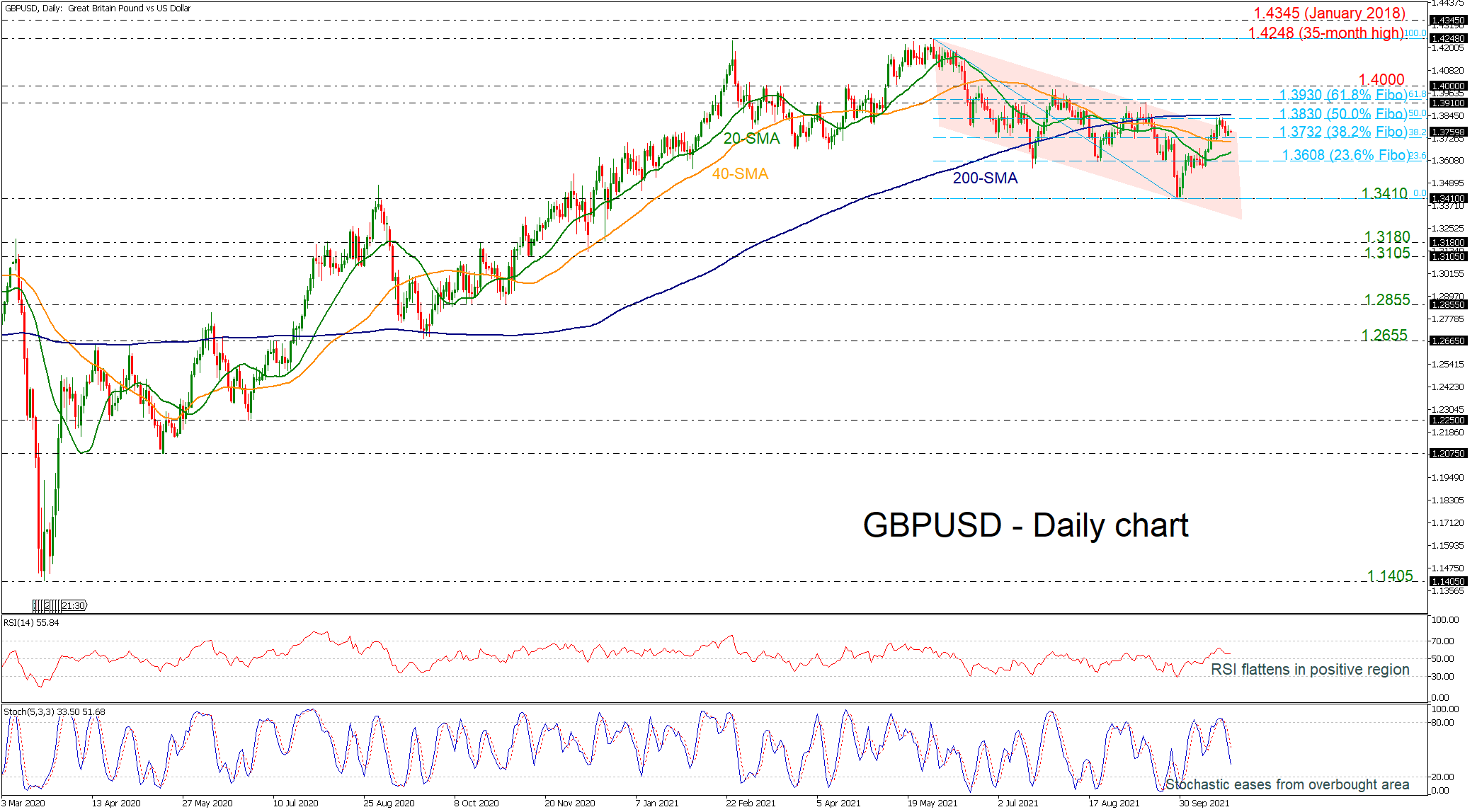

GBPUSD found a strong resistance at the 200-day simple moving average (SMA) currently at 1.3830, where the 50.0% Fibonacci retracement level of the down leg from 1.4248 to 1.3410 also happens to be. The price jumped slightly above the almost five-month-old descending channel but is retreating again in the very short term.

Technically, the RSI indicator is moving sideways in the positive region, suggesting a weakening positive bias. The stochastic oscillator is also sending discouraging signals as it is diving towards the 20 levels, confirming the recent downward move.

Failure to overcome the 200-day SMA could send the price down to the immediate support level of 1.3732, which is the 38.2% Fibonacci level, while not far below, the 40-day SMA may also be closely watched. Lower support could be next found near 1.3650, where the 20-day SMA is currently positioned, while a decisive close below this level could initially test the 23.6% Fibonacci of 1.3608 ahead of the 1.3410 number.

Alternatively, if 1.3830 proves easy to get through, the spotlight will turn to the 61.8% Fibonacci of 1.3930. On top of that, the bulls would need to clear the 1.4000 psychological level to push the rally towards the 35-month high of 1.4248.

In the medium-term picture, GBPUSD is maintaining a bearish outlook despite the insignificant violation of the downtrend channel. A drop below 1.3410 would endorse the negative outlook, though, a run above the 200-day SMA would shift the view back to neutral.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.