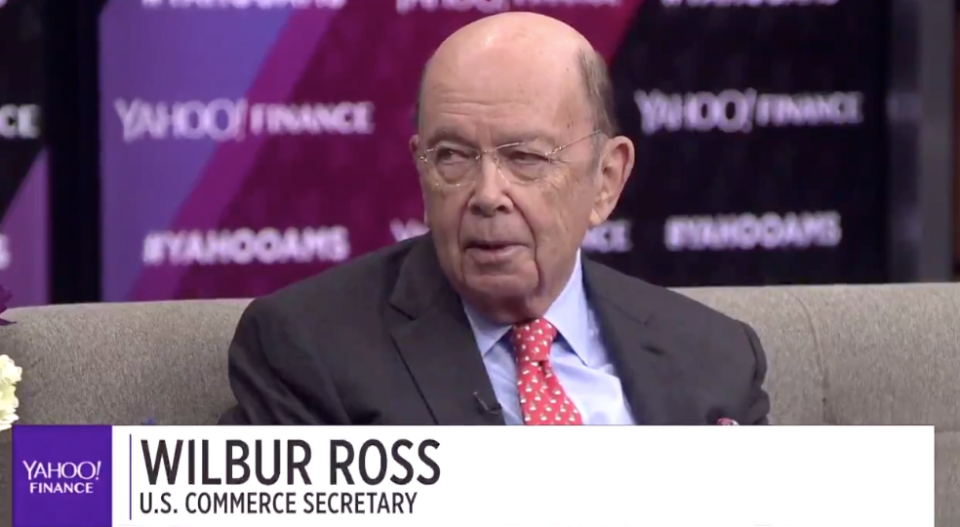

Wilbur Ross: 'The issues with China are not just tariffs'

The trade tension between Washington and Beijing has been haunting investors for months. However, U.S. Commerce Secretary Wilbur Ross is sending some positive signals ahead of the long-anticipated meeting between President Trump and President Xi Jinping at the G20 in Argentina in late November.

“The president and President Xi had a very constructive conversation couple of weeks ago,” Ross told Yahoo Finance’s editor-in-chief, Andy Serwer, at the All Markets Summit on Tuesday. He expects Chinese negotiators to be “coming over here very shortly to start some informal talk.”

But Ross acknowledges that bringing both sides back to the negotiation table doesn’t mean a deal is imminent. Experts say one of the better outcomes from the G20 meeting could be a “ceasefire agreement” between the world’s two largest economies, meaning President Trump drops the further escalation of tariffs on China to 25%.

Ross thinks the negotiation with China is particularly tough because the real issues are non-tariff barriers China has set — including invasion of intellectual property rights, forced technology transfers and espionage.

“The issues with China are not just tariffs. If it were just tariffs, I think we could work it up very very quickly,” Ross said. “We don’t mind them becoming much more technically advanced, getting into the newer technologies, but they have to do so in a legitimate fashion, not through these other practices.”

President Trump’s has been taking a tough stance with China on trade issues since last year, when U.S. Trade Representative (USTR) launched a Section 301 investigation targeting Made in China 2025, an industrial development plan to turn China into a hi-tech powerhouse. The investigation is widely interpreted by Chinese media as the U.S. trying to contain the development of China.

In the most recent earnings season, 9% of total reported S&P 500 companies noted a negative impact by tariffs, according to BofA Merrill Lynch Global Research. Asked if imposing tariffs is the best way to push China to change, “Well, what other weapons do we have?” Ross said. He also urged investors to judge the administration by results, not by methodology or interim activities.

Krystal Hu covers technology and trade for Yahoo Finance. Follow her on Twitter.

Read more:

Americans who say their finances haven’t improved mostly blame Trump

Why you won’t feel much pain from Trump’s tariffs this holiday season

Amazon bought Whole Foods a year ago. Here’s what has changed

Yahoo Finance

Yahoo Finance