The economy grew pretty fast last quarter and Donald Trump is amped. How amped? Here he was at a press conference Friday:

I am thrilled to announce that, in the second quarter of this year, the United States economy grew at the amazing rate of 4.1. We’re on track to hit the highest annual average growth rate in over 13 years. And I will say this right now, and I’ll say it strongly: As the trade deals come in one by one, we’re going to go a lot higher than these numbers. And these are great numbers.

So, OK, yeah, our president is bragging as usual, because his vocabulary is limited to approximately 20 superlatives and a few conjunctions. But how strong is the economy, really?

Honestly, pretty strong, at least measured by gross domestic product (which of course in no way speaks to deeper issues of distribution, but I digress). And for better or worse, Trump can probably claim some credit for the current pace of growth we’re enjoying, even if it might not be sustainable for too long. Here are some takeaways:

1. Growth is solid.

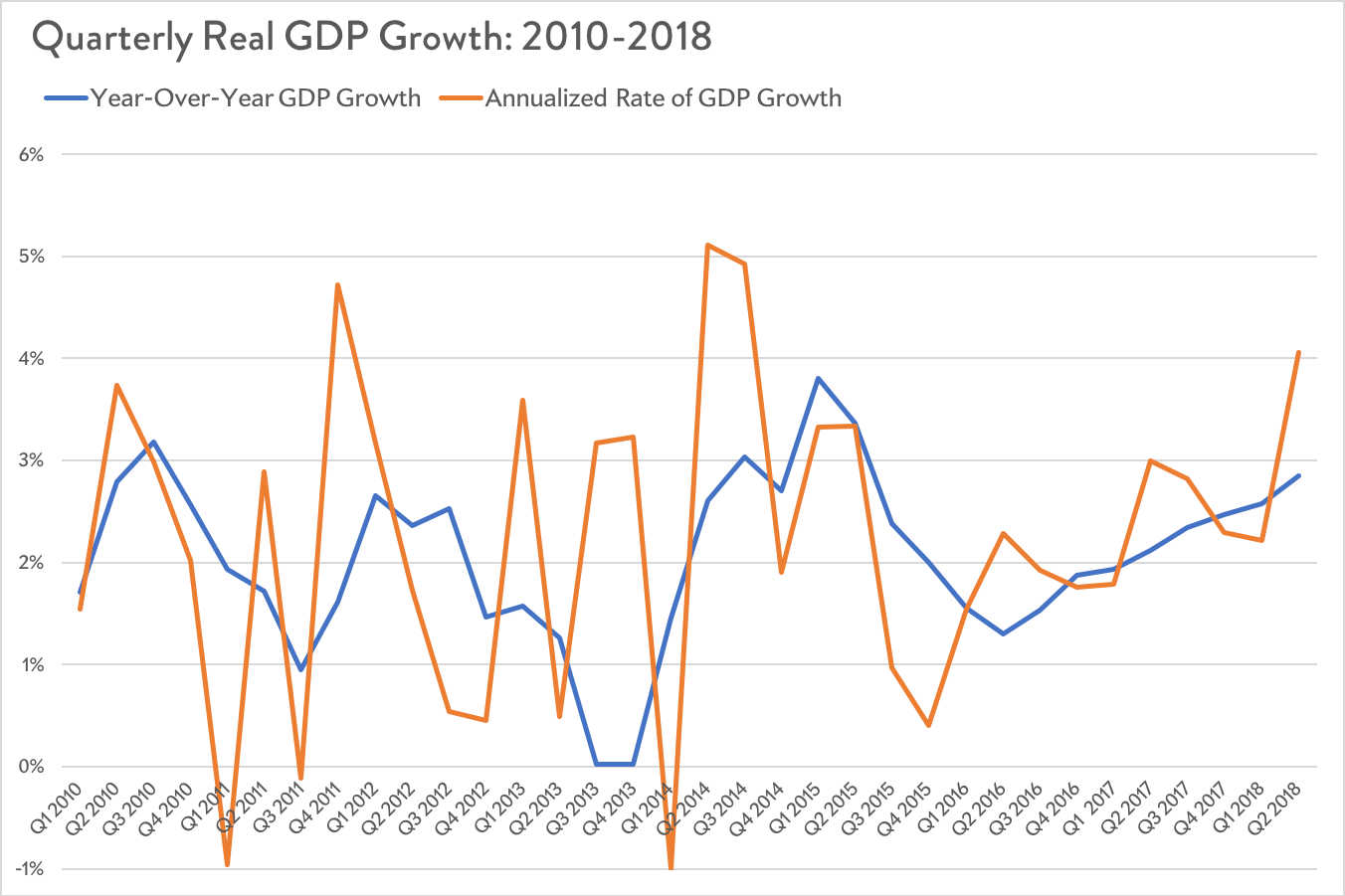

Spring’s 4.1 percent expansion rate was the fastest single quarter of GDP growth since late 2014. Chances are we won’t keep up that pace for the rest of the year (more on that in a moment). But over the past 12 months, the economy is up 2.8 percent, and we’re on an upward trajectory. It’s not crazy to think that we could break 3 percent for 2018, something the U.S. indeed has not accomplished since 2005.

2. Trump’s trade war may have juiced our GDP stats this quarter.

Weirdly, Trump’s decision to pick a trade war with China (among others) may have given our economic stats a boost this quarter. A full percentage point of that juicy 4.1 percent rate came thanks to a boom in exports that, as many have noted, was likely fueled by last-minute shipments of goods as customers tried to beat out Trump’s tariffs. Soybean shipments, for instance, basically exploded in May and likely June as well. That effect is going to fade next quarter, and if our conflict with China intensifies, exports could become a bit of a drag.

3. Political tangent: There’s some bad news for Trump’s corporate tax cuts in Friday’s report.

The entire economic argument underpinning the GOP’s corporate tax cuts was that they’d grow the economy long term by increasing business investment in things like factories, office buildings, and equipment. But while investment is growing at a fairly strong pace, it actually slowed down a bit from last quarter, which is not really what tax-cut partisans would want to see.

4. Meanwhile, housing is a drag on the economy.

The U.S. economy basically runs on home and new car sales (I’m only slightly exaggerating), so it’s always at least a tiny bit ominous when one of those flags. Residential investment has actually contracted for the past two quarters, which isn’t entirely shocking, given that the Federal Reserve has been hiking interest rates, but it can’t make the White House too comfy. (I told you Trump had good reasons to be mad at Jerome Powell.)

5. But consumers are plowing money into the economy.

The thing is, in the end, most of this quarter’s robust growth was driven by consumer spending on goods and services, and that could carry us for a while. One reason families are blowing so much cash? The tax cuts, which have shown up in families’ paychecks. Families may not be noticing the extra boost, because it’s so small, but as a result they’re probably not saving it, either. Which brings us to another important point …

6. Trump and the Republicans have done everything possible to jack up the economy with fiscal policy.

Trump and the GOP didn’t just pass a massive, deficit-funded tax cut that went into effect this year; they also pushed up federal spending, finally abandoning any pretext that they cared about fiscal discipline after spending the entirety of the Obama years pretending to be budget hawks. In other words, Washington basically dropped a stimulus grenade into the middle of an already growing economy. As Ryan Sweet, director of real-time economics at Moody’s Analytics said to me, “The economy is on a sugar high and is going to be on a sugar high for at least another year.” Trump can take credit for that. But after a while, the rush is going to wear off, and if the Republican tax cuts don’t work all the structural magic on the economy they promised, we could see growth taper back off. We might hit 3 percent this year. But it’ll be an exception, not a new normal.

Addendum: This is all subject to change.

Friday’s stats are preliminary. The BEA is going to revise them twice as more data comes in. Numbers could go up. Numbers could go down. Everything I say could be wrong. Such is blogging