Momentum Stocks Notch Best Quarterly Stretch in Years: 5 Picks

After climbing more than 20% in 2023, the S&P 500 registered its strongest first-quarter gain of 10.2% in five years. The broader index posted a series of record highs without a noteworthy pullback so far this year.

However, momentum stocks have outshined the S&P 500 in the first three months by the biggest margin since 2008. In the first quarter of 2024, the iShares MSCI USA Momentum Factor ETF (MTUM) soared more than 19%, making some investors anxious. This is because, traditionally, outperformance by momentum stocks leads to painful corrections in the near term.

But this time around, the market scenario is promising, and momentum stocks are expected to continue their winning streak. This is because investors largely remain self-assured that the economy is set for a soft landing or a situation where price pressure moderates, while recession fearmongering is on the ebb.

Momentum stocks, by the way, have gained traction this year, banking on AI-optimism and the Federal Reserve’s dovish stance. Digital disruption and AI have led to several technological headways, boosting exclusively tech companies’ profit margins (read more: 3 Solid AI Stocks Worth a Look for the Rest of the Year).

The Fed, meanwhile, is broadly anticipated to trim interest rates three times in the second half of 2024. The recent rise in the PCE index was completely disregarded by Chairman Jerome Powell. Instead, he said that keeping rates high for too long could impact consumers and trigger an economic slump. Needless to say, rate cuts boost consumer outlays, reduce the cost of borrowing and propel economic growth.

Consumers continue to open up their wallets amid a strong labor market, a tell-tale sign that the economy vis-à-vis the stock market will chug along. Consumer spending notched its biggest gain in February since January 2023.

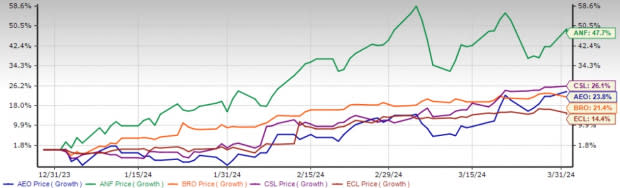

Thus, with the economy remaining on a solid footing and momentum stocks well-poised to move further up, it’s wise for investors to invest in American Eagle Outfitters, Inc. AEO, Abercrombie & Fitch Co. ANF, Brown & Brown, Inc. BRO, Carlisle Companies Incorporated CSL, and Ecolab Inc. ECL.

These stocks carry a Zacks Rank #1 (Strong Buy) or 2 (Buy) and a Momentum Score of A or B, a combination that offers the best opportunities in the momentum investing space. You can see the complete list of today’s Zacks Rank #1 stocks here.

American Eagle Outfitters is a specialty retailer of casual apparel. American Eagle Outfitters currently has a Zacks Rank #1 and a Momentum Score of B. The Zacks Consensus Estimate for its current-year earnings has moved up 11.8% over the past 60 days. AEO’s expected earnings growth rate for the current year is 12.5%.

Abercrombie & Fitch operates as a specialty retailer of premium, high-quality casual apparel for men, women and kids. Abercrombie & Fitch currently has a Zacks Rank #1 and a Momentum Score of A. The Zacks Consensus Estimate for its current-year earnings has moved up 18.9% over the past 60 days. ANF’s expected earnings growth rate for the current year is 19.1%.

Brown & Brown markets and sells insurance products and services primarily in the United States. Brown & Brown currently has a Zacks Rank #2 and a Momentum Score of B. The Zacks Consensus Estimate for its current-year earnings has moved up 2.8% over the past 60 days. BRO’s expected earnings growth rate for the current year is 17.1%.

Carlisle Companies is a global portfolio of niche brands and businesses with highly engineered and high-margin products. Carlisle Companies currently has a Zacks Rank #1 and a Momentum Score of A. The Zacks Consensus Estimate for its current-year earnings has moved up 9.7% over the past 60 days. CSL’s expected earnings growth rate for the current year is 20.5%.

Ecolab is a global sustainability provider offering water, hygiene and infection prevention solutions. Ecolab currently has a Zacks Rank #1 and a Momentum Score of B. The Zacks Consensus Estimate for its current-year earnings has moved up 5.8% over the past 60 days. ECL’s expected earnings growth rate for the current year is 23.4%.

Shares of American Eagle Outfitters, Abercrombie & Fitch, Brown & Brown, Carlisle Companies and Ecolab have surged 23.8%, 47.7%, 21.4%, 26.1%, and 14.4%, respectively, so far this year.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report