News

I invested in a tour pro for three years—and actually made (a little) money

To be honest, it was never really about the money. I invested $250 in a tour pro I had never heard of because I thought it was worth it for the story. So, yeah, if my bosses are reading this, that’s how dedicated I am to my job. I am so committed to my CRAFT that I was willing to sacrifice what would amount to a couple of small Costco runs just to write about the experience. That being said, I certainly wasn’t opposed to the prospect of making money on said story. And I allowed myself to dream about striking it rich on a golfer named Dave Coupland.

After three years, that didn’t happen. But I’m happy to report both Dave and I still wound up very pleased with the results.

• • •

I made my initial investment of £200 (or approximately $250 at the time) for two shares of Dave Coupland Golf Investments in 2017 after seeing a tweet from the English golfer. Taking the idea of diversifying my financial portfolio to such an extreme was a bit of a rash decision, which I detailed in a 2018 story. But one that proved profitable by Year 2, as I wrote about last January following Dave’s dominant season on the PGA EuroPro Tour, which earned him his card on the European Challenge Tour, Europe’s equivalent of the Korn Ferry Tour.

That meant that another strong season in 2019 could equate to some serious bucks in both of our pockets. I thought Dave might not allow his shareholders to renew their contracts with him playing for much higher stakes, but out of loyalty, he did. So I gladly stayed along for the ride by signing another one-year contract.

Unfortunately, that monster campaign didn’t come to fruition. Despite a solid season on the bigger tour, Dave made considerably less money than the previous year when he won the Order of Merit on the PGA EuroPro Tour with earnings of nearly £50,000. But when Dave sent out his annual earnings report, I was pleasantly surprised. After a few years, I had still made a few bucks. Literally.

Those two shares were now worth £213 and at the current exchange rate that came out to approximately $267. I had made a profit of about $17—or an annual return of nearly $6. I could treat myself and my wife to extra guac at Chipotle next time! But seriously, from all I had read, just getting your money back on a risky venture like this is a win.

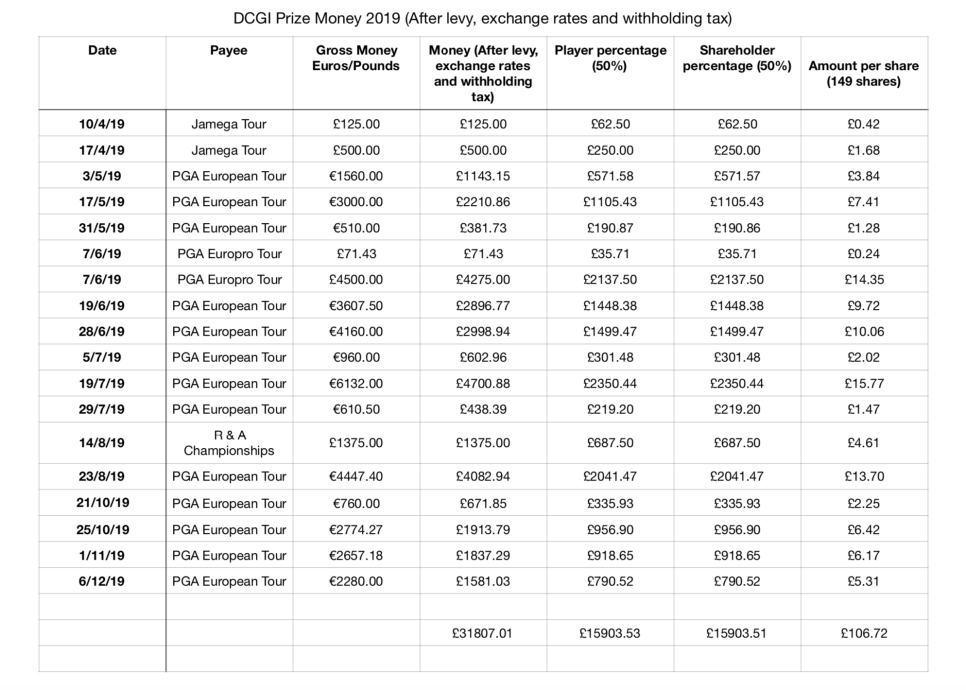

Here’s a look at the breakdown of his 2019 prize money that Coupland send me and all his investors, which was split 50/50 between Dave and his shareholders after taxes:

Even though my shares lost some value in Year 3, it wasn’t like they or Coupland’s career had cratered. In fact, he had his biggest breakthrough to date. I just didn’t profit from it.

After finishing 55th on the money list, Coupland had kept his card on the Challenge Tour for the following season, but had failed to move up to the European Tour by not finishing in the top 15. However, a T-17 at the final stage of European Tour Q school in November, including two clutch closing birdies, finally did the job for the 34-year-old.

“There’s a few videos out there that show the relief on my face,” said Coupland, who happily accepted his European Tour card instead of a check. “As years take on, you think, ‘is it ever going to happen?’ You dig in and get that self belief and trust yourself it’s going to happen.”

Here’s one of the videos Dave was referencing:

And here’s another:

And though I’ve still never met Dave in person, when I saw it, I felt a sense of relief and pride in addition to being happy for him. I had played a role—granted, a very small one—in Coupland accomplishing a lifelong dream. One that he hopes is just the beginning in a new chapter of his career.

“But you never stand still,” Coupland said. “Always drive forward. There are always new goals to accomplish, and I’m really determined to make the most of this opportunity.”

Unfortunately, though, this is where Dave and I part ways. At least, financially. As Coupland explained in his year-end report to investors, the increased prize money on the European Tour, along with increased expenses both for travel—Coupland estimated £50,000 to £70,000(!), up from £20,000 on the Challenge Tour—and potential taxes to various governments made the current fiduciary agreement no longer feasible. What had turned into a three-year partnership was over. It was time to cash out and take my meager earnings.

• • •

On the spectrum of my career investments, making $17 rates well below those shares of Apple I bought a few years back, but well above the time I got duped into thinking I’d get my money’s worth out of a gym membership. And while it hadn’t increased my net worth, it had increased my net interest in pro golf well beyond the the major tours. Following Dave’s results had provided plenty of returns in the form of entertainment and enjoyment. In other words, the story certainly had been well worth it.

Of course, the agreement worked out for Dave as well.

“I was happy to earn them a little money and give them an experience,” Coupland said of his investors. “They are part of this journey, and I couldn’t have done it without them.”

Aitor Alcalde

And I will be happy to continue following Coupland as he embarks on the European Tour, where he’s already made two cuts to start 2020. But I’ll miss tracking my investment, and I’ll do my best to not think about what my cut of those larger purses would be.

Coupland says he hopes to figure out a different investment structure at some point, but for now, he’s focused on Dave Coupland and not Dave Coupland Golf Investments. And who could blame him? There’s enough pressure trying to make it as a tour pro without having to worry about losing other people’s money.

“I know some of the investors are a little disappointed, but I’ve gained some fans all over the world,” Coupland said. “Hopefully, I get to cross paths with some of them down the road.”

I hope so, too, Dave. And if it happens, beers on me. Well, the first round, at least.