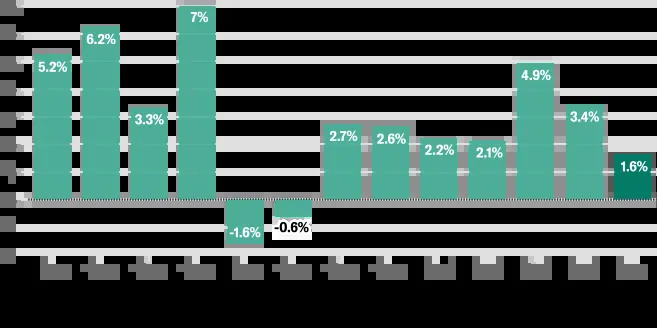

- S&P 500

5,048.42 -0.46% - Dow 30

38,085.80 -0.98% - Nasdaq

15,611.76 -0.64% - Russell 2000

1,981.12 -0.72% - Crude Oil

83.77 +1.16% - Gold

2,344.60 +0.27% - Silver

27.47 +0.44% - EUR/USD

1.0731 +0.28% - 10-Yr Bond

4.7060 +1.16% - GBP/USD

1.2512 +0.40% - USD/JPY

155.5610 +0.21% - Bitcoin USD

64,981.32 +1.04% - CMC Crypto 200

1,398.50 +1.15% - FTSE 100

8,078.86 +0.48% - Nikkei 225

37,628.48 -2.16%

Latest

Popular

Snapshots

Investment Ideas

Top Daily Gainers

Discover equities with the greatest gains during the trading day

Company

Last Price

Top Daily Losers

See equities with the greatest losses during the trading day

Company

Last Price

Most Active Stocks

Look at equities with the highest trading volume during the trading day

Company

Last Price

Top ETFs

These are top-performing ETFs in the US by asset value and Morningstar Ratings

Company

Last Price

Net Assets

Undervalued Growth Stocks

These highly undervalued equities have strong earnings growth

Company

Last Price

Analyst Strong Buy Stocks

These recently rated stocks are considered a Strong Buy by analysts

Morningstar 5-Star Stocks

Discover stocks that are rated 5-Star by analysts at Morningstar

Fundamental Trade Ideas

Investment ideas based on fundamental research by Argus and Morningstar

Technical Trade Ideas

Investment ideas based on technical chart patterns by Trading Central