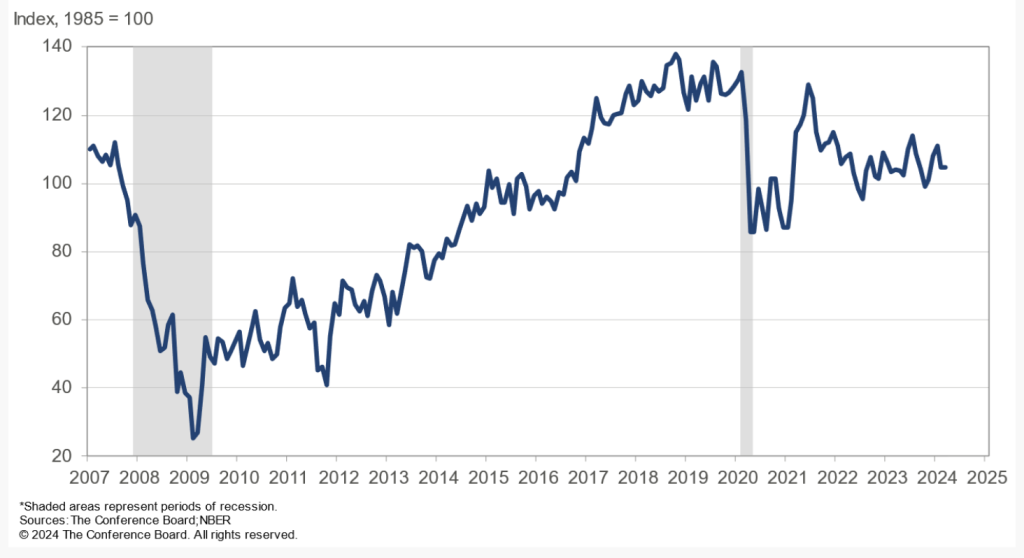

The Conference Board Consumer Confidence Index was 104.7 (1985=100) in March 2024, essentially unchanged from a downwardly revised 104.8 in February 2024.

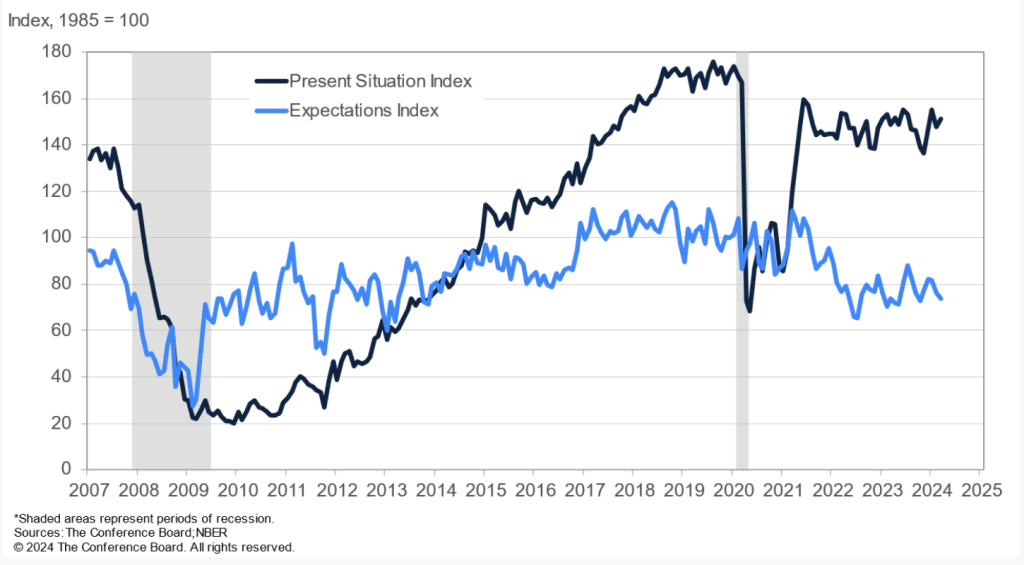

Based on consumers’ assessment of current business and labor market conditions, the Present Situation Index increased to 151.0 (1985=100) in March 2024 from 147.6 in February 2024. Meanwhile, based on consumers’ short-term outlook for income, business, and labor market conditions, the Expectations Index fell to 73.8 (1985=100), down from 76.3 in February.

The Conference Board said in its report that an Expectations Index reading below 80 often signals a forthcoming recession.

“Consumers’ assessment of the present situation improved in March, but they also became more pessimistic about the future,” said Dana M. Peterson, chief economist at The Conference Board. “Confidence rose among consumers aged 55 and over but deteriorated for those under 55. Separately, consumers in the $50,000 to $99,999 income group reported lower confidence in March, while confidence improved slightly in all other income groups. However, over the last six months, confidence has been moving sideways with no real trend to the upside or downside either by income or age group.”

Consumer Confidence Index

Peterson added: “Consumers remained concerned with elevated price levels, which predominated write-in responses. March’s write-in responses showed an uptick in concerns about food and gas prices, but general complaints about gas prices have been trending downward.

The average 12-month inflation expectations came in at 5.3 percent—barely changed from February’s four-year low of 5.2 percent. Recession fears continued to trend downward in write-in responses and as measured by consumers’ perceived likelihood of a U.S. recession over the next 12 months. Meanwhile, consumers expressed more concern about the U.S. political environment than in prior months.

Assessments of the present situation improved in March, primarily driven by more positive views of the current employment situation. Notably, the employment differential—those saying jobs are plentiful minus those saying jobs are hard to get—rose in March and has been trending higher this year. However, expectations for the next six months slipped to the lowest level since October 2023.

Consumers’ outlook for future business conditions, labor market conditions, and income expectations deteriorated in March, and they were less optimistic about their family’s financial situation, both currently and over the next six months (measures not included in calculating the Expectations Index).

Sentiment about stock prices over the year ahead continued to strengthen. The share of consumers expecting an increase in interest rates over the year ahead rose above 50 percent for the first time since November 2023.

On a six-month basis, buying plans for interest-rate-sensitive items like autos, homes and big-ticket appliances dipped again; however, based on a supplemental question, planned spending for services in 2024 increased relative to the same time last year.

Among services, consumers anticipate spending more on health care, motor vehicle services and lodging for personal travel but less on entertainment.

Present Situation

Consumers’ assessment of current business conditions fell slightly in March.

- 19.5 percent of consumers said business conditions were “good,” down from 20.4 percent in February.

- 17.2 percent said business conditions were “bad,” down from 17.7 percent.

Consumers’ appraisal of the labor market was more positive in March.

- 43.1 percent of consumers said jobs were “plentiful,” up from 42.8 percent in February.

- 10.9 percent of consumers said jobs were “hard to get,” down from 12.7 percent.

Present Situation and Expectations Index

Image courtesy Globe, Data and Charts courtesy Conference Board