Contrary to the trend in most of the nation, home foreclosure rates in Oklahoma have risen over the past two years, and some researchers say increased earthquake activity in the state may be a factor.

California-based housing data provider, ATTOM Data Solutions, and Greenfield Advisors, an economic and financial analysis firm headquartered in Seattle, have released an analysis showing that foreclosure activity in Oklahoma has increased along with the rise in the number of earthquakes in the state.

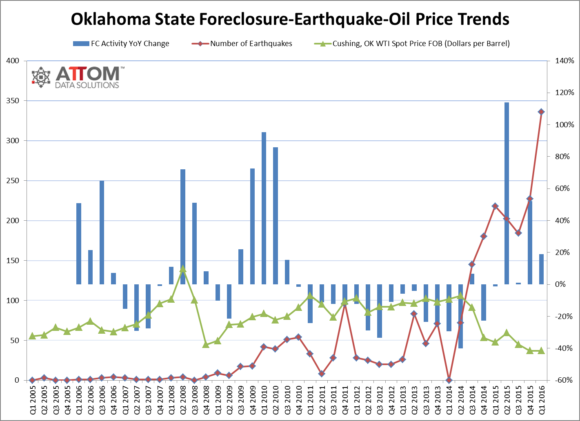

Statewide in Oklahoma, earthquakes increased 375 percent between the first quarter of 2014 and the end of the first quarter of 2016. During that time, foreclosure activity — including default notices, scheduled foreclosure auctions, and bank repossession (REOs) — increased 19 percent following a nearly four-year downward trend, according to the ATTOM/Greenfield analysis.

Statewide foreclosure activity increased on a year-over-year basis in five of the seven quarters ending in Q1 2016 following 15 consecutive quarters of year-over-year decreases in foreclosure activity.

The analysis is based on public record real estate data collected and licensed by ATTOM along with earthquake data from the U.S. Geological Survey and oil price data from the U.S. Energy Information Administration.

While the uptick in home foreclosures seems to parallel the rise in earthquake activity, the researchers point at that during the time period analyzed, oil and gas prices fell dramatically. As a result, production activity has diminished in a state where the economy is heavily dependent on the oil and gas industry.

And while the number of foreclosures have been trending up, the number of homes sold and housing prices have been increasing in Oklahoma, as well. Home sales statewide increased 12 percent over four years and median home prices in the first quarter of 2016 were up 9 percent compared with prices in the same period in 2014, the researchers say.

“Home sales and prices have consistently been trending higher in Oklahoma over the past four years, aligning with the national housing market recovery, but foreclosure activity in Oklahoma over the past two years has diverged from the national trend, rising 19 percent during the same two-year period where earthquake activity increased 375 percent,” said Daren Blomquist, senior vice president at ATTOM Data Solutions.

Blomquist acknowledged that a contributing factor in the increased foreclosure activity could be the decline in oil prices. However, “it’s important to note that foreclosure activity actually decreased 14 percent during the same time period in Tulsa County, where no earthquake epicenters were reported,” he said.

In Oklahoma County, on the other hand, during the two years studied in the analysis earthquake activity increased by 20 percent and foreclosure activity rose by 39 percent, Blomquist said.

Clifford A. Lipscomb, vice chair and co-managing director at Greenfield Advisors, said that “geographic scale is important when evaluating whether the earthquakes are responsible for loss of property value.”

For instance, “state and county level sales data can mask what’s going on in particular neighborhoods,” he said.

“To tie earthquake activity to loss in property value, it takes a close examination of the affected area and control areas, or areas that are similar to the affected area in several dimensions,” Lipscomb said.

Although Tulsa foreclosure activity increased on a year-over-year basis in three of the four quarters ending in the first quarter of 2016, foreclosure activity in the county was still down 14 percent in those four quarters compared to the four quarters ending in Q1 2014.

During the same time period there were no earthquake epicenters reported in Tulsa County, and median home prices increased 6 percent while home sales volume was up 16 percent.

Source: ATTOM Data Solutions, Greenfield Advisors

Topics Catastrophe Natural Disasters Energy Oil Gas Oklahoma

Was this article valuable?

Here are more articles you may enjoy.

FBI Says Chinese Hackers Preparing to Attack US Infrastructure

FBI Says Chinese Hackers Preparing to Attack US Infrastructure  Jury Awards $80M to 3 Former Zurich NA Employees for Wrongful Termination

Jury Awards $80M to 3 Former Zurich NA Employees for Wrongful Termination  Chubb Wins Latest Battle With New York Diocese in Bid to Avoid Sex Abuse Claims

Chubb Wins Latest Battle With New York Diocese in Bid to Avoid Sex Abuse Claims  GM Ends OnStar Driver Safety Program After Privacy Complaints

GM Ends OnStar Driver Safety Program After Privacy Complaints