India's largest private bank has raked in nearly ₹1.7 lakh crore ($20 billion) in deposits in the first three months of 2024.

More than three-fourths (77%) of that money has been in low-cost deposits.

Analysts at Macquarie, a global investment bank, described this as "impressive", "commendable" and "an excellent outcome" given the liquidity situation in the country.

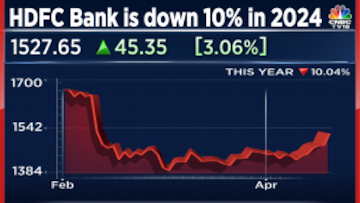

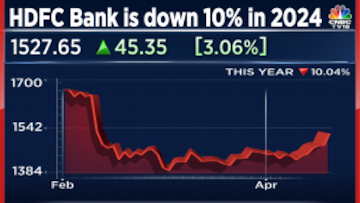

That would explain why shares of HDFC Bank reclaimed the ₹1,500 mark for the first time in over two months after a surprising spike in low-cost deposits.

Low-cost deposits, as reflected in by current account-savings account ratio (CASA), are the cheapest source of money for any bank. When that money is lent out to borrowers, the profit margin is wider.

The fear of shrinking margin had been a big reason for the sharp sell-off in the stock since mid-January.

Typically, banking regulator Reserve Bank of India (RBI) considers a loan-to-deposit ratio of 75% as a comfortable level. It means the bank can lend ₹3 out of ₹4 it has in deposits without any worry.

ALSO READ: Foreign investors trim stake in HDFC Bank but new buyers emerge

Most Indian banks exceed that level and the perceived risk starts to increase when the amount of money gets closer to the level of deposits.

At the end of December 2023, HDFC Bank had a loan-to-deposit ratio of 110% i.e. the Mumbai-based giant had lent more money than it had in its deposit accounts.

The loans-to-deposit ratio spiked after HDFC (which was the country's largest mortgage lender) merged with HDFC Bank. The former entity came in with huge loans on its book and virtually no deposits.

Therefore, the new merged entity, HDFC bank, had to rake in more deposits — because the money lent may take longer to return — to bring the loan-to-deposit ratio back to less-risky levels.

HDFC Bank is a large bank — market capitalisation of over ₹11.5 lakh crore on April 4 — with long history of credibility. However, to pressure to find more depositors in quick time would have forced the bank to offer higher interest rates, reducing the profit margin.

In February 2024, the bank did increase interest rates on fixed deposits to as high as 7.9% for bulk deposits between ₹2 crore and ₹5 crore if the depositor is willing to leave the money with the bank for a little more than a year.

On the other hand, HDFC Bank also cut back its lending to corporates and other large borrowers in the March quarter by 2.2% compared to the preceding three months.

While the company has managed to rake in the money — ₹1.7 lakh crore in deposits between January and March 2024 — but at what cost? The impact on the profit margin will be known when the earnings are reported later this month.

45 out of 50 analysts who track the stock have a 'buy' rating on HDFC Bank. No one has a 'sell' rating.

(With inputs from Abhishek Kothari)

More than three-fourths (77%) of that money has been in low-cost deposits.

| Brokerage | New target price for HDFC Bank |

| Consensus | ₹1898 |

| Macquarie (Rating: Buy) | ₹2,000 |

| Bernstein (Rating: Buy) | ₹2,100 |

| Citi (Rating: Buy) | ₹2,050 |

| Nomura (Rating: Neutral) | ₹1,625 |

Analysts at Macquarie, a global investment bank, described this as "impressive", "commendable" and "an excellent outcome" given the liquidity situation in the country.

That would explain why shares of HDFC Bank reclaimed the ₹1,500 mark for the first time in over two months after a surprising spike in low-cost deposits.

Low-cost deposits, as reflected in by current account-savings account ratio (CASA), are the cheapest source of money for any bank. When that money is lent out to borrowers, the profit margin is wider.

The fear of shrinking margin had been a big reason for the sharp sell-off in the stock since mid-January.

Typically, banking regulator Reserve Bank of India (RBI) considers a loan-to-deposit ratio of 75% as a comfortable level. It means the bank can lend ₹3 out of ₹4 it has in deposits without any worry.

ALSO READ: Foreign investors trim stake in HDFC Bank but new buyers emerge

Most Indian banks exceed that level and the perceived risk starts to increase when the amount of money gets closer to the level of deposits.

At the end of December 2023, HDFC Bank had a loan-to-deposit ratio of 110% i.e. the Mumbai-based giant had lent more money than it had in its deposit accounts.

The loans-to-deposit ratio spiked after HDFC (which was the country's largest mortgage lender) merged with HDFC Bank. The former entity came in with huge loans on its book and virtually no deposits.

Therefore, the new merged entity, HDFC bank, had to rake in more deposits — because the money lent may take longer to return — to bring the loan-to-deposit ratio back to less-risky levels.

HDFC Bank is a large bank — market capitalisation of over ₹11.5 lakh crore on April 4 — with long history of credibility. However, to pressure to find more depositors in quick time would have forced the bank to offer higher interest rates, reducing the profit margin.

In February 2024, the bank did increase interest rates on fixed deposits to as high as 7.9% for bulk deposits between ₹2 crore and ₹5 crore if the depositor is willing to leave the money with the bank for a little more than a year.

On the other hand, HDFC Bank also cut back its lending to corporates and other large borrowers in the March quarter by 2.2% compared to the preceding three months.

While the company has managed to rake in the money — ₹1.7 lakh crore in deposits between January and March 2024 — but at what cost? The impact on the profit margin will be known when the earnings are reported later this month.

45 out of 50 analysts who track the stock have a 'buy' rating on HDFC Bank. No one has a 'sell' rating.

(With inputs from Abhishek Kothari)

First Published: Apr 4, 2024 3:14 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!