After eating Intel's mobile lunch, Apple could next devour Qualcomm's Baseband Processor business

While rumors have long claimed that Apple has plans to replace Intel's x86 chips in Macs with its own custom ARM Application Processors, there are a series of more valuable opportunities available to Apple's internal silicon design team, each of which has the potential to replicate Apple's history of beating Intel in mobile chips.

Apple eyes Qualcomm's Mobile Baseband

Building upon How Intel lost the mobile chip business to Apple's Ax ARM Application Processors, this article examines how Qualcomm may suffer a fate similar to Intel in mobile chips.

Rather than further alienating Intel with plans to replace the Mac's dependence on x86 chips (for fewer than 20 million computers sold every year), it would appear to make more sense for Apple to first apply its chip design team to the task of replacing Qualcomm as its supplier for the order-of-magnitude greater number of 4G baseband chips it has to buy (at a similar name-brand premium) for use in its iPhones and cellular iPads (north of 200 million per year).

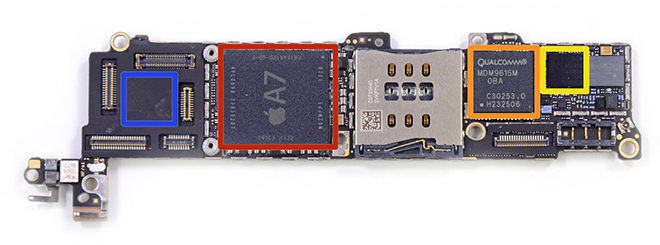

Apple's iPhones (and cellular iPad models) run an iOS environment on their Ax Application Processor, but handle all mobile radio processing on a separate baseband chip (which also incorporates an ARM processor core). The two components function as self-contained computers, each running its own independent operating system and incorporating its own RAM and firmware.

Qualcomm's slice of the Apple iOS pie

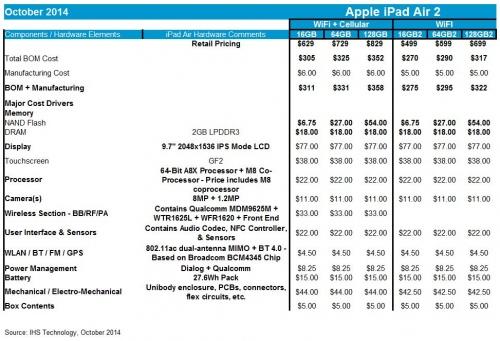

According to the bill of material estimates (of unverifiable accuracy) published by IHS iSuppli, Apple's own A8X Application Processor (together with the separate M8 motion coprocessor!) ostensibly costs Apple $22 per device, while Qualcomm's MDM9625 baseband and other wireless chips cost $33 per device.

Eliminating Qualcomm by creating a custom, in-house baseband chip (or integrating the technology into its own Ax Application Processor package) wouldn't completely erase the need to include other wireless chips, but would shave off significant expense.

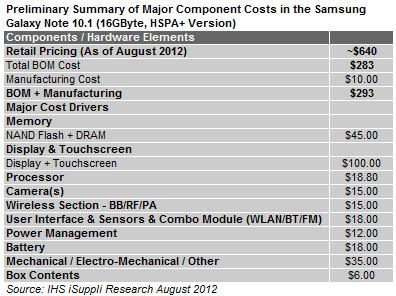

A similar BOM breakdown of the cellular Galaxy Note 10.1 (which uses Samsung's own Exynos chip, integrating baseband features) from the same firm claims a processor cost of just $18.80 and a wireless package of $15, less than half as much as the Qualcomm-supplied components in similarly priced iPad.

IHS iSuppli consistently issues select, persuasive reports that derogatorily portray Apple's products as being priced too high compared to its own BOM estimates (rarely with any competitive context), alongside provocative, bizarrely contradictory predictions that tablets from Samsung and Microsoft would be more profitable because of lower component costs (were they actually capable of selling, of course).

That makes it difficult to take IHS estimates too seriously, but it does provide at least some supporting evidence for stating that Apple could shave billions off its annual iOS component costs by eliminating Qualcomm.

Apple targeting RF engineers

Apple started making iPhones using baseband chips from Infineon, a company Intel acquired for $1.4 billion in 2010 just before Apple moved to Qualcomm's baseband chips, starting with the Verizon iPhone 4 a few months later.

Integrating its own in-house mobile baseband technology into its iOS Ax Application Processors would not just save money but also enable Apple to push proprietary wireless advances and fuel its own economies of scale. Samsung, Intel and other chip makers are already targeting integrated baseband logic in their own mobile products.

Rumors that Apple was working to build its own Baseband Processors surfaced last April, supported by reports of Apple recruiting at least 30 mid and senior-level RF engineers from Broadcom and Qualcomm.

Developing its own baseband technology (or licensing the necessary implementations and patents) would also allow Apple to more cheaply add 4G LTE support to its other products, such as its MacBooks, and potentially enable new mobile and wearable devices to access cellular networks, either with a persistent connection or with occasional sessions to remain updated, with flexible designs and at a cost effective component expense.

The frienemy of my frienemy is an opportunity

Meanwhile, Intel is also said to be attempting to win Apple's mobile baseband business away from Qualcomm. The mobile group that just lost another $1.1 billion in the winter quarter while failing to sell its Atom mobile processors is at this point likely to offer a very competitive bid to the only company capable of consistently selling high volumes of high end smartphones and tablets.

The success of Apple's vertical integration in developing Ax Application Processors suggests that the company isn't terribly likely to simply award Intel its business, given that Qualcomm is also facing competitive issues strong enough to warrant defending its current business with Apple. Qualcomm has a powerful patent portfolio in mobile CDMA and LTE technologies, but if anyone has the capital to license, cleanroom or sidestep those barriers, it's the richest tech company on the planet right now

As it has done in GPUs, Apple could play Qualcomm, Intel and Marvell (a third major chip supplier) back and forth to retain multiple competitive sources for baseband chips, but such a play would also maintain a supply of advanced, cost effective Baseband Processors for Apple's competitors.

In the Application Processor arena, Apple's proprietary A4 through A8 have effectively killed off Texas Instruments (which had previously been so powerful that even Intel couldn't compete with it in mobile chips) and starved every other chip supplier to the point where Google, Microsoft and Samsung have few competitive options left for their own ARM tablets and high end smartphones.

Even Qualcomm is struggling to release its new Snapdragon 810, aimed at powering Android flagships. The dearth of powerful, off the shelf ARM Application Processors has prompted Samsung and LG to develop their own supply, but they lack the reliable, premium device profits that Apple has to invest in custom vertical integration.

The fact that Samsung is already shipping baseband chips to reduce its dependance upon Qualcomm further underscores why Apple would have similar motivations. Qualcomm has a powerful patent portfolio in mobile CDMA and LTE technologies, but if anyone has the capital to license, cleanroom or sidestep those barriers, it's the richest tech company on the planet right now.

Alternatively: a way to get China to pay for IP

At the same time, Apple could also be considering a closer partnership with Qualcomm that would enable Apple to incorporate Qualcomm's baseband technology within its own Ax package.

Qualcomm currently sells its own integrated Snapdragon chips (which bundle an Application Processor with a Baseband Processor) alongside standalone baseband "MDM" components (like those now used by Apple) as "QTC," a business segment it differentiates from "QTL," the licensing of its patents and wireless implementations to other manufacturers.

Qualcomm recently noted in its report to shareholders, "certain licensees in China currently are not fully complying with their contractual obligations to report their sales of licensed products to us."

The chip maker's hardships in getting manufacturers in China to pay to license its patents mean that the most reliable way for Qualcomm to make any money in China may be to license its technology to the only western company that is having no problem selling lots of high end mobile products in that country.

However, such a move might also risk Qualcomm helping Apple to obliterate the remains of any high end iOS competitors, so that once Apple does develop its own baseband technology, Qualcomm wouldn't have anyone else left to sell its own premium baseband chips, where it makes the most money.

Qualcomm's IP may get the Microsoft-Google-Samsung treatment

China is not the only place where there is growing, lawless indifference for intellectual property. That is a major threat to Qualcomm's future viability and a potential windfall for Apple, if it were to simply appropriate the smaller firm's technology.

Even outside of China, courts may decide that Qualcomm's technology isn't worth anything, much the same way that Judge Lucy Koh has perpetuated a legal quagmire that enabled Samsung to pay nothing for the iPhone patents it was found to willfully infringe, despite an ostensibly favorable verdict that granted Apple a fraction of the damages it claimed.

Nearly four years have passed since that trial began, and Samsung hasn't paid Apple anything, not even an Internet meme nickel. That case was one of the most publicly scrutinized legal arguments of the past decade, with copious evidence detailing the intentional, undeniable theft of Apple's work.

If a court like Judge Koh's (or Judge Richard Posner, who dismissed Apple's case against Google's Motorola) similarly allowed Apple four years to stomp all over Qualcomm's patent portfolio without facing any consequences whatsoever, the much smaller chip firm would see its revenues collapse and its stock price implode.

Without stock-based compensation, Qualcomm's employees would flee to Apple for jobs, just as Apple's fled to Microsoft following court actions that similarly invalidated any protection for Apple's IP in the early 1990s.

Somewhere down the line there might be a settlement reached where Apple could shrug off the case by writing a check, just as Microsoft repeatedly did after losing its late 1990's Monopoly trial, along with a series of other anticompetitive lawsuits that slowly inched through the courts, validating Microsoft's strategy of stealing now and maybe paying something later. In the patent-free world imagined by free software advocates, Apple's cash pile would enable it to incinerate everyone in its path, starting with Qualcomm

So far, Apple has agreed to license patents from many IP holders in the mobile industry, but the tireless efforts of Google and the open source community to devalue patents could likely create a scenario where the only ones who have to respect anyone else's IP are tiny players who lack the capital to withstand years of litigation, forcing them to subsequently pay whatever is demanded of them.

That won't be a problem for Apple, particularly once it decided to embark upon an IP stealing binge in the model of Microsoft, Google, and Samsung. In the patent-free world imagined by free software advocates, Apple's cash pile would enable it to incinerate everyone in its path, starting with Qualcomm, the same way Google invaded Sun's IP and looted its Java Mobile platform to create Android.

The people who are always wrong bet against Apple

It is curious that the tech media— which is so intensely skeptical of Apple's potential ability to continue selling premium gear in competition with low priced commodity boogeyman products— has never concerned itself with contemplating the precarious fragility of the IP being sold for a premium by Microsoft, Intel, Qualcomm or Nvidia, all of which are actually at extreme risk of disruption from both low end Chinese cloners and higher end alternatives by Apple.

Qualcomm faces being eaten alive on both ends, just like today's Samsung, which suddenly is no longer the supposedly unstoppable Samsung of 2013.

In the baseband market, Intel and Qualcomm are now in a similar position to where Intel found itself in 2006 in mobile processors: partner with Apple and potentially make little money, or refuse to do a deal and end up with nothing.

Both chipmakers are also eyeing the "Internet of Things," a market for ubiquitous "hypermobile" devices all needing radio baseband technology. If Apple develops its own vertical supply of in-house baseband technology, the history of mobile "taking over the world" might repeat itself, in miniature and on an even larger scale.

And once again, a revolution that was supposed to broadly benefit the benefactors of the writers of buzzword-compliant press releases could instead be dominated by the company that has demonstrated an operational excellence in building products that people actually want to buy, and are willing to pay a premium to get.

Apple is nowhere close to exerting monopoly control in the market for phones or tablets, but it is approaching a monopsony— as the sole buyer with the capital to make risky, long term and large-scale purchases— in the market for premium mobile components. That begs for vertical integration.

Daniel Eran Dilger

Daniel Eran Dilger

Wesley Hilliard

Wesley Hilliard

Malcolm Owen

Malcolm Owen

William Gallagher

William Gallagher

Christine McKee

Christine McKee

David Schloss

David Schloss