Sri Lanka’s monthly milk powder consumption which stood at 7,000 MT pre-Covid has come down to 3,000 MT in the last three years due to price increases caused by the increase in US dollar, an increase in global market milk prices and a hike in government taxes. Due to the macroeconomic factors contributing to the price increase, about 1.7 million households out of a total of 5.6 million households have stopped the usage of milk and biscuits.

Jayawardena expounded that with the slight decrease in prices over the last 6 months, over 1 million households have returned to the market, although the overall consumption remains lower than pre-Covid levels. He said that it would take a minimum of two years for the domestic milk powder industry to bounce back to pre-Covid consumption in terms of volume. “We strongly feel that the bad period is over, but progress is very slow,” said Jayawardena, indicating that despite lower consumption levels, the company is hoping for more stability in the future.

Even though Maliban is an iconic and established brand, with a notable journey of growth and resilience over the last six decades, a shift was noticed, during the economic crisis, from brand loyalty to price loyalty.

Consumers are pressed due to various factors – a drop in income levels and increased prices have led consumers to be very selective about what they buy. Taking the example of biscuits, generally considered a “poor man’s product,” pre-Covid consumption levels in the country amounted to 10,000 MT per month. This dropped drastically to 6,000 MT at the peak of the crisis. Consumers are slowly returning to spending, with consumption returning to 8,000 MT, however, consumption has not returned to former levels. The company is tackling this by introducing more innovative products and adjusting marketing strategies according to consumer behaviour. One of the key focuses has been to provide products that enable consumers to make healthier choices (such as the sugar free range and

digestive biscuits).

Demand for consumer durables

Mahesh Wijewardene, the Chief Executive Officer of Singer (Sri Lanka) PLC - a trailblazer in the consumer durables industry of Sri Lanka - has been steering the company through the country’s recent economic challenges. The consumer durables industry is a highly competitive sector that encompasses a wide range of products such as electronics, appliances, furniture, and other goods that are intended for long-term use by consumers.

Several macroeconomic factors affected the business and its consumers over the last few years, making a wide range of products unaffordable for a large proportion of

the population.

However, “in general the outlook in the consumer durable sector is positive. My reason for saying this is because we are into the elevation of living standards of consumers, and irrespective of socio-economic segment, everyone aspires to live better,” explained Wijewardena – for instance, individuals currently replying on firewood to cook would aspire to own a gas cooker, those washing clothes by hand would dream of purchasing a washing machine – the aspiration to upgrades one’s lifestyle always remains, leaving ample opportunity for further market penetration by the company.

In the industry that Singer operates in, there is a strong positive correlation between GDP and consumer spending. When the GDP of a country is high, consumers tend to have more disposable income, leading to increased spending on durable goods such as appliances and electronics. Conversely, when the GDP is low, consumers are more likely to cut back on non-essential purchases.

The trickle-down effects from a good agricultural season, increased tourism and foreign remittances, coupled with growing awareness and access to information among rural consumers about the importance of quality products and brands, has led to rural markets picking up faster than urban markets. For instance, communication devices like smart phones are being prioritized as a need in the rural markets. In comparison, the urban consumers are displaying a wait-and-see approach, and are more cautious in their spending patterns since their basket sizes are bigger. Hire purchase schemes and easy payments through credit card schemes are also making consumer goods more accessible to customers, especially tech goods such as computers and smartphones.

Despite seeing a slight upturn in market sentiment in recent months, market conditions remain sluggish and contracted. As such. from this point onwards, growth can be facilitated if consumers are able to adjust to current market prices. One can no longer expect prices to return to those from pre-crisis or pre-covid times. While inflation may have slowed down, it does not mean a drastic reduction in prices. The most likely situation under normal circumstances is the continuation of current price structures with a low-inflationary regime. Consumers have to adjust to the “new normal” situation, and this may not happen overnight, it is a long-term outcome. Meanwhile, producers and suppliers also need to decide on the right pricing while maintaining a delicate balance between profit margins and volume.

Gap between wage growth and inflation

In Sri Lanka, the issue of inflation is a pressing concern for both policymakers and the general population. Real inflation, which refers to the increase in prices of goods and services over time, peaked to an all-time high during the worst of the crisis in 2022, leading to a decrease in the purchasing power of individuals, as their wages did not increase at the same rate as prices. Wage inflation, on the other hand, refers to the increase in wages and salaries of workers.

In Sri Lanka, wage inflation has not kept pace with real inflation, leading to a widening gap between what people earn and what they can afford. Despite optimistic economic indicators in recent times, with inflation rates drastically dropping from nearly 70 percent in 2022, to a current rate of 6 percent, a substantial portion of the population continues to grapple with financial hardships. Economic recovery may be a long-drawn-out process requiring a range of interventions, however the industry experts were optimistic that the gap between wage growth and inflation is on pace to reduce in 2024, with workers ideally get annual increases to keep up with inflation.

Future trends in environmental, social, and governance (ESG) practices

As the world continues to evolve, so do the trends in ESG practices. Sri Lanka is also making strides in adopting sustainable business practices for a better future. With growing concerns about climate change and the need to reduce carbon emissions, companies are now shifting towards cleaner energy sources.

The Maliban group has taken several initiatives to incorporate environmentally and socially responsible standards and mechanisms into their manufacturing processes. Maliban products are enjoyed in over 50 countries worldwide, many with stringent food safety standards. The organisation has employed several initiatives as part of their commitment to sustainability, starting with the usage of renewable energy sources such as solar power. Recognizing the importance of sustainable packaging solutions, without burdening consumers with the increased cost, has also been a gradual work-in-progress for the company. For their efforts to reduce their environmental impact, the company received the Carbon Footprint Certification for quantification and reporting of greenhouse gas emissions, from the Sri Lanka Climate Fund.

Another trend is the emphasis on social responsibility within businesses. It has become increasingly evident that the role of businesses goes beyond profit-making. Companies are recognizing the importance of giving back to their communities through initiatives such as education programs, healthcare services and supporting local traders.

Hemas Holdings has demonstrated that sustainable growth encompasses holistic approaches that benefit both the industry and the communities it operates in by promoting female hygiene awareness and providing essential resources to underserved communities in rural Sri Lanka. They have helped shatter social stigma around menstrual hygiene through various awareness programs and training and education sessions in rural schools.

Singer Sri Lanka is renowned for its eco-friendly and energy efficient product line, being the first company in South Asia to manufacture and market refrigerators with non-ozone impact gases, compelling many other competitors in the country to follow suit. The company has also taken steps to move towards sustainable packaging methods and use pulp packaging instead of Styrofoam, which cannot be recycled. Recognizing the importance of sustainable waste management in protecting the planet and its natural resources on machines, Singer Sri Lanka spearheaded a countrywide e-waste collection campaign, encouraging customers and citizens to dispose of

e-waste responsibly.

These environmental, social, and governance practices being reflect a growing awareness of sustainability and responsible business practices among Sri Lankan businesses. By embracing these trends, companies can not only contribute to a healthier planet but also build stronger relationships with their stakeholders for long-term success.

Add comment

Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Reply To:

Name - Reply Comment

US authorities are currently reviewing the manifest of every cargo aboard MV

On March 26, a couple arriving from Thailand was arrested with 88 live animal

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

30 Apr 2024

30 Apr 2024

30 Apr 2024

30 Apr 2024