The Bitcoin network has surpassed 65 million Ordinals inscriptions just days before the much-anticipated Bitcoin halving.

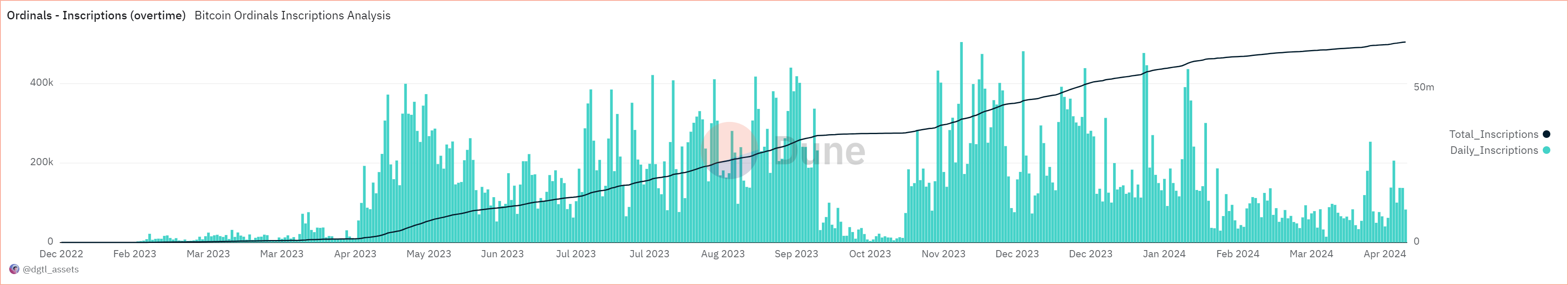

Ordinals inscriptions surpassed the 65 million mark on April 11, less than one year and three months since their launch in January 2023, according to Dune data.

Ordinals Inscriptions chart. Source: Dune

Ordinals are the first iteration of nonfungible tokens (NFTs) on Bitcoin, the world’s first blockchain network. Ordinals live solely on the Bitcoin blockchain, unlike most of today’s popular NFT collections that host their metadata on centralized servers, creating additional points of vulnerability.

The milestone comes just before the Bitcoin halving, which will happen on or around April 19, reducing block rewards from 6.25 Bitcoin (BTC $70,573) to 3.125 BTC.

To date, Ordinals have generated over $458 million worth of network fees for Bitcoin miners, according to Dune, which is a significant lifeline for mining firms as the halving approaches.

Ordinals signal demand for BTCFi

The 65 million milestone shows the increased demand for block space on Bitcoin and the need for additional Bitcoin layer-2 networks, according to Mithil Thakore, CEO of Velar, who told Cointelegraph:

As ordinals become more prevalent, the need for utility around them through lending, derivatives markets, becomes evident. This trend will likely drive the rise of Bitcoin L2s, offering the programmability needed to support smart contracts to bring these ordinals as well as BTC to DeFi [decentralized finance]. It’s an exciting time for the Bitcoin ecosystem as we witness its evolution and expansion into new realms of functionality.

BTCFi, short for Bitcoin decentralized finance, is a new paradigm aiming to bring DeFi capabilities to the Bitcoin network.

Provided that the current adoption rate continues, BTCFi could match the innovation of Ethereum-based DeFi in the future, Nash Lee, co-founder of MerlinSwap, who told Cointelegraph:

[Market appetite] is seeking expansive platforms capable of accommodating the surging volumes and expectations. DeFi stands out as the only sector with the potential to leverage this narrative, providing a sustainable ecosystem for Bitcoin’s evolving use cases. This dynamic sets the stage for Bitcoin DeFi to potentially match, if not exceed, the innovation and complexity seen in Ethereum’s DeFi ecosystem.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum (ETH) experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Bitcoin Cash advocate Roger Ver arrested and charged with falsifying taxes

Bitcoin Cash (BCH) proponent Roger Ver, also an early Bitcoin investor, was allegedly picked up by Spanish authorities over the weekend on charges of tax fraud by the US DOJ.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong Kong ETFs.

Renzo's REZ dips after airdrop and Binance listing

Renzo users could claim their airdrop based on accumulated ezPoints. REZ dips about 35% after listing on Binance and several other exchanges. Renzo seems to have gotten over an earlier scare from ezETH depeg last week.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.