Hello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Bitcoin BTCUSD published in members area of the website. Our members are aware of the numerous positive trading setups we’ve had in the crypto market recently. One of them is BTCUSD, which experienced a pullback, unfolding as an Elliott Wave Double Three Pattern. It completed clear 7 swings from the peak on March 14th and concluded the correction right at the Equal Legs zone (Blue Box Area). In the following text, we’ll delve into the Elliott Wave pattern and trading setup.

Before we take a look at the real market example, let’s explain Elliott Wave Double Three pattern.

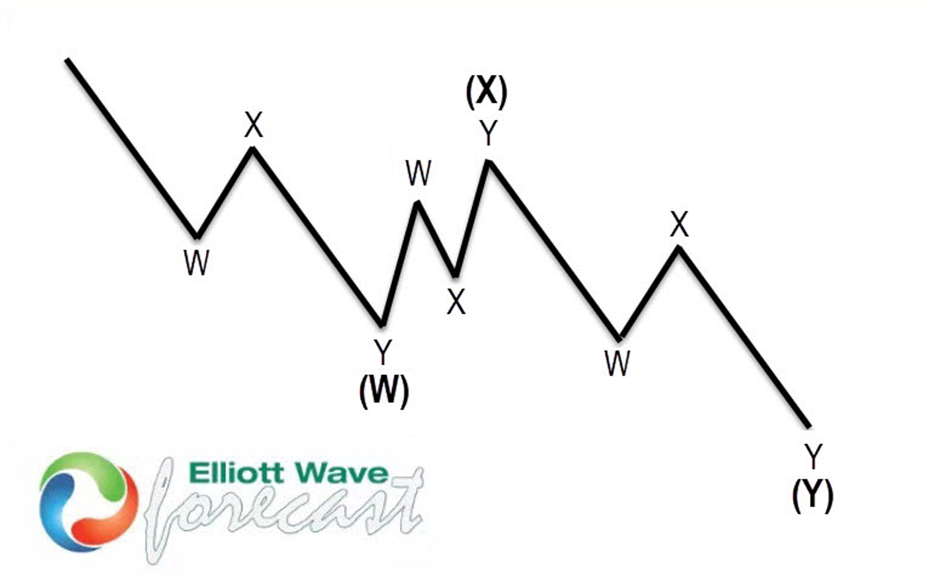

Elliott Wave Double Three Pattern

Double three is the common pattern in the market , also known as 7 swing structure. It’s a reliable pattern which is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree, or alternatively they can have W,X,Y labeling.

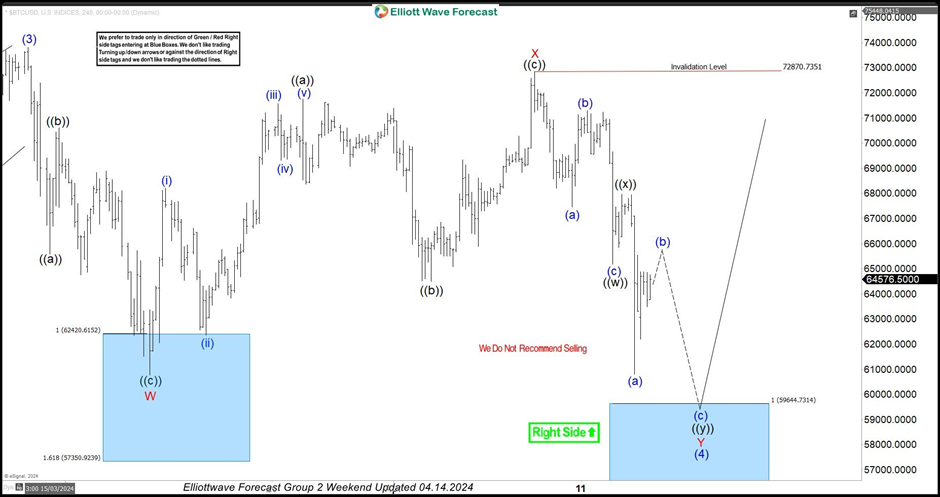

BTCUSD H4 weekend update 04.14.2024

BTCUSD is currently d0ing a wave (4) correction, unfolding in a 7-swing pattern. The pullback is identified with WXY red labeling. The first leg, W red, exhibits a clear 3-wave structure ((a))((b))(c)) black, followed by a 3-wave bounce in X red. Consequently, we anticipate the pullback to evolve as a Double Three pattern, indicating a projection of 3 waves in Y red as well. As of now, the structure remains incomplete. BTCUSD should ideally see another leg down toward the buying zone: 59644.73 to 56551.93. We expect the crypto to rally from there toward new highs or alternatively in a 3-wave bounce. Once the price retraces to the 50% Fibonacci level against the X red connector, we’ll secure positions, set the stop loss at breakeven, and take partial profits.

Official trading strategy on How to trade 3, 7, or 11 swing and equal leg is explained in details in Educational Video.

Quick reminder on how to trade our charts :

Red bearish stamp+ blue box = Selling Setup

Green bullish stamp+ blue box = Buying Setup

Charts with Black stamps are not tradable.

BTCUSD H4 update 04.21.2024

Bitcoin found buyers as expected. It made decent rally from the Blue Box. Bounce already reached 50 fibs against the X red connector which confirms cycle from the peak is done. Consequently, any long positions from the equal legs area are risk free by now and we have taken partial profits. We call wave (4) completed at the 59507.9 low.

Keep in mind not every chart is trading recommendation.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

Meme coin PEPE resists decline despite mass profit taking by whale

PEPE, an internet frog-meme inspired token, has seen a spike in profit-taking activity by traders. PEPE holders have consistently realized gains in the meme coin since April 30, as seen on on-chain activity tracker Santiment.

Solana is more profitable than Ethereum for the first time, Robinhood’s Europe arm launches SOL staking

Solana surpassed Ethereum in profitability for the first time ever. Robinhood’s European crypto arm launched Solana staking, offering nearly 5% yield per annum. SOL price added 2.25% on Wednesday.

XRP holds gains as attorneys debate relevance of discounts offered to Ripple’s institutional clients

Ripple (XRP) price consolidates in a tight range around $0.50 on Wednesday as the Securities and Exchange Commission (SEC) legal battle against payment-remittance firm Ripple intensifies with two key issues in focus this week.

Over a million new crypto tokens issued in three months, 90% on Base

The resurgence in meme coins in the past three months has resulted in over a million new tokens being issued in the crypto ecosystem. Data from crypto intelligence tracker Dune Analytics shows that 90% of the new coins in the Ethereum ecosystem are issued on Base.

Bitcoin: Why BTC is close to a bottom

Bitcoin (BTC) price efforts of a recovery this week have been countered by selling pressure during the onset of the American session. However, the downside potential appears to have been capped.