Caesars Entertainment CEO Tom Reeg told CNBC on Monday that the further legalization of sports betting is one of the biggest growth opportunities for the gaming industry in perhaps over two decades.

"This is an enormous opportunity. I'd liken it to when states outside of Nevada and New Jersey started to legalize riverboat casinos in the '90s," he said "Closing Bell."

Reeg's comments came shortly after Disney-owned ESPN announced it had struck an agreement that makes Caesars, through its sports betting partner, William Hill, a co-exclusive a partner for gambling link-outs from ESPN. Shares of Caesars, which have been hurt in 2020 as a result of the coronavirus pandemic, closed higher by more than 10% Monday to $55.39 each.

"We think there's a lot of money to be made here over time, and we're seeing a lot of interest from non-gaming operators," Reeg said of legalized sports betting. "This ESPN agreement being the latest evidence of that."

As part of Monday's multi-year deal, Caesars Sportsbook by William Hill also becomes a sponsor of ESPN's fantasy sports products. Caesars also is the exclusive odds provider for ESPN. The two companies have worked together in the past. Last month, for example, ESPN debuted a studio at Caesar's The LINQ Hotel.

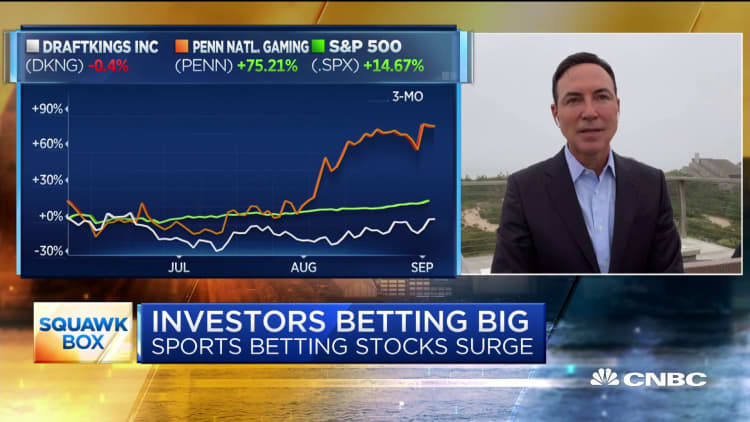

Wall Street has been increasingly interested in sports betting, too. Penn National Gaming's investment in Barstool Sports, and the possibilities it provides around sports betting, has led to a slew of positive notes from analysts in recent weeks. Shares of Penn National are up 156.42% this year, closing at a new 52-week high of $65.54 apiece Monday.

DraftKings, which also on Monday became a co-exclusive partner with ESPN on gambling link-outs, have risen more than 170% since going public through a merger in April. Additionally, DraftKings will now be ESPN's exclusive provider of daily fantasy sports.

Reeg said the fact that legalization of sports betting in additional states is still relatively new may make the gaming industry difficult to evaluate right now. "We have not seen a growth opportunity in this space in quite some time, so it's an adjustment for analysts to look at a hyper-growth piece of a business that has been mature," he said.

In May 2018, the Supreme Court struck down a federal law that effectively made sports betting illegal in most states. There are now 22 states, plus Washington D.C., that have legalized sports betting, according to the American Gaming Association. Another seven have active legislation considering it, as of Aug. 17.

With states facing significant revenue shortfalls due to the Covid-19 pandemic, Reeg said he thinks sports betting may be considered by legislatures across the U.S. as a way to plug some tax holes. In May, Penn National CEO Jay Snowden offered a similar assessment on CNBC.

"We're in the very early stages of legalization of sports betting," Reeg said Monday. "I'd expect to see states that have budget issues related to the post-Covid era that may look to sports and online as a way to raise tax revenue."