Qatari LNG has among the “lowest breakeven” prices globally, so the country is among those exporters “best positioned” to weather the downturn, says Emma Richards, senior oil & gas analyst at BMI Research.

Qatar, she said, is “relatively well-contracted” in its liquefied natural gas portfolio, with the bulk of its contract volumes flowing into Asia.

Asia contract prices are oil-linked and will benefit from a sustained recovery in the price of crude, Richards told Gulf Times yesterday.

But as the supply-demand balance in its core Asia market has deteriorated, Qatar has sent increasing cargoes into Europe, and in particular the UK.

“This is a trend we expect to see continue, which will increase Qatari exposure to any price weakness on the European hubs,” Richards said.

She expects spot LNG prices to begin recovering from 2019 or 2020.

“This is due both to a slowdown in supply addition and an uptick in demand in response to lower prices,” Richards pointed out.

Asked whether the shortfall in global LNG demand be made up by major energy-deficit consumers in Asia such as China, India, Japan and South Korea, Richards said, “Both India and China will be major drivers of LNG demand, due to strong energy consumption growth and a rising role for gas in the domestic energy mix. Both countries are investing to build out infrastructure and government policies are increasingly supportive of LNG, especially in China.

“The major established producers Japan and South Korea will see consumption stagnate, due to weaker energy demand growth, ongoing efficiency gains and a switch to alternative fuels, notably nuclear.”

In BMI’s view, the global gas markets are significantly more exposed than crude to Brexit. Sterling depreciation against the dollar will drag on European demand for LNG, a bearish sign for global spot prices.

The UK Brexit vote on June 23 would “put pressure” on global gas markets through dampened European demand for LNG, the Fitch Group company said. LNG is priced in dollars and sharp depreciation of the sterling in the wake of the vote has raised the cost of imports for UK buyers.

The JKM contract — a benchmark for spot LNG prices — fell by 1.3% in the five days to June 28, from $5.31 per million British thermal units (/mnBTU) to $5.24 /mnBTU.

“However, when converted to sterling the contract gained 9.3% over the same period,” BMI Research said. The UK market holds a significant and growing share of the global LNG market. Data show the UK accounting for 4% of global LNG imports in the first four months of 2016; it represents more than a quarter of Western European imports over the same period.

“We expect both the UK and Western Europe to take a larger share of the global market over the coming quarters, as the region’s liquid gas trading hubs absorb surplus LNG,” BMI Research said.

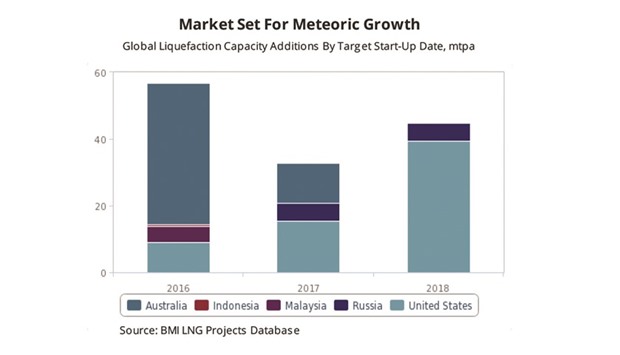

LNG trade has remained relatively flat y-o-y in 2016, due in large part to delays in commissioning the major Sabine Pass (US) and Gorgon (Australia) liquefaction facilities and the slow return to market of Angolan LNG. However, the supply side is set for rapid growth from H2, 2016, putting increased downward pressure on global spot prices, it said.

Currency weakness in the UK will compound the downtrend; BMI Research said and noted, “We expect sterling will be slow to recover against the greenback, while our outlook on the euro is broadly neutral. This undercuts the value of regasified spot LNGs old onto European gas hubs, weakening demand. In order to clear cargoes into Western Europe, LNG exporters will need to lower their prices. With Europe as the global balancing point, this in turn implies a lower floor price for spot LNG globally.”

BMI expects spot LNG prices to begin recovering from 2019 or 2020, due both to a slowdown in supply addition and an uptick in demand in response to lower prices.