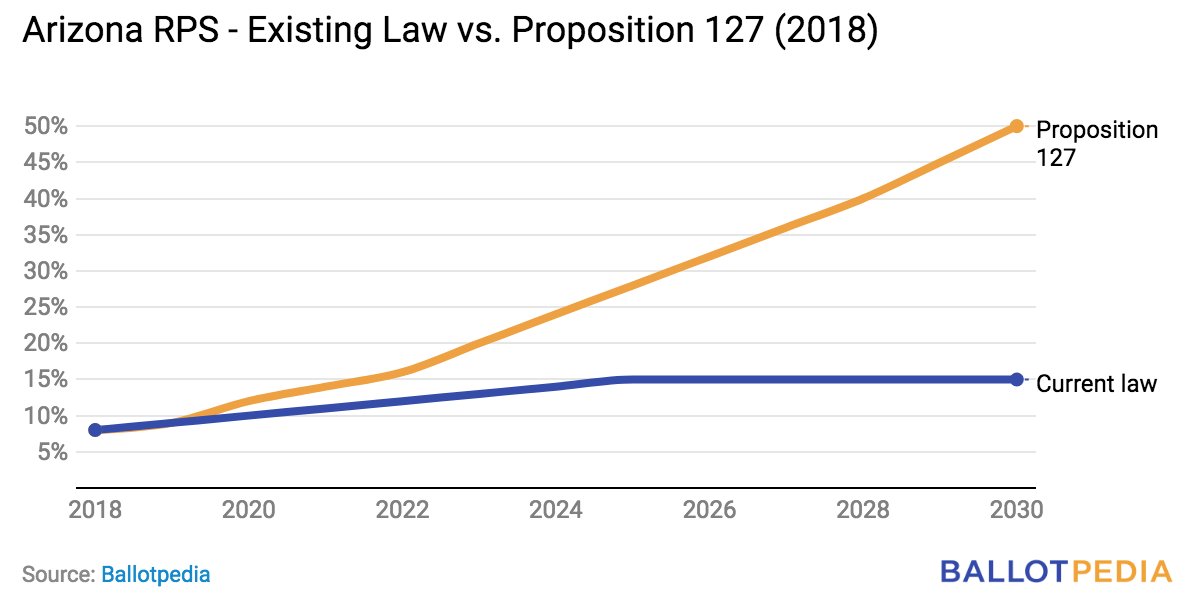

Election season is heating up, and so is a fight over a ballot initiative to boost Arizona’s renewable energy portfolio standard to 50 percent by 2030.

In November, residents will vote on whether or not to enshrine the increase in Arizona’s constitution under Proposition 127. The state’s current RPS is 15 percent by 2025.

Arizona Public Service, the state’s largest utility, is strongly opposed to the increase. In July, Arizonans for Affordable Electricity, a political action committee funded by APS’ parent company Pinnacle West Capital Corp., filed a lawsuit to keep the renewable energy initiative off the ballot. The PAC claims proponents of the measure failed to gather enough valid signatures.

The effort to increase Arizona’s RPS is being led by Clean Energy for a Healthy Arizona, which is backed by San Francisco-based billionaire Tom Steyer. Over the summer, the group submitted more than double the required number of signatures to place the constitutional amendment on the ballot. The group has raised just over $8 million to date.

Meanwhile, Pinnacle West has spent $11 million to keep the RPS measure off of the ballot this fall. According to records released by the Arizona Secretary of State, Pinnacle West has donated $7.5 million to Arizonans for Affordable Electricity. The utility company has also given $3.2 million to Arizonans for Sustainable Energy Policy, a separate group set up to oppose certain clean energy policies by backing certain Arizona Corporation Commission candidates, according to the watchdog organization Energy and Policy Institute.

In a recent op-ed, David Pomerantz, executive director of the Energy and Policy Institute, wrote that APS’ “irrational war against renewable energy policy” is ultimately a risk for investors. The utility argues that it’s not opposed to renewables or reducing emissions, but that there is a risk of undermining system reliability and affordability by mandating a 50 percent RPS.

“It creates a lot of challenges in Arizona because it really doesn't match the way people use electricity,” said Jeff Burke, the director of resource planning for APS, in an interview.

The strict timeline laid out in Proposition 127 and the fact that it only allows utilities to add renewable energy resources — so it doesn’t count APS’ Palo Verde nuclear generating station — are issues for APS, too.

As the RPS debate rages, APS has announced new distributed energy resource programs and incentives, put out requests for new clean energy resources and battery storage, and come out in support of a proposal, championed by a member of the Arizona Corporation Commission, that would increase the state’s RPS to 80 percent by 2050 and expand it to include nuclear power.

This week’s column explores the mismatched clean energy outlook in Arizona. It outlines APS’ opposition to the 50 percent renewable energy mandate, looks at research challenging the utility’s position on resource management, and profiles other policy measures APS is putting in place to make more use of and better manage renewable energy resources.

APS' argument against 50 percent renewables

Proposition 127 defines renewable energy to include resources such as solar, wind, biomass, certain hydropower, geothermal and landfill gas energies. It would require the RPS to increase each year, until reaching 50 percent in 2030.

Arizona can get oppressively hot in the summer, said Burke, but for much of the year the weather is pleasant. During those moderate months, the utility’s solar projects are generating at full production during the middle of the day when consumers (APS’ system is about 90 percent residential) aren’t using much energy. If APS has to add more renewables to the grid, it faces a negative pricing scenario, the likes of which California has been dealing with.

“That's not the right metric, from our perspective, to get to a cleaner energy mix, because you get too much production in the time periods when you can't use it,” said Burke. “Then you have the summertime, [when] you can use it, [but] that's only four months of the year.”

“That leads us to challenges with a lot of our baseload resources,” he said.

Nuclear power isn’t the kind of resource a utility can easily turn on and off. So with the addition of new solar generation, it creates a surplus situation, said Burke. APS can’t send that over-generation to California, because the Golden State is coping with its own over-generation issues at the same exact time. Energy storage is a potential solution. “We’re interested in it; we’re watching it,” he said. But prices haven’t come down far enough to meet APS’ needs.

That’s largely because the utility has long peaks, Burke explained. APS often sees a spike in energy use that lasts for six hours, from roughly 3:00 p.m. to 9:00 p.m. And so the utility needs energy resources that are long-lasting and can continue to generate into the evening — which is why the utility says it’s fighting to protect the Palo Verde nuclear plant.

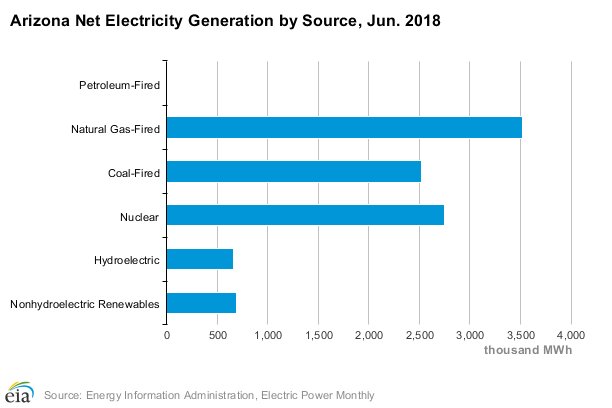

At 3.9 gigawatts, Palo Verde is the largest nuclear power plant in the nation and the second-largest power plant of any kind in capacity terms. The facility makes up about 25 percent of the APS energy mix and cranks out 30 million megawatt-hours of electricity per year.

APS is not the only owner of the plant. Its share represents about 1,150 megawatts of total capacity. Salt River Project, El Paso Electric, Southern California Edison, PNM Resources and Southern California Public Power Authority are also partial owners. The plant produced about 35 percent of electric power across Arizona.

If the plant gets pushed off of the grid because APS has to meet a new renewable energy mandate and there’s no room for nuclear, “We’re going to see emissions rise, and we don’t want that,” said Burke.

APS does want an RPS that couples nuclear with other carbon-free energy resources, similar to the 100 percent clean electricity bill California just passed. A proposal put forward by Arizona utility regulator Andrew Tobin would increase Arizona’s RPS to 80 percent by 2050 and broaden it to also include nuclear power.

Burke said he likes that the Tobin proposal has options and that it gives utilities a longer time window to retool their systems. “Options, duration — those kinds of things are essential to really getting to that type of [low carbon] plan in an affordable manner,” he said.

Tobin’s Energy Modernization Plan was recently moved into a larger energy docket (RU-00000A-18-0284), but it hasn’t seen much action yet. The focus, at least for now, appears to be on Proposition 127.

If the initiative succeeds, APS maintains that Palo Verde will have to close in 2024 — 20 years ahead of schedule.

“What's the ultimate goal? It's to reduce carbon,” said Burke. “So if you say only one type of resource qualifies, that makes it [much] harder, right? Because as you continue to add a single type of resource, the marginal cost of it escalates enormously when you get to really high penetrations.”

According to APS, the 50 percent renewable energy mandate would double customers’ electricity bills. APS puts the cost of taking Palo Verde offline at around $15 billion, but it would also require replacing the plant with new energy resources. APS’ model assumes the replacement mix would be 2,400 megawatts of solar, 800 megawatts of wind and roughly 1,500 megawatts of batteries. Plus, it would have to add an additional 1,200 to 1,300 megawatts of combustion turbines.

APS’ coal resources would also come offline early if Proposition 127 is approved. The 400-megawatt Troy coal plant would close early in 2022; the Four Corners coal plant, of which APS own 1,000 megawatts, would close in 2023; and Palo Verde would close in 2024.

But why is that? Does Palo Verde really have to close under a 50 percent RPS scenario?

Keeping the Palo Verde nuclear plant open

The Natural Resources Defense Council argues that the Palo Verde nuclear plant is still viable in a high-wind-and-solar energy future under Proposition 127.

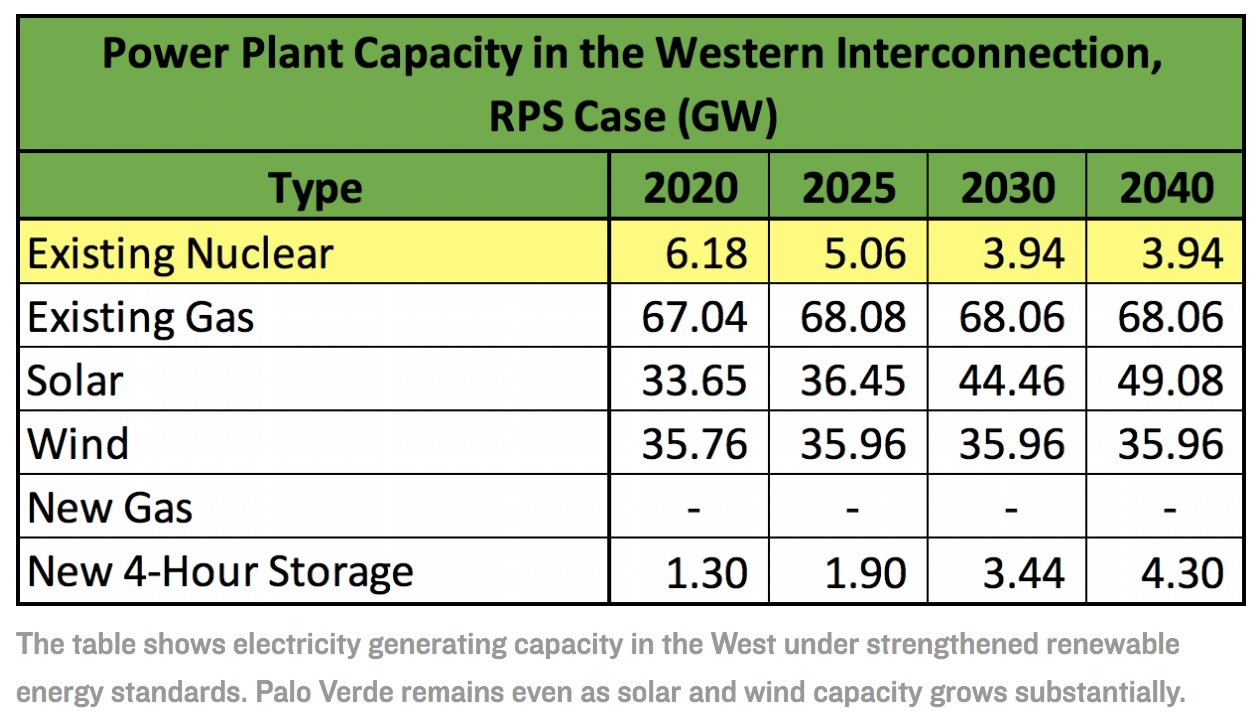

In a new energy modeling analysis conducted by ICF, which adds to earlier research published by NRDC, it was found that Palo Verde can remain open “because it’s the lowest-cost non-renewable power plant in the West, able to spread its fixed cost of operation over a lot of electricity output.” The model shows that Arizona and states across the West have sufficient demand and available transmission capacity to use the nuclear plant electricity, even in a high-renewables future.

The model didn’t only look at the RPS increase in Arizona. It also factored in “50 percent by 2030” standards that apply to utilities in Colorado, Nevada and New Mexico. And it included a “25 percent by 2025” standard for Arizona’s Salt River Project. Using ICF’s Integrated Planning Model, the study generated a model of the electric power system and used it to assess the effects of environmental regulations and policy.

Under the strengthened renewable portfolio standards scenario, utilities in the Western Interconnection would add 18 gigawatts of new solar capacity by 2030, 10 gigawatts of wind, and more than 3 gigawatts of 4-hour energy storage to help balance the grid. Existing gas capacity would be used for grid balancing, and as a result it would not decline, although advancements in energy storage could change this.

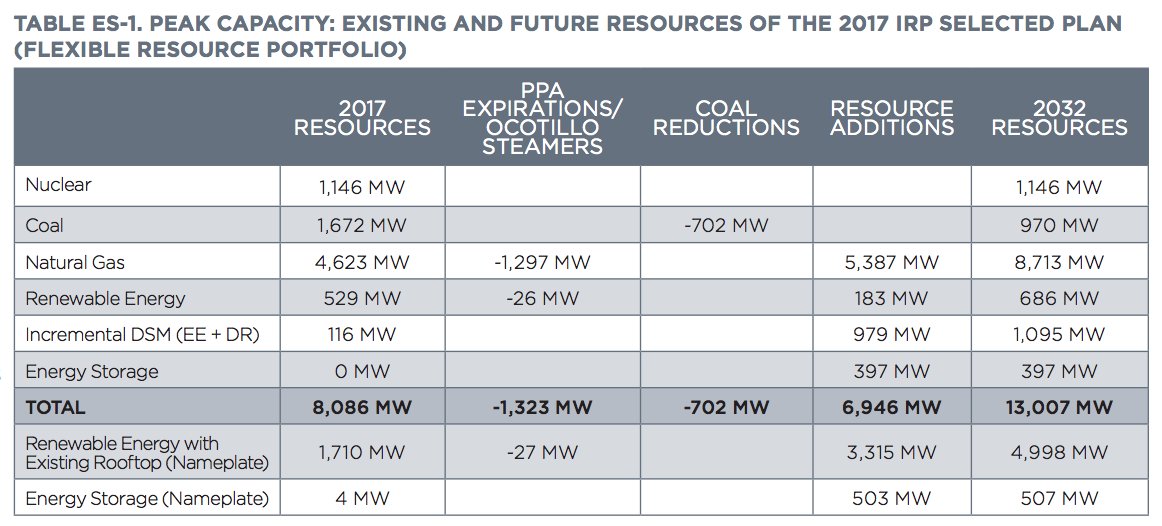

An important thing to note about NRDC’s model is that it finds energy storage coupled with renewables to be more cost-effective than building new gas-fired power plants. This is a significant point of tension. APS’ Burke said that the energy storage technologies available today are too expensive to meet Arizona’s system needs. For that reason, APS proposed building 3,500 megawatts of gas combustion turbine units, which are designed to meet peak needs, in its 2017 integrated resource plan.

The utility’s latest IRP, which covers the next 15 years, would also add 2,000 megawatts of gas combined-cycle units that are designed to operate 24/7. The plan would add only 183 megawatts of renewable energy and 397 megawatts of energy storage.

Overall, the IRP depicts a very fossil-fuel-heavy future. NRDC argues that APS’ focus on Palo Verde is specifically designed to confuse people. “Their real plan is all fossil fuels, all the time,” the organization wrote in a blog post.

In March, regulators ordered APS, as well as the state’s second-largest utility, Tucson Electric Power, to cut reliance on gas in their IRPs. The Arizona Corporation Commission ordered a new rulemaking process and encouraged the utilities to work closer with other stakeholders to develop cleaner energy resources.

Burke said that the IRP is being misunderstood. Yes, APS proposed adding more gas, but the utility plans on using it less frequently.

The utility pitched adding new gas peakers because they’re needed to balance out additional renewables on the system. While the plan forecasts just 183 megawatts of new utility-scale renewable energy capacity, it includes more than 3,000 megawatts of rooftop solar — a fact that Burke believes critics have overlooked.

“Although it looks like there's not much renewables in our plan, there's actually a really significant amount,” he said.

APS just assumes that individual customers will deploy most of the solar on their homes over the next 15 years, rather than the utility pursuing large, centralized solar projects.

Two requests for proposals

The problem with putting more solar on the grid is that the peak keeps shifting later into the evening. As a result, new peaking resources are needed to meet it. When asked why APS turned largely to gas instead of energy storage in its IRP, Burke reiterated that the long-duration storage technology needed to meet APS’ 6-hour peak load is too expensive.

There is a good chance the cost outlook could change significantly in the coming years, however. Burke said APS is accounting for that by exploring the use of energy storage to address peak load, most notably in a 50-megawatt battery project coupled with a 65-megawatt solar farm.

The utility has also issued a request for proposals for approximately 400-800 megawatts of capacity to meet peak demand beginning in 2021, specifically during the months of June through September.

“Storage is eligible, solar with storage is eligible, demand response is eligible, peak natural gas is eligible,” said Burke. “If you have something that we don't know about, come talk to us about it.”

The contract offered in the RFP is for up to seven years, he added. That gives APS the opportunity to update its energy mix as new resources become cheaper (although the shorter contract terms make the economics tougher for vendors).

“I think that's gotten lost in the shuffle a little bit, but that's the strategy we've been using: Keep customer rates low and give yourself an opportunity to realize those cost reductions as they come available,” he said.

APS also has an RFP out to retrofit its existing solar facilities with batteries so they can operate in peak conditions.

There is a disconnect between the IRP and the RFPs, Burke said. “The IRP is a 15-year look, but it's not what we're doing for 15 years. […] It’s going to get redone over again as we move on.” The RFPs are a part of that process.

Through its RFPs, APS is trying to find cleaner energy solutions. But to put clean energy resources on par with gas peakers, “I will tell you…in Arizona, it's a little more expensive,” said Burke.

Three new solar rate plans

As APS leads the charge against Proposition 127, the utility is also looking to gain more control of the renewable energy resources coming on its system with the introduction of three new rate options: Storage Rewards, Reserve Rewards and Cool Rewards.

The programs are designed to incentivize customers to adopt advanced technologies in their homes and businesses to help harness an abundance of midday solar energy, and to conserve power during the late afternoon and early evening peaks. According to APS, the plans are laid out as follows:

- Cool Rewards allows up to 6,000 residential customers to use their eligible smart thermostats to help shift energy use to off-peak hours, outside of the hours of 3 p.m. to 8 p.m., Monday through Friday. Thermostats are adjusted remotely by the utility up to 20 times per year. However, customers retain full ability to override the adjusted settings. Participants will receive a $25 bill credit upon enrollment and a $25 bill credit annually for as long as they participate.

- Storage Rewards offers battery storage to APS customers, enabling them to get the most out of time-sensitive rate plans. Residential customers will also receive a one-time participation award of $500 once they have been accepted to the program and the battery is activated. Customers also can benefit from additional possible savings from the use of the technology. When the program launches later this year, APS will install Storage Rewards batteries in 40 residences in targeted areas.

- Reserve Rewards puts highly efficient electric water heaters in residential customers’ homes to help them save money by using energy at midday. Customers will own these water heaters, and the units will heat a home’s water when excess solar generation is available and power generally costs less. APS will give customers an instant rebate for the full installed price of the equipment. Customers may see additional savings over the lifetime of the unit. This program will launch later this year, and APS will provide rebates for about 200 grid-interactive water heaters in homes that are located in targeted areas.

The hot water heater program is one of the most exciting programs for APS, said Burke.

"I recognize that lithium-ion batteries are the sexier topic, and I think it's what comes to mind when a lot of people think about storage," he said. "We're trying to expand the conversation about what storage is."

"Thermal storage, we really think, is [more] acceptable to a larger group of people right now than lithium-ion is," Burke continued. "You can see real results. For us, this is also a test case in being able to see the response to those thermal storage [units], particularly on very solar penetrated feeders."

These three new customer rate programs, in addition to the recent RFPs APS has released and the utility's position on Proposition 127, are all part of its "all-of-the-above approach" to using more renewable energy, and not simply adding more.

"We're doing customer programs; we're doing utility-level resources; we changed our rates," said Burke. "We're trying to hit this from all aspects and make sure that we can utilize more of that energy because it's clean, and oftentimes it's very inexpensive or it might even be negatively priced."

"We want to put on solar with batteries, and we want to do more energy efficiency; we want to make sure that Palo Verde is available; we want to add batteries," he continued. "We also have to take a step back and say we have to have affordable reliability."

The odds of Proposition 127 passing

APS may soon have to take a step back and reconsider how a 50 percent RPS fits into its energy outlook. A recent poll found that 75 percent of Arizona voters want to prioritize solar energy in the next decade. Based on the latest public sentiment, the research firm Washington Analysis expects Proposition 127 will pass this fall.

Republicans are favored to maintain control of the state, and Republican Attorney General Mark Brnovich’s office added the words “irrespective of cost” to the ballot measure, which supporters say was done to undermine support. Still, "we still think this measure passes, albeit narrowly," according to Rob Rains, energy analyst at Washington Analysis.