Australian consumer confidence eased further in January, but skilled vacancies rose as the economy has to embark on a rebuilding process after the bush fires wreaked havoc across parts of the country. Over $20 billion of economic output has been lost, and the government announced an A$2 billion aid package for businesses to rebuild. The AUD/CHF was rejected by its short-term resistance zone and descended into its support zone. Bullish momentum is rising, and a breakout is favored to follow. You can learn more about the support and resistance zones here.

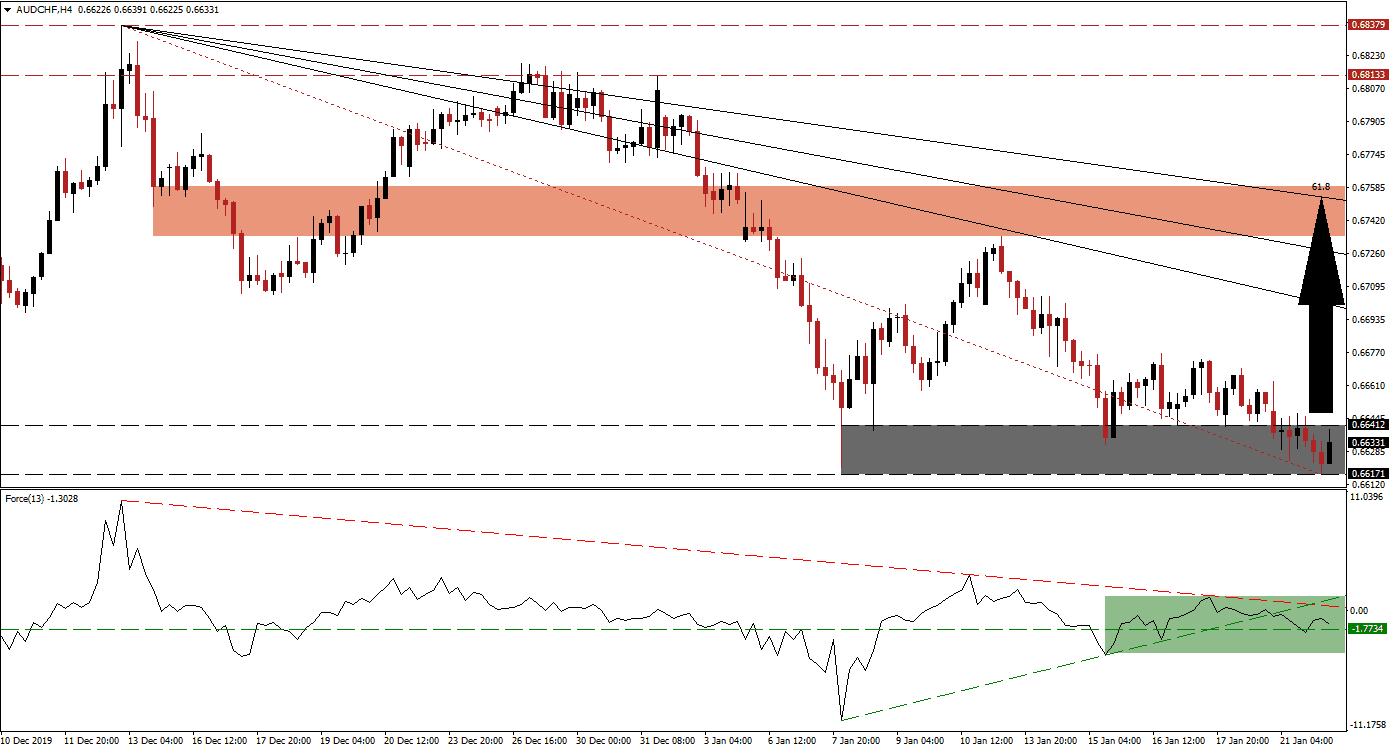

The Force Index, a next-generation technical indicator, indicates the first sign that price action is on the verge of a reversal. After this currency pair initially reached its support zone, it spiked higher before retreating to a lower low. The Force Index started to advance, allowing for a positive divergence formed. It was rejected by its descending resistance level and pressured below its ascending support level. This technical indicator remains above its horizontal support level, as marked by the green rectangle, from where a renewed push into positive territory is expected to place bulls in charge of the AUD/CHF.

Another bullish development materialized after this currency pair moved above its Fibonacci Retracement Fan trendline. This occurred inside of its support zone located between 0.66171 and 0.66412, as marked by the grey rectangle. A breakout is anticipated to ignite a short-covering rally, which will close the gap between the AUD/CHF and the descending 38.2 Fibonacci Retracement Fan Resistance Level. Market manipulation by the Swiss National Bank is likely to add to the reversal in price action.

One key level to monitor is the intra-day high of 0.66766, the peak of a previous bounce higher, which led to a lower low. A breakout above this level should result in the addition of new net long positions in the AUD/CHF, clearing the path into its short-term resistance zone. This zone is located between 0.67340 and 0.67587, as marked by the red rectangle, enforced by its 61.8 Fibonacci Retracement Fan Resistance Level. More upside is possible, but a new catalyst would re required. The next resistance zone awaits price action between 0.68133 and 0.68379.

AUD/CHF Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.66350

Take Profit @ 0.67550

Stop Loss @ 0.66100

Upside Potential: 120 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 4.80

In the event of a move in the Force Index below its horizontal support level, enforced by its descending resistance level, the AUD/CHF is likely to follow suit. The downside potential appears limited to its next support zone located between 0.64993 and 0.65335, which represents a sound long-term buying opportunity. With the SNB active in the forex market, weakening the Swiss Franc, the long-term outlook for this currency pair remains bullish.

AUD/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.65850

Take Profit @ 0.65000

Stop Loss @ 0.66150

Downside Potential: 85 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.83