Illinois is stepping up its game in financial literacy education, with new measures gaining traction across the state's high schools and higher education institutions. The bid to empower young residents with essential money management skills is rolling out through a mix of classroom instruction and legislative initiatives, reflecting an escalating concern for the financial well-being of the next generation.

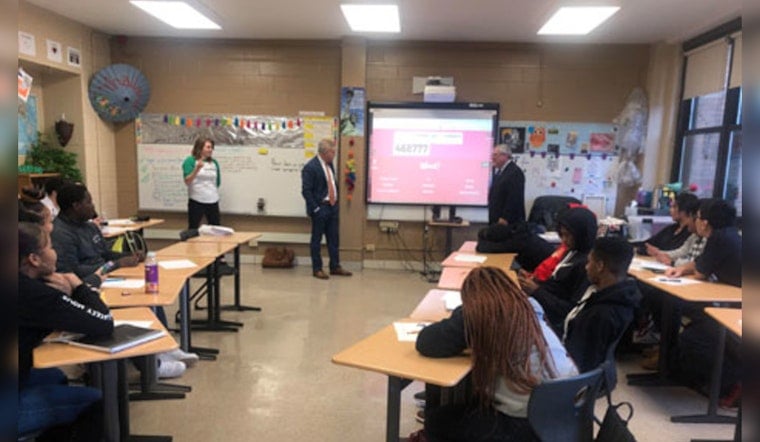

According to a recent report by the Chicago Sun-Times, efforts such as Credit Abuse Resistance Education Chicago (CARE Chicago) are making strides in bridging the knowledge gap for high school students. Erica Wax, a former bankruptcy lawyer, and CARE Chicago's chairwoman, highlighted that students "have just enough experience to know what they don’t know," illuminating a hunger for practical financial savvy among the youth.

A thrust for systemic change has taken shape in legislation too. A bill introduced last year addresses the need for a financial literacy course requirement in the state's education system. While Illinois scored a 'B' in a national report card on state financial literacy improvements by the Center for Financial Literacy at Champlain College, projections show it holding steady at that grade until at least 2028, despite the ongoing reform efforts.

Financial education in the state, however, is not without its critics. Vince Shorb, CEO of the National Financial Educators Council, said, "Public schools are failing our students" when it comes to financial literacy. His campaign aims to inject fun and engagement into the subject to kindle interest and understanding among students. In addressing the challenges, the task force recommended, among other things, a Financial Empowerment Commission to better assess student and community needs, as per a report released early this year, by the advocacy group Young Invincibles.

At the college level, the push for financial know-how continues. The Financial Empowerment Report suggested by the Illinois Task Force for Financial Empowerment urges for the coordination between stakeholders to provide access to culturally relevant educational material. Young Invincibles reported that this includes promoting transparent coordination for financial empowerment and improving the availability of learning resources for students in public postsecondary institutions across Illinois.

Chicago Public Schools are piloting mini financial education lessons and gearing up to fully roll out a curriculum next year that covers economic concepts, money management, and consumer protection.

-1.webp?w=1000&h=1000&fit=crop&crop:edges)