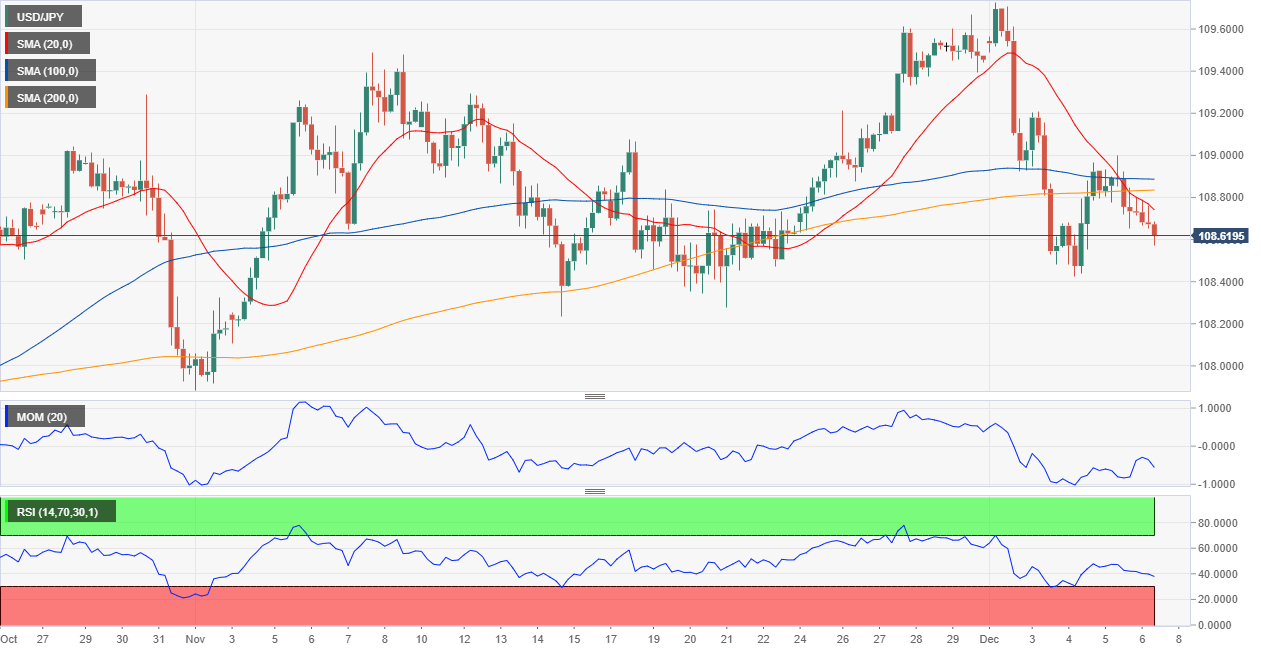

USD/JPY Current price: 108.61

- Japanese data missed the market’s expectations, triggering fresh concerns about the economy.

- Focus on US employment figures, market players anticipate dismal numbers.

- USD/JPY is technically bearish could break below the 108.00 level.

The Japanese yen is marginally higher against its American rival, with the pair trading around 108.60, although the action across the FX board is limited, ahead of the US Nonfarm Payrolls report. The greenback remains among the weakest, despite encouraging comments from US and Chinese representatives, reaffirming that trade talks continue to progress.

Japanese data released overnight missed the market’s expectations, as Overall Household Spending fell by 5.1% in October against the -3.0% expected by the market. The October preliminary Leading Economic Index came in at 91.8, missing the market’s expectations of 92 and below the previous 91.9.

Speculative interest is waiting for US November employment data. The country is expected to have added 180K new jobs, while the unemployment rate is foreseen steady at 3.6%. Wages’ growth is also seen within familiar levels, up by 0.3% MoM and by 3.0% when compared to a year earlier. Later in the day, the US will release the preliminary estimate of the Michigan Consumer Sentiment Index, seen at 96.5 from 96.8 in the previous month.

USD/JPY short-term technical outlook

The USD/JPY pair is technically bearish, according to the 4-hour chart, as it’s below a bearish 20 SMA, which extends its decline below the larger ones. The Momentum indicator heads marginally lower around its mid-line, while the RSI eases within negative levels, at around 39. Additional declines are likely on a break below 108.45 triggered by a dismal US employment report.

Support levels: 108.45 108.10 107.75

Resistance levels: 109.00 109.30 109.60

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.