European Central Bank keeps interest rates on hold at 4%

Gold’s latest record high takes 2024 gain past 15%

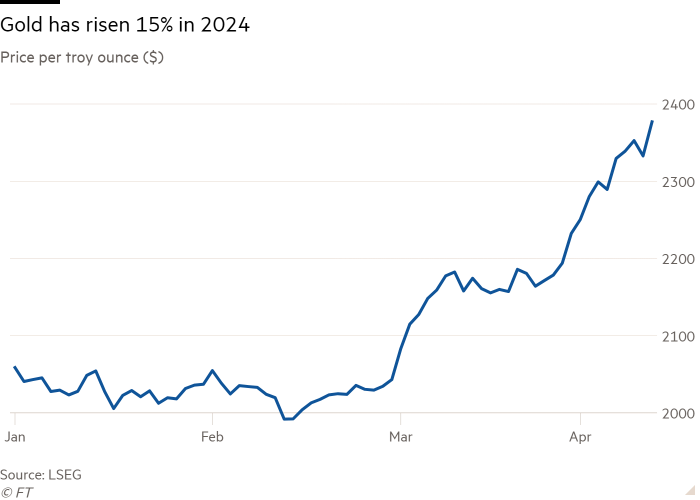

Gold’s latest record high has taken the metal’s 2024 gains past 15 per cent, building on its best start to a year since 2017.

The metal was up 1.7 per cent in late New York trading at $2,373.23 per troy ounce. Gold has notched up almost 20 record high closes since the start of the year.

Gold is up 6.3 per cent so far this month, building on an 8.2 per cent rise in the first quarter that marked its best start to a calendar year since 2017.

Gold’s rally has picked up since late last year, particularly since the start of the Israel-Hamas war and as inflation in big economies proves sticky. The yellow metal is often regarded as a relative haven during times of geopolitical tension, as well as a perceived hedge against inflation.

US stocks climb in reversal from Wednesday sell-off

Wall Street stocks rose on Thursday, marking a sharp reversal from the previous session as shares in Big Tech companies led the march higher.

The benchmark S&P 500 gauge closed up 0.7 per cent, after a drop of almost 1 per cent on Wednesday triggered by a hotter than expected US inflation reading for March.

The Nasdaq Composite rose 1.7 per cent, more than reversing a 0.8 per cent decline a day earlier.

Large tech companies were among the biggest risers, with Amazon, Alphabet and Microsoft adding 1.7 per cent, 2 per cent and 1.1 per cent respectively. Apple and Nvidia both gained more than 4 per cent.

In government bond markets, the two-year Treasury yield slipped 0.02 percentage points lower to 4.95 per cent, following a heavy sell-off a day earlier.

Amazon shares close at record high for first time since 2021

Amazon shares closed at a record high, extending a six-month rally that has lifted several of Wall Street’s biggest tech stocks and has helped the ecommerce group surpass its previous peak from July 2021.

Shares closed 1.7 per cent higher to $189.05, leaving them up almost one-quarter in 2024. The company, with a market capitalisation of $1.96tn, is the fourth-most valuable company on Wall Street behind fellow Magnificent Seven groups Microsoft, Apple and Nvidia.

More US regulators join Morgan Stanley wealth management probe

Three more US regulators have opened investigations into how Morgan Stanley’s wealth management division handles potentially risky clients, according to a person familiar with the matter.

The business, which has been central to the bank’s growth in recent years, was already in the sights of the Federal Reserve over money laundering controls. Now the Securities and Exchange Commission, the Office of the Comptroller of the Currency and the Treasury are also involved, the person said.

Regulators are looking into the level of thoroughness of the investigations Morgan Stanley conducted around the source of clients’ wealth and their financial activity.

Read more here

US charges interpreter of baseball star Shohei Ohtani over $16mn bank fraud

Shohei Ohtani’s former interpreter was charged with fraud by the US justice department and accused of wiring more than $16mn from the Los Angeles Dodgers baseball star’s bank account to pay off gambling debts.

Ippei Mizuhara, who was the interpreter of the star Major League Baseball player, risks up to 30 years in prison. Ohtani, who is from Japan and did not speak English, had no knowledge Mizuhara was accessing his bank accounts to cover gambling losses, the US attorney’s office in California said.

The Department of Justice said Mizuhara made “unauthorised transfers” worth more than $16mn from November 2021 to January 2024 from Ohtani’s account.

“The transfers from this bank account allegedly were made from devices and IP addresses associated with Mizuhara, who served as Ohtani’s translator and de facto manager,” the DoJ said in a statement.

Read more here

Mexico asks UN to suspend Ecuador over embassy raid in Quito

Mexico has asked the UN to expel Ecuador over a police raid on its embassy in Quito last week.

Ecuadorean authorities forced their way into the Mexican embassy late last Friday to capture Ecuador’s former vice-president, Jorge Glas, triggering a diplomatic crisis between the two countries that led Mexico to break off relations.

Mexico has filed a complaint at the International Court of Justice, the UN’s top court, asking the UN to suspend Ecuador pending a public apology.

“The court, in accordance with the United Nations charter, should approve the expulsion, and there should be no veto [from the UN Security Council],” said President Andrés Manuel López Obrador.

Read more here

Exxon chief earns four times as much as bosses at Shell and BP

ExxonMobil’s chief executive collected a pay packet last year worth almost four times that of bosses at rivals BP and Shell, underlining the vast disparity between European and US remuneration in the booming oil sector.

Darren Woods received salary, stock options and a bonus amounting to $36.9mn in 2023, the US’s biggest oil company reported in a securities filing on Thursday. That was $1mn more than the previous year.

His remuneration compares with the $26.5mn paid to Mike Wirth, boss of rival US supermajor Chevron, which was a $3mn increase on the previous year.

Read more here

Taylor Swift returns to TikTok despite its fight with Universal

Taylor Swift has reinstated her music on TikTok, putting her at odds with her own record label, Universal Music, which went to war with the social media group in February, muting her songs and the rest of its vast catalogue from the platform.

A selection of Swift’s songs was made available again on TikTok on Thursday, ahead of a planned album release next week.

Swift, who owns the copyrights to her recordings through a 2018 deal struck with Universal, can control where her work is made available, unlike many other artists. Her return to TikTok had been in the works for some time, people familiar with the matter said.

Universal Music did not respond to several requests for comment, nor did TikTok or a representative for Swift.

Read more here

Argentina’s central bank cuts rate for third time under Javier Milei

Argentina’s central bank has cut its benchmark interest rate by 10 percentage points to 70 per cent as the monetary authority seeks to reduce the amount of pesos it must print to pay interest on its liabilities with domestic creditors.

Libertarian President Javier Milei says halting money printing is the key to bringing down Argentina’s 276 per cent annual inflation — the worst rate in three decades. Thursday’s rate cut is the third since Milei took office in December, when the benchmark rate stood at 133 per cent.

Analysts expect official data on price rises due to be published on Friday will show that the monthly inflation rate was just over 10 per cent in March, down from 13 per cent in February and a peak of 26 per cent in December.

AstraZeneca shareholders approve CEO Soriot’s £18.7mn pay despite revolt

AstraZeneca shareholders approved a potential £1.8mn pay rise for chief executive Pascal Soriot, despite a significant investor revolt against a pay increase advisers had called “excessive”.

Almost 36 per cent of shareholders voted against the plans, under which Soriot could earn annual incentive payments based on long-term performance worth up to 850 per cent of his almost £1.5mn base salary.

This compares with the maximum of 650 per cent under the previous policy set in 2021. Soriot would also be in line for a bonus worth up to 300 per cent of his base salary, compared with the prior policy of 250 per cent.

Read more here

European stocks fall as ECB signals June rate cut

European equities fell on Thursday, pulled lower by steep declines for bank stocks after the European Central Bank sent a strong signal that it would consider cutting interest rates at its next meeting in June.

The region-wide Stoxx Europe 600 dropped 0.4 per cent. The sector-specific Stoxx 600 Banks index fell 2.4 per cent, its biggest one-day drop since August.

France’s Cac 40 fell 0.3 per cent, London’s FTSE 100 slipped 0.5 per cent, and Germany’s Dax dropped 0.8 per cent.

Former NFL star OJ Simpson dies aged 76

OJ Simpson, the star American football player and actor who made international headlines in the 1990s after being acquitted on charges of murdering his ex-wife and her friend, has died aged 76.

Simpson died from cancer on Wednesday, according to a post from his family on X.

On April 10th, our father, Orenthal James Simpson, succumbed to his battle with cancer.

— O.J. Simpson (@TheRealOJ32) April 11, 2024

He was surrounded by his children and grandchildren.

During this time of transition, his family asks that you please respect their wishes for privacy and grace.

-The Simpson Family

Simpson was charged with two counts of first-degree murder in 1994 for the death of his ex-wife, Nicole Brown, and her friend, Ronald Goldman. The 11-month trial was dubbed the “trial of the century” and enthralled the public and the press. In 1997, Simpson was found liable for their deaths in a civil suit.

Simpson spent about 10 years in prison after being charged in 2007 on 12 counts related to an armed robbery in Nevada.

Markets update: US stocks and bonds rise on cooler than expected wholesale inflation

Wall Street stocks and US Treasuries rallied slightly after the latest wholesale inflation figures came in cooler than economists had expected.

The benchmark S&P 500 was 0.2 per cent higher shortly after the opening in New York, while the tech-heavy Nasdaq Composite rose 0.4 per cent. The moves reverse some of Wednesday’s steep declines, sparked by an unexpected jump in consumer price inflation.

Yields on benchmark 10-year Treasuries fell 0.04 percentage points to 4.52 per cent. Yields move inversely to prices.

The moves came after producer price inflation rose less than expected to an annual rate of 2.1 per cent in March from 1.6 per cent in February. Economists polled by Reuters had forecast an increase to 2.2 per cent.

US producer price index hits 6-month high but comes in lower than expected

Wholesale inflation in the US hit its highest level in six months in March, but came in below expectations and may help ease concerns about the persistence of price pressures and the outlook for rate cuts.

The producer price index, a leading indicator of consumer price inflation, rose 0.2 per cent month-on-month in March, the US labour department said on Thursday. That was down from a 0.6 per cent rise in February and also below economists’ forecasts for a 0.3 per cent increase.

The increase in the PPI on an annual basis accelerated to 2.1 per cent in March from 1.6 per cent in February. This was the highest level since September, but below expectations for a 2.2 per cent rise.

US inflation still on course for 2% target, Fed policymaker says

The head of the New York Federal Reserve said he still expects inflation to drift towards the US central bank’s 2 per cent goal, despite some bumpy recent readings.

John Williams, a voting member of the Fed’s policymaking committee, said he expected inflation “to continue its gradual return to 2 per cent, although there will likely be bumps along the way”.

The remarks come after March data showed inflation rose more than expected, prompting traders to rethink their expectations that the Fed would make three quarter-point cuts this year.

However, Williams suggested that he still believed the federal funds target range, of 5.25 to 5.5 per cent, could end the year 75 basis points lower.

Euro nudges lower as ECB hold rates at 4 per cent

The euro nudged lower on Thursday, down 0.2 per cent against the dollar at $1.0721, after the European Central Bank’s widely anticipated decision to hold rates at 4 per cent.

Interest rate sensitive two-year German Bund yields — a benchmark for the eurozone — held steady at 2.98 per cent, up 0.02 percentage points on the day.

Traders in swaps markets moved to price a 67 per cent probability of the first interest rate cut by June, down from 75 per cent chance earlier in the day.

Markets continue to price around three quarter point cuts this year.

Vietnamese property tycoon Truong My Lan sentenced to death over $12bn fraud

Vietnamese property tycoon Truong My Lan has been sentenced to death by a court in Ho Chi Minh City for embezzling more than $12bn, state media reported on Thursday.

Lan, chair of developer Van Thinh Phat Group, went to trial last month for the fraud — the largest in Vietnam’s history.

She was charged with bribery, embezzlement and abuse of power in the case, which formed part of a broader corruption crackdown by the ruling communist party.

Markets update: European stocks and bonds slip ahead of ECB rate decision

European stocks and bonds fell on Thursday morning ahead of the European Central Bank’s policy decision and press conference, which traders will be scrutinising for signals on when European borrowing costs might start to fall.

The region-wide Stoxx Europe 600 was down 0.4 per cent by late morning in London, with particularly steep declines for technology and bank stocks. France’s Cac 40 fell 0.1 per cent, while Germany’s Dax fell 0.5 per cent.

Yields on eurozone government bonds edged higher, reflecting falling prices. Yields on 10-year German Bunds — a benchmark for the eurozone — were up 0.03 percentage points for the day at 2.46 per cent.

What to watch in North America today

Wholesale inflation: US producer prices are expected to have risen 2.2 per cent on an annual basis in March, up from a reading of 1.6 per cent in February that was higher than expected. The “core” measure, which strips out volatile food and energy prices, is expected to have risen 2.3 per cent from a year ago.

Constellation Brands: The producer of Modelo, the top-selling beer in the US, is forecast to post earnings of $2.04 a share in its fiscal fourth quarter, almost 70 per cent higher than a year earlier. Modelo, which is brewed in the US by Constellation, eclipsed Bud Light last year to become the country’s best-selling beer by volume.

Jobless claims: New applications for US state unemployment aid are expected to come in at 215,000 in the week ending April 6, down from 221,000 in the prior week.

BlackRock loses appeal over UK tax paid in BGI deal

BlackRock, the world’s largest asset manager, has lost an appeal relating to the tax it was seeking to reclaim from HM Revenue & Customs on its $13.5bn acquisition of Barclays Global Investors in 2009.

The US part of the BGI business was acquired through a corporate structure that included a UK tax-resident entity, LLC5.

HMRC originally declined to grant tax deductions. The First-tier Tribunal then allowed LLC5’s appeal against HMRC’s decision. That decision was reversed by the Upper Tribunal and LLC5 appealed to the Court of Appeal.

The Court of Appeal concluded on Thursday that LLC5 had a main purpose of obtaining a tax advantage.

BlackRock said it was evaluating its next steps.

This post has been amended to reflect that BlackRock had sought to reclaim tax.

FCA issues warning notice against Neil Woodford over collapse of £3.7bn fund

The UK financial watchdog has issued a warning notice against Neil Woodford following the collapse of his £3.7bn Equity Income fund in 2019, which trapped thousands of investors and left them nursing losses.

The Financial Conduct Authority alleges in its warning statement that Woodford had “a defective and unreasonably narrow understanding of his responsibilities for managing liquidity risks”, which ultimately led to the fund’s downfall and the collapse of his firm.

The watchdog also alleges that Woodford and his firm failed to ensure that the fund’s liquidity risk framework was appropriate. The FCA did not set out what action it would take, but it has the ability to issue fines and bans.

Hospital waiting lists in England fall for fifth consecutive month

Waiting lists for routine hospital care in England fell in February for the fifth consecutive month, according to official figures released on Thursday.

Patients were waiting for almost 7.54mn appointments, down from 7.58mn at the end of January and below a record 7.7mn in September last year, NHS England data showed.

Prime Minister Rishi Sunak has pledged to cut waiting lists ahead of the general election expected this year, in which health is likely to be a key battleground.

UK mortgage demand returns to growth in first quarter, BoE survey suggests

UK lenders said mortgage demand returned to growth in the first three months of 2024, according to official data published on Thursday that adds to evidence of stabilisation in the property market.

The index for mortgage demand for house purchases rose to 35.9 in the first three months of 2024, from minus 31.6 in the previous three months and from minus 54.9 in the third quarter of 2023, according to the Bank of England’s quarterly survey of banks and building societies.

The index tracking demand for remortgages also rose to 52.8 in the first quarter of 2024, from minus 27.7 in the previous three months.

The figures suggest a recovery from the sluggish performance last year as mortgage rates have fallen from their peaks.

Risers and fallers in Europe

Big share price moves in Europe today include French lender Société Générale, UK self-storage group Lok’nStore and UK supermarket chain Tesco:

Société Générale: Shares in the French bank edged up 3.5 per cent after it announced the sale of its equipment financing arm to BPCE for €1.1bn.

Lok’nStore Group: Shares in the UK self-storage company shot up 18 per cent following news that it had agreed to be bought by Brussels-listed rival Shurgard for £378mn, at a 16 per cent premium to Wednesday’s closing price.

Tesco: Shares in the UK grocery chain retreated 3.5 per cent on Thursday, having risen 2.5 per cent in the previous session after it posted a 7.2 per cent increase in sales for the year to February and announced a £1bn share buyback.

Traders reduce bets on ECB interest rate cuts

Traders in swaps markets are betting on fewer than three quarter-point rate cuts by the ECB this year after strong US inflation data on Wednesday prompted a sharp repricing in interest rate expectations.

The probability of the first ECB cut being delivered by June has fallen to 75 per cent, having been fully priced last month.

The ECB is widely expected to hold its deposit rate at 4 per cent when it meets on Thursday but investors will be on watch for clues to see how independent of the Federal Reserve narrative the ECB can be.

Traders push back expectations of UK interest rate cuts

Traders are pricing in fewer than two quarter-point interest rate cuts from the Bank of England this year, as policymaker Megan Greene said cuts “should still be a way off”.

Traders are also no longer fully pricing in the first interest rate cut in August and now expect borrowing costs to begin to fall in the UK in either August or September.

Hopes for imminent rate cuts were dented on both sides of the Atlantic by an unexpectedly hot US inflation reading on Wednesday.

Gilts sold off as traders pared their rate cut expectations. Yields on benchmark 10-year gilts rose 0.09 percentage points to 4.24 per cent, reflecting falling prices.

European stocks hold steady ahead of ECB decision

European stocks held steady in early trading as investors await the European Central Bank’s latest policy decision, due on Thursday.

The region-wide Stoxx Europe 600 was close to flat shortly after the opening bell, as was Germany’s Dax. London’s FTSE 100 gained 0.1 per cent and France’s Cac 40 gained 0.2 per cent.

The ECB is widely expected to keep interest rates on hold, but traders will be looking for signals on whether they can still expect borrowing costs to fall as early as June, as some of the central bank’s policymakers have hinted.

US futures held steady ahead of the New York market open after Wall Street stocks sank in the previous session following an unexpectedly hot inflation print.

Zelenskyy accuses allies of ‘turning a blind eye’ as Russia intensifies air strikes

President Volodymyr Zelenskyy scolded Ukraine’s western partners and pleaded for more air defences after a Russian air attack early on Thursday targeted critical infrastructure in five regions.

Zelenskyy said Russia attacked energy infrastructure in Kharkiv city and the Kharkiv region, as well as the Kyiv, Zaporizhzhia, Lviv and Odesa regions.

“All of our European neighbours and other partners see Ukraine’s critical need for air defence systems,” Zelenskyy said in an early morning statement. “We need air defence systems and other defence assistance, not just turning a blind eye and having lengthy discussions.”

The Air Force said it had shot down 39 out of 40 Russian drones but just 18 of the 42 cruise and ballistic missiles used in the attack.

Shurgard agrees to buy Lok’nStore for £378mn

Lok’nStore is set to become the latest company to leave the UK stock market, after the self storage group agreed to be bought by Brussels-listed rival Shurgard for £378mn.

Shurgard, which describes itself as “the largest developer, owner and operator of self-storage facilities in Europe”, said it would pay 1,110 pence a share in cash to acquire Lok’nStore, a 16 per cent premium to Wednesday’s closing price.

Shurgard chief executive Marc Oursin said the acquisition “doubles our presence in the country and accelerates our growth and expansion strategy”.

Lok’nStore’s directors said the company’s share price had not consistently reflected its achievements or growth potential.

UK cyber security company Darktrace raises guidance as revenues beat expectations

Cambridge-based cyber security company Darktrace has raised its earnings forecasts after revenues in the three months to December grew by more than a quarter, saying its market is “emerging from a period of relative economic uncertainty”.

Revenues in Darktrace’s third quarter were $176mn, up 26.5 per cent from a year earlier. As a result, it said, its adjusted earnings margin for the year to March would be at least 23 per cent, up from previous guidance of at least 21 per cent. Revenue growth would be at least 25.5 per cent, above previous guidance.

Darktrace claims that by using generative AI, its systems can learn continuously and “help transform security operations to a state of proactive cyber resilience”.

Markets update: Indian equities lead gains in Asia while Hong Kong languishes

India’s benchmark stock index led gains in Asia on Thursday as the country’s markets took hotter-than-expected US inflation data in their stride.

The Nifty 50 index of the country’s largest listed companies added 0.5 per cent, with Coal India and Bharat Petroleum leading gains as they rose 3.8 per cent and 3.2 per cent, respectively.

Hong Kong’s benchmark Hang Seng index was the region’s weakest performer as it fell 0.5 per cent.

The Chinese territory is exposed to “higher for longer” interest rates in the US because its currency is pegged to the dollar, meaning the city’s monetary policy moves in lockstep with the Federal Reserve.

AstraZeneca promises dividend increase ahead of key vote on CEO pay

AstraZeneca has promised to increase its dividend by 7 per cent this year, ahead of a key shareholder vote on pay for its long-standing chief executive Pascal Soriot.

In a statement on Thursday, the UK-based pharmaceutical company said that it would pay a $3.10-per-share dividend for 2024, 20 cents above the 2023 payout, “underlining the company’s confidence in its performance and cash generation”.

Shareholders will vote later today on a plan to raise Soriot’s pay by £1.8mn to a maximum of £18.7mn in 2024.

The move has been criticised by shareholder advisers Glass Lewis and ISS but welcomed by some major shareholders, with Rajiv Jain, chief investment officer at GQG Partners, saying Soriot is “massively underpaid”.

What to watch in Europe today

ECB rate decision: The European Central Bank will decide whether to change its current policy rate of 4.5 per cent, as inflation fell further than expected to 2.4 per cent last month, leading markets to price in three or four ECB rate cuts by the end of the year.

UK business sentiment: The British Chambers of Commerce publishes its quarterly economic survey. Its previous poll of more than 5,000 respondents showed more than half expected their turnover to grow in the following 12 month period, while most companies predicted higher prices and no growth in investment. Last month, the trade association warned that Britain’s politicians were failing to champion UK trade and inward investment.

Cannes Film Festival: The official selection of movies for this year’s event will be announced in France.

Markets update: Hong Kong equities fall as expectations of imminent US rate cuts fade

Hong Kong equities fell in early trading on Thursday following stronger than expected US inflation that caused US stocks and treasuries to sell off.

The territory’s benchmark Hang Seng index shed 0.8 per cent, making it the morning’s worst performing major stock market in Asia. South Korea, Japan and mainland China’s benchmark indices all rose slightly.

Hong Kong is the most exposed to “higher for longer” interest rates in the US because its currency is pegged to the dollar, meaning the city’s monetary policy moves in lockstep with the Federal Reserve.

Philippines looks to generate $100bn of investment from trilateral summit

The Philippines is looking to generate $100bn in investments from the trilateral meeting between President Ferdinand Marcos Jr, US President Joe Biden and Japanese Prime Minister Fumio Kishida, the government said on Thursday.

The investments will be over the next “five to 10 years” in sectors including energy and digital infrastructure, Marcos’ press office said in a statement citing Jose Manuel Romualdez, Manila’s ambassador to the United States.

Marcos will be meeting with his US and Japanese counterparts in Washington this week in the first summit between the three countries.

Chinese consumer prices edge up in March amid sluggish demand

China’s consumer prices edged higher in March, missing analysts’ forecasts and underlining the challenges for the world’s second-largest economy as it tries to boost domestic demand.

The country’s consumer price index was 0.1 per cent higher year on year in March, according to official statistics released on Thursday, lower than the 0.7 per cent reading in February and below the 0.4 per cent increase forecast by a Reuters poll of analysts.

China’s President Xi Jinping is trying to transition the economy away from its debt-stricken real estate sector towards high-end manufacturing in a delicate transition that is leading to trade tensions with the US and Europe.

What to watch in Asia today

Events: President Biden hosts Japanese Prime Minister Fumio Kishida and Philippines President Ferdinand Marcos Jr for trilateral talks in Washington. Kishida will separately deliver a speech at a joint session of the US congress, only the second time a Japanese leader has done so.

Economic data: China will release inflation data for March. In February the consumer price index rose 0.7 per cent, more than forecast, after a series of readings indicating the country was experiencing deflation.

Corporate results: Uniqlo owner Fast Retailing announces results.

Opposition parties win landslide victory in South Korea election in blow to president

Left-wing parties won a landslide victory in South Korea’s parliamentary elections on Wednesday, dealing a severe blow to conservative president Yoon Suk Yeol.

The main opposition Democratic Party of Korea (DPK) is projected to win 176 out of 300 seats in the National Assembly, according to results released early on Thursday morning, against 109 seats for Yoon’s People Power Party (PPP).

Together with the smaller Rebuilding Korea Party, which is projected to win between 12 and 14 seats, that means a left-wing alliance will control up to 190 seats — enough to fast-track legislation through the parliament, but just short of the 200 required to override a presidential veto.

Judge in DoJ lawsuit against Apple recuses himself

The New Jersey federal judge presiding over the US Department of Justice’s antitrust lawsuit against Apple has recused himself from the case because of a potential conflict of interest.

The case has now been reassigned from Judge Michael E Farbiarz to Judge Julien Xavier Neals, according to a court order published on Wednesday.

Neals was appointed to the federal bench by President Joe Biden in 2021.

The justice department and a group of state and district attorneys-general filed the landmark case against Apple last month, accusing the tech company of abusing a smartphone monopoly.

Yen falls past ¥153 after sticky US inflation report

The dollar jumped to a new 34-year high against the yen on Wednesday evening in New York, briefly pushing the Japanese currency through what was considered a key line of support and reviving market speculation that the authorities in Tokyo may attempt to intervene.

Currency analysts said Tokyo markets would now be on high alert for signs that the Japanese ministry of finance was conducting a “rate check”, where officials check the level of yen offered by traders as a precursor to a possible official currency intervention operation.

The dollar briefly broke through ¥153 for the first time since mid-1990 — a line that some analysts had previously warned could represent a “line in the sand” and draw direct intervention by Japan.

The dollar’s move against the yen followed a stronger-than-expected readout of US inflation in March.

US stocks sink as Treasury yields surge to five-month high

US stocks and Treasuries sold off after higher than expected inflation in March dimmed traders’ hopes for near-term interest rate cuts.

Wall Street’s S&P 500 index closed 0.9 per cent lower on Wednesday. Every sector declined except for energy, which was helped by a rebound in the price of oil.

The tech-focused Nasdaq Composite declined 0.8 per cent, with four of the Magnificent Seven tech groups falling.

Yields on two-year and 10-year Treasuries leapt to their highest levels since mid-November following the release of the inflation data. The yield on the two-year note jumped as much as 0.24 percentage points to almost 4.99 per cent and near the 5 per cent threshold it most recently touched on November 14.

The price of gold fell 1 per cent from Tuesday’s record high close. The yellow metal had advanced in 11 of the past 12 sessions.

US and Japan announce ‘most significant’ upgrade to military alliance

The US and Japan plan to modernise their military command and control structures in what President Joe Biden said was the “most significant” upgrade to their alliance since it was created decades ago.

Speaking alongside Japanese Prime Minister Fumio Kishida at a news conference on Wednesday, Biden said the allies were taking significant steps to ensure their militaries could “work together in a seamless and effective way”.

The US president added that the two countries had transformed their relationship into a “truly global partnership” over the past three years, and that the alliance now served as a “beacon to their entire world”.

Read more here

Comments